If you are considering debt consolidation using a loan then you need to consider the question of does a debt consolidation loan hurt your credit score? Debt consolidation can be a good way to help you manage your debt and can make it easier to pay down the debt process. Depending on how you go through the process of debt consolidation, a loan can have an impact on your credit score. It can help your credit score in some ways and in other ways it can hurt your credit score.

How Does a Debt Consolidation Loan Hurt Your Credit Score?

Determining how can a debt consolidation loan hurt your credit score will depend on various options you choose. When you choose a loan or a credit card then you are applying for new credit, which will mean a hard inquiry on your credit report. Anytime this happens, the score can suffer. Before you start a debt consolidation plan, check your score. If you close down your credit cards in the process of paying down a loan then it can also hurt your score.

How to Prevent a Debt Consolidation Loan from Hurting Credit

If you are considering debt consolidation then your credit isn’t the best shape. If your credit score is already in bad shape then the answer to does a debt consolidation loan hurt your credit score won’t really matter as much. When you don’t want a debt consolidation loan to hurt your credit then it’s time to become aware of all your choices.

The higher the amount of debt, the greater the impact on the credit score. Even if you see a slip in your credit score, chances are your credit score is low enough that it won’t make much of an impact. If you are considering debt relief then be sure to arm yourself with information.

What Is Debt Consolidation?

In order to answer the question of does a debt consolidation loan hurt your credit score, it helps to know what bill consolidation financing is. Debt consolidation can help you get control of your money. During the process, you merge different bills into one debt you pay off with one monthly payment. You can do this using a debt management company or by getting a loan to get out of debt. Debt consolidation can work for credit cards with high interest.

Pros of Debt Consolidation

One of the main advantages of going through the process of debt consolidation is being able to handle your bills. First, try to negotiate your bills down as much as possible. Yes, that’s right it just takes calling and asking sometimes.

It helps to know the advantages of debt consolidation so you know if the risk of using debt consolidation is worth it to you. You get to merge all your debts into one larger debt.

If you are feeling overwhelmed about your debt then debt consolidating can make it easier to manage. One payment can be much easier to manage than a bunch of little ones. It can also improve your credit as you start to go through the process. As long as you are making consistent monthly payments, you decrease your debt and this will decrease your debt-to-income ratio as well.

Cons of Debt Consolidation

The biggest con of debt consolidation is the interest rate. You can have a high-interest rate on any loan you get, especially if you have bad credit. However, once you have locked in an interest rate, it won’t change as long as it’s a fixed rate. Consolidating debt won’t shorten the repayment in any way.

Unless you close your credit cards, they will still be available to use and you can increase your debt while paying the consolidation loan. This can be dangerous so you have to change habits in order for it to not be a problem.

How Does a Debt Consolidation Loan Help Your Credit Score?

While it initially seems the result is that a debt consolidation loan hurts your credit score, adding new credit or a loan will cause your utilization ratio to go up and this could help you score. For this to work, you will need to leave your credit cards alone after you pay them off.

Process of Debt Consolidation

In order to be successful and not have a debt consolidation loan hurt your credit score, it helps to know the process.

Know Your Goal

When you start to consider consolidation, there are some things you need to know because you do not want to have a debt consolidation loan hurt your credit score. The most obvious goal is to get out of debt but you may also have the goal to prevent debt consolidation from hurting your credit report. You should have long and short-range goals.

A long-term goal can be able to save for retirement. A short-term goal can be to begin saving money. When you consolidate your debt, it gives you the freedom to start to think about these goals. You also want to make sure that consolidating your debt doesn’t stand in the way of your goals.

Gather Your Debts

You need to gather information about your debts so you can know the gravity of the situation. You can’t start to understand the debt problem until you know how deep you are in. Check with your credit card companies and other loan companies to know the pay off amount. It could be different than you think.

Don’t stop paying debts just because you are considering consolidation. You still need to continue to pay off your debts. If you aren’t paying, this can hurt your credit score and give you additional fees. You also need to gather up your debts so that you know how much the loan should be, should you choose to go with that option.

Look at Your Assets

This is a step that many people overlook. Assets can be your home and vehicles you have. You can also consider other valuables you have. This can include investments, savings, and retirement plans. Assets can make a difference. Some companies that help with debt management will want you to use assets to pay off your debts. This may not be the best idea. Remember your goals about how paying off debt can be a short-term goal and saving for retirement is a long-term goal. Protecting assets can be a good way to also protect your financial future.

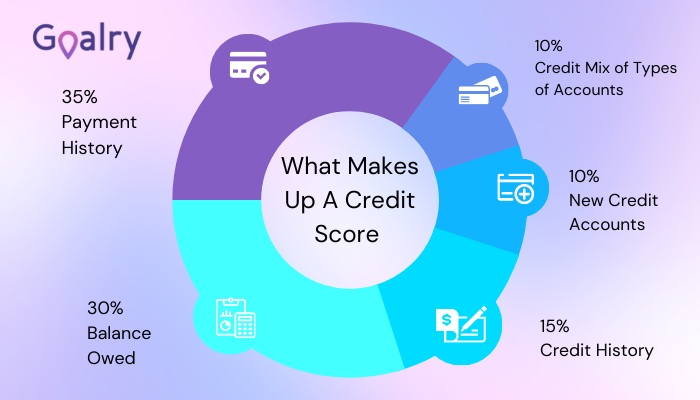

Understand Your Credit Score: In order to start the process, you should have an idea of your credit score. Your credit score can impact the interest rate you get on a debt consolidation loan. A lower credit score can give you a higher interest rate, which can result in having a debt consolidation loan hurt your credit score.

Look at Your Budget

Once you understand your debt, you also need to understand your budget. It helps to know how much you need to pay off your debt. If you aren’t able to pay off all your debt before the process then you may not be able to pay off the amount of the debt consolidation loan.

Know Your Options

There may be a few debt consolidation options available to you. Some of the options may not make sense for you but it’s important to know these options are available. A debt consolidation loan can be used to pay off all your debt and then you are responsible for paying that one payment. If you own a home, you can also consider a home equity loan.

This is a secured loan since you are using your home as collateral. These loans may have a lower interest rate but you do risk your home if you aren’t paying. A balance transfer may also be another option available to you. This also requires you to have a new credit card. You can transfer the balance and pay it off with a lower interest rate. You can also use a debt settlement company with an expert in debt consolidation to help you. The expert will come up with a plan for you that is tailored for your specific situation.

Can You Get a Debt Consolidation Loan with Bad Credit?

While the answer to does a debt consolidation loan hurt your credit score may be no, it can be harder to get a loan with bad credit. While it may be harder to get a loan, debt consolidation for poor credit can still be an option. Many modern lenders can give you a debt consolidation loan online and you can get approved in a very short period of time.

You can start to compare different consolidation lenders online so you can find the right one for you. There are some alternatives that you should be aware of. Payday lenders may not be looking out for your best interest. Some can give you decent terms but others will have interest rates that are extremely high.

Should You Consolidate?

The key to debt consolidation is to avoid taking on new debt. If you are borrowing money and paying off your credit cards but still charging them up, then you can be in worse shape than before. Think about your individual situation so you know how the process can affect your payments and your specific debt. Taking steps to consolidate debt can be the right choice if you are drowning in debt and you don’t have any end in sight.

If you feel that you can’t get your bills paid each month because you can only afford the minimum payment then you may also want to consider consolidating. If you don’t want to deal with multiple payments each month and want an easier way to settle your bills then you may also want to consider consolidating. You will have to decide which steps to address debt are the right choices for you. There are many different ways to access debt consolidation.

Final Thoughts

When you are trying to answer the question of does a debt consolidation loan hurt your credit score, you need to consider your unique situation. Debt consolidation can help your credit score but it may also hurt your credit score if you aren’t careful with the process. There are different ways to consolidate your debt, including a debt consolidation loan. It helps to know what kind of debt you have in order to understand if it is good or bad. By going through the process correctly, you can prevent a debt consolidation loan from hurting your credit score.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.