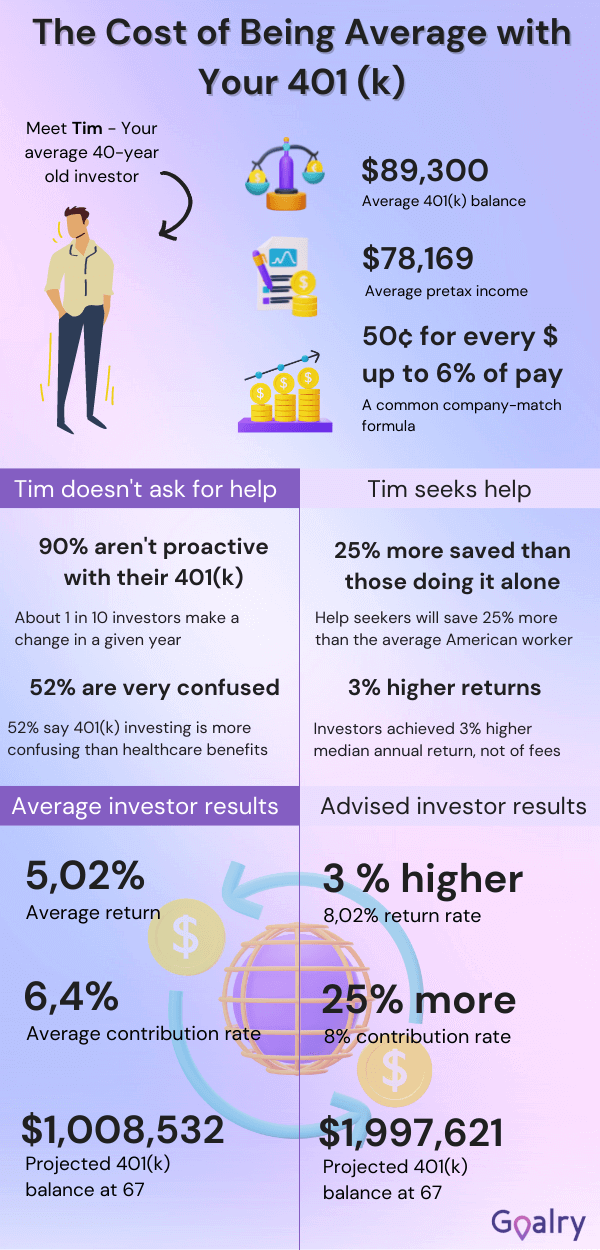

Maybe you’ve heard that the average American needs over $1 million in retirement savings to comfortably enjoy their golden years. While it is easy to get overwhelmed by a huge number like $1 million, most workers get help saving for retirement in the form of a 401(k). Here a 401k defined and explained with guidance on how it helps you save. We also will show you how to take advantage of an employer match if you’re fortunate enough to receive one.

How Does a 401K Plan Work?

As defined, a 401(k) gets its name from the U.S. tax code. Eligible employees can select a percentage of their salary to deposit pre-tax in a 401(k) account. If you make $50,000 and deposit $5,000 in your 401(k), your taxable income is only $45,000.

Some companies offer a Roth 401(k). Money deposited in a Roth 401(k) is taxed at the time of contribution, but not when withdrawn.

Many workplaces offer 401(k) matches, which are exactly what they sound like. If you sign up to save 3 percent of your income in your 401(k), your employer will match your 3 percent, effectively doubling your retirement savings. This is a cornerstone to good financial planning and management.

The IRS sets retirement account limits every year. For 2022, individuals can contribute up to $20,500 to a 401(k). Workers over age 50 can add an extra $6,000 to their accounts in catch-up benefits.

Real Life Example

A 401k defined and explained wouldn’t be complete without a real life example. Meet Henry. If Henry plays it right by following a careful 401k plan he could retire almost $1,000,000’s richer. You can do the same!

Things to Consider 401(k)

A 401(k) can be a convenient way to save for retirement, but it isn’t perfect. To get the most out of your 401(k) account, keep fees low and avoid early withdrawals. Track your rate of return (how much interest you earn per year). The higher your rate of return, the faster your money grows.

Policy research organization found that 401(k) account holders were losing as much as 30 percent of their retirements savings on account fees by time of retirement.

To see how much you’re spending on retirement account fees, look at the expense ratio for any fund you invest in. This should be expressed as a percentage. In general, an expense ratio of 1 percent or less is good, while higher expense ratios mean you lose more money. In addition to account fees, you may be subject to 401(k) administrative fees.

Wait until after age 59.5 to cash out a 401(k) account. If you cash in your 401(k) earlier, you’ll be taxed on the account federally and at the state level. You’ll also be hit with early withdrawal fees.

If you are leaving a position, do not cash out your workplace 401(k). The better option is to request a direct rollover into an IRA (individual retirement account). The 401(k) administrator will send a check to your IRA account and you’ll retain the full value of your 401(k) plan.

The only exception to early withdrawal is for first-time homebuyers, who can safely take 10 percent of their 401(k) for down payment helping them loan shop for a mortgage.

In Conclusion

Know that you’ve had a 401k defined and explained in detail, you have no excuse not to take advantage of things like adding to your workplace retirement account. It’s never too early to start saving!

Ethan founded Goalry, Inc in Dec 2016 with the mission to build the world’s first and only Financial Goal Mall. One place to reach financial goals and comparison shop for any money matter. Taub invents the IP for the finance stores within the mall, while overseeing various aspects of the company. He also has orchestrated the company’s earned media across the finance stores: Accury®, Billry®, Budgetry®, Debtry®, Cashry®, Creditry®, Loanry®, Taxry® and Wealthry®. This includes over 1200 blogs, 400 videos, thousands of social post and publications that have been featured across the web.