Those horror stories you see on the news about someone’s credit card getting stolen and the thief racking up thousands in debt happen every week. Credit card fraud is scary. It does not need to happen to you though. You can protect yourself. As you prepare for the holiday shopping season, you need to prepare for the inevitable crush of shoppers, the fights over the last of an item and most importantly, you need to protect your credit card.

Most of my shopping gets done online since I stay pretty busy writing, so I am pretty ratchet about protecting my credit card information. Still, a few years ago someone did nab my information and I had to clean up a ton of problems on my credit report. Sometimes, I think I got invited to write here because I have learned so much the hard way. It happened to me and I can tell you how to protect yourself and how to clean up the mess if it has already happened to you.

Tips for Preventing Credit Card Fraud

Whether you shop in-stores or online, your credit card information remains at risk. You can keep it safer though. It just takes a few extra steps to avoid credit card fraud. You have to learn to be on the lookout for scammers and thieves. It is all in the preparation you make. Start with these tips to get yourself well prepared to shop.

- Tuck your credit cards into your purse or wallet and wear it close to your body. This makes it tough for thieves to snatch.

- In busy shopping centers or malls or in busy outdoor shopping markets, carry a small purse to make it tougher to steal or pick-pocket.

- Take only the credit or debit card you will actually use that day like the zero APR credit card you plan to use for that new stove. Leave everything else at home, especially your cash advance credit card.

- Quickly use your credit card and then put it away. The less time it gets exposed, the less likely your numbers can get stolen. Thieves can use their cell phone to photograph your credit card while it is out getting used.

- Keep your cards in a separate location from your wallet or purse. If you get pickpocketed, you only lose the cash in the purse or wallet.

- During a transaction, keep your eye on your card. Make sure you get it back before you walk away.

- Save your receipts, so you can compare them with your statement.

- Make sure that you have your credit card with you before you leave the shop or restaurant.

- Do not sign a blank credit card receipt. Write a zero into each unused blank or draw a line through it so no person can add to the receipt. Verify your total before signing it.

- Be just as vigilant when you stop for gas. Check the gas pump or ATM before you use it to make sure a credit card skimmer has not attached anything to the pump.

- Credit card thieves sometimes place credit card skimming devices onto the credit card readers at gas pumps or ATMs. This attaches over the regular credit card swiper and stores all data. Immediately report any such device to the gas station manager and go to a different gas station or ATM.

At-Home Tips for Safer Credit Cards

You also need to be extra careful at home. Handle your financial statements carefully.

- Shred anything correspondence with your bank routing number and account number on it or your debit or credit card number on It.

- Do not throw your credit card statements in the trash without shredding them first.

- Throw the shredded pieces away in different trash cans to thwart thieves from taping pieces together.

- Whether you phone your credit card company or they phone you – do not give your credit card number over the phone.

- When you phone your credit card company’s customer service, use the toll-free phone number on the back of your credit card.

- Do not return calls to a phone number left on your voice mail or sent via email or text message. It could be fake. Always phone the telephone number on the back of the card.

- Avoid sharing your phone number with anyone who calls you. You should ask to call them back at the number on the reverse of the card. Get their employee number or extension, so you can reach them directly.

- Make it simple to cancel your credit cards by keeping a record of your account numbers, expiration dates and the credit card fraud hotline for each company in your safe or in a safe deposit box. You need it to be in a location that only you can get to the information.

- You should be the only person to use your card. Do not lend it to your children, spouse or roommates.

- Do not leave your credit cards, shopping receipts or financial statements lying around the house or office.

- Open financial mail promptly and reconcile statements with the purchases you’ve made.

- Let your credit card issuer know immediately if your address changes.

- Let your credit card issuer know immediately if you are going on vacation or will be traveling.

- Never write your account number on the outside of an envelope.

Online Credit Card Safety

Your workplace may have a litany of rules for getting online and opening e-mails. Follow them at home, too. For real. They are doing that to keep their servers and systems safe. By following the same rules at home, you can do the same for yourself. You can keep your credit card, bank and investment account information safe, as well as your computer system. Start with these tips.

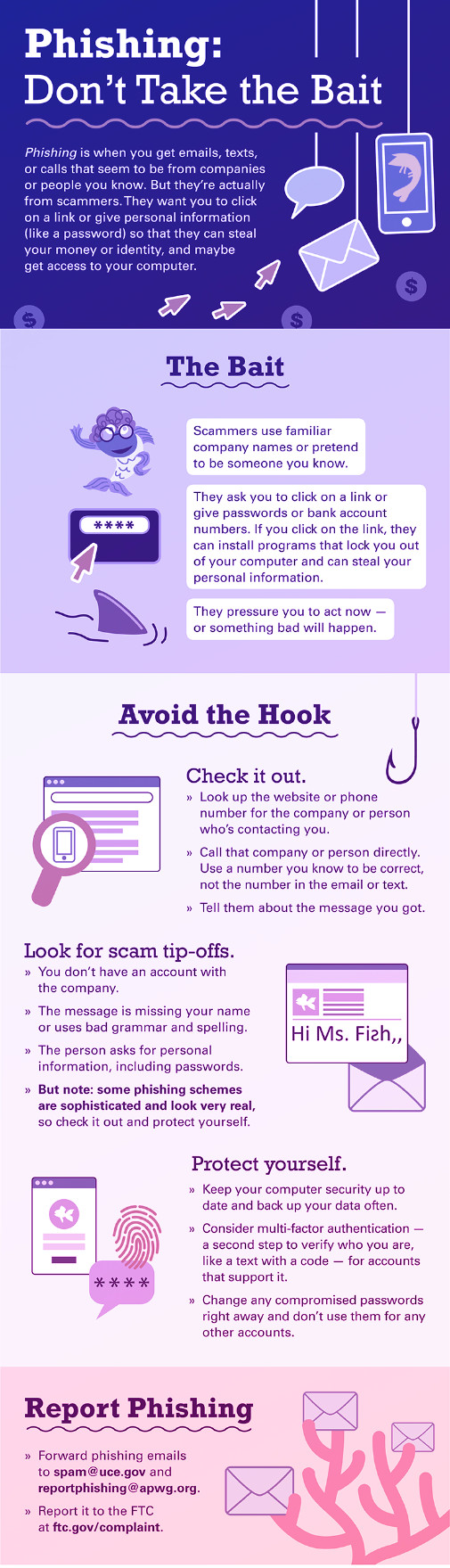

- Be wary of phishing emails. These appear to be from a company you genuinely do business with, but really come from a scammer. Avoid clicking on links in an email appearing to come from your bank, credit card company or any other business that you use. PayPal often gets spoofed in emails. Read the information provided in the email, then take action on it by going to the financial institution’s website on your own – typing the URL of the site into your browser yourself.

- Use caution when you use your credit card on the Internet. Enter your number only on sites you know are secure and legitimate.

- Use websites that use https:// to indicate there are secure.

- Look for the lock icon in the lower right corner of the browser.

- Create a really strong password for the card issuer’s website. Make it hard to guess. Keep it safe by not writing it down.

- Also, create really strong passwords for any website where you store your credit card number like Amazon or Walmart.

- A strong password contains upper- and lower-case letters, numbers, and special characters.

- Before you shop with a company for the first time, conduct an online search to read reviews and complaints. This includes online card shops. Use easily checked, reliable sites like Loanry.com or Cashry.com.

What to Do if You Lose Your Card or It Gets Stolen

As soon as you realize your credit card is missing, call your credit card issuer to cancel it. This prevents fraudulent charges. Make a list now of the phone numbers of your credit card companies’ customer service numbers. This makes it easy to find them when you need them.

You are liable for the first $50 charged after the card was stolen. This could be more if you do not report it quickly.

Carefully review your billing statements every month for unauthorized charges. One of the first signs of credit card fraud is unauthorized or duplicate charges. Any charge you see that you know you did not make; you should report to the credit card company right away.

Your credit card issuer can tell if it was an innocuous mistake or if you need to close your account and open a new one to avoid credit card fraud. Does that sound like a lot to go through just to keep your credit cards safe?

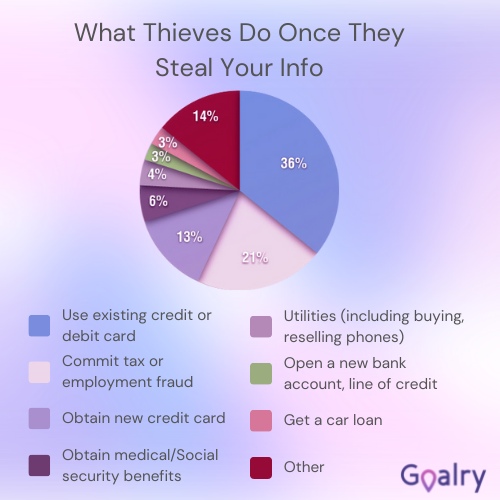

When I went through my problem with identity theft, the thieves had first borrowed my address. Once that happened, their information merged in with mine. Many organizations use the information from credit reporting bureaus to verify identity elsewhere. Want to know how bad it can get?

I could not set up a Federal Express account to schedule deliveries to my home because FedEx uses a credit bureau to verify your identity. They want to make sure they are delivering to the appropriate address for your packages and all the others that should go there. Problem was, I was and am the only person to have ever lived in that house. When the verification asked me which of the four people had been my roommate at my lake house, I was at a loss. It took months to clear everything up and I still do not have a FedEx account.

Report Losses and Credit Card Fraud

Call the card issuer as soon as you realize your card has been lost or stolen. Many companies have toll-free credit card fraud hotlines and 24-hour services handle these issues. If you think that your card was used fraudulently, you typically must sign a statement under oath that you didn’t make the purchases or open the account in question.

Reporting Your Identity Theft

While we’re on the topic, reporting identity theft and fraudulent charges does not work quite the same as reporting typical theft like the stealing of a motorcycle. Rather than phoning the 911 line, you should call the non-emergency or business phone number of the local police department. Tell them you need to report a financial crime. If the officer balks at taking the report, you should let them know that you do not expect them to conduct an investigation, but that you are filing it to clear your name and help with the process of reporting it to the credit card companies and credit reporting bureaus. If they continue to balk, request to speak with their supervisor.

Here are five really important reasons to report credit card fraud and identity theft to the authorities.

- You help yourself psychologically because it is cathartic. You provide yourself some emotional resolution. Making a police report lets you take back some measure of control that was stolen from you.

- Your report provides you proof of the event. Some creditors will request the police report number.

- The report means you get the credit report/file freeze for free.

- The police might solve the case, especially if you are able to provide the suspect’s name and contact information.

- As mentioned, your data provides a piece of information that can lead to the solution of larger crimes.

An investigation could solve a credit card fraud. The more information you can provide, the more likely it is that the police will actually investigate. Cases get scored numerically based on available data provided. The reports that rank the highest by providing the most detail and information get the most attention. If you have identified a suspect or have an actionable activity to investigate, your case stands a better chance of getting investigated. But if a bank just got robbed though, the financial crimes folks will already be busy investigating that. If there already exists a higher-scoring credit card fraud case, they probably won’t investigate you aggressively.

Final Thoughts

You can do a lot to protect yourself from credit card fraud. It begins with your vigilance. Use sites like Creditry and options like store apps to protect your credit cards. Keep on top of your finances. Look at credit card statements as soon as they arrive. Learn the vigilance necessary to protect yourself and, if something does go awry, report it to the police immediately. Stay on top of it and keep it on their front burner. Make sure you help educate others about what it takes to remain safe and protect yourself from credit card fraud. You are your first and best defense.

Carlie Lawson writes about business and finance, specializing in entertainment, cryptocurrency and FOREX coverage. She wrote weekly entertainment business and finance articles for JollyJo.tv, Keysian and Movitly for a combined seven years. A former newspaper journalist, she now owns Powell Lawson Creatives, a PR firm, and Powell Lawson Consulting, a business continuity and hazards planning consultancy. She earned BAs in Journalism and Film & Video Studies from the University of Oklahoma. She also earned her Master of Regional & City Planning at OU. Her passion lies in helping people make money while reducing risk.