Choosing a new car is hassle enough itself. Getting financing in order does not have to be. Before you start shopping for a car, have your financing lined up with a pre-approved car loan.

You have probably heard the terms “prequalified” and “preapproved”. Both are helpful steps but which one should you go for? Well, let’s take a look.

Getting prequalified is a simpler process but it gives you a more vague answer. Basically, a lender will take a quick look at your credit- a soft credit pull- and tell you what you might qualify for based on the limited information. Sure, it can be helpful, but it might change when they do the hard credit pull. Getting prequalified is like saying “Maybe you can get this loan”.

Getting a pre-approved car loan is a bit different.

Steps to Get a Pre-approved Car Loan

In this case, the car loan process is a bit more complicated. The lender does a hard pull on your credit. There is a deep dive into your credit score and report, giving them a good look at how you handle your finances. If you do get a pre-approved car loan, it is basically saying, “According to your current information, we should be able to loan you X amount at X percent interest.” Of course, if anything changes in the meantime, it can change your preapproval, but as long as it stays the same, you should get the pre-approved car loan amount at the offered interest rate.

Now, let’s take a look at how to get an auto loan.

Assess Your Finances

Before you even begin to look for a loan, you need to take a look at your current financial situation. Answer the following questions:

These are just a few things to look at to determine if getting a new car auto loan is a good idea at the time. As you look at your finances, you may notice things I have not yet mentioned. Just be sure you take it all into account.

If your credit is too low, you will either get rejected for the loan or get some really unfavorable terms. The closer to 700 your score is, the better chance of getting a pre-approved car loan and a good interest rate. However, 600 to 650 is good enough for some lenders. If your score is under 600, try to wait a little longer and improve your credit first.

Be honest with yourself here. Are you already struggling to make ends meet? If so, getting a new loan is probably not a good idea. Additionally, the lender will not approve you for a loan if you do not have the money to cover it. If that is the case, try increasing your income before applying for a pre-approved car loan.

Can you put any money towards your car? If you can, not only will you have to borrow less but you also have a better chance of getting a pre-approved car loan.

Many dealerships will let you trade in an old car as a down payment. If you can do this, that is less you will have to borrow. You might also use your collateral with the lender you are speaking to. By securing your loan with some form of collateral, the lender is more comfortable loaning you money and giving you a good rate since you are less of a risk.

Make a Budget

Next, you need to make a budget for a new car. Compare your incoming to your outgoing money. How much can you afford to pay each month on a loan payment?

It is important that you figure this out before speaking to a lender for a very important reason: They do not take your entire situation into account. When a lender determines how much to loan you, they are going by what they think you can afford.

The problem is that they are only looking at your regular documented bills. If you pay out $100 to charity each month or $50 for your daughter’s dance class, those numbers likely will not be factored in. Vacation money, date night cash, and birthdays are not typically factored in either.

This is why you have to look at everything yourself. You need to calculate everything you payout on a weekly, monthly, and yearly basis. Try not to leave anything out, no matter how insignificant it may seem. Only after you cannot think of another thing, then determine what you can spend out each month. Have this number in mind when you speak to lenders so you are not talked into borrowing more than you can afford.

Shop Rates

This is a biggie: You have to shop around for the best interest rates. Even one or two percent difference in rates can add up to a large amount. You want to find the absolute lowest rate that you can get.

Shop Cars

I am not yet talking about actually shopping for the car. I mean you should go ahead and figure out what kind of car you want. What does this have to do with getting a pre-approved car loan? Well, a couple of things.

First of all, the type of car you want determines the amount you need to borrow. By having two or three cars that you like in mind, you will know when you apply for a preapproval whether or not that lender can offer you enough to cover the car. If not, you will either know you need to find a new car or that you need to work on your financial situation before buying.

Another thing is that some lenders only work with certain types of cars. Some will not work with certain makes and models- mostly because they want to know the car will be valuable enough to sell should you not make your payments. Some only work with cars made after a certain year. Others require the car to have under a specific amount of miles. Having all of this information cleared up beforehand will help you narrow down lenders to apply with.

Shop Dealerships

While this is a little rarer, it is still important enough to mention: Some lenders will only loan money for automobiles from certain dealerships in the area. This may seem a little crazy, but you have to remember that if you decide not to make your payments, the lender is stuck figuring out what to do with the car to get their money back. They want to know that the dealer you are purchasing the car from does not have a history of selling cars in bad shape or something equally horrible. You might not run into this issue, but it is still something to ask different lenders before applying with them.

Apply

Your next step is to apply at the lenders you have chosen- preferably at least two or three, but more gives you a better comparison. By getting multiple pre-approved car loans, you can make sure that you are choosing the best one. Never settle for a loan until you have at least a couple of more to compare it to.

I understand that the idea of filling out several applications is exhausting, but it doesn’t have to be. Thanks to our digital age, you can now apply for loans- including car loans- online. Even better, if you choose a platform that is connected to a network of lenders, you can fill out most of your information just once.

I also want to point out the fact that you should do all of your applications within two weeks. Every time you apply for a loan- even for a pre-approval- it is a hard hit on your credit, which can bring your score down. If you apply for car loans in a spread-out period, each application will be a hard hit. However, if you do all of your applications for one industry- i.e. auto loan, mortgage, and so on- within two weeks, it only puts one hard hit on your credit.

Benefits of Getting a Pre-approved Car Loan

Most people do not apply for credit for a vehicle until they are at the dealership. Getting a pre-approved car loan before visiting the dealership, though, provides several benefits.

Your preapproval will give you the amount you will likely be able to borrow. This means that when you begin to shop for a car, you know what price range you should look at. This benefit alone is worth the trouble. It can keep you from overspending or tell you if you will need a secondary source to help cover your vehicle.

When you get a pre-approved car loan, the lender should give you the information you need upfront. That includes what your monthly payments will be. If the payments will be too high for you, you will know to either look for another car loan or not spend the full amount of your pre-approved car loan.

You have probably heard the term “Money talks”. This happens to be very true. If you can take cash to purchases for homes, vehicles, and a few other items, you have much stronger negotiation power.

Having a pre-approved car loan lets you do just that. Taking your approval note from your lender is like taking a blank check to the dealership. You can say, “This is my preapproval and this is what I am willing to spend”. Salespeople love when customers come with cash and will work with you to get the car you want.

Choose and Finalize Your Loan Within 30 to 60 Days

Pre-approvals are usually only valid for 30 to 60 days depending on the lender. A lot can change quickly, so just because you get approved now does not necessarily mean you can get approved again. Once you have chosen your lender, you need to find your car and finalize the paperwork as soon as possible.

That is actually another reason I said you should already have an idea of what car you want and where you are thinking of purchasing it. If you have these preliminary decisions out of the way, you can finalize your loan in plenty of time without having to rush.

Before you finalize the loan, though, take a moment to really look it over. Be sure that you know what is expected of you, any fees you could end up paying, how much your monthly payments are and where they need to be paid, and anything else that is valid to you successfully repaying the loan. This also gives you one last chance to make sure that everything in the paperwork is what you previously discussed with the lender. You do not want any surprises later.

What to Do If You Cannot Get a Pre-approved Car Loan

Of course, there is always a chance that you do not get a pre-approval. Different factors could prevent a lender from feeling comfortable enough to loan you money. What do you do then?

First off, try to find out why you did not get approved. Sometimes a lender can tell you this immediately. Others usually send out a letter of denial within a week or so pointing out things that might have caused the rejection. If you can figure out what is wrong, you can make a plan to fix it. Most often, you will need to do one of the following:

Work on Your Credit

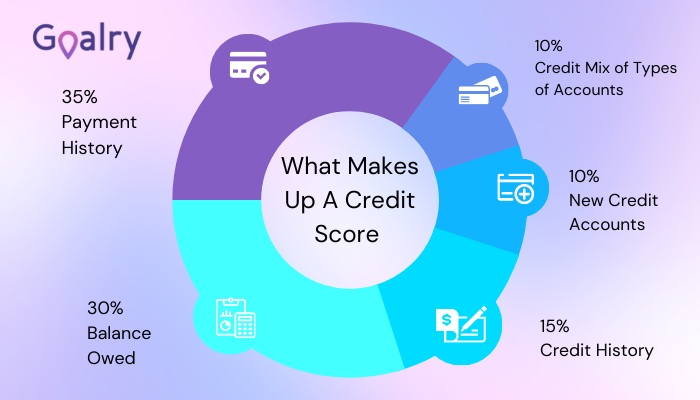

This is usually the big one. Your credit is the lender’s reference point for whether or not it is safe to loan you money. They look at things like how much debt you are in, what type of debt it is, what your payment history looks like, whether or not you have any bankruptcies or judgments recently, and more.

If you are turned down due to your credit, take a look at those areas. If you need help, websites like Credit Karma can be a great tool. Not only can you check your credit score and look at your credit report, but the website also gives you tips on what needs to be fixed. It breaks down different sections of your credit and tells you where you stand with that section. This is a good place to start if you are rejected.

Increase Your Income

Another factor that can impact your potential pre-approval is your income. Actually, it is your debt to income ratio (DTI). This is the amount you payout compared to what you bring in. If your debt is too high or your income too low, the lender will think you cannot make your payments and reject you.

There are two ways to fix this: Increase your income or decrease your debt. In many people’s cases, it would take a combination of these ways to make it work. The more you can increase your income while decreasing your debt, the quicker you can make a big enough change to get your pre-approval.

Increase Your Savings

it is not always necessary for you to have money that you can put down on a car, but it sure never hurts. If you do not have any money for your car or just do not have enough, try to grow your savings. This can help in three ways:

- First off, the lender will see that you are serious because you have skin in the game, so to speak.

- The second reason is that if you can put anything toward the car, it decreases the amount of loan you need. This not only gives you a better chance of getting a loan but also means you owe less back- which is a really good thing since we are talking about adding interest here.

- The last reason is similar to the others but works a little differently. We talked earlier about secured loans, aka using collateral. You can actually use your savings or an investment account as collateral. So- again- with collateral, you can typically get approved for a larger loan amount with a lower interest rate. And, of course, all of that is good.

If you have been denied credit and you can manage it, try putting away at least $1000 to $2000, but the more, the better.

Conclusion

Getting a pre-approved car loan is not as tough as many think. If you follow these steps, you should find yourself with a pre-approval soon or- at the very least- a plan on how to get that pre-approved car loan. Just remember that if you don’t succeed the first time, don’t give up. Keep pushing forward until you get what you are looking for.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.