You may have lost a lot of savings and credit-worthiness during the coronavirus pandemic. Perhaps your savings and credit score were on the low side even before the pandemic.

Either way, purchase-money mortgages are largely utilized by potential home buyers who do not have enough money in the bank for a traditional down payment on a home. And by folks who have bad credit and are unable to get approved for a mortgage through a bank or other lender.

Unlike traditional bank mortgages, purchase-money mortgages come with mostly non-negotiable and quite high-interest rates.

A Guide to Purchase Money Mortgage

So, we already know after reading the first few paragraphs above that difficulty for those with poor credit or the lack of cash to put down on a house along the usual paths — thus turning to a purchase-money mortgage.

But what exactly are the details surrounding a purchase-money mortgage?

Basically, a purchase money mortgage is allocated to the new home buyer by the actual seller.

Yup. You read that right.

Also known by terms such as “seller financing” and “owner financing,” a purchase-money mortgage is literally when the seller of the house issues a loan to the home buyer (or borrower, to be exact here).

The Purchase Money Mortgage Lowdown

Purchase-money mortgages can be designed to appear a lot like traditional loans. Also, they can consist of having the home buyer take over the seller’s current mortgage.

- There are those buyers who are able to secure a traditional loan from a bank or lender. BUT are not approved for enough of a loan to cover the monetary gap that needs to be filled in order to cover the difference between the home’s purchase price and the necessary down payment for the home

- Then, there are those buyers who are not able to secure a loan of any amount at all

In either situation, because the buyer is unable to acquire the entire loan amount needed for the home purchase by way of a bank or other lender, the buyer then needs to provide the seller with an agreed-upon down payment amount along with a vital security instrument, such as a promissory note, to prove the loan’s existence. This kind of security is usually a legal recording of the transaction and/or process within public records.

This security instrument or promissory note is an important protection against future lawsuits or disputes between the buyer and the seller.

A Purchase Money Mortgage is Very Unlike a Traditional Mortgage

A purchase-money mortgage is a loan that the property seller him or herself issues to the new home buyer. It is a very large piece of the property transaction.

Very unlike a traditional mortgage, getting or acquiring a purchase-money mortgage basically goes like this:

- Does the home’s seller have a clear title? If so, the buyer and seller agree on an interest rate, monthly payment, and loan term. The buyer pays the seller for the seller’s equity on a month by month installment basis

- The seller takes on the role of a typical bank, in a sense, by offering the seller the money to buy the home

- After the very last payment or in the event of a refinance situation, only then does the buyer receive the deed

Lease-purchase Agreement

There also exists what is called a lease-purchase agreement.

A lease purchase occurs when the seller gives the buyer equitable title and leases (instead of selling) the property to the buyer. Once fulfillment of the lease-purchase agreement is met, the buyer will then receive the title along with credit for a portion (or all) of the rental payments made toward the home’s purchase price. From there, the buyer usually acquires a loan in order to pay the seller.

Feeling a Bit Confused? Here’s a Purchase Money Mortgage Process Example

Say hello to Kelley. She is fully aware that she won’t be able to get approval for a conventional bank mortgage due to her low credit score and lack of savings. Kelly looks for a new house anyway. And when she finds the home that is right for her and her family. She goes ahead and asks the seller for a purchase-money mortgage.

Let’s say the house Kelley is interested in buying costs $200,000. Kelley gives the seller a down payment of $10,000. And then she acquires a purchase-money mortgage, directly from the seller, for the $190,000 that remains. The seller is paid back the purchase-money mortgage in monthly installments. Kelley is aware that this type of mortgage holds a higher interest rate than a typical bank loan.

The Pros of a Purchase Money Mortgage

Seller Pros:

- When a seller finances a portion, or all, of a home’s purchase, the entire sale process can be finished in a shorter amount of time. This is great for owners who want to quickly sell their homes

- When a seller finances the purchase of their home, they can consider the loan, with the monthly payment plus interest that goes along with it, as additional income. Furthermore, the seller is allowed to sell the loan’s promissory note to an investor in exchange for a nice, lump-sum payment

- A purchase-money mortgage gives the seller the opportunity to get the full listing price – or higher – for their home

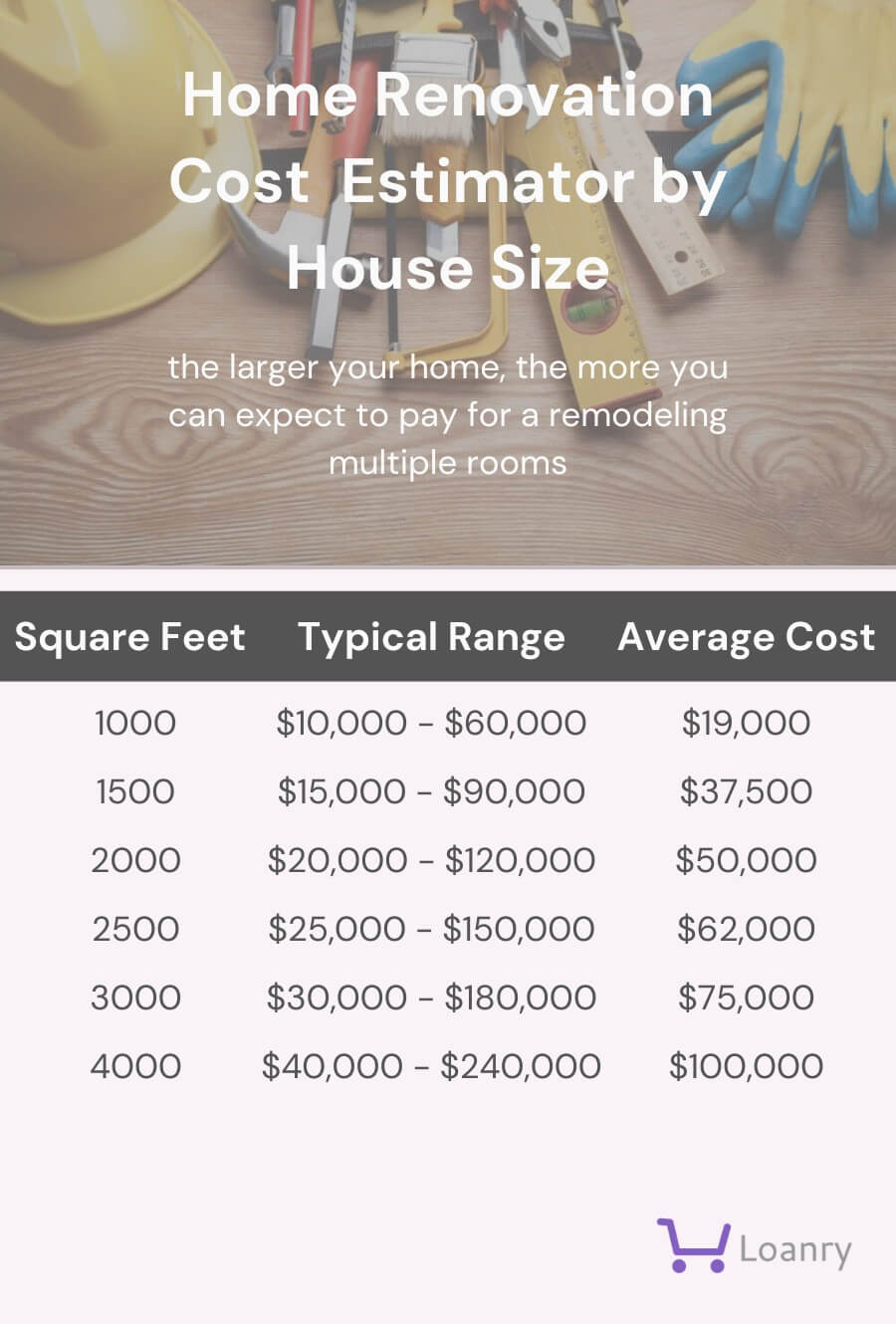

- Among the most stressful parts of selling a house is in preparing the home for the market and making costly improvements and renovations. When a purchase-money mortgage is involved, the seller is much more apt to leave the house as-is. This affords the seller enormous cost savings

- When a seller finances the entire purchase of the home purchase, the seller keeps the property’s title until the buyer pays off the loan. Should the buyer fail to keep up with the monthly payments, the seller can take back the house at any time

Buyer Pros:

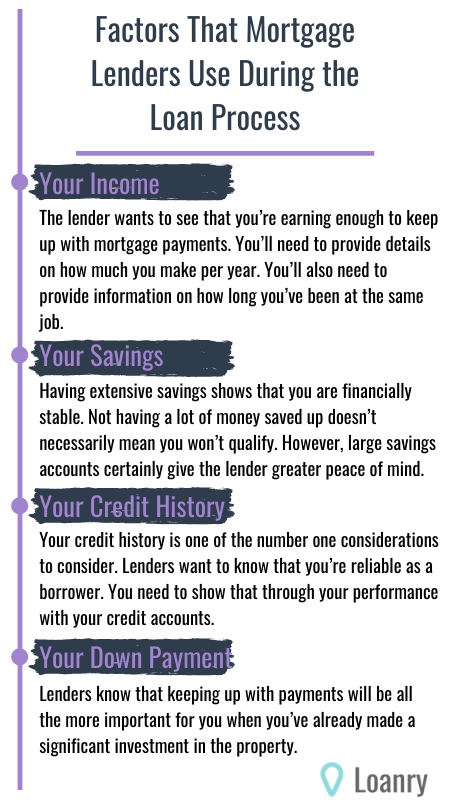

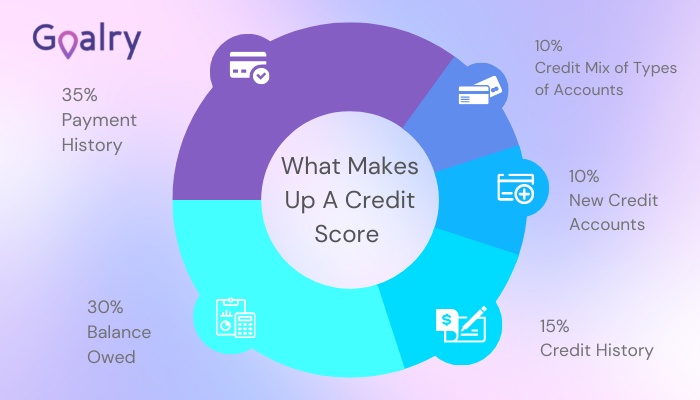

- Even though the buyer’s credit score is low to poor, the seller may still request the buyer’s credit report. However, in a purchase-mortgage situation, the seller’s credit expectations of the buyer are typically low and much more flexible than the requirements and expectations of conventional lenders

- Payments tend to be easier to negotiate. For example, if the seller asks for a down payment that is more money than the buyer has, the seller may allow the buyer to make lump-sum payments toward the down payment on a scheduled basis

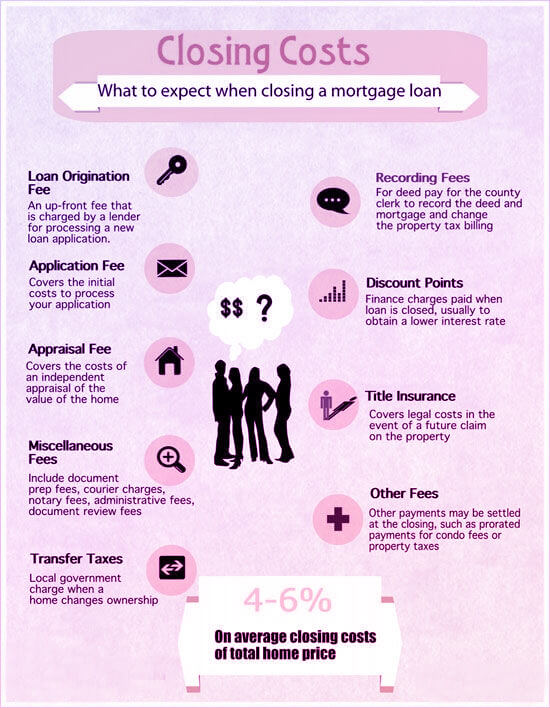

- Mortgage closing costs are considerably lower than the same type of costs through a bank or other lender

- In a purchase-mortgage situation, the buyer does not need to wait for lender financing, nor hassle with the mountain of paperwork that goes along with the lender process. That means the buyer can close on the house more quickly and take possession of the house earlier

Join Our Growing Goalry Community Today!

Learn interesting and super helpful information on house-buying and purchase-money mortgages. And so much more through our Loanry and Creditry information, both included in the information-packed Goalry mall.

Join our community today!

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.