If you have come across some unexpected bills or debt, you may find yourself in need of a loan from a friend or family member. Maybe you need help paying rent or a loan for medical bills. Sometimes when unexpected expenses arrive and you have no savings to fall back on, you find yourself in need of cash. When this happens, you may find it necessary to reach out to a friend or a family member for financial assistance.

Before you go down this road, make sure that you are cutting the right corners financially. Also, check that you are attempting to save money at all costs. It is impolite to ask for money, while still spending in excess on items and outings that are not essential. You also should seek out someone you are close with and have a regular contact relationship with. Trying to ask for a loan from your uncle that you have not spoken to in months may not be the best person to ask from.

Loan Agreements With Family and Friends

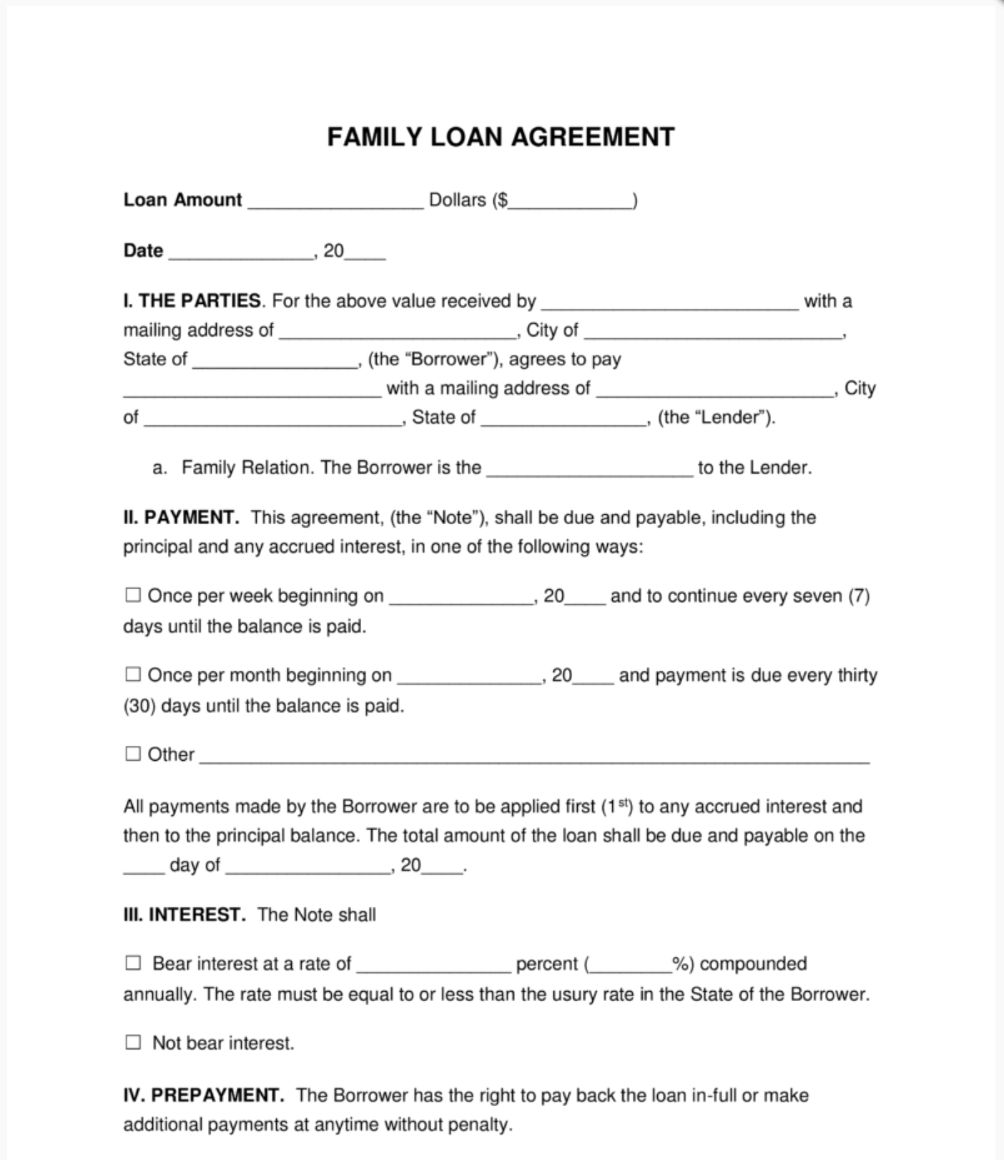

When you decide that you are going to ask either a family member or a friend for money, you must treat this loan as professional and courteous as you would with a professional lender. Be sure to ask for a contract. When you ask for the money and the friend or family member agrees to the loan, your conversation must cover the following:

- Repayment Term

- Interest

You must find out when they would like to have the money repaid by. Are they giving you six months? Eighteen months? Maybe two or three years? Whatever that time frame is, you must first find it out. Being aware of when they would like it back and if that is even possible based upon your own financial situation.

You should also ask if they would like interest on the loan. If they do not plan to charge interest, then at that point you can take the borrowed amount and divide it by the approved repayment months. If you have several years to repay the loan, you will have 5 years x 12 months = 60 total months. You may want to break that payment evenly across those months for budgeting purposes. You could also plan to make it larger to pay back quickly.

Interest Rate on a Family Loan

When a family member or friend decides to charge interest on a personal loan, the loan can not be viewed as a gift. From the IRS or anyone else, it is considered a standard personal loan in all of its value. Since you are reaching out to the family member or friend for a loan, you are seeking an option that you cannot otherwise afford. From a traditional lending service, for example. Most individuals who can borrow traditionally decide to take that route. If a family member decides to charge interest on a loan they can charge at a rate of their choosing, with room for negotiation.

Often times, the interest rate is higher than the competitors. After all, the family members are aware that you are coming to them because of this situation. Because these are individuals that know you personally and understand your situation, your interest rate should be negotiated to a percentage that allows them to earn what they are looking for as well as make the payments affordable. Consider reminding them that this is a type of emergency cash loans if the situation warrants it and that you are out of options.

Also, if the lender would like to separate the loan from a gift, there is a minimum interest. This minimum would need to be charged in order for the IRS to distinguish between a gift and a loan. Your family member or friend may decide to charge at least this minimum interest rate. This usually ensures that the loan is considered a loan.

What Do You Want?

You only want to ask for what you need. Take care to do it politely. You need to provide an exact amount of what you need, and what exactly you need it for. This loan is an unconventional loan, but you still need to explain what it is for. The same way you would do if you were lending from a standard lender. When you reach out to your family member or friend, you need to ask them in-person if possible. If you are unable to, make a personal call to them to give them a thorough explanation. Tell them what you need and why you need it for. I've written an entire blog here about "how to ask friends and family for money".

What Happens When There Is Default on a Family Loan?

If you are the lender in the case of a family member or friend personal loan, then you have several scenarios to consider when you lend money unconventionally.

It Is Hard to Collect

Although you may have a written contract, you may find it hard to collect the loan money from a friend or family member. You need to keep a receipt of all payments, preferably having them pay by check so a written record is established.

If you have lent to someone that you are close with, then you should have contact information for that person. Even so, they may decide to duck your calls or not answer the door when you knock. The good news is that if you have a written contract, you do have the ability to take this person to court. You want also to sue him/her for the remaining balance. If you have done this and still are unable to receive the loan in its entirety, you can write the debt off as a “bad debt” in your tax deductions for the year.

You Risk the Relationship

Anytime two friends or close family members find themselves having to borrow or do business together, there is always a risk for the relationship. It is understandable that you wanted to help them because you care for them if it’s for something like a loan for medical bills than your heart says naturally to help. However, now you are finding yourself in a situation. If you find yourself having to track down your friend each month to get a payment, and they are not as sincere as you originally thought, the relationship may become damaged. You begin to take a different perspective of that person from a business point of view. This can do significant damage to a relationship.

As the lender, you may find that you are providing unwanted financial advice to this person. Consistently questioning their finances and bringing up the loan can cause a disconnect between the two of you two. It might also lead to frustration.

What to Consider?

You must consider the person you are asking and his situation before you begin asking. If your family member or friend has recently experienced some form of emotional damage or financial instability, you should not reach out to them for a loan at this time, no matter how close your relationship may be. You do want the person you ask to have a regular steady job and be someone who is financially stable in their life.

You Must Be Okay With the Loss of Money Should the Situation Turn Bad

When the loan was originally requested and you agreed to the terms, you knew that the situation had the potential to turn negative. Even if you have taken your friend or family member to court for their loan, you may still not receive all of what was originally loaned. If there is no written agreement on the loan, you may not be awarded any of the loans.

You must be aware before you agree to give the loan. There is always a risk the money may never return. Like traditional personal loan lenders and banks, they also have to accept that no matter how much they seek out and try to regain their money.

Should You Lend Money to a Family Member or a Friend?

Whether or not you should lend money to a friend or family member is a personal decision. Only you can answer. First and foremost, you must be sure that you are comfortable in that situation. Especially considering the risks of the situation becoming awkward and even leading to a permanently damaged relationship. If this is a loan used for medical bills or they need help paying rent, consider the need and their monthly income situation before you decide on the loan.

If you believe you can live with this risk of an outcome then you must review your personal finances. The aim is to determine if lending money is even an option for you. Only lend what you are comfortable lending if you have the means to do so.

Finally, if you do decide to lend the money, make sure that the agreement is done so in writing. Also, take care that it is signed by both parties.

Can You Legally Lend Money?

While it is an unconventional process, it is legal to lend money to others. When you decide to lend money, you need to refer to your personal state’s policy. Ensure that you are charging the correct interest rates as stated by your state. Should you need to collect on the debt when payments are missed, you are limited to resources. However, you will have access to small claims court in an attempt to have the debt repaid.

Also, you can suggest your friends or family use a lender finder service online who can help them to find the right loan for their needs.

Alternative Types of Personal Loans

If you are seeking a personal loan and are either not comfortable asking for a loan agreement between friends and family or do not have a viable option, then you have other personal loan options.

- From a bank

- From an online lender

- Peer-to-peer lender

You do have the option to apply for a personal bank loan from your local bank or credit union. Your credit score, current outstanding, debt, and employment history are factors that are considered when you apply for a personal loan.

By using an online lender finder service, you have the ability to supply limited information. Doing so from the comfort of your home and getting a list of results of potential lenders and their interest rates available. Many individuals enjoy this option because they are able to loan shop online. They can also compare their different options before choosing one.

If your credit score is less than fair, you may need to apply for a personal loan from a peer-to-peer lender. Like the online lenders, they can be found using an online lender finder service. However, they have higher interest rates available due to their clients often having less than average credit.

Is a Loan Agreement Between Friends and Family Right for You?

Whether you are requesting the loan from friends and family or a direct lender, a loan agreement is a situation that should never be overlooked. Especially because it has the potential to cause negative strain on a relationship. Having to be strictly professional in terms of this loan and demand written agreements can be difficult to manage. Before a loan agreement between friends and family is decided upon, several factors must be discussed and considered. Make sure you considered all of them before an agreement is signed and a deposit has been made.

Conclusion

If a loan agreement between friends and family can be met, approved, and paid successfully, the relationship between the two parties can be successfully maintained. Depending on the state’s required interest rate, this loan option could be cheaper. This loan would be keeping them from having to pay a much higher interest rate with online lending services. Even more, considering peer-to-peer lending if they have bad credit.