Shopping around for a house mortgage is an important step of the process. However, many people don’t have time to contact different lenders and look at all the little details so they choose to go with a mortgage broker instead. Before you decide to go with a mortgage broker, you should understand how mortgage broker fees work so you can make sure it’s the right decision for you.

How Do Mortgage Broker Fees Work?

Unlike a loan offer, a mortgage broker doesn’t work for a bank. Brokers are independent and must have a license. They will charge a fee for their service, which can be paid by you as the borrower or the lender. The fee will usually be a small percentage of the loan, which varies between 1% and 2%. If you are paying these fees, the dollar amount can be paid upfront or added into the loan. Mortgage brokers will need to disclose fees/ upfront and only charge what is disclosed. Every fee should be itemized and the mortgage broker will need to tell you exactly why each fee is being charged. Fee costs will vary depending on the number and size of the loans.

The Dodd-Frank Act put in new regulations on how mortgage brokers get paid and how the fees work. Prior to this, lenders could compensate brokers if the brokers could get their clients to agree to high interest rate loans and then sign off on the fees. There were few laws in place in order to protect clients. As a result of this, there is more protection for clients.

Now mortgage brokers can’t charge hidden fees, can’t tie the pay to your loans’ interest rate, can’t get paid for steering you in the direction of an affiliated business, and can’t be paid by both you and the lender. Unless you pay the cost upfront, mortgage brokers will generally not receive payment unless there is a closed deal.

What Does a Mortgage Broker Do?

When you go to the bank to get a loan, the bank offers you only the loans they carry. Since it’s only one institution, the loan options can be limited and may not suit your needs.

If you go to a mortgage broker, he or she can have a variety of loan options from various lenders. It’s the mortgage broker’s job to find the best mortgage rate tailored to you and this is why they charge mortgage broker fees. For example, if you need to get a house but can’t afford more than 5% down payment then your mortgage broker should approach lenders that have those terms.

Lender Paid Compensation

With a lender paid fee, a broker will connect a homebuyer to a mortgage lender and then the lender will pay the broker. Brokers can receive different compensation from different lenders. For a homebuyer, this structure can work out because they don’t have to pay for the broker when the deal is closed. However, you will still cover the commission indirectly, usually by paying a higher interest rate.

A drawback to this payment structure is that brokers can be biased by the compensation given by different lenders. A responsible broker should be offering the most affordable option, regardless of the commission they are getting paid. Unfortunately, not all brokers can be so honest and if the broker is going to prioritize their own profit then the homebuyer can end up paying a lot more than what is needed.

Borrower Paid Compensation

When a mortgage broker users a borrower paid fee schedule, the homebuyer pays for the broker’s services when they close on the loan. This payment will come in the form of an origination fee. The fee will vary based on your state of residence, your broker, the complexity and size of the loan, the housing market, fee caps, and more.

Borrower compensation also isn’t always in the form of origination fees and can just be another miscellaneous fee. Even if the borrower is paying this fee, it’s still advantageous to borrowers since it will remove the broker’s temptation to choose a more expensive lender who gives them higher compensation. The broker is more motivated to choose an affordable lender since they will be paid the same.

Which Mortgage Broker Fee Structure Is Right for You?

Regardless of the compensation structure, you will end up paying the broker’s fees in one way or another. The right fee structure for you will depend on whether you want to make the payment over the course of the loan or upfront. If you are able to have the money upfront then a borrower paid compensation option can be your best bet. This way you can avoid inflating your loan payments. You also won’t have to worry about whether or not the recommendations were just influenced by the broker’s desire for higher compensation.

Fee schedules can vary by different brokers. If you want to get a good deal, you will have to comparison shop. Be sure to look at the whole picture, including other lender fees and the interest rate for the best overall value. Brokers will not usually have a salary or any base pay. Brokers get paid by commission. If you see a broker advertising a no-cost loan, this should make you suspicious. Ask how a broker is being compensated if they aren’t disclosing that information to you.

Do You Need a Mortgage Broker?

Since there are mortgage broker fees, you may be wondering if you actually need the services of a mortgage broker. There are pros and cons to using their services but it’s helpful to know that mortgages can be complicated and it can be difficult to actually crunch all the numbers yourself.

Pros of Working with a Mortgage Broker

Brokers will give you all of your options. Many homebuyers just choose a loan from the bank where they already have a checking account but it helps to know all your loan options from a variety of lenders. Shopping around is the key to finding the best deal and a broker can deliver a more ideal loan than one bank ever could. Brokers are able to save you time. While it’s possible to compare all your options on your own, it can be time-consuming.

Brokers can handle all the negotiations with the lenders and many have relationships with certain banks that allow you to speed up the process. If you are in a rush then using a broker can help. Brokers will give you specialized attention and factor in your specific characteristics to match your application to the best lender for your circumstances. This can be helpful if you are an abnormal candidate but it can also help even if you do have good credit.

Cons of Working with a Mortgage Broker

No matter where you get the loan from, there will be fees. These can be in the form of appraisal fees, origination fees, and application fees. Some mortgage brokers can get some of the fees waived. However, brokers still charge their own mortgage broker fees. Mortgage broker fees are usually paid by you but in some cases can be paid by the lender. Whether it is added to the loan or paid upfront, it can still be a chunk of change. You need to know what your mortgage broker is charging you and weigh it against the benefits.

Mortgage brokers are independent from banks but they can still have biases. Some brokers can have a long history of dealing with a certain lender and favor them. In some cases, the lender may pay the mortgage broker fee, which sounds great unless the loan has undesirable terms.

Different Mortgage Broker Fees

Mortgage brokers may have different ways of naming their fees. Here are some that you may find.

Some brokers will add their fees to the origination fees by the lender. If this is the case, you want to ask for a breakdown. Loan origination fees will be a percentage of the loan.

This is a fee that lenders pay brokers for getting the client to agree on an interest that is higher than the going market rate. If you are going to choose this deal with your broker then check to see if the interest rate is competitive. If the broker is not charging you this fee then someone is paying this fee.

This fee will usually be charged if a borrower is looking for a jumbo loan. They are typically charged as a flat fee for setting up the loan. If the broker isn’t charging this fee then check to make sure the broker isn’t getting a yield spread premium from the lender.

In some cases, a mortgage broker will add administrative fees to the standard fee. If you see these fees on your agreement, ask to have them be waived. Unless you are at high risk due to your credit profile, you can usually negotiate your way out of these types of fees.

How Do You Find a Mortgage Broker?

Mortgage broker fees are important but it should only be one factor when you are shopping for a broker.

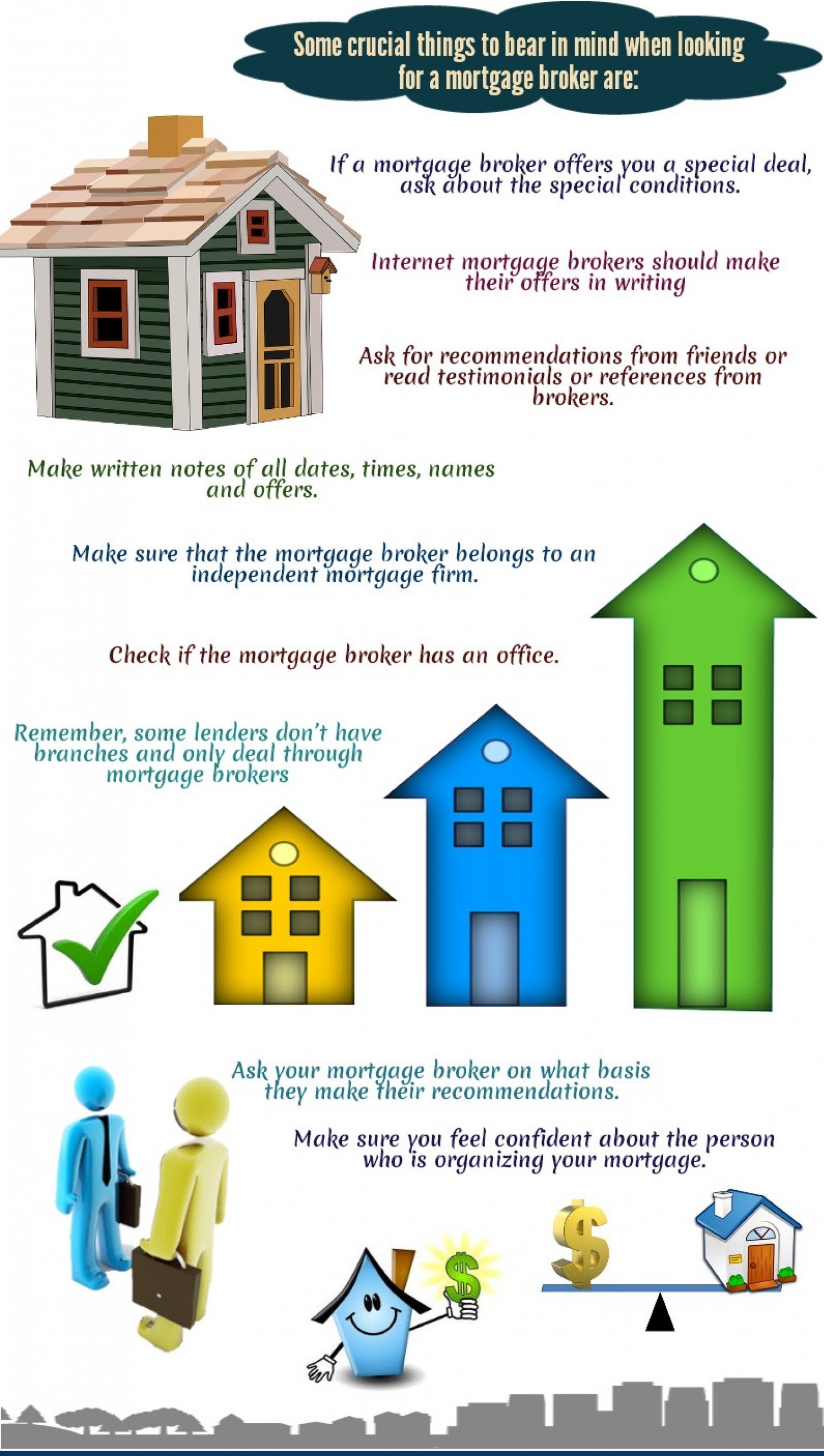

The best way to find a broker is by asking relatives and friends for referrals and make sure they have actually used the mortgage broker. Learn what you can about the services, communication style, and approach to clients to make sure it’s the right fit for you. You can also ask your real estate agent. Some real estate companies do have an in-house mortgage broker as part of their service but you don’t need to be obligated to go with that individual or company.

There are some different questions you can ask. Ask how the application process works. One of the main reasons for using a broker is to make the home buying process easier. The best mortgage brokers can provide information on the mortgage application process, such as a comprehensive list of documents you need to complete an application. The broker should take into account your personal circumstances and ask questions about your situation so they can find the best solution. Find out how long the entire process will take. You want to know what to expect and if the broker can guarantee on-time closings. Check the track record of the broker. Does he or she have a good reputation? How long has he or she been in business? Read reviews and ask for references.

Mistakes You Should Avoid When Buying a House

There are a lot of mortgage tips out there but there are some mistakes you should avoid when getting a mortgage, whether you are a first-time buyer or looking to refinance.

Not Getting Pre-approved

Not shopping for a mortgage until you have already found your dream home can be a big mistake since you can be too late. Many sellers require a pre-approval notice be given with an offer and the process can take days or even weeks. It’s best to apply for pre-approval before you look at any available properties. When you do this extra step to prepare your finances, you are ready to submit an offer quickly when you find the perfect home.

Borrowing Your Max Amount

The pre-approval can help you figure out how much you can afford to spend. Many buyers believe that the amount on their pre-approval letter means that is the amount they can spend. Instead, it’s better to think of the loan amounts as a range. You may have the ability to borrow that much but you don’t necessarily want to go that far. It’s best to do some budgeting on your own. Look at your income and expenses in order to figure out how much you would be comfortable putting toward a mortgage each month. Use that number and play around with a mortgage calculator until you land on the price of how much home you should really be buying.

Overestimating Abilities

Buyers may be willing to take on remodeling and repairs in order to get a lower sale price. The repairs may require more money, time, and skills than buyers have. If you are looking at a fixer-upper property that will need a lot of care, make sure that you are honest about your abilities. Do you have previous remodeling experiences? Can you afford professional help? What will happen if there are unforeseen expenses and problems?

Not Reading the Fine Print

You should be reading everything you are signing in full. This is easier said than done so it’s easy to skip a section. This mistake can cost you a lot. When you are negotiating an offer, you need to know exactly what you are agreeing to before you sign. The mortgage broker fees are just one of the things you need to understand when getting a mortgage.

Not Getting an Inspection

Inspections are there for the buyer’s benefit and skipping inspections may not give you more bargaining power. If you choose to waive any inspections then you agree to take financial responsibility for any repairs that can come up, even if the problems pre-date your ownership. Weigh your options carefully if you decide to not get an inspection.

Forgetting About the Closing Costs

Budgeting to get a home isn’t just about what you can afford as the monthly mortgage payment and down payment. You also need to consider closing costs. Closings costs are paid at settlement and include the fees needed for the transaction. The exact amount you will pay at closing will depend on your property but it usually between 2% and 5% of the purchase price.

Conclusion

A mortgage broker can help you when it comes to where to shop for a mortgage and finding the best deal for your situation. Brokers do have mortgage broker fees that you will need to understand when it comes to getting the deal. Some of the time the lender pays mortgage broker fees and other times borrower pays these fees.

There are advantages and disadvantages of working with a mortgage broker that you will want to weigh out. You also want to make sure you are getting a broker that will give you the best deal and really help you with your application process. Whether or not you work with a broker, be sure to avoid some home buying mistakes and know the mortgage process in order to make sure it all goes smoothly.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.