Many people choose to buy a car out of state over buying a car in their state for various reasons. Sometimes, sellers are offering a much lower price than others or maybe someone in another state simply has the vehicle the buyer is looking for. No matter the reason, it is a common occurrence.

It can also be a troubling one if you are not prepared.

Unfortunately, buying a car from out of state can take longer than buying one from down the road. The last thing you want is for it to take even longer because you- or the seller- are not as prepared as you should be. By following the tips in this article, you can speed up the process of buying a car from out of state.

Dealer or Individual?

Are you buying a car out of state from an individual or a dealership? The answer to this question will carry some weight on how you handle things. Buying a car at a dealership is much different than buying one from an individual. Many dealerships can handle all of the paperwork, financing, and everything else you need from afar. There is often no need for you to actually travel to get the car. This does not necessarily mean that you should not, just that you have more options. There are many other ways that things are different between the two, so decide which route you feel safest going before you dig in too far.

Do Your Research

Never, ever go into any purchase without doing some research- especially when the purchase is made out of state. Buying something at a Walmart while you are on vacation is not so risky because there are Walmart’s everywhere at which you can make exchanges and returns. Buying from people in different states is a little different. You may not ever see or speak to that person again, so you really need to do your research long before the sale takes place. Also, if you consider an auto loan, start thinking about where you should go shopping for a car loan.

Here is some basic information on what you need to look into when buying a car out of state:

1. The Seller

The seller- whether it is an individual or a dealership- should be checked out before dealing with them. It is easy to find information on dealerships as they tend to have websites and online reviews. Individuals might be a little trickier but not impossible.

Social media is a great tool for checking out individual sellers. In fact, most individuals that sell vehicles have probably sold something else on Facebook or Craigslist. Look up the seller’s name and see what you can find. There may not be any information if the person does not normally sell items, but it is still worth a look.

2. The Vehicle

You absolutely need to know everything you can about the vehicle- and not just the information given by the seller. In general, people are good and are not looking to get over on you. Still, there are some that are only concerned with themselves. As much as I would love to say that you can trust everyone, we all know that this is not true. You have to watch your own back.

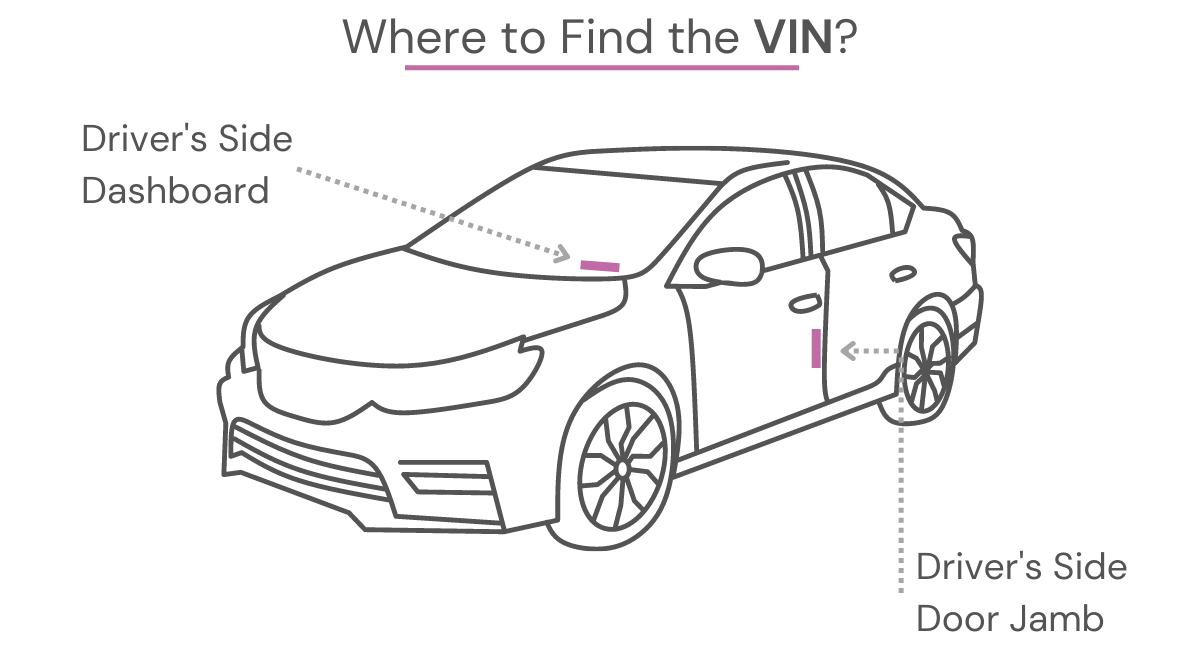

Get the VIN, or the vehicle identification number, from the seller. This is a 17 digit number that is similar to a social security number. Each VIN is only intended for one vehicle, and that VIN keeps up with the history of the vehicle. With the VIN, you can learn about any accidents the car has been involved in, any work that has been registered, and more.

Have the seller take a photo of the VIN on the vehicle and send it to you so that there is no confusion of the numbers or letters of the VIN. It is typically in two places on the vehicle- under the front windshield and on the door jamb. You can then look that VIN up online and learn what you know about the car. You will need to pay for a vehicle report, but the cost is nothing compared to how much you might have to spend out if the car is a lemon. For legitimate reports, go through the National Motor Vehicle Title Information System or Carfax.

You can also check the U.S. Department of Transportation with that VIN to determine if there have been any safety recalls of that vehicle. You can even check for common complaints of that vehicle type. Having the VIN is incredibly important to ensure that you get a good vehicle. Do not skip this step.

3. State Requirements

One of the biggest mistakes one might make when buying a car out of state is not knowing the state requirements. This includes both the state you are purchasing the vehicle from and your own state as they will likely both have separate requirements. For instance, my state does not require an emissions test. However, a few years back when I lived in a neighboring state, we did have to get an emissions test prior to being able to register it. Although these two states are side by side, the requirements were very different.

For the most part, the requirements from your own state are the most important for you to pay attention to. But knowing the other state’s laws can help protect you. Let’s say the state in which you are purchasing your new car requires the seller to take certain steps, including providing a recent inspection report. That report could tell you many things you need to know about the condition of the car. But if you do not know that the seller is required to provide that, they could easily avoid giving it to you. However, if you know what is required, you know what to ask for.

Knowledge is one of the best ways to prevent someone from scamming you. To gain that information, you can look up both states’ government websites or even call the departments that handle registration. You might also consider having a lawyer ensure everything goes as it should.

Line It Up

You want to make buying a car out of state as easy and as smooth as you possibly can. While you might not be able to prevent all hiccups, there are many steps you can take to minimize difficulties. Before purchasing a vehicle from another state, have the following lined up to the best of your ability:

1. Registration

Just like every vehicle you purchase in state, you will have to register any car you purchase out of state. If you are purchasing the car through a dealership, they should send you all of the paperwork necessary to register the car. Buying a car out of state from an individual, on the other hand, might be different.

It is best to assume that you will be responsible for all paperwork so there are no surprises later. Call your state’s vehicle registration department and explain that you are about to purchase a vehicle from a different state. Ask what all you will need to bring with you to register the vehicle. Then, pass this information onto the seller. Be sure that they have all of the paperwork they are responsible for ready to go for the purchase. Otherwise, you might end up waiting for the sale to be final while you wait on the seller to get everything in order.

Best State to Buy a Car?

New Hampshire is the overall best state to purchase a car.

The average annual cost of car ownership in New Hampshire is around $2,691.

2. Taxes

There is a common point of confusion when it comes to the taxes involved when buying a car out of state. People often think that they can avoid paying taxes if they purchase the vehicle from a state that does not charge state taxes. This is simply not true. Any taxes charged go by your own state’s tax rate. This means that unless the state you live in does not charge state taxes, you will be paying taxes on your new vehicle. Be prepared to pay taxes when you register your car.

3. Emissions and Inspections

- Will your state require that the vehicle has an emissions test prior to registering it? If so, you need to know where to have this done, how much it will cost, and how long you have to do it. You should be able to easily get this information from your state’s registration office.

- Has the vehicle had a recent emissions test? If the seller has had a recent emissions test, you should ask to see the results. If the car has passed, you can breathe a little easier as it should pass the one you have to get. However, if it has not had a recent test or it did not pass a recent test, you need to be more careful and understand why it did not pass the test.

- Has the car recently been inspected? You definitely want to check out any information there is regarding recent inspections. Still, you should plan to have your own done as well- especially if it is a used car. Find a trusted mechanic who is located near the seller. You can have the seller meet you at the mechanic shop before you make a purchase and have this inspection done.

If you cannot make it to the inspection yourself, you can probably pay for the inspection over the phone and have the mechanic’s shop send the results directly to you. Some mechanics will even go to the car. However, you choose to do it, just be sure to get it done so that you are aware of any current or potential issues

4. Transporting the Car

How exactly will you be transporting the car? Are you going to drive it back yourself or will you hire a transportation company to bring it to you? Most dealerships have ways to get the vehicle to you if you need them to. If an individual is really desperate to sell the vehicle or you are willing to pay a little extra, they might deliver it to you themselves. Either way, you need to have all of this worked out before you purchase the car. How you choose to transport it can greatly affect the cost as well as your purchasing timeline.

5. Financing

How will you pay for the car? If it is a used one that you are purchasing from an individual, you might simply have the cash to pay outright. For other vehicles, you might need to get a loan. No matter how you choose to pay, have your financing lined up before you head out.

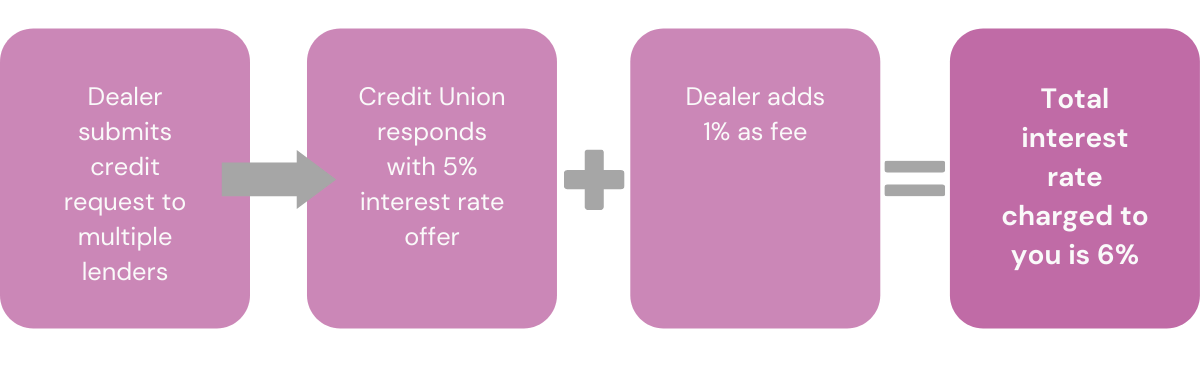

If it is cash, have it on you- or at least be able to take it out of an ATM close to the seller’s location. If you will need a loan, get your applications in and either get the cash or get a preapproval for the dealership. Most dealerships have their own online auto financing, but some people prefer to have alternate lenders available so that they can compare rates and terms.

If you are unsure of how to shop for a car loan, it is the same as shopping for insurance or even a big screen TV that you want. Check out multiple lenders and compare their rates, the amount you can get approved for, and the repayment term. Choose the one that offers the best overall package.

6. Insurance

While you typically have a few weeks or so to get your registration taken care of, insurance is a completely different story. In fact, you are legally required to have insurance on a vehicle prior to pulling off the lot- or out of the seller’s drive. Waiting until the last minute to get your insurance in order can make the whole process take even longer.

At the same time, though, you do not want to pay for insurance if you are not yet sure you will be buying a car out of state. You do not necessarily have to pre-buy the insurance. Instead, just go ahead and have the insurance lined up. Once you have the VIN of the car, shop around for the best insurance. Most insurance agencies keep quotes in their system for about 30 days. This means that if you get a quote one week and then decide to buy the car the next week, you should be able to simply call the agency back and get the coverage active.

If you choose not to get the car, you should be able to call and cancel the policy easily. Just ask the agency about its cancellation policy before making any payments. You will not be the first person to insure a car out of state, so the agency should have systems in place for catering to your needs.

7. Names on Title

There is something very, very important to pay attention to when buying any used car. The name or names on the title. Imagine that you go through the trouble of buying a car only to find out later that the person who sold it to you had no legal right to do so. As sad as it is, it can happen and it is a headache that no one wants.

Before buying a car out of state- actually, before you even waste your time going to the car- tell the seller that you would like to see the title. You need to verify three basic, important things- though your state may require more:

First and foremost, you need to be sure that the person you are discussing the purchase with is actually on the title. You can ask that they send you a picture of the name on the title, a picture of their face, and a picture of their ID. They can black out any pertinent information on the ID, as long as you can see their picture and name.

If they are uncomfortable sending a photo, you can ask them to Skype with you and show you the necessary documents there. Of course, you can verify identity in person. But if you wait until then, you might find out that you have been lied to and have wasted your time.

You also need to check how many names are on the title and how they are listed. If it is just the one name, this step can be skipped. However, if it is more than one name, you need to pay close attention.

Let’s say that you are talking to a Mr. John Smith about purchasing his car. If the car is only in his name, that is the only person you have to deal with. But what if the vehicle is in both Mr. Smith’s name and his wife’s name? The sale may require both parties, depending on how the title reads.

If the title says, “Mr. John Smith & Mrs. Jane Smith”, both parties have to sign the paperwork involved in the sale. If, though, the title says, “Mr. John Smith OR Mrs. Jane Smith”, you should be able to deal with either one. Both parties should not be required. To be safe, though, call the DMV in your state to be sure of their requirements.

Titles also show the names of any companies that have liens on a vehicle. For instance, if Mr. Smith had used his car as collateral for a loan, the lender’s name will be on the title as well. In theory, if there is a lien on the vehicle, the lender should have the actual title in hand. So this should not necessarily be an issue, but it is always best to double-check.

Once a loan is repaid and ownership is reverted back to the individual, the lender signs a line under their name showing that it has been released. Vehicle liens can get complicated. If you see that a lender’s name is on a title, double-check with your state’s registration office to ensure that the seller has the legal right to sell the vehicle.

Pay Attention

One final tip when it comes to buying a car out of state: Pay attention. Of course, you definitely need to pay attention to each step you take, how much you are paying, and other things such as that, but I am actually referring to something else. I mean that you should pay close attention to your gut.

If ever something does not feel right, take a breath and step away. Sometimes, we get bad feelings simply because we are confused about something or simply do not have all of the information. If something does not feel right, ask questions. And research more until you feel that you know all that you need to know.

Sometimes, we get bad feelings because something is not right. It means that our subconscious has picked up on something that our conscious brain has not yet. If you get a bad feeling that you cannot shake no matter how much research you have, you should probably let go of the sale completely. Additionally, if your significant other or even a friend tells you they have a bad feeling, stop, and pay attention. They just might have noticed something that you did not.

Conclusion

Buying a car out of state does not have to be too complicated or take too long. Follow the above tips one at a time to prevent overwhelm and to ensure you have everything in place. With the right preparation, you can be driving away in the vehicle you want in no time.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.

This part applies whether you have great, so-so, bad, or no credit. Regardless of how you currently manage credit and money, you can always learn something new and improve. Creditry helps you keep on top of all your credit lines and loans. If you have not opened any credit lines yet, you are in luck because it lets you learn how to deftly manage your credit cards and loans.

This part applies whether you have great, so-so, bad, or no credit. Regardless of how you currently manage credit and money, you can always learn something new and improve. Creditry helps you keep on top of all your credit lines and loans. If you have not opened any credit lines yet, you are in luck because it lets you learn how to deftly manage your credit cards and loans.