A mortgage is a loan that you take out to buy a home. When you get a mortgage, the home you are going to be purchasing will generally be used as collateral. If you fall behind on your repayments, the lending institution will have the right to take your house. There are different mortgage terms that can help you understand the process. These terms are principle, interest and down payment.

What Are Principle, Interest and Down Payment?

Principle, interest and down payment are different parts of the mortgage that you will be responsible for paying.

What is Principle?

The first of the mortgage terms you need to know of principle, interest and down payment is principle. The principle of your payment is what goes to the actual price of the home. Principle refers to the initial size of a loan and it also means the amount still owed on a loan. For example, if you take out a $100,000 mortgage then the principal is $100,000. If you pay off $30,000 of the principle then the $70,000 is also called the principle.

At first, when you are making monthly payments on your loan, your payments will likely go toward interest. Then the remainder applies to your principle. When you pay down the principle of a loan then you can also reduce the amount of interest you pay each month.

Besides making your mortgage payment on time, there can also be other methods in order to reduce your mortgage principle, provided that you are allowed to prepay or your mortgage permits additional payments. For example, if you make one additional payment per year then you can reduce the principle enough to pay off the mortgage sooner, five years sooner actually and can save additional money in interest.

What Is the Interest Rate?

Out of the principle, interest and down payment, one of the main concerns that many soon-to-be-homeowners have is about interest rates.

There are different things that will impact mortgage interest rates. You may think that daily mortgage rates don’t matter all that much but they do. It matters what the rate is today and what it might be tomorrow or next week. However, you aren’t able to control what the market does or what could be impacting the housing market. What can you do is be educated on interest rates and focus on the things you can control, such as your credit score and down payment.

Here are some factors that impact your mortgage interest rates:

One of the biggest factors for the interest rate you get on your mortgage is your credit score. Lenders will use your credit score as an indicator of how likely you are to pay back your loan. If you have difficulty paying back a loan and your credit score reflects that then you are more likely to have trouble with paying down bigger debts like a mortgage.

If your credit score isn’t that high then one thing you can do to lower the interest rate is make a more sizable down payment. This works to show the lender you are capable of saving and it will lower the amount you are then getting from the lender.

Many mortgage loans are either 15-year or 20-year loans. Many homeowners will choose a 30-year option but shorter loan terms can be eligible for better interest rates. There are two reasons for this. The bank will recoup the investment faster with a shorter-term loan. The lender is also going to be getting a higher payment from you every month. If you are going this route to lower your interest rate then you need to make sure you can handle the higher payment.

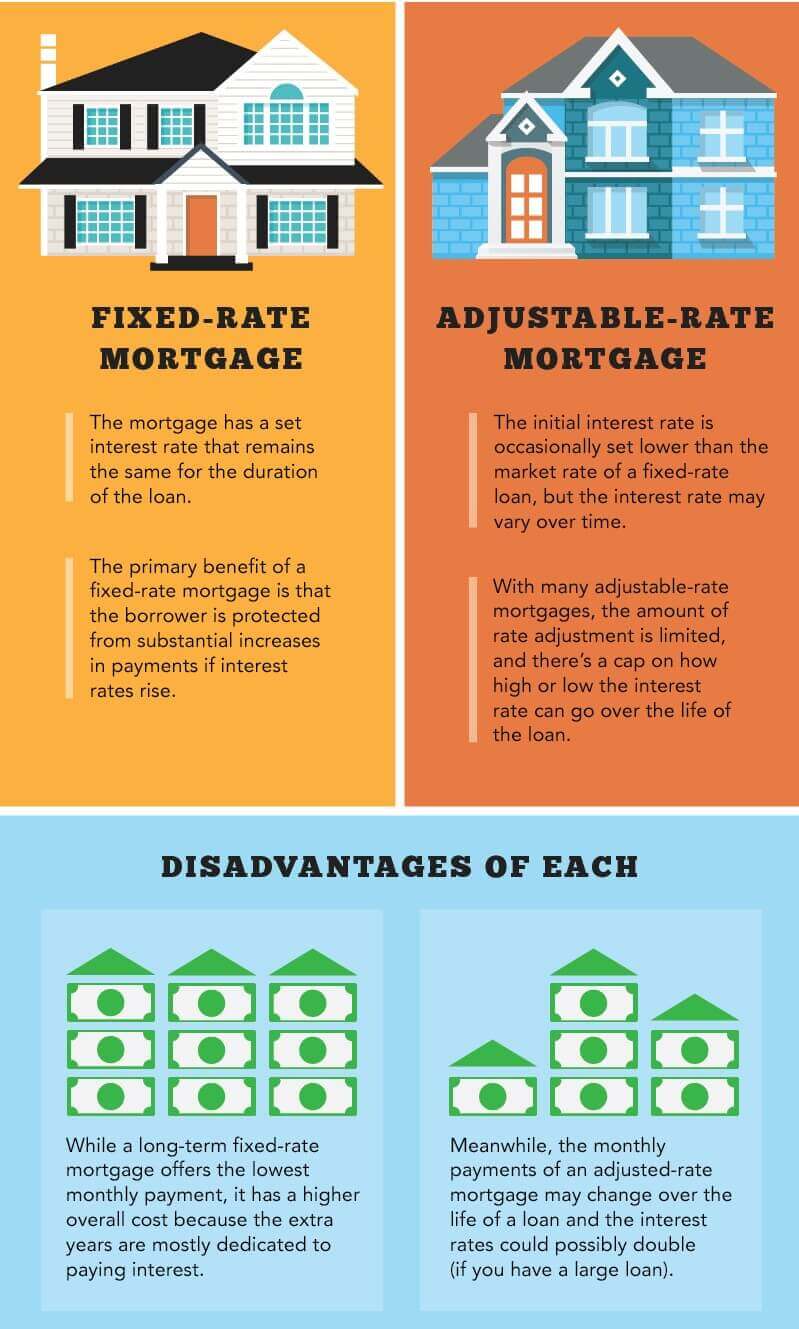

The Interest Rate Type

There are two types of interest rates that homeowners will need to be aware of.

An adjustable-rate loan will still start off with a lower introductory interest rate. After a set period of time, the rates will adjust to being more in line with the current market interest rates. At this time, your monthly payments change accordingly.

Fixed rates can be higher than adjustable ones but they stay the same over the entire length of the loan and ensure that you have the same payment each month. You can decide whether you get a fixed or adjustable rate but if you choose the adjustable-rate option you need to be prepared that your payment can go up.

Of course, every option has its disadvantages. It’s important that you know them before you decide. Unfortunately, here it all comes down to picking between two not so great things. Either you’re going to pay extra if you choose the fixed-rate option, since there are additional years when you pay interest. Or your going to risk paying much higher interest than initially, if you choose the adjusted-rate option.

What Is the Down Payment?

The last thing you need to know about the main mortgage terms of principle, interest and down payment is what a down payment is. The down payment is the upfront payment you make when you purchase a home. The down payment is the portion of the purchase price that you pay for yourself out of pocket instead of borrowing. In most cases, the money will typically come from your personal savings and you can pay with an electronic payment, credit card, or check.

Down payments are usually not part of a loan. However, you may see zero down offers where no down payment is required. Even if you don’t have to have a down payment, there are benefits of having one. The down payment will cover a meaningful part of the total purchase price. For example, if you are buying a home for $200,000 and have saved $40,000 as the down payment then you only have to mortgage $160,000.

There are debates about how big of a down payment you should have. You can often choose how large the down payment should be but the decision isn’t always that easy. Some people believe that a larger down payment is better, while others think that it’s best to keep the down payment as small as possible.

What Are the Benefits of a Bigger Down Payment?

A larger down payment will help you borrow less. The more you pay upfront, then the smaller your loan will be. This means you will have a smaller principle but larger interest costs over the life of the loan. You could benefit from lower payments.

You may qualify for lower interest rates if you put more down. Lenders will usually like to see a larger down payment since they can easily get more of the money back if you default. When you reduce your lender’s risk then you can also reduce your interest charges.

When you are purchasing a home, you can avoid private mortgage insurance and other fees with a larger upfront payment. On FHA loans, mortgage insurance costs will decrease with a larger down payment. You may be stuck with private insurance throughout the life of the loan unless you refinance at some later time when you have paid more on the home.

A lower monthly payment can make it easier for you. If your income changes due to a job change or loss then a lower payment can give you more wiggle room, which is always helpful. You can also save more for an emergency fund or other improvements to the home.

A lower payment makes it easier to qualify for additional loans in the future. Lenders will want to see that you have more than enough income to meet monthly obligations and will evaluate finances with what is called a debt-to-income ratio.

Occasionally you can borrow against an asset such as your home and use the asset as collateral. If you put down more than 20% of the home you can enjoy price appreciation and may be able to pull funds out of a home equity loan.

What Are the Benefits of a Smaller Down Payment?

A smaller down payment appeals to a lot of people because you don’t have to come up with as much money.

When you are trying to save 20% for a home purchase it can take a while. For some, this can take even decades and this may not work in your situation.

If you are able to save up a significant amount then it can be scary to part with all that money. You may be wondering what you will do if something happens, such as health problems or if your car breaks down. Putting all your free cash into the house means your money is tied up in something that can be hard to sell.

When you have a smaller down payment, you get to use the cash you keep to help with inevitable improvements and repairs.

You may want to use the funds for other purposes, such as growing your business or retirement savings.

The decision about whether or not you choose to go with a larger or smaller down payment will depend on different factors. The best scenario is you have a solid emergency fund to deal with any surprises and you aren’t robbing this fund to make your down payment.

What About Lender Requirements for a Down Payment?

Lenders can set minimum requirements for down payments but you can always choose to go with a larger down payment. Remember that a larger down payment will reduce the risk for the lender.

Down payments can also have a psychological impact. A larger down payment shows lenders that you have more skin in the game because you have more of your own money at stake. This means you may be more likely to keep making payments. For home purchases, 20% is a significant number. When you pay at least 20%, you can avoid paying for mortgage insurance.

When Mortgage Interest Rates Are Low, Housing Prices Rise

Housing prices and interest rates do vary from market to market and even month to month. Since many people will base what you can afford on monthly payments, you are likely to take on more debt if the interest rate is good as long as you keep payments under control. Supply and demand say if people are paying more for housing then the housing prices go up.

Conclusion

The principle, interest, and down payment are three very important mortgage terms that you will need to know when mortgage shopping. All three items affect each other. The larger the down payment, the smaller your interest rates may be and the smaller your interest rates then the less you will be paying each month. The principle, interest and down payment will also affect your choices if you want to refinance your home. Knowing how a mortgage works can help you make the best decision about shopping around and knowing when it’s the right time to apply for a mortgage.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.