When you get a house mortgage with a down payment that is less than 20%, the lender will require you to buy private mortgage insurance. The same would be true if you refinanced with less than 20% equity. However, mortgage PMI payments can be expensive so it’s best to remove them as soon as you can.

Ways to Get Rid of Your Mortgage PMI Payments

There are different ways to get rid of your mortgage PMI payments, depending on your situation.

Pay Down Mortgage for Automatic Termination of PMI

This is not going to be the fastest way to get your mortgage PMI payments over with, but under the rules, mortgage lenders are required to drop PMI when your balance reaches 78% of the original purchase price, and you haven’t missed any payments and are in good standing.

The lender also requires you to stop the PMI at the halfway point of your amortization schedule. For example, if you have a 30-year loan this midpoint is 15 years. The lender needs to cancel the PMI then, even if your balance hasn’t reached the percentage point. This is called final termination. Removing PMI in this manner works for those with traditional mortgages who have paid according to the payment schedule. Remember, you need to be up to date on payments.

Request PMI Cancelation When Your Balances Reaches 80%

Instead of just waiting for an automatic cancellation, a faster option is to ask the servicer to cancel PMI once the loan balance is at 80% of the home’s original value. If you are going to be making your payments as scheduled, you will be able to find this date on your PMI disclosure form. You can also request this from the servicer. If you have some cash on hand, you can get to this point faster by making some extra payments.

You can also prepay the principal on the loan and reduce the balance. This will help you build some equity faster to get to this point and help you save on interest payments. Even something as small as an extra $50 a month can mean a big drop in your balance and interest over the term of the loan.

Some people decide to do a lump sum toward the principal or make just an extra mortgage payment every year. In order to estimate the amount, your balance needs to be eligible for cancellation, just multiply the original home price by 0.8. To cancel your PMI, you need to send a request to your lender in writing, be current on payments and have a good payment history. You may also need to meet other requirements for the lender, such as making sure there aren’t any liens on the home. You may also need to get a home appraisal. If, by chance, your home value has lowered, it’s possible you won’t be able to cancel PMI.

What Does Mortgage Insurance Do?

Mortgage insurance is designed to reimburse the lender if you default on your home loan. You, as the borrower, are responsible for paying the mortgage PMI payments. When a company sells the insurance it’s known as private mortgage insurance. However, the government does sell mortgage insurance as well. This means PMI doesn’t apply to all mortgages with down payments below 20%.

Refinance to Get Rid of Your Mortgage PMI Payments

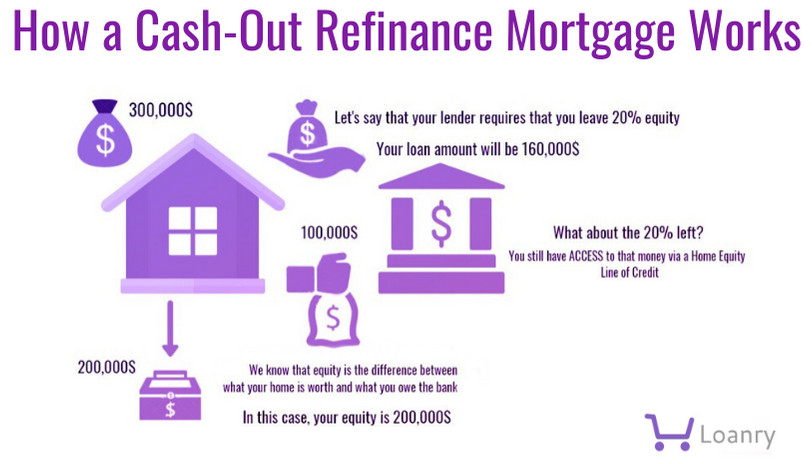

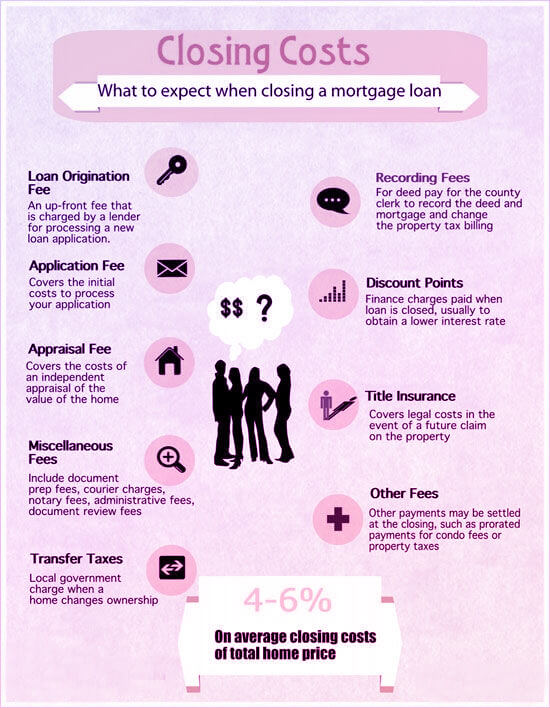

If mortgage rates are low then you may want to consider a refinance for a number of benefits. Mortgage refinancing can save on interest costs or reduce your monthly payments. In addition to helping you save money, refinancing may enable you to get rid of your PMI. If your new mortgage balance is below 80% of the home value then you can get even more savings. In order for this refinancing strategy to work, your home needs to have gained value since the last time you got a mortgage. With refinancing, you want to weigh the closing costs against the potential savings from the new loan terms to see if it is worth it.

Refinancing is a strategy that works well in neighborhoods where home values are rising. If your home value has declined then refinancing may have the opposite effect. It’s possible that, if you want to refinance your mortgage, you may need to add PMI if your home equity has dropped.

Refinancing to get rid of your mortgage PMI payments usually doesn’t work well for a new homeowner. Some loans have a requirement that makes you wait at least two years before you are able to refinance to get rid of these payments. If your loan is less than two years old then you can ask about this but it’s not possible that you will be guaranteed approval.

Get a Reappraisal if Your Home Has Gained Value

In an area where homes are increasing in value, your home equity could reach 20% ahead of the schedule.

If this is the case, you may find that it’s worth it to pay for a new appraisal. Let’s suppose you have owned your home for at least five years and the loan balance isn’t more than 80% of the new valuation then you can ask for PMI to be canceled. If you have owned the home for at least two years then the remaining mortgage balance can’t be any greater than 75%.

Appraisals can range between $450 and $600, depending on your area. Some lenders might be willing to accept a broker’s price opinion instead and this can be a much cheaper option for you. If this is the case for you, it’s best to speak with your lender about the potential to cancel your PMI requirement. If you have added some extra amenities or even renovated parts of your home then the home could have also increased in value, which also means more equity. Whether it’s a pool, common upgrades, or an extra room, check to see if it increases your value.

What to Know About Getting Rid of Mortgage PMI Payments

Whether you are paying PMI every month or as part of a lump sum, it’s not fun. However, you should be aware not to make your financial situation worse by trying too hard to get rid of PMI. Many financial experts will agree that it’s important to have some liquidity in case of an emergency. You don’t want to tap into your retirement funds or savings to reach that 20% equity mark. Speak with a financial advisor to make sure you are on the right track to reach it instead of tapping into savings.

As long as you aren’t taking on an FHA loan, you won’t be married to PMI. You are able to drop it once you get that 20% in equity. This means you may only be paying for a few years, depending on how fast your home appreciates. Don’t feel the need to use every last bit of your cash to make a bigger down payment that avoids PMI. You don’t want to be left in a situation that doesn’t provide you with financial flexibility, especially as you move into a new home.

Requirements to Cancel PMI

No matter how you are canceling your PMI, there will be different requirements. Any PMI cancellation must be done in writing. You need to have a good payment history and be current on your payments. You will need to make sure that you don’t have any liens on the home and have to prove this. For example, you can’t have a home equity line of credit. An appraisal can be helpful to demonstrate that the loan balance isn’t too high compared to the home’s current value.

-

Important Criteria for PMI cancellation

- ✓Additional payments that reduce the principal balance of your mortgage to 80% of the original value of your home

- ✓Your request must be in writing

- ✓Good payment history

- ✓No junior liens (such as a second mortgage) on your home

- ✓The value of your property can't declined below the original value of the home

Different Types of Mortgage Insurance

While you may be paying mortgage insurance, it only covers the lender. There are different types of mortgage insurance and each will work a little differently, depending on your type of home buying options.

PMI for a Conventional Mortgage

Many lenders will still offer conventional mortgages with low down payment requirements and some are as low as 3%. A lender will require that you pay for this private mortgage insurance, also known as PMI if you have a down payment that is less than 20%. Before you buy a home, it’s best to use a PMI calculator in order to estimate the cost of your PMI. This will vary according to the size of the loan, your credit score, and some other factors. Typically, this will be added to your monthly mortgage payment.

FHA Mortgage Insurance Premiums

FHA loans are insured by the Federal Housing Administration. And these loans have down payments as low as 3.5% and there are easier credit qualifications when compared to conventional loans. This loan requires you to pay mortgage insurance upfront and an annual payment, regardless of what you have for a down payment. The upfront premium will be 1.75% of the loan amount. The annual premiums can range from 0.45% to 1.05% of the outstanding balance. You will pay this for the life of the FHA loan.

USDA Mortgage Insurance

USDA loans, backed by the U.S. Department of Agriculture, usually are 0% down loans for suburban and rural homebuyers. There can be two different charges for mortgage insurance, including an upfront guarantee fee paid in the beginning and an annual fee you need to pay for the life of the loan. The federal government will evaluate the fee each fiscal year and can change it. However, your fee doesn’t fluctuate and they are fixed when the loan closes.

VA Mortgage Insurance

VA loans, similar to other government-backed loans, don’t have any down payments and feature low-interest rates for retired, disabled, and active military members. While these loans don’t require mortgage insurance, many borrowers will pay a funding fee that is between 1.25% and 3.3% of the loan amount. This fee will depend on a variety of different factors, including whether or not you have applied for a loan before and how big your down payment is.

Can You Avoid Mortgage Insurance?

The main way to avoid mortgage PMI payments is to make a down payment that equals 20%, or one-fifth, of the purchase price of the home. For example, if the home costs $180,000 then you would need to pay at least $36,000 to avoid paying PMI. While it’s the easiest way to avoid mortgage insurance, a down payment of this size may not be a feasible option.

Another option to avoid paying this is for qualified borrowers to get a piggyback mortgage. A home equity loan or second mortgage is taken out at the same time as the first mortgage. This means that 80% of the purchase price is then covered by the first mortgage, 10% is covered by the second loan, and then the final 10% is covered by the down payment. This will eliminate the need for PMI. With a home valued at $180,000, the first mortgage would be $144,000, the second mortgage would be about $18,000, and your down payment would be $18,000. This may be a more feasible option when saving.

A final option is the option of lender paid mortgage insurance where the cost of PMI is included in your interest rate for the life of the loan. While you are technically avoiding PMI payments, this means you are paying more in interest over the life of the loan.

Know Your Rights About Mortgage PMI Payments

Those who are making mortgage PMI payments should be aware of their rights under the Homeowners Protection Act. This is a federal law that will protect you from excessive PMI charges. This means you have the right to get rid of your payments once you have built up a certain amount of equity in the home. Lenders will all have different rules for canceling PMI but they have to let you do so.

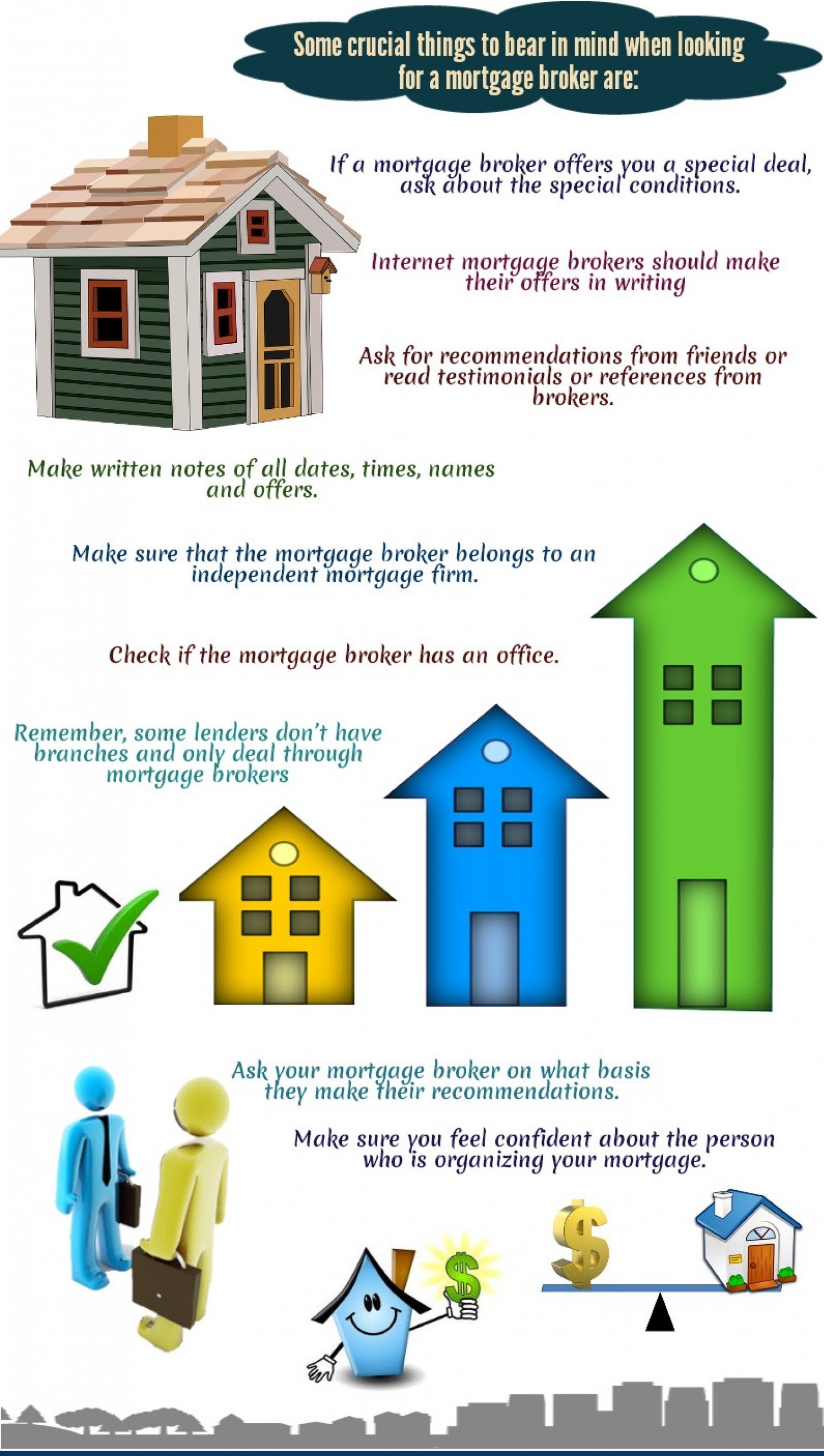

Before you get a mortgage with PMI, ask for an explanation of PMI rules and the schedule and make sure you understand it. This will help you actually track progress toward ending the payment. If you feel like your lender isn’t following the rules for getting rid of PMI, you can report the situation to the Consumer Financial Protection Bureau.

In Conclusion

There are some ways to avoid PMI but in many instances, it isn’t feasible for a borrower. This is why a borrower may be looking for a way to end mortgage PMI payments immediately. There are four different ways to do this, depending on your financial situation and the type of loan you have. There are reasons to avoid PMI so it’s best to get to the point where you can cancel it as soon as possible, as long as you aren’t getting into worse financial shape by doing so.

Jackie Strauss is a finance writer with a background in economics living in Los Angeles. She has a passion for helping readers learn more about personal finance, insurance, home loans and paying down debt. As a college student during the Great Recession, she has had to learn budgeting and money saving techniques to become a new homeowner.