Everyone has heard about personal loans, but not everyone knows the difference between business loans and personal loans. To make it even more complicated, there are many different types of business loans out there to choose from. If your business is a startup, needs new equipment, or is looking to expand, then you might benefit from getting a business loan. Before you make such a big commitment, though, you should learn about the different types of business loans out there. Business loan shopping doesn’t have to be difficult if you have a great understanding of what is offered.

What Are the Different Types of Business Loans?

As a small business owner, you will need to find funding from outside sources every now and then. It is important to understand the different types of business loans available to you. There are several kinds of business loans, and you may or may not qualify for all of them depending on factors such as how old your business is, what your credit is like, and what you want to use the money for. There is also a big difference between traditional business loans and some more nontraditional ones, and knowing how to seek out the kind of loan you want can save your business money and help build your credit.

One important thing to keep in mind is that most loans go to individuals, but business loans go to the business itself. A business is a separate entity, with its own credit history and creditworthiness. Any effect of not paying will only affect you in relation to how you are tied to the business. The liability you carry depends on what kind of business you have, such as whether it is a sole proprietorship, partnership, limited liability company (LLC), or corporation.

Traditional Small Business Loans

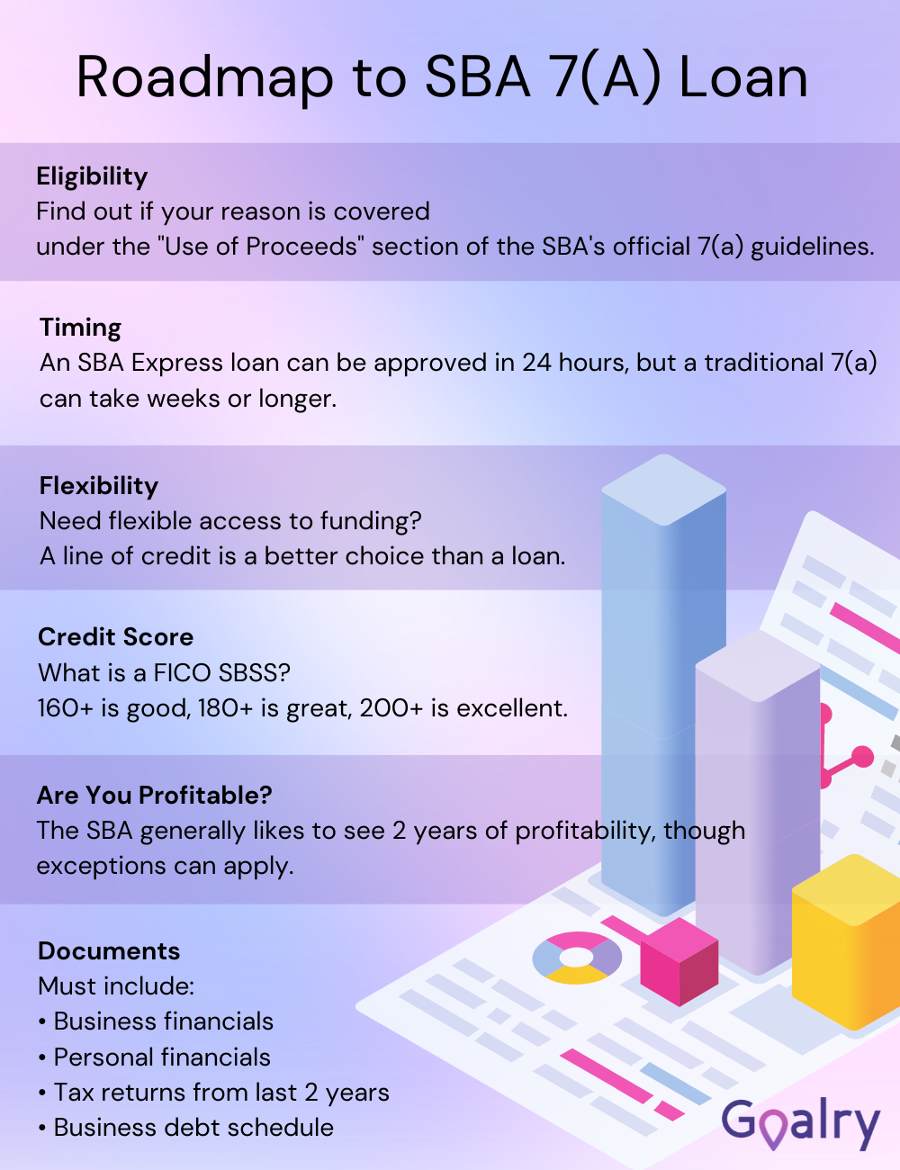

SBA Loans

SBA Loans can be one of the best options because they can offer great benefits. This isn’t the kind of loan to take out for most last minute or emergency needs. U.S. Small Business Loans are for big decisions, like acquiring a company or refinancing a mortgage. Among the benefits:

- You can choose between fixed rate and variable rate loans.

- The financing from the SBA is good for up to 90%.

- There are various loan terms, up to 25 years.

Part of the loan is guaranteed by the SBA, even in cases of default, making this one of the safer options. However, there are some drawbacks, such as:

- The application can be time-consuming and will include everything from financial reports to background checks and possibly even owner information.

- Because of the stringent requirements, not everyone will qualify.

- You may be required to put down collateral to guarantee the loan.

There are different kinds of SBA loans, such as the SBA 7(a) which is specifically designed for very large decisions; the SBA 504 which focuses on real estate, including construction projects; and the SBA Express, a smaller class of loan with a $350,000 cap that is designed more for sudden needs like business equipment, working capital, and other needs. The SBA Express is also different in that once approved, the funds can be available in as soon as 48 hours. The SBA guarantees 50% of SBA Express loans.

Term Loans

Term loans are a more traditional kind of loan and are probably the most common kind of small business loan. Business term loans help with any kind of business needs that can’t be paid with cash, such as new equipment, working capital, or large expansions. Term loans are flexible and have flexible terms, and you can get one from a regular bank or a nontraditional lender. More established companies like term loans because of the flexible terms, but companies with less history might have a harder time qualifying. The advantages to business term loans are:

- Term loans have flexibility, such as the amount borrowed, the repayment terms, and the kind of lender used.

- You can use a term loan for almost any kind of need or situation.

- Using a term loan can help to improve your business credit ratings.

Drawbacks, on the other hand, can include:

- Term loans may require at least some collateral to guarantee the loan.

- There is a lot of documentation required in order to apply for a term loan, including business statements.

The interest rate is often easier to predict on a term loan because it will carry standard fixed rate interest or flat fees. The actual rate may vary widely and can be anywhere from 6 to 30 percent. If your company has been operating for at least 2 years and you can show a high enough level of solvency, a business term loan might be the best one for you.

Equipment Financing Loans

An equipment financing loan is a loan or lease used to purchase or borrow hard assets, like equipment, vehicles, machinery, or computers needed for your business. Unlike the loans already mentioned, an equipment financing loan is a secured loan, in the sense that the equipment itself can act as collateral for the loan.

Because it is a secured loan, your equipment financing loan may have better terms, such as a lower interest rate. Not every lender offers equipment financing loans, and your credit will need to be good to qualify. This may also be a good time to consider the advantages and disadvantages involved in buying versus leasing your company’s equipment.

Lease vs Buy Equipment

When it comes to equipment buying versus leasing, you have to take into account your own short term and long term needs and assets. While buying seems like a good idea because it means you can keep the equipment forever and give you more flexibility in dealing with it, leasing could end up saving you money.

When you lease equipment, you don’t have to come up with as much money to start. Unlike the major expenditure when you buy expensive equipment, leasing will probably not affect your cash flow much if at all. Also unlike when buying, lease payments can be written off on your taxes as business expenses. You may be able to get better terms when leasing, especially if your credit isn’t stellar. It is also easier to upgrade to better and more modern equipment as soon as your lease expires.

On the other hand, if you buy equipment, you will own it forever. With some kinds of equipment that lasts a long time, like office furniture, it makes more sense to buy it. If you decide you don’t need it anymore, it’s yours to sell. You may be able to get a tax break during the first year after a big purchase by using Section 179 of the Internal Revenue Code to deduct up to $500,000 of equipment. There are also potential tax incentives for depreciation, so you may be able to deduct money off your taxes because your assets have gone down in value.

Commercial Real Estate Loans

Other traditional loan possibilities are commercial real estate loans. These are secured loans like the equipment loans, and the collateral is the real estate itself. If you have ever been involved in buying your own home, you understand what a long and complicated process it can be, with many players working together to provide the financing, appraise the property, and clear the title, among other tasks.

Because of the strict rules around selling property, the lenders can feel assured that the property really does belong to the person taking out the money. Like property loans, real estate loans are also secured loans. With that security and the fact that the loan is secured, you can get some great rates when it comes to buying real estate. You also get longer to pay off a real estate loan, usually 30 years, although you can usually get a better interest rate with a shorter repayment period.

Business Line of Credit

If you just want to have the funds available if you need them, you may want to look into applying for a business line of credit. You would basically apply for a certain limit but only take out as much as you needed at one time. Lines of credit are a lot like credit cards, in that you have a maximum limit but you can use them to purchase whatever you need at any time. You would need a strong credit rating to apply for this kind of loan, as it is an unsecured loan with a lot of flexibility. It offers some great benefits, including:

- You can take out funds whenever you need them, up to your limit, without going through another application process.

- You will only ever pay interest on funds you have actually withdrawn.

- This kind of credit can help with all kinds of both short term and longer term business needs.

The disadvantages of using a business line of credit include:

- If you do have poor credit and they offer you a line of credit, you will likely pay a higher interest rate.

- A line of credit isn’t for big purchases that you would normally take out in one lump sum.

- They may ask you to provide collateral to back up your loan, turning it into at least a partially secured loan.

Before you consider getting this kind of loan, think about what you need the money for. Some businesses use a line of credit to meet ongoing needs. To purchase supplies they need, or to make up for income they lose when business is slow, such as in the off season. Interest rates tend to be between as little as 8% and as much as 24%.

Nontraditional Small Business Loans

If you’re just starting out, you may not have much credit history yet, so you may not qualify for the traditional business loans. And if you do qualify, the rates might not be as good as you can get with a more nontraditional business loan.

If you are committed enough to your business, you may take it a step further and take out a personal loan to get what you need for your business. If you take out a personal loan to start a business, the rates and terms will depend on what kind of credit you have personally.

The Pros of Using a Personal Loan for Business

The positive reasons that you should use a personal loan for business include:

- It’s easier. When you apply for a personal loan, the lender will only consider your personal trustworthiness, so you only need to provide information about your own income and credit trustworthiness. When you apply for a business loan, you will need to provide all the information about the business, including business tax returns and other information that can be difficult to get together. You may even be able to apply for a personal loan online.

- Your interest rate may be lower. Especially if your business is new, you probably have a much longer history of borrowing money and paying it back. That means you may personally be able to get better terms than your business can.

- It’s usually faster. Because of the larger amount of information that needs to be processed for a business loan, it usually takes much longer to be processed. A Small Business Administration Loan can take months to approve because it is a government loan. You could get your funds with a personal loan in just a few days.

The Cons of Using a Personal Loan for Business

The downsides of using a personal loan for your business include:

- You’re on the hook. If your business isn’t able to pay back the money, you are the one responsible for paying back all the money. Even if the business closes because it doesn’t succeed, you will have to pay back the entire loan or your personal credit will suffer.

- Your income to debt ratio suffers. Even if you plan on using all the money for the business, the amount of money will show up as personal debt when you use a personal loan. That means that you may be turned down if you try to take out another loan, like for a house or car, or you may not be offered good terms because of your high amount of debt.

- It may not be big enough. Even if you have great credit, you probably won’t be able to borrow as much as a typical business loan. An unsecured personal loan might be for thousands of dollars, while business loans can be millions. Unfortunately, the amount you borrow will depend on your own personal salary and ability to pay the money back.

Reasons for Taking Out a Business Loan

Taking out a business loan is a big commitment. You need to carefully consider whether a loan is the best idea and what the effects will be if your company borrows money. The basic premise is the same as with any other type of loan, as far as that you will need to fill out an application and try to get money. But there is a lot to consider.

The first question you should be asking yourself is: why does the business need this loan? Here are some legitimate reasons for business loans:

- Do you need more space? Are you doing so well your supply can’t keep up with demand? Do you need to hire more employees but don’t have space for them? Business growth is a great reason to take out a business loan.

- Do you need new equipment? Is your old equipment outdated, or do you just need new equipment to keep up with your current demand? If you really need new equipment, it’s better to get it than to let your business suffer without it.

- Does your business have seasonal needs? You might need to get supplies for an upcoming rush, or you might need to pay for expenses during a break. A business loan can help you get through those kinds of periods.

- Does your business need to build its credit? Just like with your personal credit, your business also needs to build its credit. Your business builds credit the same way you do, by taking out a loan and making regular payments on time every time. If you work on building the credit for your business, your business will qualify for better loans with more favorable terms in the future.

When it comes to business finance, you want to make the best choices every time if possible. In order to grow your business, you have to make some tough decisions, but you can make better decisions if you have more knowledge. To make money, you often have to have money, and shopping for business loans is a way to find a good deal that will give you the cash you need to make an investment in your business.

Warning Signs

You don’t want to take out a business loan for the wrong reason. Using loans to meet everyday expenses or overextending your business will only hurt you financially in the long run. There are many pros and cons of small business loans, so it is important to make sure that you are making the right decision for your business. Here are some warning signs to look out for:

- Are you regularly falling behind when it comes to meeting your responsibilities?

- Is your business just not producing the kind of income you expected?

- Have the original circumstances changed? You made your original business plans based on a particular set of circumstances. But the only thing you can really count on is change. Take a good look at the current situation and be honest with yourself.

- Are you trying to bite off more than you can chew? Everyone has big plans, but you need to be realistic if you are going to be successful. Don’t take on more than you can handle.

Long Term and Short Term Business Loans

Another important distinction between types of business loans is between long term and short term business loans. Long term business loans are paid back over an extended amount of time, but there are more differences than that.

Short Term Business Loans

These types of business loans need to be paid back on a daily, weekly, or monthly basis. Normally the entire period for paying back a short term loan is only 3 to 18 months. When it comes to short term business loans, they are usually for emergencies, for immediate financing needs, or to take advantage of an opportunity. Short term loans may have a higher interest rate than longer term loans, and they need to be repaid quickly. The interest rate can vary from 9% to 80%, which is very expensive.

Some people make the mistake of turning to short term loans to fill regular needs, keeping them in an endless debt cycle. Unfortunately, if your business doesn’t have good credit, your business may only qualify for a short term loan.

Long Term Business Loans

You can use a long term business loan for almost any kind of purpose. You don’t have to use these types of business loans in a certain way. So you can use them for everything from purchasing new equipment to opening a new branch of your business. There is no limit to how much you can borrow with a long term business loan, as long as the lender is willing. Traditional lenders like banks don’t offer small long term loans, so if you are trying to borrow a smaller amount over an extended repayment period, it is better to use a service that can help you find a loan online.

It is important to do your research when looking for a lender for a long term business loan. Because different lenders offer different amounts, different interest rates, and different terms. Longer term business loans tend to have lower interest rates than short term business loans, with rates ranging from 4% to 30%. While the terms are better for longer term loans, these types of business loans are harder to get.

Keep In Mind

The longer term is a longer commitment. And the lenders want to make sure they can trust you that you will pay off the loan over an extended period of time. Competition is also very high to receive a long term business loan, and there is a lot of paperwork involved. The bank may collect personal information from you before approving the loan, and some lenders will require collateral for at least part of the loan. On the other hand, online loans aren’t as cumbersome and don’t require as much paperwork.

Where Get a Business Loan?

But where to find a business loan shop? There are many places where you might look, but make sure you are dealing with reputable companies. Not every company is legitimate, and some offer deals that are legal but barely so.

Luckily, there are ways to recognize and avoid personal loan scams. Plus, there are a lot of legitimate business loan companies that want to lend companies money. Because they know it will help their business. There are so many ways to finance your business. Once you have looked at all of your options and have decided to get a business loan, then it is time to find the right lender. Credit unions, banks, online lenders, and the Small Business Administration (SBA) are all great places to start. The process of applying for a small business loan is pretty simple from there.

The Process Explained

First, you need to select the right loan amount for your business loan. Then you should pull your credit history and score, to see what kind of options you have. For instance, a better credit score could mean a better interest rate. Once you know what your credit is like, you should create a business plan and gather all of your pertinent financial information. Evaluate a variety of lenders, so that you are sure that you have found the best option for you and your business. Then all you have to do it fill out the application and hope that the lender approves it!

Don’t worry if your loan application is rejected, it just means you need to try again. Once you find out the reason or reasons that they rejected your application, you can fix any of the issues that you have control over. Once you have fixed any issues that you possibly can, you should wait for a better time to reapply. Maybe waiting for different market trends is best for your business, or maybe you just need a year or so to improve your credit and build up your business profile. Sometimes you think you found a perfect fit, but it turns out differently.

Conclusion

Regardless of the reason your business needs financing, there is a way to get help with financing. There are many different types of business loans to choose from. And there should be one out there that is just right for you and your business. There are traditional and nontraditional types of business loans. As well as short term types of business loans and long term types of business loans. One of these will be the right one for you.

Grace Douglas is a master candidate in international security management by day and a personal finance writer by night! With powers in finance, writing, and languages that she received by being exposed to high dosages of university courses and being bitten by booklice while working in a rare books library, Grace loves to use her powers for good rather than evil. If you need help with budgets or personal loan questions, then just call Grace, your friendly neighborhood FinanceWoman!