You just got your credit report and you took a look at your credit score. If you are one of the lucky ones, it is good. For many, it is not so good. That’s OK, I know how it feels. You get a sinking feeling in the pit of your stomach that you should have done things differently. Maybe you screwed up or maybe you just got overwhelmed by unexpected things. Well, the past is past; however, you wonder if anything can be done about it. You need to know how to improve your credit score, and I am going to help you do this.

Learn How to Improve Your Credit Score

The good news is that by reading this guide you can learn how to improve your credit score. How to get rid of all the mysteries and break it down for you. I want to show you how to improve your credit score in a step-by-step way.

I want to teach you that there is really no magic way of how to improve your credit score super fast. Anyone who says this is not telling the truth. However, if you learn these techniques of how to improve your credit score, you will likely see improvement within a few months.

I want to encourage you to continue to improve your credit score over the long term. If you give this effort a bit of time, over the next few months, you will learn how to improve your credit score and thereafter you will be in charge of your own financial destiny.

What is a Good Credit Score?

Credit scores are based on your credit history file that is maintained by the three main credit-reporting bureaus, which are of Equifax, Experian, and Transunion. Your credit score is called a FICO score because that is the rating system, which is used by about 90% of toplenders. It was invented by the Fair Isaac Corporation (FICO).

Your credit score is calculated in pretty much the same way by all three of the credit bureaus. Equifax and Transunion use the exact FICO process. CNBC reports that in 2009, Transunion broke with the official FICO system, but still basically follows the same system.

The information in your credit history file at each bureau may differ between these three systems. This may result in your credit score being slightly different on each system. This can be to your advantage if a lender will accept a higher score from one credit bureau over a lower one from another credit bureau. In a perfect world, the three scores would be the same since theoretically they are supposed to be based on the same information.

A credit score rating can be categorized as high, lower, and very low credit score.

Here is a breakdown of the rating levels:

How Can I Get My Credit Score Up Fast?

The first thing everyone wants to know is how to improve your credit score fast. There are some things you can do that help fairly quickly. However, there is no way to wave a magic wand and make all your credit troubles go away in one moment. If your credit score is low, it probably took you a long time to mess up your credit. It also takes some time to improve it.

If you want to improve your credit score by next week that is simply not going to happen. Be cautious of anyone who advertises “miracle” ways to instantly improve your credit score. They are very likely to be scams.

You have to think in terms of monthly segments of time to see improvements because something you do today will take at least a month, maybe two or three, to appear on your credit report. Your credit report is a history of what happened the month before and going back in time from there.

If you start making improvements today, you can start to see changes that may improve your score over the next few months.

How Long Does it Take to Improve a Credit Score?

The very first thing to learn about how to improve your credit score is to stop messing it up more. One late payment is enough to do a lot of damage to your score. It is frustrating to look at a person’s bad credit score and then realize that they had enough money to pay their bills on time in the past. They simply forgot to pay them! That is like hitting your thumb with a hammer. You only have yourself to blame.

Set up automatic payments for all of your reoccurring bills and you will not have this problem ever again. And, if you want to drive nails safely, hold them with a pair of needle-nose pliers, not between your thumb and forefinger. These are simple things you can do, starting right now, and from now on. No late payments and no more bruised thumbs in your future.

As I said, it takes time to improve your credit score. If you are aggressive in doing the things I suggest, you can see improvements within 60 to 90 days. In about six months to a year, you will see even more improvements.

Get a Credit Repair

You can get a credit repair company to help you. Be careful if you decide to go this route because there are lots of ripoffs out there. Check for complaints about them with the Better Business Bureau. Find positive reviews on the consumer review websites, like Yelp and others, before you make any commitment to work with them or pay them anything.

I prefer that you do this work to repair your credit yourself. It takes time and your involvement; however, it is not that difficult. The reason why I recommend a hands-on approach is that you will be empowered by taking control of your finances. You are the one ultimately in charge of your credit score. It is better if you do not have to rely on others to do this for you.

The Super Lazy Way to Improve Your Credit Score

Your credit score will eventually improve if you can simply wait for a long time. If you don’t add any more negative credit information on your credit history, after a long time, the bad stuff disappears from your credit record. Some of this happens because of the policies of the credit bureaus. Other parts of the negative information in your credit history have to be removed after a certain period by law. You can force the credit bureaus to remove this information if they do not follow the law.

It takes up to a decade to get rid of everything on your credit record that is negative, except for student loan debt. Student loan debt never goes away unless it is forgiven by the U. S. government under special forgiveness/cancellation programs for student loans. Even bankruptcy does not get rid of it.

For everything else, except student loan debt, here are the timelines of when the information gets removed from your credit history file:

Accounts Sent to Collections or Charged Off as Non-Collectible:

180 days from the date you failed to make a payment plus seven years.

Tax Liens

These stay on your credit record for seven years from when they were finally paid off or officially discharged in bankruptcy.

Civil Judgments

Judgments are shown on your credit history for seven years or until the statute of limitation expires, whichever is longer (check your state’s laws). Note that it may be possible for a creditor to request the judgment to be renewed by the court. This extends the time for the collection of the judgment and how long the item appears on your credit history.

Bankruptcy

A bankruptcy stays on your credit history for up to ten years after the official “discharge” date, which is when the bankruptcy is finalized. Some credit bureaus take Chapter 13 bankruptcies off your credit history after only seven years from the discharge date.

If you are the lazy type, waiting does work. Any negative information that becomes older has less impact our your current credit score as long as you do not continue doing bad things to mess up your credit.

What Makes Up Your Credit Score?

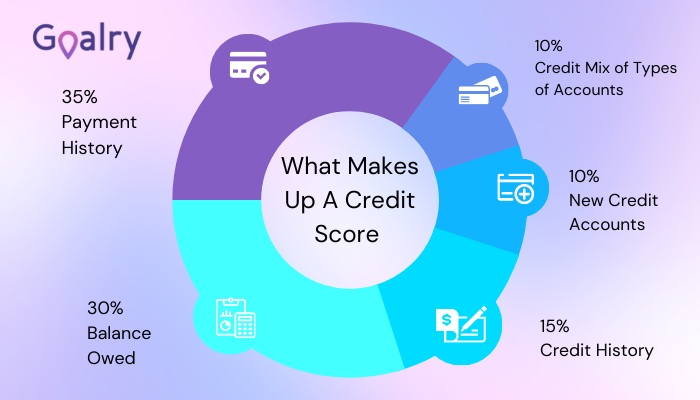

Learning how to improve your credit score starts with understanding what goes into the calculation. Here are the things that make up your credit score and what causes the number to go up or down.

Your credit score is an algorithm. That is a fancy term from mathematics that means many things are used to calculate your score. They are given different weights in the calculations based on their perceived importance.

Here are the main categories and their respective weights in the calculations:

Payment History (35% weight)

Always pay everything on time. A single late payment is very damaging to your credit score.

Amount Still Owed (30% weight)

As a rule of thumb, restrict the use of your credit to half of the limit and frequently pay down the balance. Paying off a credit card at the end of each month, to avoid paying interest, saves money wasted on interest payments. This is also a wonderful thing that improves your credit score.

Length of Your Credit History (15% weight)

Showing many years of good payment records on your credit history is very powerful and improves your credit score dramatically.

New Credit Recently Added or Applied For (10% weight)

Having many recent credit inquiries about your credit history is a red flag These show up on your credit report when you apply for new credit. This can negatively impact your credit score.

Be sure you know who is accessing your credit file. If you don’t want unsolicited credit offers, you can lock your file at the three credit bureaus. If your file is locked you can then unlock the file just for the lenders that you approve.

In some states, this is a free service required by law. In other states, there may be a $10 fee for each time you unlock your credit file. Locking your file is free. Locking and unlocking can be done online at the websites of the credit bureaus Equifax, Experian and Transunion.

Some systems have monthly memberships that offer this service combined with sending you email notifications of changes when they are made to your credit history file. If you want to permanently lock your accounts, so no one can get access, you can freeze them.

Kinds of Credit You Use (10%)

Good credit scores come from a balanced mix of installment payments, such as an auto loan, and credit line payments, such as credit cards. Having a home mortgage is a plus.

7 Ways to Improve Your Credit Score

In this section, I am going to describe the seven steps you can take while you learn how to improve your credit score. These are the exact same steps that a credit repair company would do for you if you decide to pay for that service. As you will learn, it is not that difficult to take these steps after you learn how to improve your credit score.

Credit history files are notoriously inaccurate. This is not necessarily the fault of the three main credit bureaus. The credit bureaus want to maintain accurate records; however, they report the information that they receive from the lenders. The trouble is that they may get lots of stuff from lenders that is wrong. Files get mixed up. Data entry mistakes create errors.

You should check your credit score by reviewing a report from all three credit bureaus and look for inaccuracies. Then, dispute anything you find that is wrong. Each credit bureau has a system for disputes. Disputes can be made online. Go to their websites and follow the dispute procedures for each system at Equifax, Experian and Transunion. This is a very good way of starting on the pathway of how to improve your credit score.

After you clean up your credit reports and make sure all the information is accurate, then the next steps are all about reducing spending, following a budget, and dealing with old problems. If you are constantly using your credit cards to buy things, you are spending too much. Switch to using cash instead. Only carry one credit card for emergencies and leave the rest at home locked away in a safe place.

When you run out of cash, stop spending money, especially on frivolous things that you do not really need. Reserve a portion of your monthly budget for paying down credit card debt. Don’t just pay a minimum payment because you will never reduce the balance that way. Cut up credit cards (but don’t close the accounts) except one that you keep for emergencies that has plenty of credit available on it that is still left to use.

If you are really in a bind, negotiate with your lenders to lower your interest rate or ask them to forgive the interest. Tell them you are planning a bankruptcy if they don’t cooperate and you will get their attention fast. If possible, consolidate high-interest credit card debt into one personal loan at a lower rate. Avoid having to take personal loans with bad credit customers can as you improve your credit score. Eventually, you can get a better deal on personal loans with good credit. Don’t take on any more debt if you cannot handle the debt that you already have.

Dispute all late payments on your credit history, even if they are accurate. The credit bureaus ask the lenders to verify the information. The lenders must respond within a certain amount of time. If the lenders fail to respond in time, the credit bureaus will remove the negative information.

If this does not get rid of all late payments in your credit files, negotiate with the lenders that put the negative information on your credit history. A lender that gave your payment information to a credit bureau also has the ability to change it.

Offer to pay off all the debt if you can, or bring the account current, or make a big payment. Do this in exchange for the correction and removal of all past due, late payment information in your file. Alternatively, get the lender to accept an amount to satisfy the entire debt (at a discount), then the account will show on your credit history “closed, paid as agreed.”

An easy way to make sure you get the agreed terms is to put the payment amount in an escrow account. The funds are held there waiting for the lender to comply with the written contract terms before the funds are released.

Collection accounts can be paid off at a steep discount. A good rule of thumbs is to offer ten cents on the dollar. If you owe $1,000 offer to pay $100 and tell them this is your last money before you file bankruptcy. It helps if you use a low-cost legal service or decently-price lawyer who is competent and honest.

There are flat fee lawyers who work to resolve certain issues, which you can contact through findlaw.com. It is beneficial to have a lawyer do this negotiation because the collection agencies cannot harass you, or even speak with you after you inform them that you have legal representation.

One good rule of how to improve your credit score is not to apply for more credit once you have all the credit cards that you need. Every time you apply for a credit card or a loan, your credit score is “dinged.” This means you lose some points of your score, whether you get the loan, credit card, or not.

The credit utilization ratio is the amount that you have borrowed compared with the amount of remaining approved credit balance that you have left. It is best to only use up to half the amount of credit you have available on each account. Never max out your credit cards, unless you pay off the entire balance at the end of each month.

Your best bet for succeeding in how to improve your credit score is to show prudent use of your credit and pay all accounts on time, as agreed, over a long period. Then, you can get a personal loan to improve your credit score if the rates work out for your budget.

Can You Improve Your Credit Score by 100 Points?

Now, that you know how to improve your credit score take these three steps and you will likely see at least a 100 points increase in your score:

- Correct all errors on your credit reports by disputing them

- Fix delinquent accounts by paying them off or bringing them current in exchange for getting the negative information removed from your credit files

- Pay down your debts to improve your credit utilization ratio

Summary

If you follow my advice, I see a 550 to 650 changing to maybe a 650 to 750, or even an 800+ score as a happy possibility for your future. Good luck.

William Vinson has been a professional writer for more than 35 years. He is also a seasoned financial professional and raised significant capital for the startup of over 30 companies. He has expertise in real estate, insurance, financial planning, and investment management. He wrote thousands of articles for publication on major websites. All of his earnings from writing are used to support the charitable efforts of the Willivision Foundation that helps the elderly and does animal rescue.