In the past few years, you have likely seen many commercials and advertisements for debt settlement companies. If you are in a lot of debt, their promises to help reduce or eliminate your debt probably made you want to call them up immediately. Take a breath before signing the dotted line. Every financial decision deserves extra care and consideration because these decisions can affect you for years to come. Below we go over everything about debt settlement and answer some questions, including ones you did not even know you had yet. Read on for a better understanding of this process and why you should or should not sign up.

What Is Debt Settlement?

At times when you owe a company money, they will settle the debt with a lower payment and the company will say that the debt is paid in full. You can call any creditor you owe an outstanding balance to and ask if a debt settlement is possible. Some debtors will pay a company to handle these negotiations for them. You may even get an offer sent to you from the creditor.

On more than one occasion, I have found debt settlement offers in my mailbox, especially around tax time. The offer will usually give me three options:

- To pay the full debt in 12 payments,

- To pay 75% of the debt in 6 payments, or

- To pay half or a third of the debt in one payment

It can be beneficial for both parties to some extent.

The Pros and Cons of Debt Settlements

When reviewing a guide to debt settlement, it is essential to know both the pros and cons that exist within this option. Like any other financial obligation, both lists exist.

Pros

- It is a way to lower your debt amount.

- Debt Settlement can help you avoid bankruptcy.

- Get creditors and collectors off your back.

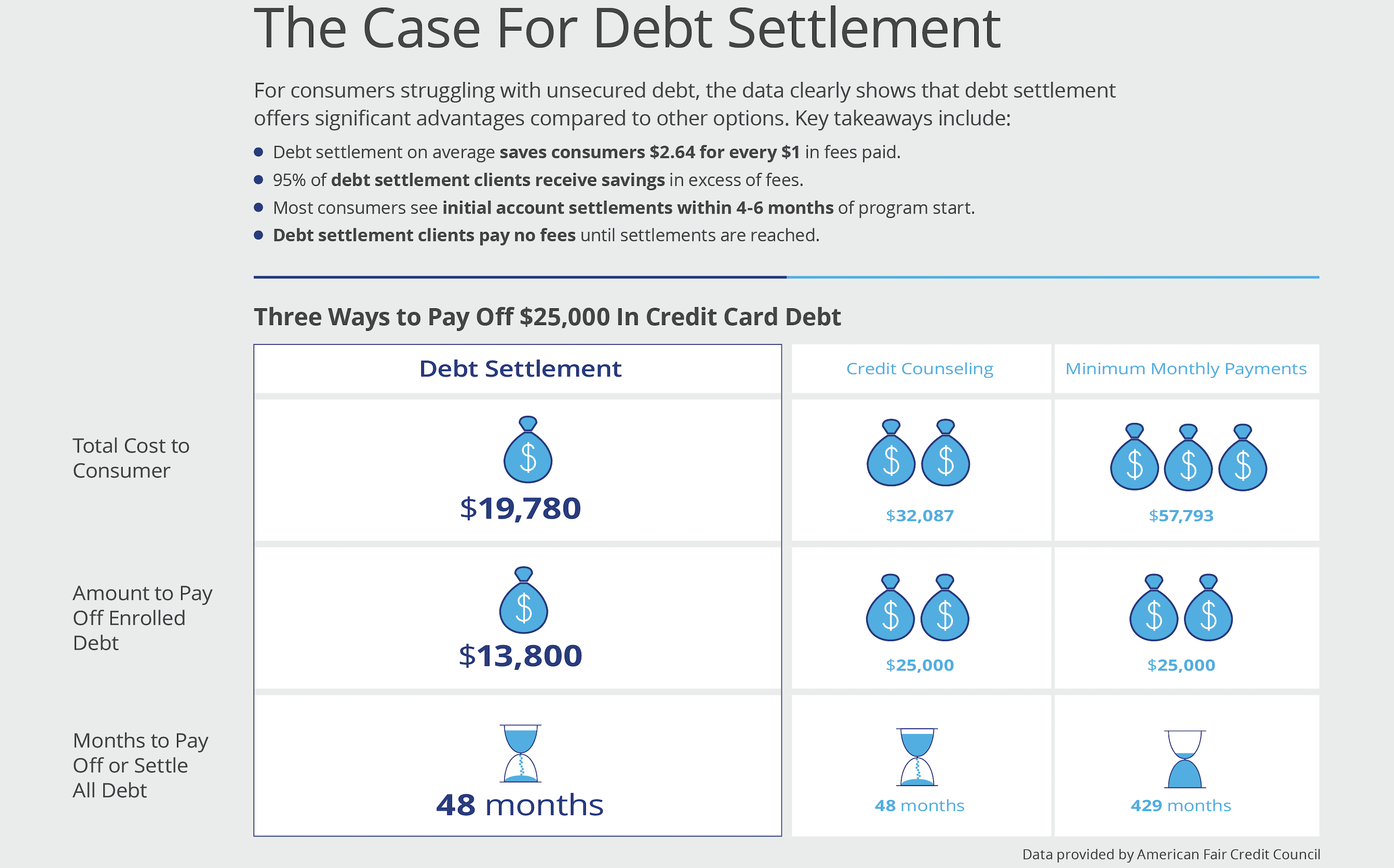

The biggest advantage of using a debt settlement company is that they lower the current debt amount you have. Of course, if they negotiate successfully. The debt consolidation company will negotiate with your creditors. They have the ability to settle on an amount with them. Consequently, you pay less than what you owed originally to that creditor.

Some debt consolidation lenders have been known to have the debt lowered beyond fifty percent, eliminating quite an expense for those of us with the outstanding debt.

You can avoid bankruptcy when you take advantage of a debt settlement company. Bankruptcy is something that is a final and last resort option. When you file for bankruptcy, you will have a long-term hit to credit in a negative way.

Are you being harassed by creditors and debt collectors daily? If so, when you hire a debt settlement company, you have the ability to sleep more peacefully knowing they are being dealt with and you are no longer being contacted consistently.

You are no longer responsible for the communication with these creditors, as the debt settlement company will take over communication with them moving forward. If you have been hounded with phone calls, letters in the mail, and emails, you can look for that to cease shortly after hiring your debt consolidation lender.

Cons

- Your creditors still have to agree to negotiate.

- You could end up with more debt.

- Even if it settles part of your debts, there may be fees

While the debt settlement company advertises lower debt options, this is all at a best-case scenario. The truth is this. The creditor still must agree to the terms debt settlement company proposes.

The creditor still has the ability to say no. And still fight for the original outstanding debt that you agreed to initially. This can be a difficult negotiation for creditor companies that are smaller and require these debts in full to operate. Larger creditors may be more open to negotiation, but they also have a negotiating team of their own in most cases ready to take on debt consolidation negotiators.

Hiring yet another lender could further your debt all in the attempt of you trying to lower it. In the case that your creditors all decide that a lower payout is not negotiable, you as the debtor are still left with this outstanding debt balance. And the interest will accrue from the new loan obtained by the debt consolidation lender.

Where Can I Find a Reputable Debt Settlement Company?

An online search will yield results for a lot of debt settlement companies. Almost all of them will promise great results. Do not get caught up in the advertisement, however. They can say anything they want to say. You must be diligent and make intelligent choices in this matter.

A further online search of the companies that pop up in your results will lead you to customer reviews, either on their site or on separate ones that give an unbiased review. Look for one with a good track record, will work within your budget, and set realistic expectations.

If you are considering a debt consolidation loan, make sure you find the best lenders for your situation. And if you want some help with that, Loanry is here.

Are There Upfront Fees With All Debt Settlement Companies?

No. There are many debt settlement companies that do not charge any upfront fees. In many states, it is against the law for them to charge fees prior to services. In fact, some do not get paid at all unless they are able to reduce your debt, such as Settleit.com. If they are successful in reducing your debt, their fee is 25% of the total debt enrolled in their program.

Where Can I Find Flexible Debt Resolution Repayment Options?

Signing up for debt settlement will not do you much good if the payments set are too high for you to pay. Places like Settleit.com can work with you on your payment options to help you find an affordable plan. Debt settlement companies that are really in the business of helping people will do the best they can to work with what you can offer.

Obviously, if you have absolutely nothing that you can pay, they will not be able to help you. Most companies can work with a budget even if that means spreading the payment plan over a longer period of time. Additionally, they can answer everything about the debt settlement you want to know.

How Does Debt Settlement Affect Credit Scores?

Debt settlement can negatively affect your credit for a period of time as the debt is not being paid in full. However, the negative effect will generally be reversed as the debt is being paid off. If you are wondering whether you should take the risk, consider the fact that at this time, you are behind on your payments or you would not be considering debt settlement. Late or lack of payments also negatively affect your credit.

If you do not expect a large inheritance or bonus check soon, those debts may stay unpaid on your credit for a long time. With debt settlement, getting them off of your credit will probably happen much sooner. Additionally, if your credit score is already low, you probably do not have much to lose from debt settlement and everything to gain.

How Long Does Debt Settlement Take?

The answer to this question depends on the amount of debt you are hoping to settle and how fast you can pay the settlements. A person who is looking to settle $50,000 in debt but cannot pay more than $100 per month will take much longer to get out of debt than someone who owes $50,000 and can pay $500 per month. Settleit.com reports that its program length usually varies from 12 months to 54 months. When you sign up for a debt settlement program, or just speak with a debt settlement company, they can typically give you an idea though it may vary further depending on the settlement amounts companies are willing to accept, i.e. if they will accept 50% as opposed to 75%. Consulting with a debt settlement firm is the best way to get an estimate on your particular debt.

The Bankruptcy or Debt Settlement Decision?

A few years ago, I decided to apply for bankruptcy because the weight of my debt was too much to bear. I wanted to give my family some relief and stop the harassing phone calls, get a little breathing room, and hit the debt strategically. The only way I knew to do this at the time was through bankruptcy. It was one of the biggest mistakes of my life.

The payments were as much as my rent, which was high. The phone calls did stop, but I had to work double shifts just to make the bankruptcy payments. I found myself in over my head even more. Though I had a Bachelor’s Degree, I could not get hired in my field. It felt like I wasted all of the blood, sweat and tears I put into that degree while working and raising a family. It was a more depressing and exhausting spiral than before I filed for bankruptcy.

If your financial situation is that bleak, debt settlement is a great alternative to consider. Debt consolidation even with bad credit generally works to lower the settlement amounts and generally work with a payment plan that you can afford. Also, debt settlement does not keep you from work or moving, and you will see a positive impact on your credit much faster.

Is Debt Settlement a Good Idea?

There is not really a simple “yes” or “no” answer to this question. If you are not currently behind on any debt, creditors will most likely not accept a settlement offer. You have to intentionally stop making payments for at least six months to get settlements approved. If your credit is good, not making payments is going to mess it up.

If you are not yet behind but need to get out from under some of the pressure, you may want to consider other programs like debt consolidation or simply reworking your budget to make extra payments. Sometimes simple tweaks in your monthly budget can put a big dent in your debt without negatively impacting your credit. Take a good hard look at what you spend and be honest about whether every expense is necessary. Can you take your lunch to work? Can you limit your Starbucks visits?

If, however, you are at the end of your rope and are already behind on your debt, you may want to consider debt settlement. Learn everything about debt settlement you can. It should be viewed as an option only when you have tried everything else you know to do except for filing bankruptcy, and it should not be viewed as an excuse to not pay your debt. If it is the right move for you, find a company that will work with your budget and commit yourself to the process.

What Percentage of a Debt is Typically Accepted in a Settlement?

The answer to this question is as versatile as the types of debt settled, which creditors agree to the settlements and the amount of debt you owe. Since many creditors settle debts often, they have a scale set up to go by. Others will negotiate only when the problem arises. Generally, however, you can expect to pay anywhere from 40% of the original debt up to 85%. Some debt settlement experts can negotiate far smaller percentages, so looking for an experienced company is the best choice.

Can You Settle Debt On Your Own?

It is very possible to settle debt on your own. As I previously stated, I will often receive debt settlement offers in the mail. At this point, the only things I have to do is accept it and pay the settlement amount. If you have received these offers, the same applies to you.

If, however, you are starting from scratch, the process is a bit different. It can be exhausting and take a lot of time to get in touch with the correct people and then negotiate the settlement. It is important to note that you may not get as good of a result as an expert. They know what exactly to do. An expert may be able to negotiate down an extra 20% or so that can save you money.

Though it is possible to settle debt yourself, it is worth the time to consider hiring a debt settlement company. This is especially true if there are many debts to negotiate. It comes down to deciding if you want to put in the extra time and effort or if you would rather let the experts do it for you.

If you choose to try it on your own, gather all of your debts. Put them in the order you would like to attack them in. You may list them in order by amount, or in order of how much interest is racking up. Either way, pick your first debt to work on. Determine how much you can pay for it, call the creditor, and make the offer. It is best to have that amount available to pay that day or at least during that week. This will likely help you get settlements easier.

One do it yourself debt settlement option is to get a loan to pay off debt or consolidate debt into a single lower payment. Ideally, the payment is with a lower interest rate and payment.

What Are Debt Settlement Risks?

Debt settlement can sound like paradise compared to what you currently deal with, especially if you cannot seem to keep your head above water. And it can help some people a great deal. It is important to note, though, that there are risks that come with this process and those risks may not be worth it to you.

It will affect your credit negatively. Sadly, anything other than paying a debt in full is going to put some negative marks on your credit. These marks will most likely be nowhere near as bad as bankruptcy. It can be worth it there is no other way to get the debt paid, but it should only be done after weighing out the options.

You may not get the results you want. Not every creditor will negotiate with all debt settlement companies. Some may not negotiate at all. So while you may dream of knocking your debt down to half or less, that may not happen.

It is not an overnight process. Paying off debt takes time so if you think you will be getting out from all your debt in a year, it could end up taking 5 years. Debt settlement is not a quick fix.

Interest does not stop growing. Interest adds onto your debt until it is paid in full. You have to pay to get the debt settled. Besides paying for the debt itself, you will owe the debt settlement company. Also, you will likely have to pay taxes on any forgiven debt. Before taking the plunge, consider all of this. You may find that debt settlement is not worth it for you.

What Does Debt Settlement Cost?

The cost of debt settlement ultimately depends on the debt settlement company. They may charge as much as 25% of the debt they settle. That is a high amount, especially if they cannot get much of the debt reduced. Earlier we discussed that you can expect to pay anywhere from 40%-85% of your debt. If the debt settlement company only gets your debt reduced 15% but charges you 25% of the original debt, you will lose money. In this case, it is cheaper to either chip away at the debt, or call the creditor yourself. This is another reason it is important to find a reputable company with good results.

Conclusion

Financial struggles are a very prevalent problem everywhere, regardless of income, location, job, etc. Anyone can get in over his or her head, be it from a loss of income or a lack of responsibility with money. It can be extremely tempting to take what may seem like the easy way out, i.e. bankruptcy, debt settlement, etc.

However, all of these options involve risks and negatively impact your credit. The decision to take one of these steps should not be taken lightly. It should be weighed heavily against other options. It may benefit you to seek the counsel of a wise friend or mentor. Let them look at your situation with you and guide you in the right direction

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.