Personal loans have become much more available and useful ever since competition increased via the Internet for consumer financial needs. There are some common basics to know before getting a personal loan. Prior to these tools coming online, literally, folks had to juggle between either a collateral loan against a home, a personal bank loan which was hard to get or a credit card. Most folks chose a credit card not wanting to deal with the scrutiny of the first two and being told no. However, in doing so folks also ended up placing themselves in a high-interest trap costing them dearly.

Personal Loan: Benefits and Disbenefits

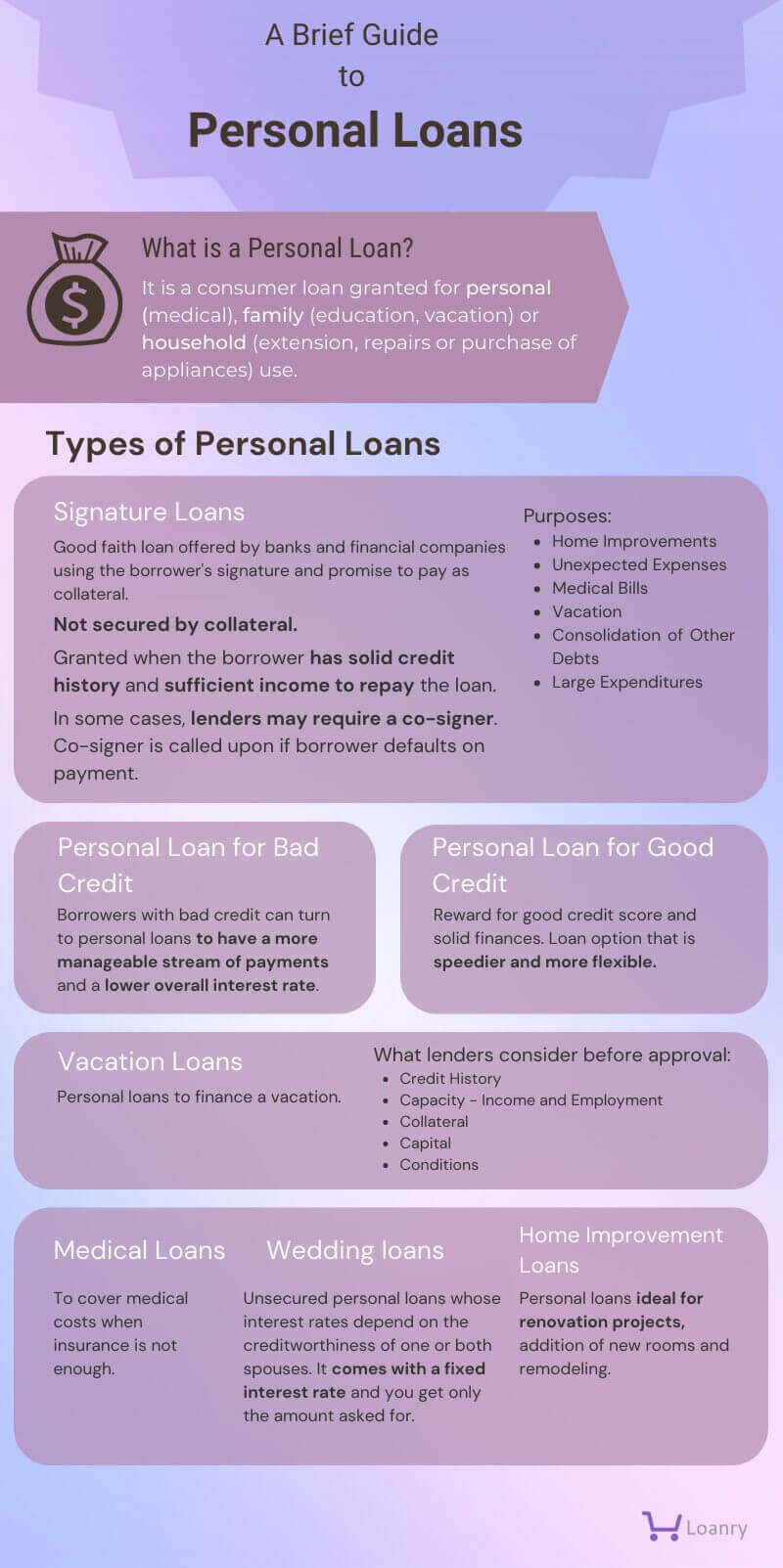

Today, a personal loan can be used for anything. From making the holidays extra special to helping your kid finish that last year of college. Car repairs and medical issues are common situations where the insurance won’t cover everything. The repair or treatment is a must for daily life. As a result, despite traditional views, personal loans are and will remain a viable tool for personal finance for years to come. And they can definitely help people right-size their financial situation if they are used correctly.

Here are the pros and cons of taking out a personal loan. Every borrower should consider them prior to initiating and accepting a personal loan online or in person:

Pro: You Could Consolidate Your Credit Card Debt

Loan consolidation is probably one of the top three if not the primary reason people use personal loans. Most folks get introduced to these tools after they have already built a credit record and activity, often on credit cards. They carry a balance and it’s not going to go away very soon. But if you have to have debt, why pay through the nose for it when the same debt can be managed with a far cheaper interest rate? That’s where a personal loan comes in. It becomes the very easy-to-use vehicle by which a consumer can swap out high interest credit card debt with a manageable, schedule personal loan.

Doing so, consolidation gives a borrower multiple benefit right away. First, it clears off your debt from credit cards, known as revolving account debt. This is painful to have and often lowers people’s credit score when the balances are high. Instead, the second benefit happens by changing the debt to a scheduled loan instead. Personal loans, unlike credit cards, don’t keep growing. They are capped. So as long as the borrower makes the payments, the loan will eventually decrease and be paid off. One can’t say the same for credit card accounts.

Third, personal loans allow people to switch all their debt to one payment. This can also be an organizational advantage. The borrower, as for him, can arrange the loan to match his paycheck and cash flow timing better. Cash flow management is a big problem for folks, especially those servicing multiple accounts. By placing the debt payment into one transaction right after a paycheck comes in. It then becomes easy to pay every month and won’t be a problem three weeks in and not close enough to the next paycheck.

Pro: Personal Loans Allow For Flexibility and Can Be Used for a Number of Purposes

Unlike personal loans, most bank loans are purpose-specific. Folks realize this when they go in to apply. If they are lucky enough to be approved, they realize hardly anything is up to them. The funding gets approved and immediately sent to whomever is supposed to be paid. Whether that be a home seller agent or a credit card company. Then the borrower gets a statement of what payments were made and when the first new payment on the bank loan will be due. There is hardly ever any opportunity to receive the funds and then apply them personally. Banks do this because they essentially mistrust consumers to handle large sums properly, especially with a loan they are financing.

With personal loans, the funding is provided direct to the borrower and you make the decision how they will be used specifically. The lender doesn’t get into your business and why a wedding is a priority or why a vacation should be funded with a loan; that’s your private matter. The personal loan lender is focused on whether you’re a good borrower, pay your bills on time, and will pay back the loan when expected. That means whether you need the funds to help your kids sports’ team travel to a game or you need to consolidate credit cards, you make that decision once approved.

Pro: Convenient and Efficient

A personal loan key advantage involves how quick the process happens. With bank-funded loans the matter can take weeks to resolve. However, consumers don’t always have 8 weeks to wait for financing. Personal loans solve that problem with a very fast approval process. At best, it takes maybe two to three days on the outside. The funding of the loan goes directly to a bank account electronically and shows up first thing in the morning of the day it is deposited. From there, the consumer starts making decisions. He uses the funds just like any other monies deposited in his checking account.

The payment process is oftentimes very convenient and easy as well. Electronic payment skips all the problems with trying to remember to put a check in the mail before a due date. Instead, the lender received information during the application from the borrower’s bank account. The borrower then makes sure by date certain, usually the 5th of the month, that sufficient money is in the account for the monthly payment due. The lender initiates the payment action, and transfer money electronically from the borrower to the lender–payment made timely. That’s it!

Again, as long as a borrower makes sure his payment is in place for the right amount, the mainly online personal loan process takes care of everything else. And there’re no envelopes to hurry into the mail. No moment hoping they get to an address on time before a late payment penalty kicks in.

There are, of course, disadvantages with personal loans to be aware of. Not every issue is the same for every borrower, so it depends on how you come into a personal loan whether one factor matters more than the other.

Con: It Could Come with High-Interest Rates and Fees

Personal loans are still, after all, consumer loans that are unsecured. That means there is no collateral to back them up if the borrower fails to pay in full. To offset this risk, the borrower still charges a typically higher interest rate than what one would see with a secured loan such as a home mortgage or auto loan. Typical interest rates run about 10 to 14 percent, while car and home loans are usually a third of this cost.

In addition to higher interest rates, personal loans often come with fees upfront. A big issue to weigh in the pros and cons of taking out a personal loan. These fees, added up, represent anywhere from 2 to 4 percent more in cost the first year of the loan mathematically. Whether you call them loan origination fees, processing fees, application fees or similar; they are in essence a price to pay for getting access to a personal loan. For a lender, fees represent instant profit from the borrower. For the borrower, he either sees a reduced loan value from the total asked for, or the fees are paid on top of the loan as a cost. Either way, it’s an expense that reminds the borrower loans aren’t free.

Most borrowers tend to fold the fees into the loan amount. So, for example, a borrower to takes out a $25,000 personal loan would actually see $23,200 deposited in his account less the fees charged. Because the borrower doesn’t manually pay the fee, he thinks it doesn’t exist, but his payment over time are on the full $25,000 and interest.

Con: Certain Personal Loans Penalize Borrowers for Early Repayment

Many times, borrowers use a personal loan to get some breathing room. Then, somewhere down the line but before the personal loan expires, the borrower gets an opportunity and wants to pay off all his debts early. That’s a great situation for the borrower, but not so good for his personal loan.

Personal loan lenders want to make sure they get the full cycle of their expected interest over the life of the loan provided. So, they include a pre-payment penalty in their loan agreements. These penalties essentially charge a penalty up front for borrowers who don’t keep the loan on installment payment status for a certain period of time. It is usually a few years. This hidden cost often surprises borrowers who are then frustrated they can’t resolve their final debts as quickly as possible. It frequently comes up on a home refinance situation or when they need clear financing to buy a new home and the old loan won’t get out of the way quickly.

The best prevention for pre-payment penalties tends to be avoiding them in the first place. Read the fine print carefully on a personal loan application and agreement. That is the best chance for avoiding these minefields, not after the fact when the loan has already been funded.

Con: It Serves to Help Through Downturns and Is Not a Cure for Spending

While personal loans can be a temporary safety net in terms of getting through a financial pinch, they are not a permanent solution to how your debt was created in the first place. They remember in the pros and cons of taking out a personal loan. Debt is a mathematical result of having more money going out the door versus coming in through paycheck or earnings. If you want your debt to go away, you need to reduce your spending and increase your earning. When you finally paid off your debt, then you are essentially debt-free.

Personal loans can help structure your debt so it doesn’t grow anymore and you begin to pay it down, but they don’t wipe out your debt per se. And if you go and spend more on those paid-off credit cards, you just made the debt problem worse, not better.

Con: Loan Amounts Generally are Smaller

A factor in pros and cons of taking out a personal loan remains that personal loans are always going to be smaller than large purpose bank loans. For instead, you’re not going to be able to use a personal loan to a buy home in most cases. That said, personal loan amounts are increasing in size, with some loans reaching as much as $35,000 for customers with good credit histories, long working career records, and a viable income source to pay the loan back with. Stable career types tend to get these offers far more often versus first-time borrowers. However, even with the large amounts, personal loans will still charge more, and secured loans such as those for a home or car will easily be larger in money amounts lent.

is the largest unsecured personal loan amount that lender will allow you to borrow.

Is a Personal Loan a Bad Idea?

Keep in mind, in addition to the above, you need to make sure a personal loan will fit your monthly budget. Remember, cash flow during the month can be trick to manage. You want to be sure that if approved, the monthly payment amount is going to be a cost you can handle. This oftentimes becomes an issue with folks who think consolidating their credit cards will be easy. They’ve been paying $300 in minimum payments for $22,000 in credit card accounts. Then they consolidate with a personal loan and find the monthly payment reaches over $500. Can they afford it? If extremely tight, the new loan might actually make monthly cash flow worse.

How to Get a Personal Loan?

Again, personal loan shopping today is quite easy to find a lender, with most of them managed online via Internet websites. (the convenience by another reason to first weigh pros and cons of taking out a personal loan). They operate in every state and can work with most banks and credit unions in terms of transferring funds to a borrower. The best method to start is do your research first. Plan out what you will need for what purpose and what the fees are. Then plan out how you pay back the loan. Do a cost-benefit analysis on a piece of paper, mapping the plusses and minuses on why the personal loan is a good idea or not. If you have more positives than negatives, then you’re likely on the right track for your particular financial need to get personal loan online help.

When Should You Avoid a Personal Loan?

Within the pros and cons of taking out a personal loan a borrower shouldn’t even consider a personal loan if he has no steady income with which to pay back the amount monthly. College students are at particular risk for this problem, marketed to by less-than-stellar companies and lenders pushing online quick cash loans who figure the student will either use parents’ help or scholarships to pay off the loan after the fact. These companies typically initiate the loans and then sell them to other lenders as a high risk but high-profit tools based on interest charges calculated.

Another common situation that ends up badly in personal loan borrowing tends to be when borrowers use the funds for highly irresponsible needs. Gambling, for example, is a really bad choice. Even more assuming that one more bet will pay off everything. In most cases, the borrower will lose everything in gambling and be further in debt and in financial problems. Gambling is often associated with a behavioral issue. The best approach is really to get medical help.

In Conclusion

Everybody’s situation is unique to some extent. While there are similarities, each situation has its own details. Remembering this, borrowers should really focus their use of a personal loan on issues that matter. Skip the entertainment ideas and target big leaps forward in life. Following this philosophy, you will see personal loans make more sense and produce more value.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.