Whether you open a business or want to expand an existing one, you at some time will likely need a business loan. Regardless of your situation, you may need a business loan with bad credit because not every business person has a credit score of 800.

Before you jump into applying for loans, let’s look at your other options. Despite where you’re reading this, as a business owner and finance writer, I will tell you that a loan should be your last resort, not your first choice. A lot of people jump at the chance to take out a loan because it seems easy. It seems like a choice that will provide them all the money, all at once.

They do not consider the interest added to the principal of the loan and how much it will add to the cost. Nor do they think about the fees. They do not consider what will happen if their business hits a rough spot and their revenue slows down. They just think, “Hey, here’s a quick way I can get the money I need.” So, before we jump into applying for bad credit business loans, let’s look at how to finance a business.

How to Finance a Business

You really have a wide range of choices in funding opportunities. You could suss out angel investors, venture capital, go public, fund your business with a cryptocurrency token, gather private investors, crowdfund or use a combination of these. Then, when you have exhausted all of those opportunities, you turn to taking out the smallest loan you need. That may mean applying for a micro loan or a standard small business loan. The best place to start for the latter in the US is the Small Business Administration. So, let’s explore each of these succinctly and you can read more about the choice that resounds most with you on your own.

Before you begin, examine your actual financial needs. You should be applying for the lowest amount of capital needed for two main reasons.

First, most organizations, especially lending institutions, loan or invest based upon your ability to pay it all back. Now, you might think, “Hey, an investor doesn’t get paid back. They don’t make a loan, so there is no interest.” Insert angry buzzer sound here. Your investors expect a hefty return on investment. They anticipate that when they invest in your firm or startup they will earn money from it. Either way you go, you should ask for the smallest amount. If it comes from an investor, you can buy them out more easily and go back to being the sole owner of the company.

Second, both lending institutions and investors recognize padding when they see it. Padding refers to when you add extra funding need needlessly. For example, when you create a line item budget and include a laptop computer with a terabyte drive, but the amount of cost you include is twice what the laptop costs. You padded the cost.

Loan officers and angel investors aren’t dumb bunnies, as my Daddy used to say. They recognize padding when they see it. They know what things cost because they look at budgets and budget requests just like yours every single day of their lives. It is the majority of how they spend their time. Your accuracy in your budget and budget discussion shows them your overall accuracy. It also reveals your honesty and transparency. Few people want to loan or invest with a dishonest liar who they have no idea how they are spending the money. Determine the smallest amount of funding you need and chase that amount with ferocity.

Despite all the preparation, prepare yourself to receive less funding than you requested. Less than half, 46 percent, of businesses receive their full funding request. If you already bootstrap your business, prepare to tighten up things further. Waste not, want not – another favorite of my father.

Angel Investors

Many startups hope and pray they’ll land an angel investor. It’s tough. Mainly, three reasons make it hard to land an angel.

- They like to remain anonymous.

- They typically do not know you.

- You need to already have a minimum viable product (MVP) prepared to present.

A very few wealthy individuals or families have formed investment offices to screen potential investment deals. You will need to angel investors that understand your industry and business model. You can check Angel List if you just began your firm, but if you already established, check with board members and business advisors first. Your best bet is an individual or family with whom you already have an established relationship.

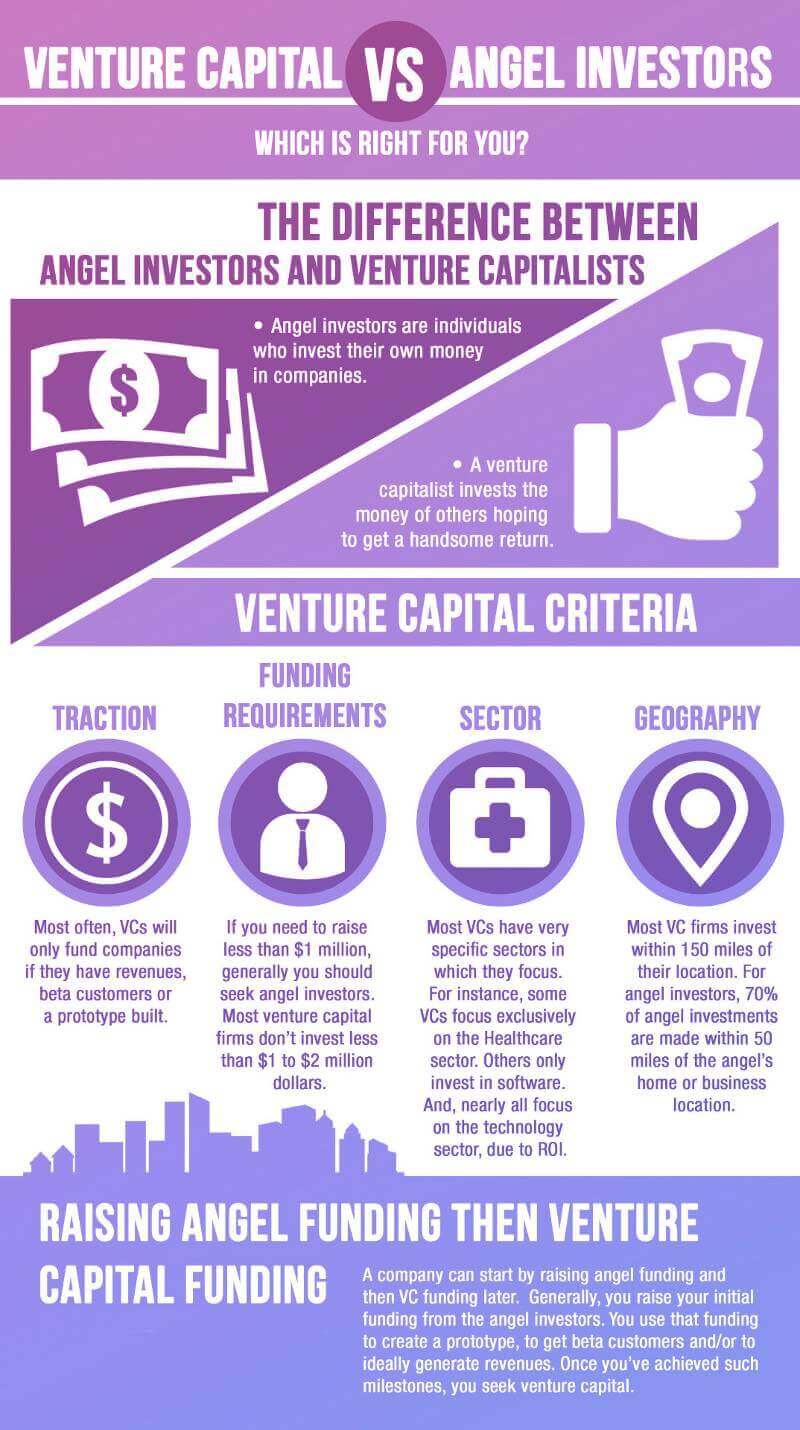

Venture Capital

Established firms or startups can seek financing from venture capital (VC) firms. A VC bears close resemblance to an angel investor, except that the angel may be an individual more often than a VC would be. Typically, you will find a VC firm comprised of a group of investors with significant business experience. This firm may provide much more than funding, including:

- strategic assistance,

- potential client and partner introductions,

- assistance drawing high-quality employees,

- other business growth advisement.

Similar to the tough time landing angel investors, you’ll also find it challenging to obtain venture capital financing. You need an introduction to the VC. Most cold calls go unreturned and feeler emails get ignored. You need a colleague who knows the VC well to provide an actual face-to-face introduction.

At this introduction, you’ll have an opportunity to hit them with your elevator pitch. That refers to a 60-second or less description of your company or product. Until you can describe what you offer in one minute or less and make it sound great, cataclysmic, amazing, you aren’t ready. You also have to be able to prove what you said you deliver in that elevator pitch.

That pitch starts you on the process to getting a meeting. Simply setting up the first meeting can take weeks after your introduction. You get one shot. Go listen to Eminem “Lose Yourself” a few times before you launch into your presentation. Ah, your presentation… make it 15 minutes or less. Include tons of relevant, meaningful graphics. Bring an actual MVP with you with emphasis on the “V” for viable. You need to show the investors that you could take their money and genuinely enter production phase today.

If you do not yet have a MVP, you aren’t ready for this. Take your financials and your projections with you. Be prepared to get hit with every conceivable question. If you watch a few episodes of “Law & Order” in which the district attorney totally grills the perpetrator, you’ll have a relatively accurate idea of what this will be like. Don’t be shocked if they ask about your personal finances, too. At this level, as with angel investors, you are typically asking for a mountain of money. Between the time of your introduction and your meeting, you will be vetted. Expect full background checks.

Here’s why beyond the fact that you are asking for a ton of money. You are also adding a business partner(s). Most angels and VCs expect to either come on as a silent partner or to place a board member. They are buying into your business. Their upfront capital for your startup or expansion comes at a price. You will share ownership of your business with them. Their investment increases the your business’ creditworthiness. Landing a VC can be tough, but worthy.

Initial Public Offering (IPO)

In today’s business climate, you have a choice between methods of initially going public with your business. If you choose the traditional route, your company will offer a public sale of stock via an initial public offering (IPO). From this you will amass a group of shareholders to whom you pay dividends when revenue is good. These shareholders obtain voting rights in major company decisions. You must undergo a formal process with the US Securities Exchange Commission (SEC) which includes a not so small mountain of paperwork. The SEC also sets rules for how you can run your IPO and the regulatory environment remains complicated. IPOs only work for those with an already established business.

Initial Token/Coin Offering (ITO/ICO)

Your other option in today’s business climate is an initial coin offering (ICO) or initial token offering (ITO). This option creates and sells a cryptocurrency coin/token on a blockchain. Unlike stock, the coin or token offered on a distributed public ledger, theoretically gains value and allows the purchaser to resell it on an open market.

Startups or existing businesses can use this as a method for fundraising. Depending on the type of token issued, you may have to adhere to SEC rules similar to those for an IPO. Tokens provide a great way to raise seed capital, especially for those not yet to point of proof of concept. You do need a well-researched whitepaper describing the proposed minimum viable product with a complete competition analysis. With an ICO/ITO you retain control and management since you give up no voting rights to shareholders.

Private Investors

A friendlier way to obtain funding is to take on private investors. This includes friends, family and customers that might have interest in your business. Again, you will add business partners and they can want varying degrees of control. As with VCs, the private investors add their creditworthiness to your business. You also benefit from their collateral and industry experience.

Crowdfunding

Crowdfunding has become a go to for startups. Register with any of the major crowdfunding companies to gather funds from a multitude of micro investors. You can start a campaign on Indiegogo, Kickstarter or GoFundMe. Each website uses different rules. Some require you to raise the full amount to access funds while others allow access to partial funds.

Bad Credit Business Loans

After you have exhausted all of the above possibilities, turn to the option of a obtaining a business loan with bad credit. You may by this point need to take out a much smaller loan than previously. This is awesometastic.

This will save you money in the long run. The less money you require, the less money you have to pay back. That matters even more if you have bad credit. Here’s why.

When you have bad credit, you will not qualify for prime interest rates. Prime rates, the lowest interest rates available, go to those with exceedingly great credit scores. You would need a 680 to 720 to qualify for a prime rate loan. Those are the loans that provide interest rates of ten percent or less.

Bad credit to you might mean a credit score of 300 or so. To a bank or lending institution, it means anything under 680 or so. To a bank, you’re either a sure thing or nothing. Your credit score lets them know how likely you are to pay off your loan.

Remember that when you start a business, you will not have the business’ clout or finances to back your loan. You have your own personal finances. So, if you have bad credit or no credit, you need to obtain as much of your funding from a source besides loans as possible.

Spend a little time building your credit score up. You can start this process by visiting Creditry.com. The site will help you take charge of your credit and get things under control.

You need to get copies of each of your credit reports. You will have three – one from each of the credit reporting agencies. Study your reports to determine whether each is correct.

Complete a report form for any mistakes you find. Each credit reporting agency has its own. The agency will investigate your report and make an inquiry to the organization that issued the credit information.

If it really is a mistake, the agency removes the negative information from your report. If it is not, you will have an opportunity to discuss it with the creditor and make a payment plan. Either way, you will produce the result of improved credit.

You can begin this process when you first start your business financing activities. That way, while people are checking your credit score, potential investors will see it continue to move up. When your score improves while you are applying for funding, potential investors and financial lending institutions look upon this favorably. By the time you have exhausted all other possibilities for funding, you will have an improved score and be ready to apply for loans.

You now need to determine which loan type you want. You may still need a significant amount of start up or expansion capital. In that case, you need a standard small business loan. After all the other funding pieces, you may only need a small amount. That means you could use a micro loan.

Standard Small Business Loan

As I mentioned, you can still get a business loan with bad credit. It will not provide the prime interest rate you probably hoped for, but you can obtain a business loan. Remember that unlike all the other funding types discussed which bear closer resemblance to grants, you must pay back a business loan. You are just borrowing the money. The lender will charge fees plus interest. You literally promise, via a legal contract called a promissory note, to repay the money, typically in monthly installments for a specified length of time. Depending on the loan, you may or may not make a lump sum payment at the end of the repayment period.

You can opt for an unsecured or secured business loan or a line of credit. You will probably find it simplest to obtain a secured business loan since this uses collateral to guarantee you will pay back the loan amount. An unsecured loan is much tougher to get since you have provided no promised collateral that you will repay it. The third option is a line of credit. You typically get a line of credit based upon equity in your home or business.

Shop Business Loans

You probably do not think of shopping when you think of business loans. You can shop for them though. Visit Loanry.com to use the awesome loan mall there.

You will simply need to complete a really short form with basic identifying information which will enable Loanry to match you with potential lenders. Remember, Loanry is just there to make the process easier, but Loanry does not make loans. Lenders do. Additionally, if you use a loan mall, you avoid reducing your credit score since a soft check is conducted, and not a hard one.

Loanry then may connect you to potential lenders that typically loan to individuals with your credit score and situation. It does not mean that you will qualify or obtain a loan from them. It just reduces your research time by finding potential lenders for you. You still need to fill out the loan application from each lender that’s on the list.

Do not apply for all of them at once. Go through the list one at a time. Wait for a reply. If you get turned down, you move on to the next lender. If you get a yes from a lender, you are done.

Every loan application costs money. You must pay an application fee to be considered for a loan. These can run as high as $50.

In Conlusion

You can obtain the business loan you need. It may not be easy or quick, but you can get the money. Start with the methods that do not require you to pay back the loan. Move on to business loans for bad credit only when you must. You can get your business off the ground or expanded. It takes time, effort and hard work.

Carlie Lawson writes about business and finance, specializing in entertainment, cryptocurrency and FOREX coverage. She wrote weekly entertainment business and finance articles for JollyJo.tv, Keysian and Movitly for a combined seven years. A former newspaper journalist, she now owns Powell Lawson Creatives, a PR firm, and Powell Lawson Consulting, a business continuity and hazards planning consultancy. She earned BAs in Journalism and Film & Video Studies from the University of Oklahoma. She also earned her Master of Regional & City Planning at OU. Her passion lies in helping people make money while reducing risk.