Buying a car is one of the most expensive purchases you will make. Although you may not be able to do anything about the rising auto prices, you can save money on your auto loan by lowering the interest rate you will pay. When using auto finance options to pay for a vehicle, you will end up paying a higher amount when compared to the actual value, thanks to the interest. By the time you finish paying of the loan, the value of the vehicle has gone down significantly from when you bought it. Paying with cash may be a better way to purchase a vehicle but it’s just not a reality for most people.

Ways to Cut the Cost of an Auto Loan

If you are hoping to save money on your auto loan, there are some ways you can cut down on the costs.

Work on Your Credit

The terms of an auto loan will be based on your credit. If you have perfect credit then it’s easier for you to get the lowest interest rate. But if you don’t then you may have to pay more. If there are issues with your credit and you don’t need to get a new car right now then consider waiting until you can work on your score. Just a small decrease in the interest rate can save you a lot of money over the lifetime of the loan.

Don’t Borrow Too Little

If you only need a few thousand dollars to purchase a new vehicle then don’t get an auto loan. Instead, save money. Since small loans are paid off quicker than larger loans, the bank doesn’t make as much money. Smaller loans will have a higher interest rate than bigger loans so the bank can make more money off you. If the car purchase is an emergency then this may be the only option you have.

Refinancing Your Auto Loan

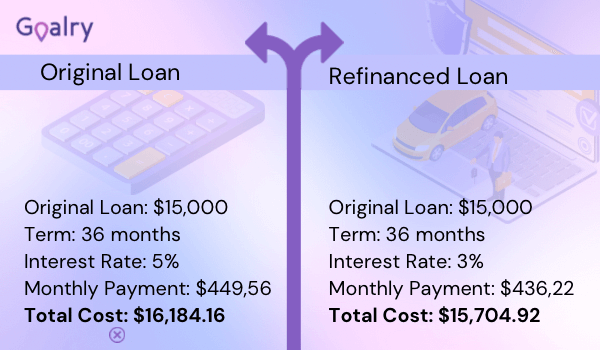

One of the ways to save money on your auto loan is by refinancing. You need to carefully look at your current situation to see if you are actually getting a better deal.

The first step is finding how much you owe on your existing loan. Then find out how much interest you will pay on the existing loan. Add together the remaining amount owed and the estimated interest payment and this is the number you want to beat with your new loan.

Don’t Get a Loan at the Dealership

The dealership is the middleman when selling you a car and also the middleman when you are set up with a lease or loan. Middlemen always get paid and the person that is paying is you. You should get a financing quote from the dealer because it may be a good option but if you don’t get other quotes, you could be paying too much money. You are doing some shopping around for your car so you should do the same for the loan.

Buy a Cheaper Car

This may seem like obvious advice but many people are in a habit of purchasing more than they can afford. Do you need to purchase a new car or can you get a pre-owned model? Do you really need a luxury car that will just put you more in debt? It’s worth considering if you are looking to save money on your auto loan.

Will I Save More Money if I Lease or Buy?

Buying a new car can be overwhelming and one of the decisions you are faced with is whether or not to lease or buy.

Buying a Car

Purchasing a car is one of the straightforward ways of getting it and you either pay cash or use a loan to cover the cost. The great benefit of buying a car is that one day you will own it and be free of vehicle payments until you decide to purchase another one. The car can be yours to sell at any time and you won’t be locked into a fixed ownership premium.

Car insurance premiums can be lower and you don’t have to worry about any mileage restrictions. The downside is that there will be a higher monthly payment. Dealers may also require a down payment so out-of-pocket costs will be higher when buying a car. As you pay down the loan you have the ability to build equity in the car. However, this may not be the case since depreciation can take a toll on the value. Buyers with down payments can find themselves in an upside-down situation where the car is worth less than what the buyer owes.

Leasing a Car

For those who haven’t leased before, the process can seem confusing. There are some benefits to leasing a car. The greatest advantage is the lower out-of-pocket cost when maintaining and acquiring the car. Leases don’t require much of a down payment and the monthly payments are usually lower. You also get the advantage of getting a new car every few years.

The drawback is you have a payment but you never get to own the vehicle. Depending on the lease you choose, when the term is up you could have the option of financing the remaining value, which means you will own it once you finish making payments.

Mileage restrictions also are another disadvantage. If you drive a lot during the year then buying a car may be a better choice. If you do drive a lot, there could be the option for an open-ended lease, which may not have as many mileage restrictions. You may get charged more for insurance for lease vehicles. Depending on your driving record, age, and where you live, the additional cost may be small but it’s still something to consider.

How to Shop for an Auto Loan

In order to save money on your auto loan, you have to shop around and shop smart.

Before you start negotiating the extra features, price, and car you want, start the loan application process with banks, credit unions, and other well-respected online lenders. Banks may be the best, especially smaller ones. Credit unions are also a good choice. You can get prequalification for a loan, which then allows you to go to the dealer with a blank check for the specified amount. Once you have a solid written contract with the dealer then you can get a good financing deal. Use an auto loan estimator to help with the shopping process.

Be sure to get copies of your credit report from the three main agencies. With an auto loan, you may have some more wiggle room in terms of your score as opposed to a mortgage. If you are looking for auto loans for bad credit online may be your best option.

It’s best to take the loan paperwork home and read it before signing anything. If the dealer or lender won’t let you do this then walk away from the offer. A loan is a binding agreement that will last you for years so you need to know what’s in it. There are some things that warrant some special attention. If you see mandatory binding arbitration, know that this will take your right to court to court away.

A variable interest rate could mean that you end up with a high payment. Find the highest possible payment and see if you can afford it. If you can’t then the loan isn’t right for you. See if there are any prepayment penalties. Learn how much it costs you if you want to pay off the loan early or refinance it. Is what the lender promised you in the contract? Oral promises can be impossible to enforce so you need to make sure it’s in the written paperwork.

Check on any lender you are dealing with ahead of time. Search online to learn what any customers or former customers are saying. While online comments should be taken with caution, you may be able to use them as an early warning for any possible problems. You can also consult with us about your lender choice.

Mistakes You Could Be Making with Your Auto Loan

If you want to save on your auto loan, you should avoid making some of these common mistakes.

- Not Investigating All Your Options. The key to saving the most money with an auto loan is to investigate all your potential lending options and this can include the dealership.

- Going by the Rate Alone. The rate is only part of the equation. You also need to know how much of a down payment is required and the terms of the loan before you make a decision.

- Not Reviewing Your Credit Score First. Know what your score is so you now what the lender is looking at. If there are any errors on your credit report, you can get them fixed beforehand.

- Being Quick to Accept the Dealership’s Offer. Dealerships may offer a higher rate because they get financing from banks. They raise the rates to make a profit so it’s always necessary to shop around.

- Focusing on the Payments over Price. If you are more focused on the monthly payments than the overall price of the car, you could be paying more in the long run. Consider the price of the car, the terms, length of the loan, and the APR.

- Looking for a Car First. If you are serous about getting a car, you need to start shopping around for financing first and determine how much you can afford before you start car shopping.

- Not Taking the Shorter Loan Term. Cars depreciate rather quickly so you want to finish paying off the loan in the shortest amount of time. Monthly payments will be higher with shorter-term loans but you will also be paying less in interest.

- Not Determining What You Can Afford. When it comes to car buying, not everyone takes the payments into careful consideration. Since it may only be for three years, you may not evaluate the impact these payments have on your budget but you need to. Before you buy a car, you need to determine how much you can put down and how much you can spend according to your monthly budget.

Ways to Pay Off Your Car Loan Early

A typical car loan can take you 60 to 72 months to pay off, which equals five to six years. That is a lot of interest to pay so if you want to pay off the loan faster and save money on your auto loan with interest, there are some things you can do.

If your lender lets you do this then you should consider it. When you pay every two weeks, you are actually making 26 half payments throughout the year, which adds up to 13 full payments instead of 12. While you may not save you as much on your auto loan, you will be able to repay the loan much faster. This amounts to months that you can get back for your life and it’s not a bad transition if you get paid every two weeks.

Instead of just paying your payment, round up to the nearest $50 to help repay the loan quicker. This can also help you save money on your auto loan. For example, if you have a $10,000 loan with a 10% interest rate for 60 months, the monthly payment is about $412. If you round up and pay $450 then you will have paid the loan in 47 months instead of 60 and can save over $2,000 in interest.

This is a similar version to rounding up. It doesn’t matter when you make the payment and it can help you save money on your auto loan.

If you make at least one large extra payment each year, you can save even more on interest and save money on your auto loan. The earlier you make a big payment, the sooner you will be able to pay off the car loan.

Even though some lenders may let you skip a payment once or twice a year, it’s best to resist the temptation. Skipping payments doesn’t save you money on your auto loan. It instead lengthens the term of the loan and will cost you more in interest.

You can negotiate a new monthly payment and pay off date when you refinance your loan. In order to save money on your auto loan, you should only do this if you actually get a lower monthly payment and a sooner pay off date. Refinancing may sometimes not make sense. You don’t want to just lower your monthly payment and lengthen the loan term since you will end up paying the same principal and then more in interest.

Final Thoughts

When you want to save money on your auto loan, there are different things you can do. First, look at ways to pay off your car early. Since this will lessen the amount of interest you are paying. Having a down payment can lessen how much you have to borrow so it helps to know how to save for a car. Know the steps to shopping for an auto loan so you can get the best deal possible. Refinancing may be an option to save money on your auto loan. But you need to make sure the situation will make sense for you. Also know what common mistakes you could be making so you don’t get stuck in a financing trap.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.