Planning a wedding is an amazing time in your life. You are preparing to share the rest of your life with your soulmate. I already know you want the day to be perfect. You do not want to overlook one single detail. If you have begun looking at all the various pieces you can have in your wedding, you already know it can be expensive. Before you go down the path of a complete freak out, take a breath and continue reading. I will share ways for you to fund your dream wedding.

Can I Get A Loan To Pay For My Wedding?

The short answer is yes, you can get a wedding loan to fund your dream wedding. This loan is the same thing as a personal loan, which means it is not a secured loan. A lender lets you borrow money with your promise to repay it with regular monthly payments for a set period of time. The lender charges you interest as a fee for allowing you to borrow the money. The amount of the interest is directly related to your credit score.

A lender can be a traditional bank, a credit union, an online bank, even a friend or family member. In addition to your credit score, lenders want to see your credit history. You must have valid employment with income to receive a loan for a wedding. A lender also is interested in your debt to income ratio. This is the amount of debt that you have as it relates to the amount of income that you have. Most lenders prefer that you have a debt-to-income ratio that is under 35 percent.

Should I Get a Loan to Pay For My Wedding?

When you are thinking about whether you want to fund your dream wedding with a loan, you must take your specific circumstances into consideration. No one can determine if a loan for your wedding is the right thing for you but you. It is important that when you are considering wedding financing that you look for a loan that fits your needs and budget. Remember, a loan is not money that is being given to you. It is money that you have to pay back. You must have the money to pay back each month. If you do not have the money to pay back the money, you could put yourself in a worse financial position.

You should not take on a loan without a significant amount of thought. You should know if your budget can support making a regular monthly payment. Perhaps you know that you are going to have the money in six months and you can pay off the loan. It may be to your advantage to take out a loan so that you can pay for all of the wedding in full today. You may be able to obtain a discount by paying it in full. Then you can pay the monthly payments on the loan until you are able to pay the loan in full.

What Are the Benefits of Getting a Loan for My Wedding?

One of the most obvious benefits of getting a loan to fund your dream wedding is you get the money you need immediately. Planning a wedding is a stressful time in your life. When you add the complication of trying to figure out how you are going to pay for the wedding, you may fight more than anything. The last thing you want to bring with you into your marriage is the stress of the actual wedding. Getting a loan for a wedding may help to alleviate some of that stress because you know you have the money available to you.

If you know that you are able to make that monthly loan payment, then a wedding loan may be the best thing for you as you plan the wedding. You do not have to worry about how everything is adding up and when it comes time to pay, you do not know if you will have the money. It gives you the freedom to focus on what is really important, which is marrying your best friend. You will see how easy it is to get wrapped up in all the details of a wedding. It is so easy to forget why you are getting married in the first place. By taking out a loan to cover all the money for the wedding, it allows you to shift your focus to the marriage and the things that make you both happy.

What Are the Negatives to Getting a Loan for My Wedding?

There is always a downside to things, right? Getting a loan to fund your dream wedding is no different. Let us talk about the negatives of a loan for a moment. First, it is adding to your debt. You will start your marriage already in debt and that really is not a good way to begin things. Maybe you have unlimited income and paying a monthly loan payment does not have a huge impact on your budget. However, not many of us have that type of income and taking on a monthly loan payment could be a hefty weight.

Another downside is you have this money at your disposal. When the money is sitting in your bank account it is easy to forget about your budget. When you have the money, it is easy just to start saying yes to everything and pretty soon, you have spent all of the money but have not paid for everything. It is easy to lose sight of how much money you really want to spend. It is amazing how quickly your budget gets tossed to the side. If you take out a loan for your wedding, you have to remain disciplined with money that you get and stick to your budget.

Do I Have Alternatives to Getting a Loan?

Yes, there are always alternatives to getting a loan to fund your dream wedding. You may not like them, though. Those alternatives may not be easy, but it all depends on what are your goals.

One of the easiest alternatives is to use a credit card to pay for your wedding. However, just like the loan, you have to pay the credit card bill eventually. Unlike the loan, the payment is not static and it may have a high-interest rate. You only pay what you spent on your credit card and because that is a moving target, so is the amount you owe each month. When you pay the minimum payment on a credit card, most likely you are not making any real progress with paying off the credit card bill. When you pay the minimum on your loan, you are making progress towards paying off the loan.

Ask Your Parents for Help

Another way to pay for your wedding without taking out a loan is by asking for help from your parents. There was a time when the parents of the bride paid for the wedding. While we have begun to move away from that whole concept, it does not mean that your parents are not willing to pay for something. They may be willing to pay for a large expense, like the reception. Possibly, they may be willing to pay for a lot more of your wedding, but all you have to do is ask.

You can work hard to cut some things out of your wedding to bring down the cost. This requires having a hard conversation with your future spouse about what it is you really must have at your wedding to make it complete. Once you know what you are willing to eliminate and what must stay, it is easier to begin to remove things.

What Loan Options Are Available?

There are many different types of loans that are available to you to fund your dream wedding. I mentioned the most common type above when I talked about an unsecured personal loan. These loans do not have collateral attached to them. They are riskier because the lender does not have a guarantee you will repay other than your promise to do so. This is why lenders may be hesitant to loan money to someone with bad credit.

There are some other types of loans that are intended for short periods of time. You may have heard of payday loans or fast cash loans. The major difference with these is they are typically small amounts of money and you must pay them back in a short amount of time. These types of loans typically have really high-interest rates and excessive fees if you miss a payment. Most of these loans must be paid back in one payment, but some are stretched out over two or three payments. These loans should only be considered if you need a small amount of money. You should only consider them if you know for sure you can pay back the money.

This might be good in instances where you forgot you had to pay the caterer and you do not get paid until next week. However, if you do not pay the caterer tomorrow, you may lose that caterer. In this instance, it may be in your best interest to take out a loan of this type. Again, carefully consider any loan before you agree to it. Make sure you understand the loan terms and repayment schedule before you sign anything.

Does My Credit Matter?

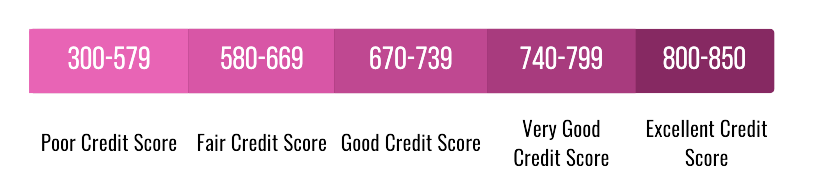

When it comes to obtaining loans for wedding expenses, your credit does matter. Truthfully, it matters for just about everything. However, I am going to focus on your credit and how it can impact your plan to fund your dream wedding. Your credit score is an indicator to lenders about your credit worthiness. It also gives them insight as to whether or not you will pay back your loan. The lower your credit score is, the higher your interest will be. Interest is what a lender charges you to borrow money. When your credit is low, the lender feels it is risky to lend you money. They charge you a higher interest because they are taking a risk by lending you money.

A typical credit score range from 350 to 850. Most people have a credit score somewhere between 600 to 750. Good credit falls somewhere between 670 to 800. Anything below 570 falls into the danger zone of bad credit. When you have bad credit, it is much harder to get a good interest rate. You may find it is difficult to be approved for a loan. Lenders feel those with bad credit scores may not be the best candidates for loans for a wedding.

How Much Will a Wedding Cost?

I have already touched on the fact that if you plan to fund your dream wedding, it is going to cost you a large amount of money. The average cost of a wedding these days is around $22,500. While this number seems unrealistically high, the cost of things for a wedding adds up quickly. That $22,500 price tag does include the cost of rings.

That money could be used for a new car, or for a down payment on a house. You have to determine what is most important to you, the wedding of your dreams, or a house. The next most expensive thing is the reception venue and the honeymoon. This is the time when you have to really think about what you want at your wedding. There are many ways to reduce the cost of your wedding.

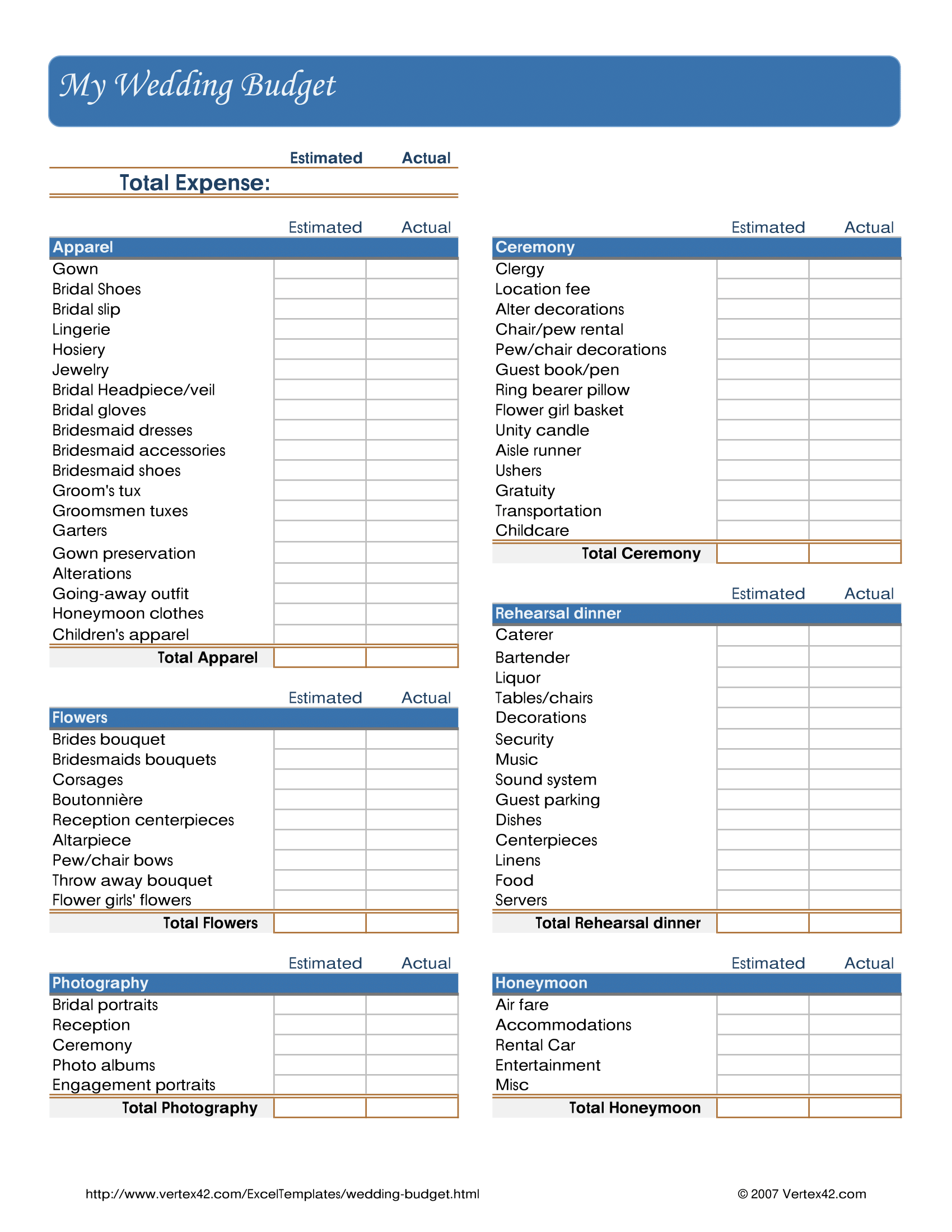

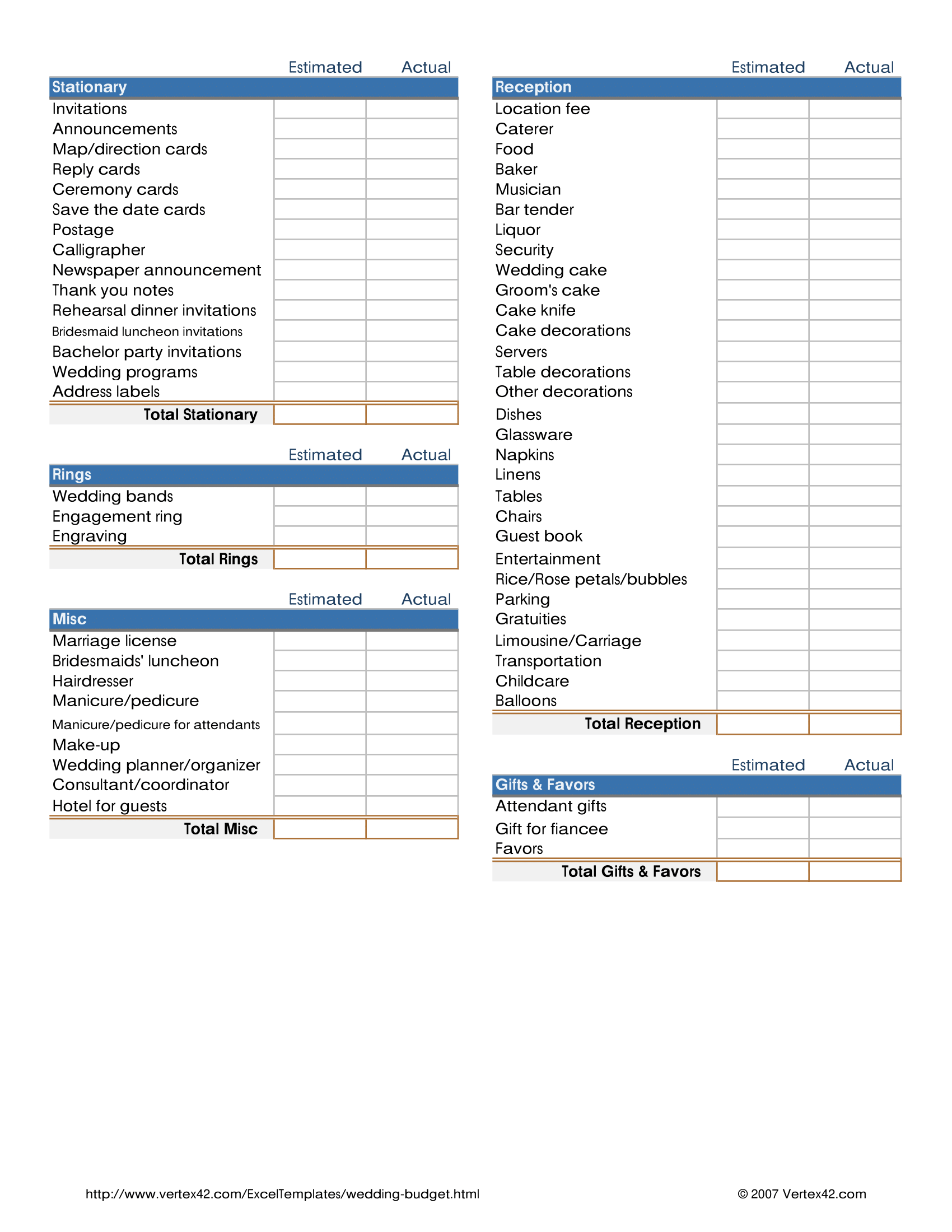

How Do I Create a Wedding Budget?

Once you estimate cost, you know how much money you need to have for your wedding. There are many websites and apps that can help you create a quick and easy budget. Creating a budget is not hard, it is just not something people like to do. No one really wants to limit the amount of money you can spend.

The easiest way to start is to write down all, and I do mean all, of your expenses. All of the things on which you spend money on a daily, weekly, monthly, or annual basis, you must write down. Once you have all of those items, you add up that column. Then in the next column, you write down how much money you earn in income. You subtract the total expenses from the total income and you have the total amount of money you have left over every month.

Hopefully, you have a positive number and it is more than zero. Realistically, this is the amount of money you have to save towards your wedding, or spend per month for your wedding. I am going to warn you right now, it is probably lower than you want it to be. It is probably lower than what you thought it would be. This is why no one likes to talk about a budget. No one likes to see the cold hard facts on paper.

How Can I Reduce My Wedding Costs?

So, now you know how much money you have to save or spend when you want to fund your dream wedding. Most likely, it is not as much as you hoped. You have also determined all of your must-haves for your wedding. Now, that you know those items, we can begin to reduce the cost of your must-haves. Believe it or not, it is possible to do some major cost-cutting.

Let us start with the dress. Buying a dress off the rack at a wedding dress shop is ridiculously expensive. You might get lucky and find something on the clearance rack or one that is last year’s dress. These dresses typically are only in one size, so you have to get really lucky.

Most of the time when you buy a dress from a dress shop, they tell you the dress runs small so they order a size or two up and inevitably, you have to alter the dress. The cost of alterations for a wedding dress is expensive. You should consider purchasing your dress from a resale or second-hand shop. Often you can find amazing dresses at really low prices.

Pare down your guest list. If you do not know the person, do not invite him. Do not invite someone that you have never met just because your parents said so. You can also limit the guest list to the guest only and that person cannot bring a date. This will decrease the number of people for which you are paying.

You can have a cash bar instead of an open bar. This will save you thousands of dollars because alcohol is expensive. When you want to fund your dream wedding, you have to be smart about where you make your cuts. You want to make cuts that give you a high amount of savings, but have little impact on your guests. You can make your own decorations and decorate the reception venue yourself. This could cut down on a significant amount of cost.

What Timeline Should I Follow For My Wedding?

The best way to fund your dream wedding is to set the date as far in advance as you can. I understand that when you are planning your wedding you want it to be as close to now as possible. The last thing most people want is a long engagement. However, the more time you have between now and your wedding date, the more time you have to save money.

When considering a timeline for your wedding, you should begin to start planning in earnest about six months before the date of your wedding. About six months before the wedding, you want to decide if you have enough money saved for your wedding, or if you need to take out a loan for your wedding. To best determine this, you need to have an understanding of how much money you need for your wedding. You can do this with estimates of the cost of the various pieces of your wedding.

You should also consider where you would like to honeymoon. If you plan to go out of the country for your honeymoon, you need passports. It could take up to six months to get those, so you need to start working on passports for you and your future spouse. About four months prior to the wedding you need to send out your invitations. Make sure you ordered them and have them delivered so you can mail them four months ahead of the wedding.

You should schedule appointments for your hair, makeup, and nails. And you should also have your dress by now. Two months before the wedding, you should begin to have dress fittings. Weeks before that wedding is when you are going to start to feel really nervous. Make sure you have a final checklist that gives you all the items you must do during this time. This list helps to keep you start, organize, and prepare for what is to come.

Conclusion

I have given you a number of ways to fund your dream wedding. I have talked about everything from loans to credit cards to saving money. It could be a combination of all three of those things that works best for you. You must do what is the right thing for you to do at this time. You are the only one that can make that determination. I strongly caution you to think clearly and rationally when making the decision about a loan to pay for your wedding. You should make sure that a loan is the right thing for you and will not put you in a worse financial position. Be smart about the choices you are making and be sure to have all the information before making a final decision.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.