OK, I’ll admit it. This probably sounds like a silly question. Why would we even open with something so… obvious?!

I’m glad you asked.

Too many times, we dive into new debt without fully thinking through what we’re committing to. If we don’t fully understand what we’re applying for, we can’t properly determine whether or not there may be loan options that make more sense for our situation. There are as many varieties of loans as there are borrowers and lenders, and unless we stop and think about the specifics of what’s in front of us, we’ll most likely agree to the first offer that waves “low monthly payments” or “zero percent interest” in front of us like a hypnotist’s shiny watch.

Any offer that doesn’t hold up well to a few simple questions probably isn’t a very good offer.

Use Your Personal Loan In The Best Way

The “personal” part means you’re taking out this loan based on your individual credit score, your credit history, your current income and employment, and your assurance of repayment. The funds aren’t committed to purchasing a home, a new vehicle, or starting a business. With most personal loans, once approved you can do pretty much anything you wish with the money. If you’re taking out a personal loan for a major purchase, the assumption is that you anticipate a major purchase of some sort – but that may not matter to the lender. What matters to the lender is how likely you are to make your payments on time, every time. Unless your purchase is specifically required as collateral on the loan, it’s only a personal loan for a major purchase because of YOUR decisions and goals.

Most personal loans are “term loans”. These are the most standard sort of loans with which most of us are familiar. You reach an agreement with a lender to receive a lump sum upfront, and you repay it over a set amount of time in regular monthly payments until the loan is paid in full.

Secured and Unsecured Personal Loans

A personal loan for a major purchase can be “secured” or “unsecured.”

“Secured” means you’re offering the lender some form of collateral – your home, or automobile, or perhaps the item you’re purchasing. If for any reason you’re unable or unwilling to make your payments, the lender has the right to take possession of the collateral to recoup their losses. Because the lender is protected in this way, secured loans are often easier to get approved even with less-than-perfect credit. Sometimes you can negotiate lower interest rates as well.

An “unsecured” personal loan for a major purchase relies entirely on your credit history and personal guarantee for approval. Lenders may require higher credit scores to approve unsecured loans, and interest rates will likely reflect their higher risk. On the one hand, you’re not risking personal property if anything goes badly; on the other, the loan will probably cost you more and defaulting will seriously damage your credit. Secured or unsecured, you want to make sure you’re able to make each and every payment on time, every time.

How Much Interest Will I Pay on a Personal Loan for a Major Purchase?

“Interest” is the primary cost to you of borrowing money. There are sometimes other fees or extra charges for late payments. But interest generally makes up the bulk of the lender’s profits. Most basic personal loans carry a fixed interest rate. Your monthly payments remain the same each month until paid in full. And you know the day you agree to the loan exactly what it will cost you and the date of your final payment.

Some lenders will offer adjustable-rate interest for personal loans as well. These usually start off at a lower interest rate, but after a set amount of time can rise or fall based on current market averages. The lower initial rate is tempting for many borrowers, but over time loans calculated under this method tend to cost more than locking in a set rate at the outset. That’s the risk of adjustable rates – you can’t predict for certain which way rates will go during the life of your loan.

Whether fixed or adjustable, your interest rate will largely depend on your credit history and your current three-digit credit score. If you shop personal loans today, you’ll find rates from major lenders are running anywhere from the single digits – around 7% or so – to 35% and higher. With a little searching, you’d no doubt find someone offering lower rates in the right circumstances. I’m positive there are other folks paying far more. It all depends on your specific credit history and timing.

What Determines My Interest Rate?

The stronger your credit history, the better the rates available to you. This doesn’t mean that every lender will offer you the same rate, however. Different lenders weigh the same factors in different ways. Some are quite myopic about your credit score and barely pay attention to anything else. Others look at your credit history to see what sorts of debt you seem to do well with and which sorts have led to difficulty. A chain-store retailer, for example, may give extra attention to your track record paying on store-issued credit cards and less attention to outstanding medical debt that hurt your credit score years ago.

In short, interest rates are strongly shaped by your credit, but they’re not 100% determined by it. Be prepared to do a little personal loan shopping until you’re confident you’ve found the best terms available to you.

Factors that Determine Interest Rate

- Credit Score

- Credit History

- Employment Type and Income

- Loan Size

- Length of Term

Your Credit Determines Terms for Your Personal Loan

In the same way, your current credit history and three-digit credit score shape the rates and other terms available to you, the way you handle this loan going forward shapes your future credit history and credit score in return. As you make your monthly payments, your credit history grows stronger and your credit score gradually rises. It takes time to build, repair, or strengthen credit – but it may not take as long as you think it will.

One day, you’ll need financing again. You’ll want to make another major purchase, finance a vehicle, buy a house, pay for a wedding, or go on a vacation. The amounts and terms available to you when that day comes will be largely shaped by what you do between now and then. If you have good credit, you can make it better. If you have no credit, you can establish it between now and then. And if you have bad credit, you can start fixing it.

It may not be easy, but it doesn’t have to be as hard as it sometimes seems. And you don’t have to do it alone.

Should I Use My Savings Instead?

This isn’t a bad idea, especially if you’ve been saving up specifically for whatever it is you’re about to buy. On the other hand, you don’t want to empty your emergency funds or other savings accounts if you can avoid doing so. It’s sometimes worth financing small purchases (anything that costs less than a new car, for example) in order to keep money in reserve.

That’s assuming we have savings, of course. As Forbes recently reported, more and more of us are living paycheck-to-paycheck these days.

A new survey shows that 49% of Americans expect to live paycheck to paycheck each month this year. More strikingly, 53% say that they don't have an emergency fund that covers at least three months of expenses. At the same time, 91% say they want to develop better money habits this year.

They’re talking about our language. Taking more effective control of your personal and small business finances is what Loanry and the rest of the Goalry family are all about. It’s why we keep sharing these articles and offering free access to online money management tools. It’s also why you should keep reading.

If you can realistically put off your major purchase for another six months or a year until you’ve saved enough to simply pay cash, that’s often ideal. If not, the first “better money habit” you might want to develop is taking the time to explore your financing options before you buy.

Why Not Use Credit Cards?

You can certainly use your credit cards to purchase appliances, home electronics, or whatever else you need. It’s important to consider several things before making that decision, however.

High Interest-rate

Credit card interest tends to be higher than the rates you may be able to qualify for on a personal loan for a major purchase. A few percentage points may not seem like a big deal on paper, but over time, the dollar difference adds up faster than you’d think.

I’m sure you’ve noticed that paying your minimum payment on your credit card bill doesn’t seem to lower the balance very much from month to month. That’s because credit card billing is intentionally set up to keep you paying interest each month and very little towards the principal. A personal loan is a term loan. Your payments are the same each month and you know exactly when it will be paid in full. There’s no temptation to pay just enough to get by until next month.

You Shop More Than You Need With The Credit Card

Finally, credit cards make impulse buying much easier than it should be. You are thinking to buy a new laptop or desktop pc and you see in the store – it’s shiny and new and the description makes all sorts of promises. The plastic practically leaps out of your wallet or purse, begging to be used. How often have you been excited about a major purchase only to realize a few days later that you overlooked something very important to you in the excitement of the moment? That you probably didn’t need the “extended warranty” or should have negotiated better delivery options? Plus, it never hurts to let the salesperson see that you’re a methodical shopper, not likely to pull the trigger five minutes into your first visit.

Then again, getting a personal loan for a major purchase isn’t the time-consuming, laborious process it was a generation ago. You can log in from any connected device and in a matter of minutes submit your information.

“Zero-interest” Trap

So you’re at the electronics store, and there’s the amazing new 240” HD Quantum Plasma something-or-other TV and home entertainment system you’ve been lusting after ever since you first heard they were coming out. Or maybe your wife or girlfriend wants you to buy a brand new washer and dryer. The salesperson asks if you have any questions, then casually mentions that they have “interest-free” financing or that you get special terms if you sign up for one of their store credit cards today. Awesome, right?!

Well, maybe. Sometimes major chain stores offer promotional financing similar to what automobile dealerships do periodically. It’s possible that if you look over the details, you’ll discover it’s a pretty good way to get yourself that TV or entertainment system and finance it for practically nothing. The key is to really look at those details because other times you’ll find that “zero interest” only applies to the first few months, after which all of that interest is suddenly added back in and you’re actually paying a rate closer to your age than your shoe size. And most credit cards from chain stores are just that – credit cards. You may save a few points here or there when you use them at that store, but otherwise, they have the same advantages and disadvantages as any other card.

Be Patient and Compare All Loan and Credit Card Options

Store financing isn’t always bad. Like so many things, it’s all about knowing what you’re getting into. Compare the terms you’re being offered to those you get on your existing credit cards, then compare both to the terms you could get with a personal loan for a major purchase. You might be surprised how much difference you’ll find.

Oh, and by the way… are you SURE you need that 240” HD Quantum Plasma whatever-it-was? I mean, that thing will hardly fit in your house. Did you notice the great price on last year’s latest and greatest home entertainment system – the one they’re replacing to make room for this one? Ask your salesperson about that one; I’ll bet you could get a pretty good deal.

How About Rent-to-Own Places?

No. Just… don’t. Unless you for some reason need to fill a living room or office for a month or two then return it all, there’s no point even walking into most of these places. I’m happy to talk pros and cons of credit cards, dealer financing, personal loans, how to lower your interest, when to consider refinancing, etc., but if you’re seriously considering rent-to-own, I respectfully advise you save yourself some trouble. It’s better to simply withdraw all of the cash you have in your account and go throw it into the street and walk away.

Start Looking For Personal Loan Online With Your Cup of Coffee on the Table

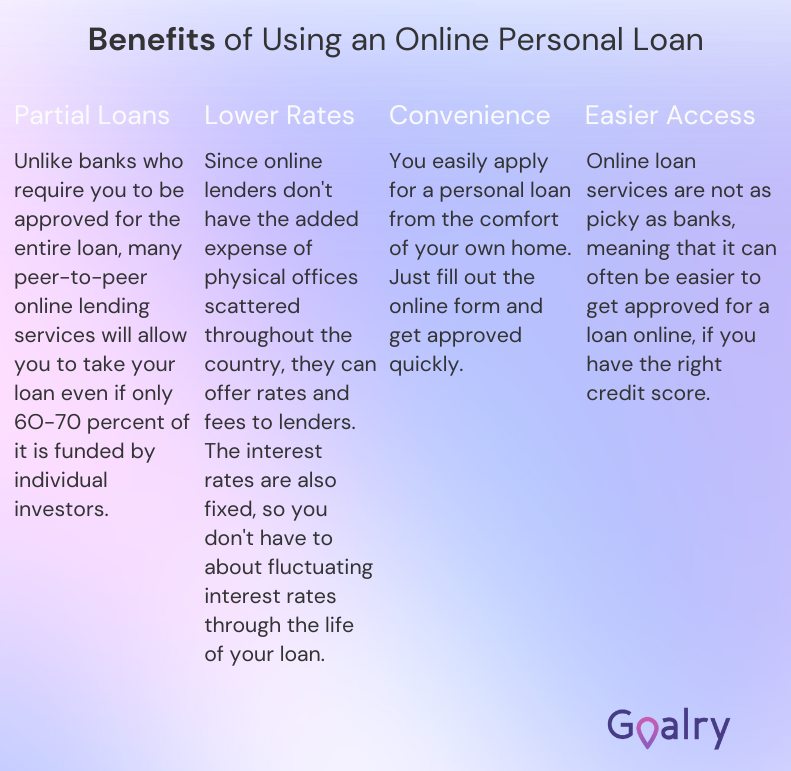

The explosion of the internet in the 21st century has opened up possibilities inconceivable a generation ago. That includes a plethora of online lenders with low overhead and national reach. Have you ever noticed that in almost every other industry, companies compete for your business? In traditional lending, however, you’ve been expected to persuade financial institutions to accept you as a customer. That’s backward.

At Loanry, we maintain a curated database of reputable online lenders. When you’re ready, let us know a little bit about you and what you need. And we’ll hook you up with a lender we think is most likely to win your business. In other words, the lenders compete for you – not you for them.

It’s always up to you, of course. If you don’t like what they offer, you walk away – no cost, no-obligation, no hurt feelings. But I gotta tell you, from the feedback we get, that doesn’t happen very often. It turns out we’re pretty good at this, and oddly, we enjoy it.

When you’re ready to explore that personal loan for a major purchase, let us know.

In Conclusion

If you’ve decided it’s time to make the move and finally get new tv and audio equipment or replace those old kitchen appliances, then it’s also time to talk about a personal loan for a major purchase. You have several options.

Your local bank or credit union may be willing to consider extending your credit for purchases like these, assuming you have pretty good credit and can document your income from the past several years. It’s also helpful if you have an existing relationship with the institution – maybe a checking or savings account you’ve had for a while. We’ve already looked at credit cards and store financing as options. And you’ve probably figured out I’m not a fan of rent-to-own.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.