Let’s talk about mortgage loan basics.

Although they are often the largest debt an individual will experience in their lifetime, mortgages are a wonderful creation. Imagine if you had to pay cash up front for any home you wished to purchase. How many bedrooms would you have in that scenario? How many square feet? If it were me, I’d probably have to forego having a roof for the first year or two until I could save up for such luxuries.

Mortgages also keep interest rates moderated. Because the property acts as natural collateral for the loan, lenders are able to be somewhat flexible with their terms. It’s not that they want to take your home, but it does give them a safety net of sorts so that they can reasonably take the risk of loaning you funds to begin with.

Get Introduce Yourself With Mortage Loan Basics

A mortgage is a loan on the property – for example, your home – which is paid back over time to the lender along with an agreed upon interest rate. What makes it different than a simple “loan” is that the lender has the right to take over the property if payments are not made. This is sometimes called having a “lien on the property”. In other words, you don’t fully own the property until the last payment is made. That’s called “paying off your mortgage.”

How Does a Mortgage Work?

Because we’re talking mortgage loan basics, let’s assume we’re talking about a home mortgage – the most common type of mortgage.

You find a home you wish to purchase. Let’s say you have $20,000 in savings, but the home is $140,000. You do some mortgage loan shopping and decide on Morty’s Mortgages. Morty is willing to loan you the full $140,000, but in return, you essentially “pledge” your house to Morty. If you miss too many payments, Morty can take your house and sell it to someone else to recoup his losses. Since you have every intention of making your payments, you decide to finance through Morty.

The thing is, you’ll be paying back more than $140,000 to Morty. How much more depends on several factors, the biggest of which is the interest rate. There are two basic types of interest on mortgages – “fixed-rate” and “adjustable rate.” Understanding the difference is Mortgage Loan Basics 101.

Fixed-rate Mortgage

A fixed-rate mortgage is one in which your interest rate remains the same for the life of the loan. The monthly payments stay pretty much the same (there are other costs besides interest, but we’ll get to those) from your first payment to your last. These are the most typical type of mortgage and sometimes simply referred to as a “traditional mortgage”. The payments are generally structured so that your early payments go towards the interest on the loan. Over time, your payments apply more and more towards the principal of the loan – the actual money you borrowed to buy your house.

You’ll sometimes hear the term “amortization” used to describe this system. I wouldn’t get too sidetracked by it; it’s pretty much the universal way things are done when it comes to mortgages. The important thing is that the amount of your monthly payment devoted to principal plus interest stays the same, even if how much of each payment goes where evolves over the life of the loan.

Awesome! But What Are the Down-side?

The only down-side to a fixed-rate (“traditional”) mortgage is that market interest rates change regularly. Daily mortgage rates fluctuate naturally, and over time they can rise or fall considerably. Either way, you’re committed to whatever it was when you first took out the home loan. If the difference is significant enough, some homeowners elect to refinance their mortgage – to essentially start from scratch, treating the balance on the mortgage as if it were a brand new home loan.

Because there are other costs associated with the process, this only makes sense if the difference in what you’ll pay is substantial over time. We should cover a few more mortgage loan basics before we address refinancing.

Adjustable-rate Mortgage

The other type of home loan is an adjustable-rate mortgage. An adjustable-rate mortgage fluctuates with market interest rates. What determines daily mortgage rates gets a bit hairy, but basically they’re the result of three interwoven factors:

The Rate Set by the Federal Reserve (often simply referred to as “The Fed”).

You hear about this in the news from time to time depending on what’s going on with politics and the economy at the moment.

Investor Demand for Treasury Bonds and Related Low-risk

When big-money individuals or institutions don’t feel good about playing the stock market or whatever else they might normally do to grow their wealth, they invest in these.

How Good the Banking Industry Is Feeling at the Moment

OK, not how they’re feeling, exactly, but what they perceive to be their current risk and potential reward. This is the closest element to what we were taught in high school about “supply and demand” and the “free market” and all that.

If you really want to dive in more to these factors and how they shape mortgage rates, be my guest. I’ll be honest and tell you that the details make my head hurt and my eyes glaze over a bit, so forgive me if we move on.

In December 2021, the average mortgage loan exceeded 313,000 U.S. dollars, up from 204,000 in 2012.

Some lenders offer a “hybrid” of fixed and adjustable-rate mortgages. You’ll agree to a low, fixed interest rate for a specified length of time – say, the first five years of the loan. After that, the rate is adjustable based on market rates. The idea is that new homebuyers lock in a “grace period” of sorts at a lower rate than would be possible with a traditional fixed-rate mortgage. If you’re new to the adult world or just starting a family, the assumption is that a few years down the road you’ll be in a better position to tackle a higher house payment in exchange for that initial period of smaller payments.

Other Payment Factors

Either way it’s figured, interest plus principal is the bulk of your payment each month. Those are fundamental mortgage loan basics. But they’re not all of it. Remember those other factors in the cost of the loan we mentioned above? The two most common elements packaged with your mortgage payment are insurance and taxes.

Most lenders will expect you to purchase enough insurance to cover the cost of the home in case of fire, flood, meteor shower, etc. Remember – your home is collateral for the loan, and it’s not unreasonable for the lender to expect their interests to be protected. Depending on the details of your coverage, your monthly payment can go up (or down) over time based on changing insurance rates.

The other way lenders protect themselves is by making sure you’re able to pay any property taxes associated with your home. If you don’t pay your taxes, the government might take your home and then both you and the lender are out of luck. Lenders guard against this by estimating the annual property taxes and dividing that amount by 12 months, then simply adding it to your required mortgage payment.

But Here’s the Trick

The folks doing the estimating and the folks determining your actual property taxes each year aren’t the same folks. Besides, property taxes go up and down depending on any number of factors. That’s where your “escrow account” comes in. As you make your monthly payments, they take the amount set aside for taxes and put it into “escrow” to be paid to the government come tax time. If your escrow has too much, you’ll get a small refund. If there’s too little, you’ll get a bill asking you to add a bit. Depending on the details of your mortgage, this might increase (or decrease) your monthly payments as adjustments are made to cover those taxes.

If all of this seems a bit overwhelming, don’t panic. Many people live long, happy lives without all the big words and complex financial computations. Our goal for now is to have a better general understanding of mortgage loan basics. Honestly, just by having read this far, you already know more than most.

Whether that’s frightening or reassuring I will leave up to you.

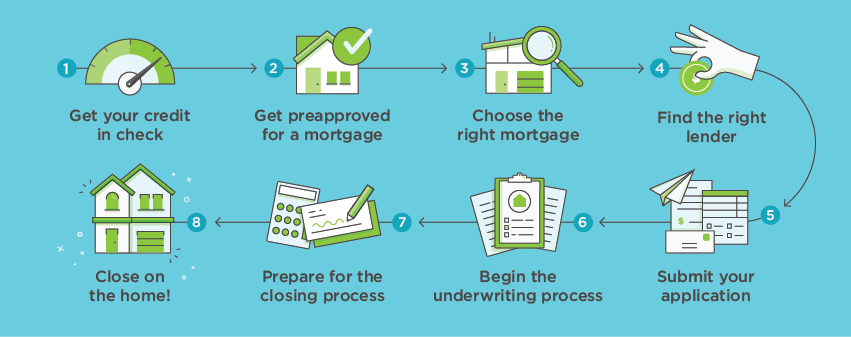

Understanding the Mortgage Process

Now that we’ve talked about some of the technical stuff, let’s step back and walk through the most likely scenario in which you’ll be utilizing your new mastery of mortgage loan basics – buying a new home.

Home Buying Step 1 – Find a Lender

I know, I know – house shopping is the fun part. Imagining what you’d do to this kitchen or how you’d utilize that den, just like on all those TV shows. But the right mortgage and mortgage provider is essential to a positive home-buying experience. Shop your options first, before you’re all giddy over the closet space. It’s easier to pay attention to things like interest rates and closing costs that way.

Home Buying Step 2 – Get Pre-approved

You get two mortgage shopping tips on this one. First, pre-approved financing is pretty much required when buying a house. Some realtors won’t even start showing you properties until you’ve got the money lined up. And a pre-approved mortgage makes it much easier to move quickly on a home you really want. Your mortgage provider will even give you an official letter showing how much you’ve been approved for just to keep things official. This isn’t unexpected – it’s mortgage loan basics.

Second, the “pre” in “pre-approved” here doesn’t mean the financial stuff is settled and over. It merely means you have a solid indication of how much you can spend and that your lender is reasonably certain you’ll qualify to borrow that amount from them if you choose to buy a house. That’s when the real paperwork begins.

Home Buying Step 3– Look at Homes

Finally, the fun part! Don’t be that person who finds something wrong with every house, but neither should you jump at every opportunity. Make a short list of must haves, wants, dislikes, and must avoid, and do that part well ahead of time before you’re caught up in the moment. Then, refer to it as you go. Even if you modify it along the way, it will help you keep focused and remember your priorities.

Home Buying Step 4– Make an Offer

This is where a good real estate agent is so important. They can help you figure out a reasonable starting offer based on activity in the market, the area, the home itself, etc. If homes are selling quickly, it may be pointless to make an offer below asking price. At the same time, there’s usually no harm done by a little cautious negotiating. It doesn’t have to be all about the asking price, either – sometimes sellers will agree to leave the washer and dryer or replace that weird section of carpet instead of lowering their asking price.

Home Buying Step 5 – Brace Yourself (Now the Real Paperwork Begins)

If your offer is accepted, the lender will require you to complete a mortgage loan application and to submit documentation related to your income and financial history – pay stubs, W-2s, bank statements, tax returns, etc. These will be evaluated by an underwriter, whose primary function is to study the documentation provided and verify that everything is in order. There are lender requirements to be met and government guidelines to be followed and the whole thing can make your head spin a bit if you let it.

If it makes you feel any better, the underwriter is also measuring the value of the property in question and making sure it meets all sorts of requirements and guidelines as well. They may order a value assessment or other inspections if there are questions. These are all mortgage loan basics; it doesn’t mean there’s a problem.

Possible Questions During the Underwriting Process

You may be asked about events in your financial past. Where did this deposit come from? Why was this debt written off? What happened in such-and-such year that caused this change? None of this is personal – it’s just tedious. Answer as completely and honestly as you can, and keep taking deep, slow breaths. On the other hand, you may not be asked anything at all. That’s normal as well.

Once the underwriter approves everything, you are “clear to close.” Everything is sent to a title company chosen by the lender (because there haven’t been enough people involved in the process yet).

Home Buying Step 6 – The Closing

Let’s talk good news and bad news here.

The good news is that you’re almost through the paperwork/financing/questions/approval part of the home-buying process. This is the last stage of small print and legal details.

The bad news is that if this is your first closing, there’s simply no way to be prepared for the volume of papers you’re about to be asked to sign or initial. Your next lesson in mortgage loan basics? Warm up your writing hand.

While you should always pay attention to anything you’re signing, nothing presented at this stage requires major decision-making or new action on your part. The representative from the title company will explain as you go and let you know which parts you should care about. While this part is tedious, it’s not hard. Traditionally, you’ll get the keys to your new home at the end of this part. Congratulations!

Oh – one last critical detail. You will be expected to bring a certified check or something comparable with you to cover your down payment and closing costs. These often include an initial escrow deposit and various fees to pay all the different people involved in the process up to this point. Your realtor will be able to let you know exactly how much this needs to be and what’s covered, so it won’t be a surprise. They’re not the same in every situation, and sometimes the seller agrees to take on part of these expenses as part of the negotiations. All that has been settled by this point, however, and it’s time to hand over your first check and get those keys.

Home Buying Step 7– Move In

This isn’t technically part of the mortgage process, but it’s sometimes helpful to remember why you’re putting yourself through all of this. Why are you dragging yourself through mortgage loan basics? It’s all been for this moment. Try to enjoy it.

Types of Mortgages

These aren’t entirely distinct forms of mortgages so much as variations you may encounter as you begin the process. A given mortgage arrangement can involve several of these factors together, or prove so straightforward that most of this terminology never even comes up. Still, knowing some terms common in mortgage loan basics might help you ask better questions of potential lenders.

We talked about these above. With a fixed-rate mortgage, your monthly payment stays largely the same throughout the life of the loan (other than small adjustments based on changes to your taxes or insurance).

You probably remember this one as well. Most adjustable-rate mortgages start off as “hybrids” in which you commit to a lower initial interest rate for a fixed amount of time before throwing yourself on the mercies of the market.

Ballon Mortgages are fairly uncommon. For most of the term of the loan, you’d pay very little. Then, at the end of the time specified by the terms of the loan, the full balance would come due. This sort of mortgage only makes sense if you have unusual circumstances involving guaranteed funds down the road.

These are similar to the balloon structure above, but are structured so that the increase in payments over time is more gradual. Borrowers pay only on interest for a predetermined amount of time, then begin paying on the principal as well. These are sometimes a decent option for some first-time homebuyers just starting their careers.

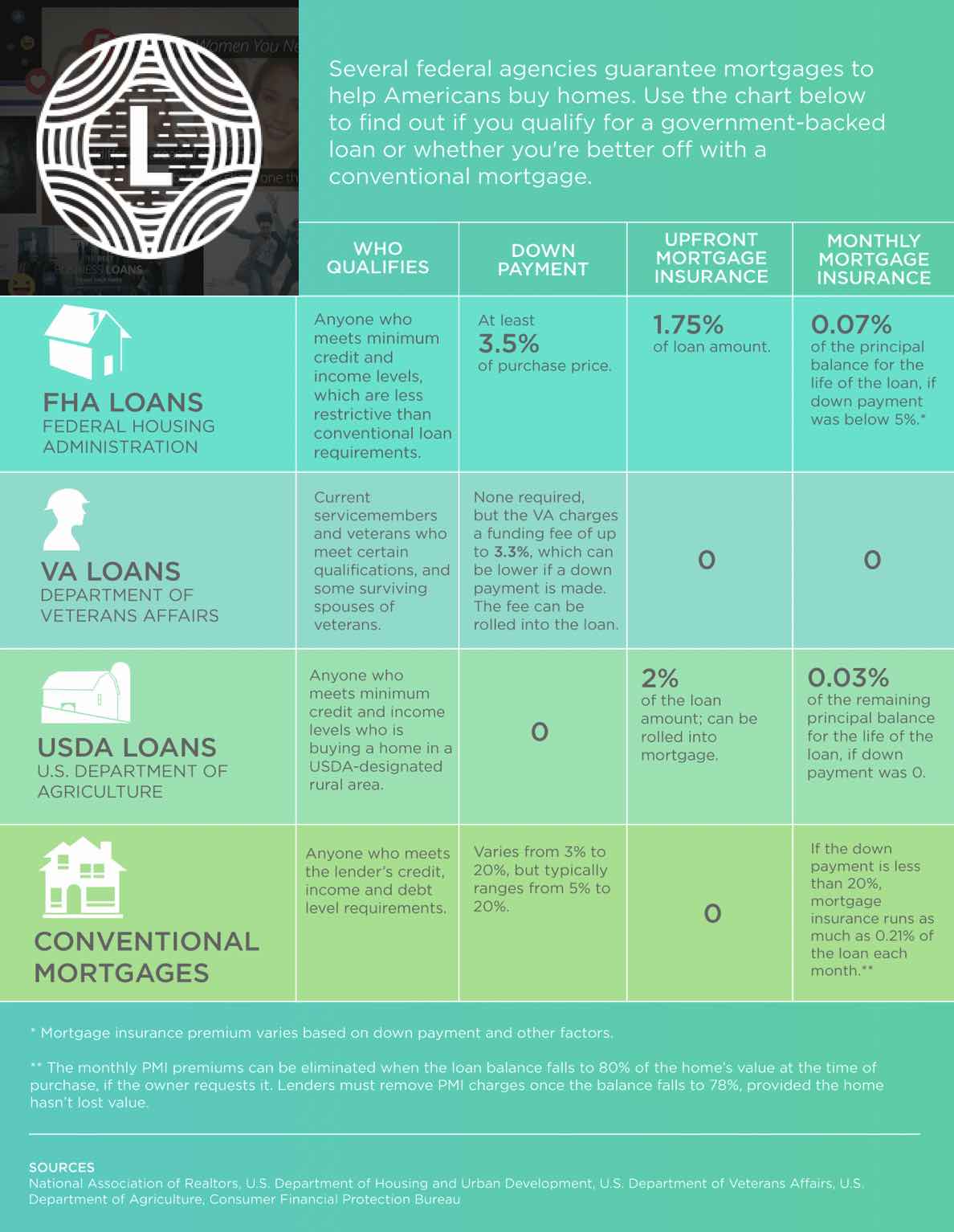

Government-insured Home Loan Options

Federal Housing Administration Mortgages

FHA mortgages are backed up by the government, protecting lenders in case of default. This allows lenders to offer lower down payments and better terms, although you’ll have to provide proof of appropriate insurance.

The U.S. Department of Agriculture (USDA)

It has several options for rural homebuyers who meet their requirements. They’re looking for borrowers with limited resources but who can demonstrate a predictable income, however modest. The mortgage process is handled by the Rural Housing Service (RHS), a subdivision of the USDA.

The U.S. Department of Veterans Affairs (VA)

It provides mortgage assistance to veterans or active military members and their families. As with FHA loans, the government guarantees payment to lenders in order to secure the best possible terms for borrowers. There’s also an option for no down payment, which is more common than it used to be but still unusual.

Other Government-backed Mortgages

They vary from state to state, or even region to region. There are programs to help those with Native American ancestry purchase a home, or to promote the revitalization of certain cities or parts of some states. Ask your realtor what might be available.

These are only a few of the most common variations you may encounter. Pay attention to the details. What does each mortgage option mean in terms of the total you’ll pay for your home? What does it mean for your monthly payments now, and in five years, and in fifteen years? Not to forget, what obligations are you taking on, and what can you reasonably expect from other interested parties?

When Should You Refinance?

There are Several Good Reasons:

- Interest rates are so much lower than it’s worth the time and costs to secure the lower rates for the remainder of the loan

- You want to shorten the length of the mortgage so that your home will be paid more quickly

- It’s advantageous to change from an adjustable-rate mortgage to a fixed-rate mortgage, or the other way around

- You’re using your home as equity to finance a major purchase

- You’re consolidating your total debt and refinancing is part of that consolidation

Refinancing isn’t free, so make sure the amount you’ll save in the long run makes the process worth it. If you’re still considering refinancing your mortgage, check out these mortgage calculators for more details to consider.

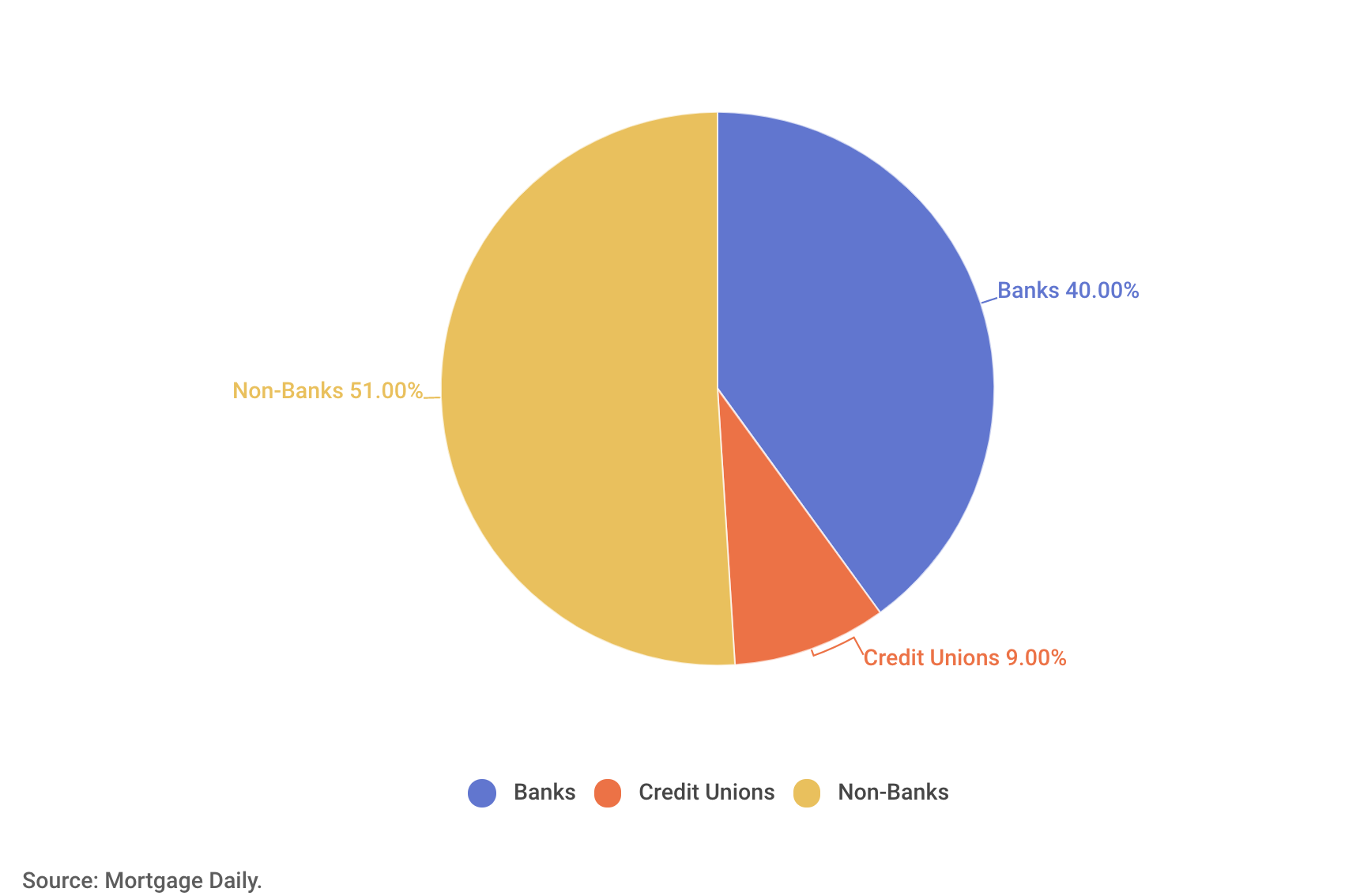

Where to Shop for a Mortgage?

We thought you’d never ask.

There’s no harm trying traditional sources – your local bank or credit union or other favorite financial institution. But in the 21st century, you have numerous online options as well. That’s where we come in. We’re not trying to sell you anything or tell you what to do about your mortgage. That’s not our business. What we’re good at is connecting you to quality lender options based on the information you share with us about your needs and background. The rest is between you and them.

In Conclusion

It can be a bit intimidating at first, but let me offer a few mortgage shopping tips. Remember that you are the customer. In the end, you’re the person everyone else should want to be happy. Just keep your eyes open and mind focused, and don’t shy away from asking for clarification of anything you’re not quite sure about. It’s their job to make sure you know what’s going on; it’s your job to be as prepared and as upfront as possible. Know your mortgage loan basics and breathe.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.