A no closing cost mortgage can be a bit confusing but it’s one of the residential mortgage types that are available to you. With this term, you may think that the fees are being paid by someone else or being waived completely. With a no closing cost mortgage, you are instead paying the closing cost with your loan balance instead of out of pocket. Not every bit of your closing costs will be able to get folded into your loan. But the closing costs you pay at the signing will be less than with a traditional mortgage.

How Does a No Closing Cost Mortgage Work?

There are two different ways that lenders structure no closing costs mortgages. The differences are subtle but the result is the same.

1. A lender can have you finance the closing costs. With this loan, the lender just adds your closing costs to the total loan balance. The monthly payments will be higher because you are now paying the closing costs with interest for the full length of the term.

2. The second option is that the lender absorbs the closing costs but you have a higher interest rate. This also means you will be paying more each month since your total interest costs will be higher over the life of the loan.

No matter how the lender does it, your monthly payment will increase slightly. You will pay less at closing time but pay more over the life of the loan.

What Are the Closing Costs?

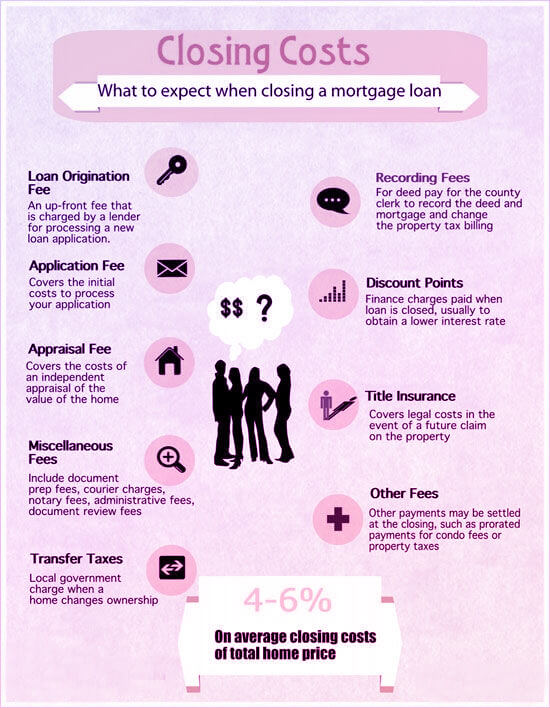

Every house mortgage will come with some closing costs. Closing costs can be pretty high and typically range from about 2% to 5% of the loan amount. It may be helpful for you to calculate the closing costs for your particular situation so you can get an idea. If you are purchasing a $250,000 home then you may be paying anywhere from $5,000 to $12,500 at the settlement table for closing costs. The closing costs vary with your specific situation and location. Common closing costs include the appraisal cost, title insurance, tax service provider fees, taxes, and prepaid costs, such as homeowners insurance and property tax. Lenders can also add loan origination fees and application fees that can increase the closing costs.

There really isn’t a way to get a home without closing costs. You have the decision whether or not you pay them with cash when you are signing the loan or add them into the monthly mortgage payment. However, there are ways to reduce the closing costs by negotiating third-party charges and lender fees. It’s also possible to qualify for housing grants or closing cost assistance in some areas. Many of the grants can be free money and you don’t need to prepay them unless you move or refinance. If you have a military connection, VA loans have a limit on the closing costs that are allowed.

Pros and Cons of a No Closing Cost Mortgage

One of the main advantages of using this type of loan is the upfront savings. With this loan, it helps a borrower who is short on funds to close. This is helpful if you have made a large down payment and already paid out of pocket for your inspection and appraisal. You may still want to have some cash on hand to make upgrades and renovations once you move into the home. You may not need the cash on hand for home improvements but may need it for other expenses, such as medical expenses. Maybe you would rather have the peace of mind that having a large emergency fund brings.

Assigning a dollar amount to the savings will depend on the purchase price and closing costs. If paying for closing costs out of pocket would drain your cash then a no closing cost mortgage can be the obvious choice. However, you should weigh the original savings against what you may pay in interest over the loan when you have a higher rate. Even just a small fraction of a point can cost you thousands of dollars over the loan term.

An Example

Buyer A has a 4% rate, while Buyer B has a 4.25% rate. Both are purchasing a $250,000 home. Buyer A pays $179,674 in interest while Buyer B pays $192,746. This is a difference of $13,072. You then have to add this interest to the additional interest Buyer B is paying for the closing costs in the loan. Financing the closing costs can make it harder to qualify for a loan and the higher interest rates can mean a bigger monthly payment, which could push your budget. If your borrower qualifications are already tight then the higher interest rate could be an issue.

Debt to Income Ratio

Your debt-to-income ratio is the percentage of your income that is going toward paying your debt each month. Many lenders like to see a number of 43% or less. This figure will include what you are spending on your mortgage, as well as student loans, credit cards, and any other debts you have. If you are accepting a higher rate to pay for the closing costs then this will increase your monthly payment. When you are increasing your monthly payment, you have a higher debt obligation.

Even if you are okay with the extra interest and are getting a no closing cost mortgage, it doesn’t mean that you don’t have any money due at the table. Your lender may allow you to have a loan that covers customary closing fees, such as tax recording or escrow. However, you may still have to pay for things typically charged as closing costs, such as private mortgage insurance, transfer fees, or real estate taxes.

Is a No Closing Cost Mortgage Right for You?

If you are considering a no closing cost mortgage then you should think through the decision carefully. You should weigh the pros and cons and keep some things in mind. What is your motivation for getting the no closing cost loan? How much are you saving by not paying any closing costs upfront? What is the new loan rate and how much does it affect your monthly payments? How long do you plan to stay in the home?

The decision on whether or not a no closing cost mortgage is right for you is going to depend on how long you plan on staying in the home. If you are going to stay in the home for the full mortgage term then you will end up paying more for the closing costs, in the long run, thanks to the interest rate. However, if you plan on moving within a few years of buying then the financial impact of the higher interest rate may not matter as much. If you have short-term plans with the financing then not paying closing costs may be a good strategy. However, if you think of this home as your forever home, it’s probably best to pay closing costs upfront, instead of throughout the life of the loan.

Things to Consider With a No Closing Cost Mortgage

You can use different mortgage calculators to determine if a no closing cost mortgage is right for you but there are also some other things to consider.

Do You Have Enough for Closing Costs?

Many people are only eligible for a loan if they can agree to have a certain amount for a down payment. This can be the bulk of savings for many people and there just isn’t enough to pay for closing costs. Instead of having to dip into an emergency fund or savings, a no closing cost mortgage may be the only way that you can go through with the purchase. If this is the case, you have to decide if the price of this type of mortgage is right for you or if you should save more before you purchase a home.

How Long Will You Be in the Home?

This can help you determine the break-even point of how long you will be in the home with the added monthly payments. If closing costs are $10,000 then it may take you about 8.3 years to break even. After this, you are paying more than if you would have just paid the closing costs upfront.

Is There an Early Repayment Penalty Clause?

If you decide to go the higher interest rate route while thinking that you can pay off the loan ahead of the break-even point, you need to check if this is an option. Many mortgage contracts have a penalty for the early repayment of a loan. If your lender does have this, it could make it harder to avoid paying closing costs upfront and avoid paying even more over the course of the loan.

Examples of Closing Costs

- Loan Origination FeeThe origination fee is so that the lender can prepare your loan. The average fee is about 1% of the loan.

- Appraisal FeeDuring the appraisal process, a professional comes to the property to assess the value. Many appraisers charge $300 to $500 for their services.

- Title FeesThe document you receive when you buy your home is the deed. The title shows that the seller legally transferred ownership of the property to you. Title insurance saves you from any errors in the records of your property or home.

- Credit Report FeeLenders need to check your credit score and some lenders will pass the fee of checking the score back to you during closing. These fees can range from $25 to $50 depending on your state and your lender.

- Prepaid InterestThe lender can ask that you pay the first month’s interest upfront during the closing. This will depend on the interest rate and that depends on the type of loan you have and your credit.

- Discount PointsThese are optional and this is the fee you would pay the lender in exchange for a lower interest rate. Each point costs 1% of the total loan amount and you are able to buy multiple points.

Are There Other Ways to Get Rid of Closing Costs?

If you are hoping to avoid closing costs then a no closing cost mortgage may not be the only thing that will work for you. You can also take other routes to help manage some of the costs. One of the first things you want to do is ask the lender to waive some of the closing fees. It doesn’t hurt to ask but don’t expect too much. A more realistic solution can be to ask the seller to cover some of the closing costs by using a concession. A seller concession works by determining the closing costs you want the seller to pay.

If the seller agrees then that amount is added to the purchase price. You get a mortgage for the new purchase price and then the original purchase price is paid to the seller and the differences go to the closing cost. This is a legal way to roll the closing cost expenses into your loan, which wouldn’t normally be allowed unless you are refinancing. However, it’s still important to note that if you are rolling the closing costs into the loan, you are paying interest on them. When you increase the total loan amount, you are increasing the monthly payment as well.

Even with a seller concession, you still need to bring money to closing. The number of seller concessions you can have will depend on the loan type. If you want to ask the seller to pick up some of the closing costs, be sure to get help from your real estate agent. Agents are able to help with negotiations for seller concessions once your offer has been accepted.

Reducing Closing Costs

Besides a seller concession, there are ways to reduce the closing costs you are paying.

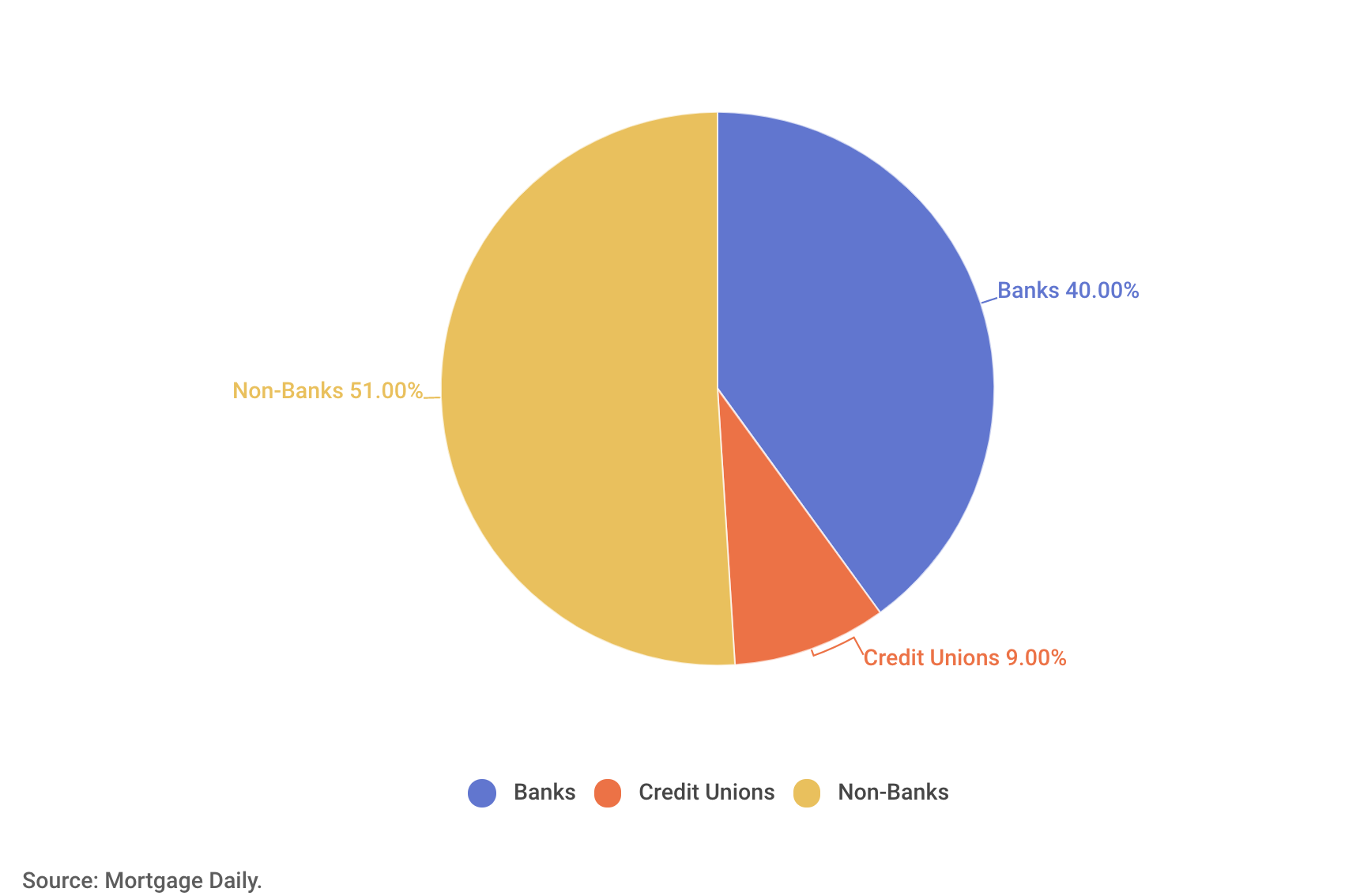

Lenders have different fees. So it’s even more of a reason to go mortgage loan shopping. And see which lender offers the lowest closing costs. You can ask a lender to match lower closing costs you see offered elsewhere. There are some services in the closing costs that you are allowed to shop around for before committing. You don’t have to go with the provider the lender suggests if you can find a lower price.

Don’t just go through the loan estimate right away. Take the time to evaluate each item with the lender and question what each fee covers. This can be a good way to identify any unnecessary or padded fees. Keep an eye out for fees that have a similar name. This could mean the lender is likely charging twice for the same thing.

Once you have a handle on the fees you are paying then you are able to start negotiating. Ask for more vague fees to be knocked off the final total. Ask the lender to give you a closing disclosure form when it’s available. This details the final closing costs. Compare it to what was on the loan estimate and then ask the lender to justify the discrepancies.

You can minimize the prepaid daily insurance charges by closing toward the end of the month. Plan ahead and try to schedule your closing when you will have to pay less money upfront.

If you are buying in a low-interest rate environment then you likely don’t need extra points. Paying for points can add up fast so save that money and pay it toward the closing costs.

Alternative Lower Cost Loans

A no closing cost mortgage isn’t the only way to save money. And you may find that there are alternative loans out there to decrease the amount of cash you need upfront.

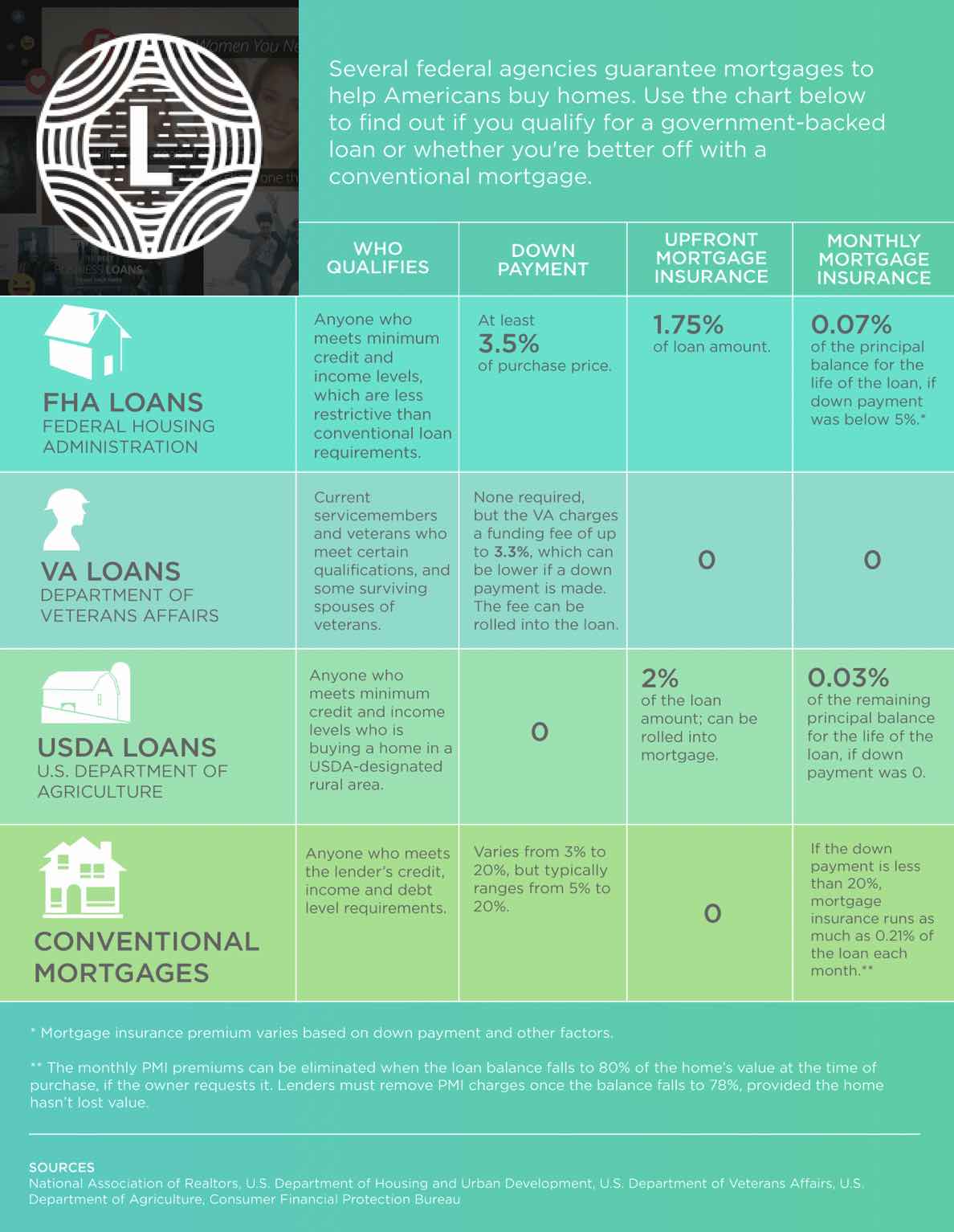

FHA Loans: These loans are offered by private lenders but are insured by the Federal Housing Administration. Under this program, you can have as little as 3.5% down on a home, saving you money on upfront costs.

VA Loans: These loans are offered to veterans and service members but may be loans that don’t require any down payment.

USDA Loans: These loans are backed by the U.S. Department of Agriculture and are designed for borrowers in rural areas defined by the agency. Under this program, borrowers may be able to take out a loan without making a down payment.

Final Thoughts

A no closing cost mortgage allows you to bundle many of the closing costs into your loan. This way, you end up paying more over the life of the loan in interest. But you don’t have to have a large amount of cash upfront. This may make sense for you depending on if you have the funds for closing, how long you are going to be in the home, and how the structure of your mortgage. There are ways to lower closing costs so you aren’t stuck paying a huge fee upfront. Or having to bundle it into the loan. There may also be alternative lower-cost loans that don’t require large down payments. So you don’t have to bring as much cash to the signing table. Always shop around for your mortgage options so you are picking the right one for your situation.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.