You have a few options when you need to buy a car, but with no credit score car finance can be a little tricky. You have no credit history or even a bad credit history. Some may seem like a no-brainer, while others you may not have known about until reading this article.

Some of these methods take a little while, so if you need the vehicle this minute, you won’t be able to use the cheapest methods. If you have six months to a year to prepare for the purchase, you can use any method. Great news, right?

A Little Truth About Buying a Car

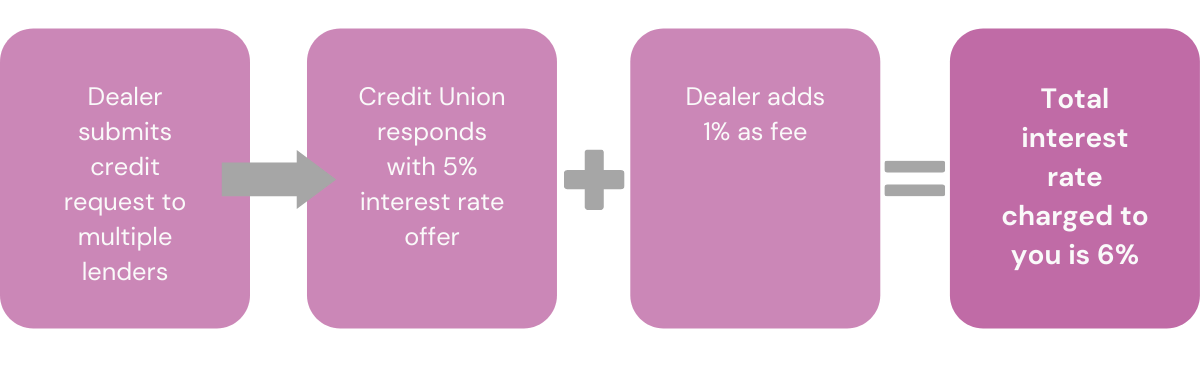

Car dealerships want to sell you cars, trucks, SUVs, motorcycles, trikes, etc. This makes them money. That’s because unless the dealership genuinely finances the loan internally, they already got paid. When you buy the vehicle, you typically take out a car loan. You give all the money from the car loan to the car dealer who gives you a nice, shiny new vehicle. The car payment you make each month goes to the bank that holds your loan.

I know, I know. You see those commercials on TV that talk about their financing department. They tell you how you can sit down with their finance rep and hash out a payment plan. You do go through them to get the loan, but the car dealership usually sells the loan to a bank. Huh. They do not want to have to deal with the money collection and handling the repossession if you default on the loan. Many times, they might have a deal with an online lender or a local bank that they will “share” the finance rep. The rep actually works at the car lot, but they have permission to approve the loan applications. The car lot does not make the loan; the bank with which they make the agreement does.

This might seem hinky, but it works to your advantage. The deal between the bank and car lot often lets the dealership accept some loan apps that would typically have gotten turned down at the bank. You could have fair credit and still get approved.

How To Buy A Car With No Credit History

The truth is, every person starts out with no credit, so we all had to find an option for no credit score car finance. We all had to grow, get that first job and apply for that first loan or credit card. Every one of us has been there and so has the credit bureaus. They know that every person starts out with no credit history.

You do begin your adult life with a credit score though, sort of. When you turn 18, you can legally sign contracts. You start out with a credit score of about 300. You have to start somewhere.

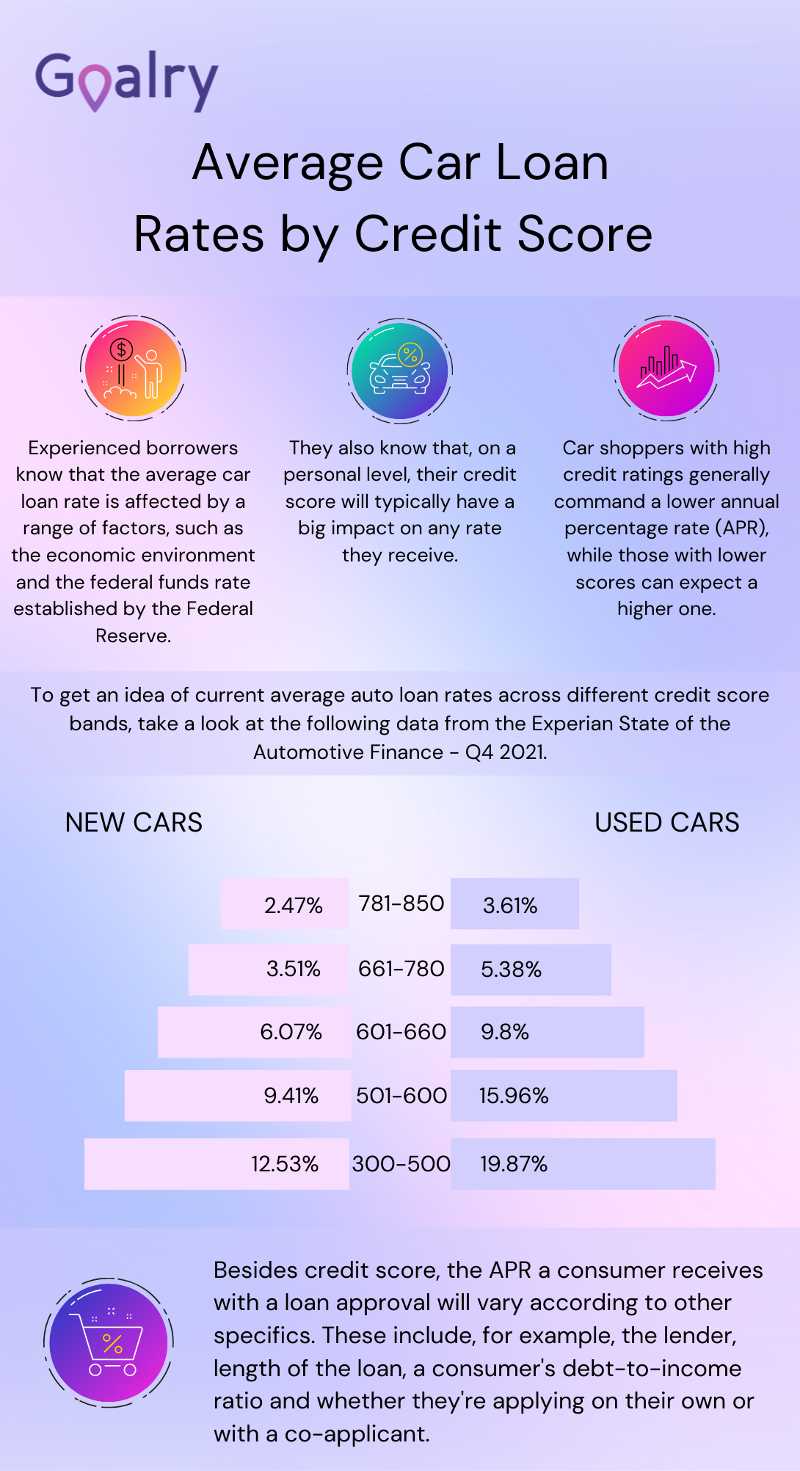

The scale ranges from 250 to 900. The idea is to only go up. This is quick and easy to do. According to Credit Sesame, the average 18-year-old has a credit score of 631.

In less than a year of having credit, most 18-year-old adults build it quickly. They do this with a credit card and a car loan. So, how did they get the car loan with no credit?

☛ Use a Co-signer

Using a co-signer provides the most common way to get a car loan without a credit history. Maybe you aren’t in your teens, and you have no person to co-sign for you. You might need to re-establish credit for some reason. You can visit an auto dealership that specializes in sales to individuals with bad credit or no credit. These auto dealerships typically work with a financial lender to offer to finance on the lot. You will pay pretty steep finance charges by using this route, but it gets you the car.

Most teens have their parents co-sign for their first auto loan to get around the no credit score car finance problem. This gets them the help they need to build credit. They make all the payments themselves. The parent simply co-signs to guarantee the bank that they will assume repayments if their child does not make the payments, or something happens to them that they cannot do so.

☛Build Credit Score With a Secured Credit Card

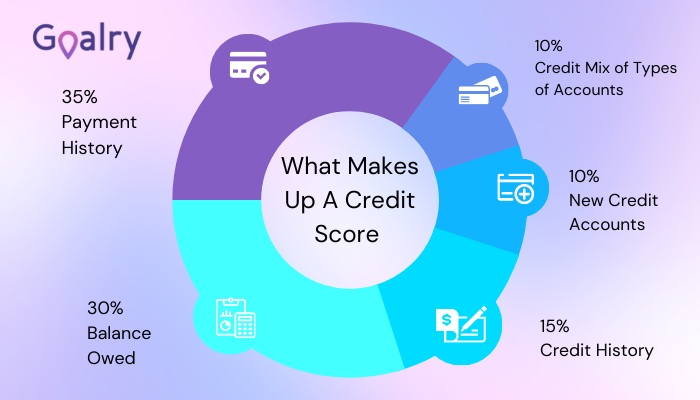

Qualify for a secured credit card and you can build your credit history easily. In just six months of paying your bills on time and always making at least the minimum payment, typically more than that, you can establish a terrific credit score and at least a short history. It only takes six months to build your score up. Conversely, you can ruin it that quickly, too, so you need to carefully pay for everything quickly.

☛Borrow the Money from Family Members

Instead of taking out a loan from a financial institution, you can borrow the money from your parents or another relative. This lets you avoid finance charges, but you do not get to build credit. That part is a bit of a bummer, and it can hurt you down the line. If you just need a small loan though because you plan to purchase a used vehicle, you can probably easily borrow it from your mom or dad if you’re just starting out.

☛Take Out a Bad Credit or No Credit Loan

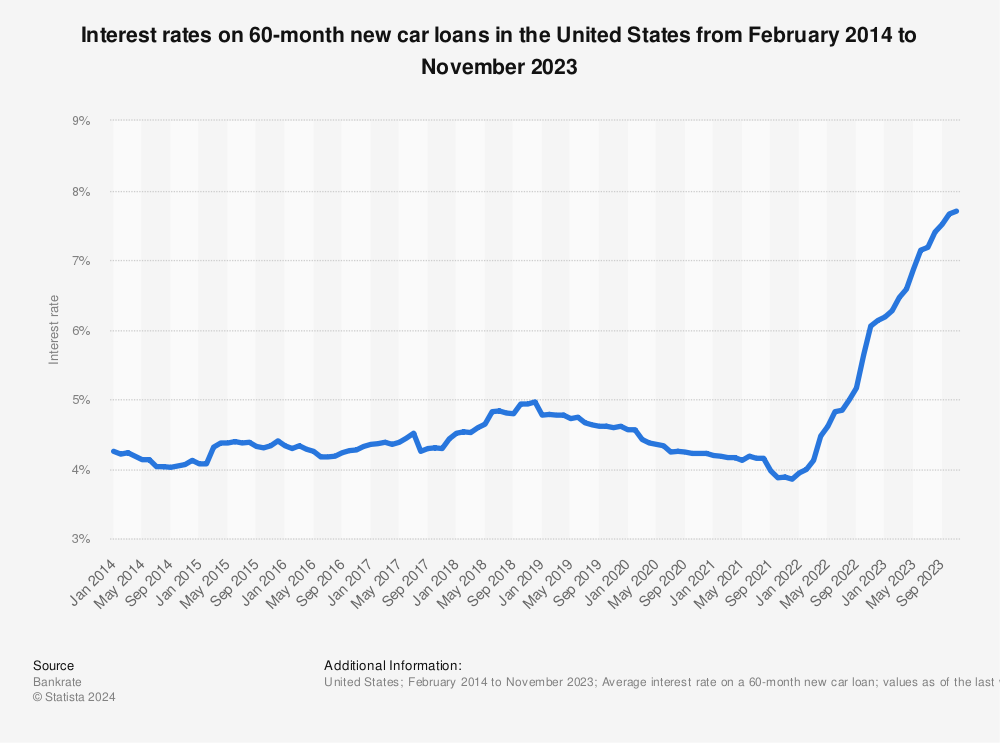

Shop around for bad credit loans and/or no credit loans. This can get scary when you read the interest rates you will pay. If this is your first loan, you probably do not know the difference between a prime interest rate and a subprime interest rate, but when you have no credit history, you will probably feel like you had to take out a loan at loan shark interest rates.

You can find some online lenders that will willingly extend a loan to someone with no credit history. They charge a lot though. Think in terms of 25 percent or more. You could end up with a loan for $10,000, but at 25 percent interest, you end up paying back $12,500. You bought a car and a quarter of another car, essentially. These options also require you to make a specific amount of money. Many of them mandate a $1,500 per month income to qualify for the loan. These make a good choice for those re-establishing credit after a bankruptcy though.

☛Buy a Used Car

Purchase a used car instead of a new vehicle. You can save thousands of dollars by purchasing a used vehicle. You might also look at program cars, certified used cars, and rental car sales.

If you have a few thousand in the bank, but you want a car quickly, you can use that money to buy a used or program car outright. Many dealerships offer certified used cars through a program with the manufacturer. This gets you a vehicle with a warranty for much less than a new car. Purchasing a vehicle that is just two or three years old can result in a savings of about $5,000. It will still have the new bells and whistles, so you enjoy the latest tech, but you won’t pay nearly as much for that.

☛Shop Smaller Auto Dealers for Better Deals

Shop at smaller car lots. Instead of shopping in the city, travel to a rural-ish area. You can shop in the suburbs, too. If you can find a small car lot, especially one that is unaffiliated with a specific manufacturer, you can usually land a better deal.

These may not have many off-of-the-line cars, but they probably have quite a few newer, used cars. Another plus is that they will often loan to you when a city dealer would not.

☛Make a Larger Down Payment

Make a larger down payment, so the car lot gets more of its money outright. You do not have to save the entire price of the vehicle. If you can save up a large down payment, you can often sway the dealership into providing you with a loan. That is because they get that money outright without waiting for the loan to get approved and processed. The larger a down payment you can make, the better.

☛Gen an Extra Job

If you are in high school, get a weekends or nights job. If you already have a job, get a second job. You can instantly increase your income.

When you increase your income, the bank or credit union looks more favorably at you. They think more highly of you when they see how much you work, and you earn. Bonus points if you put a lot of what you earn into a savings account. They love that! The US minimum wage pays $7.25. Many retail locations pay more than that though. Let’s use that for our math though.

We’ll say you landed a night and weekend job. You work eight hours on Saturday and on Sunday. During the week, you pick up just two half shifts. You might still be in high school, and you need a few nights for homework and a date night. You work 24 hours each week at minimum wage and you make $174 per week. Since there are five weeks in a month, you clean up, making $870 per month. Not bad for a 15-year-old. Your work will pay out your Social Security taxes and other federal taxes from your check, so you will get a bit less than that.

About one-third of your income usually goes to various taxes, but you get back a chunk of it at tax time, so let’s say $261 of that went to various taxes and your take-home pay is $609. In six months, you have a little more than $3,600. You could buy an older used car outright or keep saving for a full year. Then, you would have $7,308. Wow! You have two-thirds of the cost of a new car.

☛Combine a Few Options

You can combine a few options for no credit score car finance. Perhaps you need a car more quickly than six months to a year from now. Combine the job idea with saving for a larger down payment, take out the no credit loan or ask your parents to co-sign (even if you already live outside of their home on your own). If you do have a few months, get a second job and a secured credit card. Increasing your income while building just six months of credit can help you get the loan you need.

Register with Goalry

You can learn which secured credit cards you would most likely qualify for by reading the blogs at Goalry and its affiliated sites. When you sign up for a Member Key, which is free, you get access to all of the financial education articles on all of their sites – the ones I authored, plus the ones by some of their superb credit and finance experts from other fields like Katherine Davis and Kevin Strauss. You can bone up on all things financial and find the best banks with high-yield savings accounts and the top cryptocurrency exchanges. Learn how to save money and make your money make money for you at Goalry.

Carlie Lawson writes about business and finance, specializing in entertainment, cryptocurrency and FOREX coverage. She wrote weekly entertainment business and finance articles for JollyJo.tv, Keysian and Movitly for a combined seven years. A former newspaper journalist, she now owns Powell Lawson Creatives, a PR firm, and Powell Lawson Consulting, a business continuity and hazards planning consultancy. She earned BAs in Journalism and Film & Video Studies from the University of Oklahoma. She also earned her Master of Regional & City Planning at OU. Her passion lies in helping people make money while reducing risk.

This part applies whether you have great, so-so, bad, or no credit. Regardless of how you currently manage credit and money, you can always learn something new and improve. Creditry helps you keep on top of all your credit lines and loans. If you have not opened any credit lines yet, you are in luck because it lets you learn how to deftly manage your credit cards and loans.

This part applies whether you have great, so-so, bad, or no credit. Regardless of how you currently manage credit and money, you can always learn something new and improve. Creditry helps you keep on top of all your credit lines and loans. If you have not opened any credit lines yet, you are in luck because it lets you learn how to deftly manage your credit cards and loans.