Not all debt is evil. Debt is a tool that allows us to make major purchases like homes or vehicles on affordable terms. Responsible use of debt allows us to weather rough times while still putting food on the table and meeting basic needs. But sometimes, you need a bit of help organizing and paying it off. Let’s look into debt consolidations versus balance transfer cards.

Debt Consolidation Loans

The idea behind debt consolidation is simple. You owe different amounts of money to many different places under many different terms. The constant payments coming due are overwhelming – sometimes more than you even make in a month. Half the time you’re late because you can’t afford to pay for everything, and the other time you’re late because you simply can’t keep track of it all.

A debt consolidation loan is the most common solution to help you out of the swamp. It’s basically a personal loan with a specific purpose – debt consolidation – and traditional loan terms. A debt consolidation loan is generally unsecured and carries a fixed interest rate. “Unsecured” means you’re not offering up collateral as security for the loan. If you’re dealing with serious debt, it’s unlikely you have substantial collateral other than possibly your home, and we don’t want that on the line if god forbid something were to go seriously wrong and you couldn’t make your payments. “Fixed interest” means that whatever interest rate you agree to at the time of the loan remains the same over the life of the loan, making your monthly payments consistent and thus easy to budget for.

Advantages of Debt Consolidation Loans

There are numerous advantages to the right debt consolidation loan:

- It replaces multiple monthly payments to a single monthly payment. This means stretching your total debt out over a longer time period, so that each monthly installment is less than you were trying to pay in total each month

- Paying off multiple creditors means no more late charges or penalties from multiple places

- The right debt consolidation loan may carry a lower interest rate than the average you’re currently paying to various creditors, especially if you factor in those late charges and other fees we just mentioned

- A lower overall monthly payment means more money freed up to take care of your priorities and those you love. While paying down your debt is a priority, it’s rarely your ONLY priority

Disadvantages of Debt Consolidation Loans

Let’s be equally honest about the potential disadvantages of a debt consolidation loan:

You still owe the money. This isn’t actually a disadvantage so much as a reality check. It’s easy to overlook the fact that taking more effective control of your debt isn’t the same as your debt going away – it’s just not in charge anymore.

If you’ve been struggling with debt, you may not have a great credit history or a high credit score. That doesn’t mean you don’t have options. There are reputable online lenders who specialize in situations just like yours and who offer debt consolidation for poor credit.

Realistically, however, your interest rates may not be as favorable and there could be upfront fees for getting started. Pay attention to the details and don’t take a bad deal out of desperation. Still, the chance to take control of your debt and begin rebuilding your credit may still be worth it. Bad credit doesn’t have to be a permanent condition.

Balance Transfer Credit Cards

You’ve no doubt seen the ads and maybe received an offer or seven in the mail recently. “No interest on balance transfers!” “Zero percent APR for 24 months!” “You’re Pre-Approved to Apply (**approval not guaranteed**)”

What about it? Are these low-interest or no-interest credit cards a good option for debt consolidation?

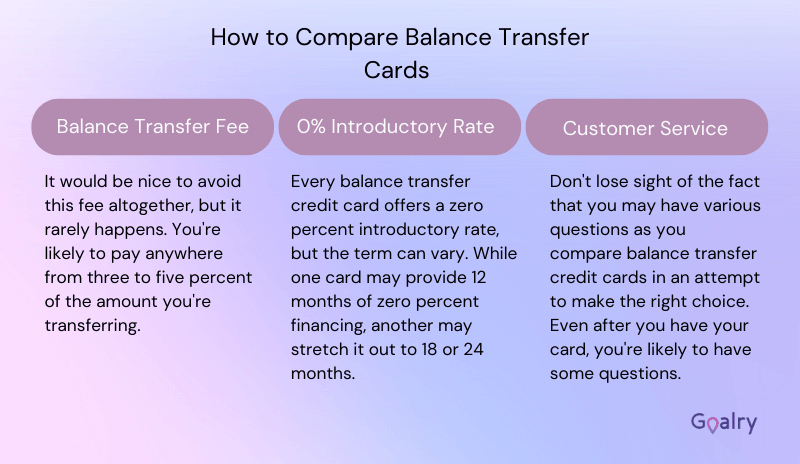

Maybe. But only in some very specific circumstances. If most of your current debt is credit card debt, and your current credit cards carry relatively high interest, a balance transfer might be a good move. You should first make sure you know what rates your cards are actually charging, which isn’t always as easy as it sounds. Somewhere on the same website you use to check your balance or make payments, there should be information about the interest you pay, usually expressed as a particular amount or percentage on top of this or that current market rate. That’s how APR works – you start with a relatively low rate, then it varies with market rates periodically. You can end up paying way more than when you started, or sometimes a little less.

If you can’t find it, call the card company. They’re legally obligated to explain this to you, and they don’t exactly try to hide it, despite it being a bit tricky to decipher on the website or those periodic “policy updates” they mail out. Until you know this rate or the formula used to determined your rate, you can’t compare it to the new card you’re considering.

Be Careful of Credit Card Rates

Be Careful of Credit Card Rates

Now you need to pay particular attention to the MULTIPLE rates being offered by the new card. Presumably, it’s promising you a year or more at some ridiculously low rate or zero interest or whatever. Does that apply to transfers as well as new purchases you might choose to make with the card, or only to one or the other? More importantly, what happens AFTER the introductory period? What will the interest rate be then? You don’t want to end up worse off than you were before.

Advantages to Balance Transfer Cards

If you’ve read all the small print and run the numbers, the biggest advantage is that a balance transfer card can conceivably save you serious money. Like with cell phone plans or cable TV packages, it seems it’s always easier to get a great deal from the company that wants to steal you than from the company who claims they’d like to keep you.

If you care about points or miles or rewards or cash back programs, a balance transfer card gives you the opportunity to move from a card that doesn’t offer the features you want to a card which does.

Most of all, balance transfers between credit cards are pretty straightforward compared to traditional loans. You fill out a little basic information, and if you’re approved, it’s almost like charging the debt from your old card onto your new card- quick and painless, more or less.

Disadvantages to Balance Transfer Cards

The biggest is that eventually, those promotional rates end. I realize we’ve already covered this, but it seemed worth repeating.

The other danger is similar to that of a debt consolidation loan. Once you transfer your balance to the new card, you suddenly have 2 or 3 credit cards with the same high limits and zero balance on them, just begging you to use them again.

If this is going to be a temptation, then close them. Eliminate the temptations. That’s not the ideal choice, but it’s better to cut them up than to fill them up.

A better option is to lock them up. Put them in the safe or somewhere else secure in your household. The available credit will help your credit score and you can always access them in emergencies. It’s best to get them out of your wallet or purse, however – no sense leaving Oreos around if you’re serious about your diet, right?

In Conclusion

No matter what your debt situation, you have options. It may not feel like it, but there’s almost always a way forward. And look at it this way… the more hopeless it feels, the less likely it is that things could honestly get much worse, right?

Stay safe, stay patient, and kind with one another, and keep following expert medical advice. And if you decide to tackle some debt management while you’re at it, we can connect you to reputable online sources who would be happy to help while maintaining COMPLETE social distancing. Just let us know when you’re ready!

You can do this.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.