There is a lot to know when you are considering a loan. It is important to fully understand your needs when it comes to a loan, so you can be sure to get the right loan for your needs. There are personal loans and business loans and many variations of each one.

Personal vs Business Loans: What You Need to Know

Business loans and personal loans have many similarities, so you should educate yourself on the details. Continue reading to find out the difference of personal versus business loans.

What Is A Personal Loan?

There is a lot to understand about personal loans when you are trying to make the decision of personal versus business loans. You should fully understand all the details about personal loans. I like to start with the simplest definition of personal loans. It is when a lender allows you to borrow a specific amount of money. You then agree to pay back the money with regular monthly payments.

The lender can be a bank, a credit union, online loan companies, even family or friends. The lender charges you a fee to allow you to borrow money from them. That fee we call interest. The lender decides your interest rate and determines it by your credit score. You have higher interest rates when you have a low credit score.

There are various personal loans by many different lenders. You do not have to select the first loan you see. But you need to make sure that whatever loan you choose, it is a good fit for you. You should do personal loan shopping before you make the final decision when it comes to your personal loan choices. It is also important that you can afford the loan payments. If you cannot afford the payment, is can negatively impact your credit score.

What Is a Business Loan?

When it comes to personal versus business loans, there are no limits to how you can use a personal loan. There are limits, however, on how you can use a business loan. A small business loan is when you request to borrow money from a lender as a business owner. The lender can be the same types of lenders as a personal loan, a traditional bank, a credit union, or an online lender. If your business has multiple owners, then all of the owners are requesting to borrow money for your business.

You are agreeing to repay the loan by making regular payments of a set amount. Just like a personal loan, lender charges interest as a fee for allowing you to borrow money. These terms vary from lender to lender and based on your credit and qualifications. When you sign the loan agreement, you are agreeing to the terms of the loan.

The lender sets the terms, which includes the interest rate and the length of the loan repayment period. The lender determines how often you repay the loan, such once a month, or every two weeks. These terms drive how much you pay with each payment. As long as you have a fixed interest rate, the amount you repay remains the same and does not fluctuate.

Are There Specific Uses For a Business Loan?

Yes, one of the largest differences between personal versus business loans is that business loans must be used for business purposes. Some business loans have specific intentions and must be used for that. For example, if you get an equipment loan, you must buy equipment with it. If you get a real estate loan, you must use it to purchase real estate. There are business lines of credit that can be used for smaller business items. Then, there are SBA loans that are intended for larger business needs. No matter which type of business loan you get, it must be used for the business.

You should have put thought into the purpose and not just apply for a business loan on a whim. Few lenders want to invest in a business that does not seem to have a lucrative idea, so make sure your plans are thought out. The lender wants you to show them that you are and can continue to make a profit. You must understand how to finance a business with any type of loan you acquire.

Can You Use A Personal Loan For Business Purposes?

One of the major differences of personal versus business loans is that you can use a personal loan for absolutely anything you want. With a few exceptions, there are no limits to what you can do with a personal loan, especially if it is an unsecured loan. Secured loans are slightly different. When you apply for an unsecured loan with a lender, you ask for a certain amount. The lender typically asks what your plan is for the money, but they never really verify it. Once you are approved, the lender deposits the money into your bank account. From there, you can do with it whatever you want.

If you choose to use a personal loan for business needs, that is up to you. One thing to consider is, if you are taking out a personal loan for your business, you are responsible. If you, Jane, are taking out the loan that makes you responsible for paying back the loan, no matter what happens to the business. Even if the business fails, you still have to make those loan payments every month. If you do not, it negatively impacts your credit. So if you do not pay back the loan, the creditors will come after you to pay them.

If you are part of S Corporation or an LLC, you may not be financially responsible for the loan, if the business does not do well and closes. Even if you have not paid the loan, it may not impact your credit. You also may not be subjected to collection calls in the middle of dinner.

Positives to Using A Personal Loan Instead of A Business Loan

There are many reasons why you might consider personal versus business loans.

Applying for a personal loan is much easier than applying for a business loan. The application process is faster and you get a response, and the money, much sooner. You can apply for a personal loan online. When applying for a personal loan the bank wants to know your personal credit history and credit worthiness. When applying for a business loan, the bank wants to know everything about the business, including tax returns, profit sheets, and the business plan.

You may be able to get a better interest rate when you apply for a personal loan. You probably have a better and longer credit history than your business, which helps when securing loans. Many lenders are less willing to invest in a business, especially a new one that does not have a proven record of success. Lenders want to make money, too. If your business does not look like you (and ultimately they) can profit from it then they may not allow you to borrow the money. If you go to an online lender, you can have your money within 24 hours.

Some business loans can take several months before you find out whether the lender approved you. Personal loans usually take a couple of days. Some personal loans give you a response the same day and if you got it, the money is in your bank account the next day.

Negatives Of A Personal Loan Over A Business Loan

There are some downsides to personal versus business loans. The biggest negative is one that I have mentioned before. That is, if you take out a personal loan for your business, you are responsible for repayment. It does not matter if your business fails or succeeds, you are personally responsible for the loan. It does not matter how the business was set up. When you take a personal loan, you are accepting personal responsibility.

When you take out a personal loan, it impacts your credit and debt to income ratio. You are taking on the personal loan as your own personal debt. So it adds to the amount of debt you are currently using. It means that it increases your debt to income ratio. If your only income is the business and it is not incredibly profitable right now, it may seem that your debt to income ratio is really high. This could prevent you from getting other items, like a house or a car.

Personal loans tend to be for smaller amounts, so it may not be a large enough loan for you to do what you need. Not only are personal loans typically for several thousands of dollars, you are limited in how much you can borrow based on your salary. As mentioned above, if your only salary is the business and it is not profitable, that may hurt you when you are trying to get a personal loan.

Can You Use Both Types of Loans to Start Up a Business?

When you want to create a start-up business and you are thinking about personal versus business loans, you should always consider the amount of money you need. You certainly can use either a personal or business loan to fund a start-up, but you have to determine which one is the right one for your needs. If you have a start-up business, most likely you do not have anything and you need to purchase it all.

You need to think about your inventory. What are you selling? How are you going to get those items? Do you need to hire people and how are you going to pay them? You might need equipment or a space to rent. All of these items cost money and you may need to take out a loan to have the cash flow to begin acquiring these items. You may decide that you are going to start your business in your home and you are the only employee.

I encourage you to do everything you can to begin making a profit before you obtain a loan from a lender. See how far you can get on your own before you begin to borrow money.

Personal Loans versus Traditional Business Loans

One of the largest differences between personal versus business loans is that business loans tend to be for larger amounts of money over longer periods of time.

An SBA loan is one of those business loans that tend to be for higher amounts of money. They are similar to a mortgage in that they are a large commitment. SBA loans are backed by the Small Business Administration. This is a government agency that guarantees 85 percent of the loan. The federal government does not provide the loan, that comes from an approved vendor. These vendors are typically banks. The government is just backing the loan so that if for some reason you do not pay it, they will cover about 85 percent of it.

These loans can only be used for business purposes, such as purchasing equipment, refinancing debt, buying real estate or other businesses, or to be working capital. These loans can be for as much as $5 million dollars and you can take up to 25 years to repay the loan with regular monthly payments. They do have fixed and variable rate options which can help with the interest rates. These loans may have a lengthy loan application process that requires background checks. You may have to provide collateral for this type of loan.

There are some other types of traditional business loans, such as an equipment loan which is used specifically for the purpose of acquiring new equipment for the business. The equipment you are buying becomes collateral for the loan. If you do not repay the loan, the lender will take that equipment. However, this may help you get a better interest rate. Commercial real estate loans are similar to equipment loans except these are specifically for purchasing new real estate for the business. These types of loans often have reasonable interest rates.

Does My Credit Matter?

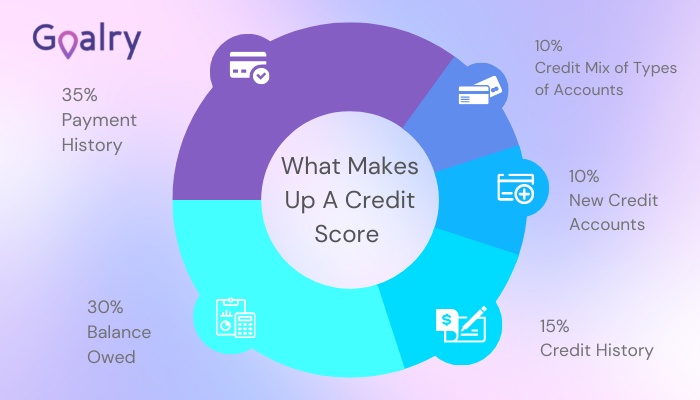

When considering personal versus business loans, one thing that matters either way if your credit. Your credit is always important, but in the case of personal loans versus business loans, it could be your personal credit, or the business credit, or both that matters. It all depends on the type of loan you are requesting and how your business is set up.

For a personal loan, only your credit matters. For a business like an S corp, only the credit of the business matters. If you are simply self-employed or have an LLC, your credit, along with the business credit may matter. What is important to know is that you want to keep your credit in the best possible shape that you can. Your credit not only impacts your ability to get a loan, but it also has much deeper implications.

When considering personal versus business loans, you must remember that a personal loan directly impacts your own credit and if the business does not do well, you are still responsible for repayment. If you do not repay, it directly impacts your credit and your ability to do other things, like get a house. This is important to keep in mind when you are thinking about personal versus business loans.

Conclusion

In all the information I provide about personal versus business loans in this article, I only touch slightly on deciding which one is best for you at this time. Most importantly, you need to make sure that you can afford to repay the loan. Businesses are hard because unless you are some mega-company that makes millions of dollars per year, you just do not know how well the business will do. You may have years where you make large profits and then lean years where you make little to no profit.

It can be hard to predict. You need to create a business plan that allows you to make smart decisions when you make a large profit but can also carry you through the lean years. It does take money to make money. However, you need to be sure you can repay your debts.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.