Student loan or campus loan repayments can be confusing. You know you have to make the payment. But where do you send the payment and where do you find your student loans? You won’t necessarily be paying the same entity that lent you money. Your student loan servicer and lender could be different so there are some things you need to know.

Finding a Student Loan Servicer

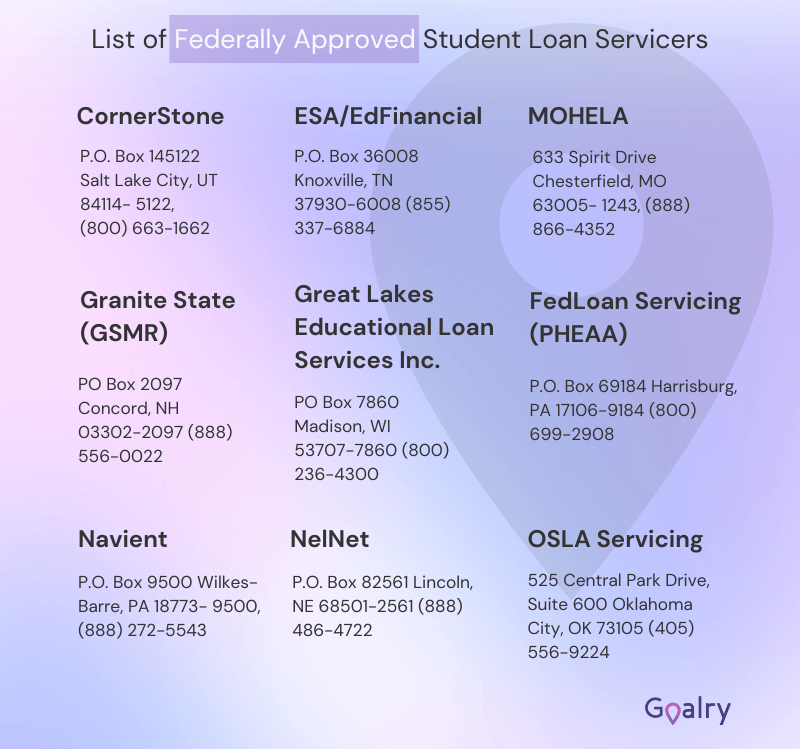

Finding your student loan servicer will be a different process depending on whether you have a private student loan or federal loan. If you have both types of loans, you will have to find your servicer for each one. There are nine different federal student loan servicers so it’s easier to find your servicer for your federal loans.

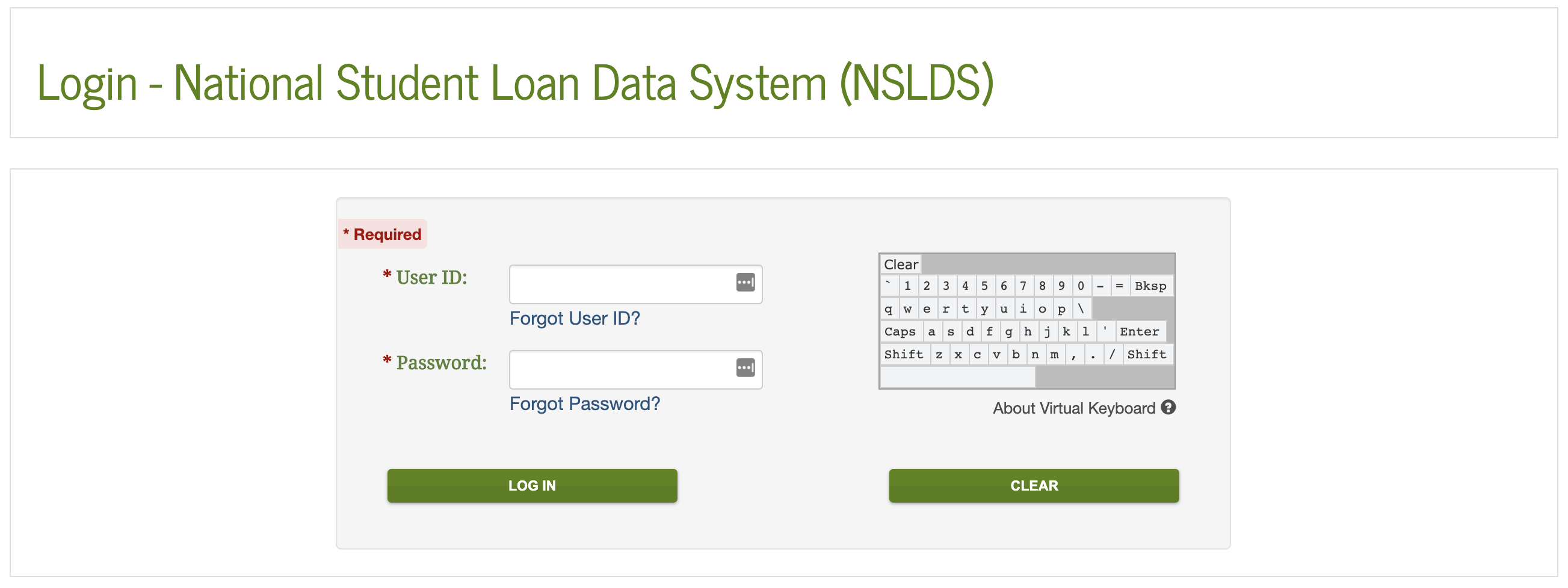

If you have a federal student loan then go to the National Student Loan Data System and use it as a student loan locator. Click on Financial Aid Review and then log in using your FSA ID. If you don’t have an ID number then you will have to create one. Once you log in you can see a summary of the loan data. This includes the different types of student loans you have, the amounts and any outstanding balances, and interest. Each loan also has a number next to it. And, if you click on it, it expands your information and contact information for the lender at the bottom of the page.

If you have student loans that are private, it takes a little more work to find the student loan servicer. It helps to start looking at your credit reports. And you are able to access your reports from the three main credit bureaus. You can also check your most recent loan statements to find the servicer.

What Does a Student Loan Servicer Do?

The student loan servicer is the company that manages your student loans. They act as a third party and a middleman between your lender and you. When you do make a payment toward your loan, it is the servicer that manages it. Servicers work with borrowers to help manage student loan repayment. If you need to change your repayment plan or apply for forbearance or deferment then you need to discuss your options with the student loan servicer.

You will want to work with your student loan servicer as best you can. Once you start earning money to pay toward your loans you may want to pay off certain loans first, such as the ones with higher interest rates, which can help you save some money on your loan. Contributing more than your scheduled payment can help you save interest.

Contact your servicer to learn how to apply for your additional money. Instead, they may just apply any extra payments and money toward the next month’s bill. You may also be eligible for student loan forgiveness if you work in a certain field for a specific period of time. In order to make sure you are on track to get this benefit, you need to work with your student loan servicer to determine whether the loans are eligible, whether you are in a repayment plan that is qualifying, and whether or not you have properly filled out the forms.

Choosing a Student Loan Servicer

You, unfortunately, don’t get to choose your loan servicer and are assigned one. If you have student loans from the federal government then your student loan servicer will be assigned by the Department of Education.

The servicer’s job is to help you keep your loans in good standing by giving you the resources and support you need. However, you need to know that they are private companies, which means they can offer choices that may not be the best for you. You have to also be your own advocate by knowing your different repayment options and asking questions when dealing with your student loan servicer.

If you have federal loans, you can exit the federal loan system and have a better chance of selecting your student loan servicer when you refinance your loans privately.

While you don’t get to choose a student loan servicer for your federal loans, when you choose a private student loan lender you are also choosing a student loan servicer so it’s important to choose a private student loan lender carefully.

When choosing a private student loan lender, the most important things to look for are fees and interest rates. In order to check this, you may need to do some shopping around. The rates you will find are just like other loans. And will depend on the market interest rate and your credit history. Some lenders require a co-signer, such as a relative or parent, who will also shoulder responsibility if you stop making payments. This means that your payment activity impacts their credit score, which is not something you really want to do to the co-signer. When looking at the costs for the private student loan lender, consider the interest, origination fees, early payment fees, and the lender costs.

What to Do Once You Find Your Student Loan Servicer?

Once you know who your servicer is you should then create an account on their site. In order to do this, you usually need to create a username or password. And then share relevant information, such as your Social Security Number, name, and address. You will also need to secure your account with some security questions. When you have registered, you are able to connect your bank information and then make payments directly. You are also able to send checks but it can be much easier to pay online.

There can also be other benefits to paying online. For example, you may get a reduction in your interest rate if you sign up for automatic payments. If you don’t want to sign up for autopay then see if you are able to sign up for online alerts so you are able to be reminded when a payment is due so you never miss a payment.

How Your Student Loan Servicer Can Help You?

Your student loan servicer can help you with many things once you track them down:

- update your contact information

- check your loan status

- find details on payment amounts

- help you make your payments

Being proactive about reaching out to your servicer and managing your loans is a good strategy to correct any issues, avoid errors, and help you keep your payments on track.

Forbearance with Your Student Loan Servicer

It is not unusual that you can not pay your student loan. According to some student debt statistics, the total amount of student loan debt in 2020 is over $1.67 trillion. If you are unable to pay your student loans then your loan servicer could suggest forbearance. Forbearance is the option to delay payments and you don’t have to make payments while loans are in forbearance. It sounds pretty great but it may not be the best option. While in forbearance, your loans still accrue interest. The interest is added to your balance once your loans are out of forbearance and you are back to making regular payments.

This means that unless you can cover the interest while your loans are in forbearance, your balance will be higher as you start to enter repayment. Since the interest keeps accruing, forbearance should be only temporary and a short-term solution and not a long-term solution.

Whether or not you can get forbearance from your student loan servicer will depend on whether or not your loans are federal or private. Federal loans will usually offer more generous forbearance terms than private lenders.

Not all forbearance terms are the same and for federal student loans, there are two types.

General forbearance can be an option for you if you aren’t able to make payments due to financial difficulties, medical expenses, an employment change, or other reasons. You have to apply for this type and the servicer has the right to deny the application at their discretion.

Mandatory forbearance is used in different situations when you are in a residency program or medical internship, an active National Guard Member, or your payment is more than 20% of your monthly gross income. If you qualify for this then the servicer isn’t able to deny the request.

In certain cases, your service provider can actually place loans in forbearance without you filling out a form. For example, forbearance can happen during a natural disaster when you aren’t able to make payments. There are other reasons why your account may be in forbearance.

While it can seem tempting to jump at the chance to not have payments for a time period, you should look at your situation before you make the decision. Why do you want to delay the payments? Are you looking for a long-term or short-term solution? Could deferment be a better option? If you decide that forbearance is your best option then it helps to make interest-only payments during this time period. The small payments that chip away at the interest will benefit you in the long run.

The less interest you get in forbearance, the less your principal will go up when you are done with forbearance. If you are placed in forbearance and you can actually make your payments then cancel your forbearance so you can work toward lowering your principal instead of letting it grow.

Deferment with Your Student Loan Servicer

This can be an option with your student loan servicer. Deferment actually excuses you from making a student loan payment for a certain period of time because of a condition in your life, such as hardship, unemployment, or returning to school. Unlike forbearance during this time, interest doesn’t accrue. You can usually qualify for deferment on a federal student loan if there are specific conditions and criteria for the loan time and you aren’t more than 270 days behind on your loan payments. You can defer student loans for only so long but usually, the maximum is for three years total. In order to apply, you need to send your servicer the right application and the necessary documentation. Your servicer needs to grant you deferment if you qualify but keep making payments until you are officially approved.

There are Different Types of Deferment Depending on Your Needs

- In-School Deferment: This deferment is when you pause your loan payments while you are enrolled in college at least half time and the six months after you leave school or graduate. If you qualify then you should automatically get this but if you don’t, ask the enrollment office to send the information to the servicer.

- Unemployment Deferment: In order to qualify for this, you will need to be unemployed and getting unemployment benefits, as well as diligently seeking full-time work. Many borrowers can get up to 26 months of this type of deferment but you will need to apply every six months.

- Economic Hardship Deferment: You can qualify for economic hardship if you are getting federal or state assistance, such as through Temporary Assistance for Needy Families, or if you are not working full time and earning a monthly income of less than the poverty guidelines for your state or volunteering for the peace corps.

- Military Deferment: If you are on active military duty then you can postpone payments. Your service needs to be related to a military operation, national emergency, or war in order to qualify. You are able to qualify for this deferment as long as you are on active military duty. You are also able to use it for 13 months after the service ends or you return to school.

- Cancer Treatment Deferment: Cancer patients that have student loan debt can also get a deferment during treatment and for six months following the conclusion of treatment.

- Other Types of Deferment: Other private lenders will also let you defer student loans while in the military or school. Be sure to contact the lender for eligibility details and to find out how to apply.

Income-Driven Repayment with Your Student Loan Servicer

If you are worried about affording payments in the long run and deferment or forbearance isn’t an option for you then an income-driven repayment can offer some immediate relief and some other benefits:

- You Will Likely Pay Less Every Month: Many factors factor into how your payments are calculated. If you are deferring loans because you don’t earn a lot of money then your payments could be as low as $0, which is basically the same as pausing them altogether.

- You Can Save on Interest: A big benefit of deferment is not paying interest on any subsidized federal loan. However, most income-driven pans also waive the costs if your payments don’t pay for your accrued interest. This will last for three years, which is the same as economic and unemployment hardship deferments.

- You May Get Loan Forgiveness: After 20 to 25 years of payments, income-driven plans will forgive the remaining balance on your payments. And forgive any remaining balance on your loans. Instead of pausing payments for three years with deferment, you could be paying under an income-driven plan and be closer to forgiveness than with deferment.

It’s possible that you will pay more interest overall on an income-driven repayment plan since these plans extend your repayment term. Use a repayment estimator to calculate short- and long-term costs. Then you can see if this is the right plan for you compared to deferment or forbearance.

Conclusion

Sometimes, with a good interest rate, personal loans can help you to get out of debt. But this is for some other story. While you may not have a choice in your student loan servicer, finding the servicer is an important part of getting your loans repaid. Working with your servicer is going to be in your best interest in order to make sure that you get your loans paid and to find the best repayment plan for your needs, whether it’s forbearance, deferment, or an income-driven repayment plan.

Jackie Strauss is a finance writer with a background in economics living in Los Angeles. She has a passion for helping readers learn more about personal finance, insurance, home loans and paying down debt. As a college student during the Great Recession, she has had to learn budgeting and money saving techniques to become a new homeowner.