When it comes to frustrating events, car trouble ranks somewhere around the top of my list. It is always unexpected – especially if you do not know enough about vehicles to easily feel or hear a change in performance. Not being able to get around when you need to is a horrible feeling, and you want to do anything to change it, even if it means going into debt and getting a loan to repair your car. That should be the last resort though not the first choice. Let’s look at some questions you need to ask yourself before getting a loan.

Before Getting a Loan to Repair Your Car

It may be tempting to jump up and decide to get a loan so you can get your car fixed quickly, but is it really necessary? Do you have some savings you could dip into instead? Will a family member pay for it and let you pay them back in payments? Getting a loan to repair your car is a big deal. It is a financial responsibility that has the potential to mess up your future if it is not handled correctly. So before you choose to take on this responsibility, be sure that it is your only option in paying for repairs.

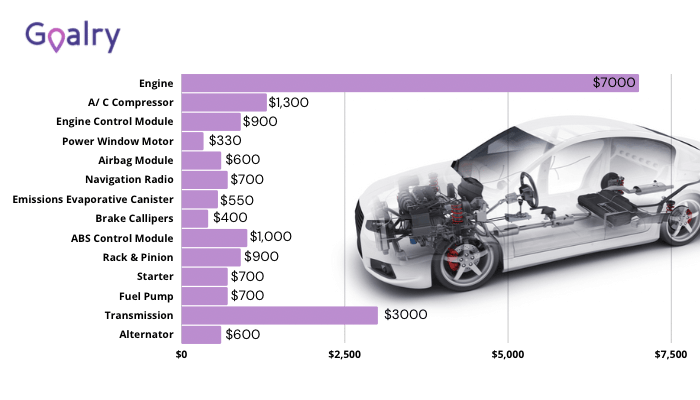

New batteries or other minor issues probably will not cost much at all. Small purchases such as these should be easily covered with a paycheck or credit card, if you have one. More serious issues will cost much more. In this case, getting a loan to repair your car might be necessary.

Is It Worth the Cost of Fixing It?

Be honest with yourself: is it worth the amount it will cost to fix it? If it is a used car that needs thousands of dollars worth of work, it might be better to count your losses and start working toward a new car, instead. This is obviously a personal decision but try to be logical when making it. If you do not know the value of your car, you can find out through the Kelly Blue Book or something like Carfax.

The vin number should give you all of the information you need about your car. If the value is less than the repair costs, unless you are keeping the car for sentimental reasons, your best bet is to get a new one.

If you determined that the cost of repair is worth it, but too high to cover it on your own, then a loan might be a good option for you. Here’s the next step.

Where to Get a Loan to Repair Your Car?

If you have decided your only option is to get a personal loan to repair your car, that’s okay. You are not the first, and you most certainly will not be the last. What is important now is that you find a loan with terms and interest rates that you can easily handle- if at all possible. To do so, you most likely need to emergency repair loan shop.

While you can drive around town- if your car is still driveable- and physically apply in person at multiple places, I cannot imagine a better time to shop online for loans than when your car is in questionable condition. Instead, let Loanry simplify the process. You can find a lender on our site from your couch in your PJs. We do not lend the money ourselves but instead, you find a lender without the hassle.

Types of Loans for Auto Repair

Once you have exhausted every other avenue you can think of, you might only be left with the option of getting a loan to repair your car. If that is the case, you need to know what types are available and which ones to steer clear from.

There are loans known as emergency repair loans. This simply means that the lender tries to process your application faster, often as fast as the next day. Thanks to the fast application and processing times, you might get charged a higher interest rate than you would with another type of loan.

I am sure you have heard of them, and yes, payday loans are an option. If you choose a payday loan though, there are a couple of things you need to understand. Most first time payday loan borrowers do not get approved for more than $150, so this probably will not help you much if the cost of your repairs exceeds that amount. Also, these interest rates are very high, so if you must take out a payday loan, pay it back asap.

Title loans are also available, but may not be viable if your car is broken down. Most title loan companies- those that you walk into, anyway- take pictures of your car as part of the application process. If you cannot drive your car, they will likely not approve you.

With online title loans, the requirements may be different but that will depend on the lender. If you do get approved for a title loan, pay it back as quickly as you can, and definitely pay more than the monthly payment. Being committed to a title loan for three years is not something anyone wants to do.

I tend to be much more partial toward personal cash loans than any other type of loans. The interest is usually much lower and figured into the payment. You get a longer time frame to pay it off. Generally speaking, they just seem much fairer to borrowers than many other loans- especially payday loans and title loans.

Personal loans are designed for long term borrowers. And, unlike title loans-which actually fit the category of short term loan– the monthly payment includes the principle, so it is possibly to actually pay them off without have to eat Ramen noodles and crackers for years to come. If you apply for a personal loan to repair your car and are approved, you receive the loan amount all at once.

If any fees are associated with the loan, such as origination fees, they are usually subtracted from the amount you borrow. The total amount you owe, including fixed interest, is then spread out into monthly payments for the extent of the repayment term. So what exactly are the benefits of getting this repair loan to fix your car?

A personal line of credit is another fair option, but it works a little differently. With a personal loan, you are given the entire amount upfront, minus any fees. With a personal line of credit, you are approved for a certain amount which is then put it something similar to a savings account. The full amount is available to you if you need it, but you do not have to borrow it all. The interest is only calculated according to how much you have taken out.

Perhaps you withdrew $300 from your $1000 credit line for the tune-up and tires. With the extra work, you might need another $300 or so. No problem, just head back to the bank or your other financial lender and withdraw the extra $300. You can continue to withdraw more money until you reach your credit limit- in this case, that is the $1000. Lines of credit are very helpful when you are unsure of the amount you actually need.

Another type of loan to repair your car is a secured loan. A secured loan is not necessarily separate from the other loans mentioned. It may just be an additional characteristic, and it just means that the lender needs you to put up some collateral to ease the risk they are taking. Most often, those with low credit scores or unfavorable financial conditions are the ones that need collateral.

Both payday loans and title loans are secured loans, but there are definitely some with less harsh terms. Some financial institutions will use your title as collateral without it being a traditional title loan. The loan itself is actually an installment loan. Your title is just in the financial institution’s hands until you repay the loan. The interest rates with secured loans are often much lower.

Other than vehicles, lenders consider collateral such as real estate property, valuable electronics and jewelry, and even certain types of investments or bank accounts. Lenders have their own guidelines about what they will accept, but the bottom line is that if you default on the loan, they can sell your collateral to recoup their losses.

Why Get a Personal Loan to Repair Your Car

In my opinion, the biggest benefits are the simplicity, the clarity, and that they are designed to be paid off- not keep you in an endless loop of debt. Let’s say you get a $1,000 personal loan to repair your car. The money is then in your possession and you head off to the mechanics shop. The lender gave you a contract that explained exactly how much your monthly payments will be and how long you will pay on it.

The bill for your repairs is only $400, so you have $600 left of the loan for auto repairs. So what do you do? We are going to ignore the temptation to spend for a minute and think about this. There are a few wise options for this extra cash.

One is that you ask the mechanic to go ahead and fix another issue that you know needs to be taken care of soon.

You can also place the $600 in a savings account with intentions of using it to make your monthly payments. That means it is also there if you need it again. You never know what might pop up next.

Finally, you might pay off another monthly bill whose interest is hurting you. We will use a credit card with a $500 balance for example. The interest is 25% and that is more than you can handle paying on a regular basis, so the balance grows. If you use the additional $600 to pay off that credit card, you are helping yourself in two big ways: you are getting the credit card off of your credit and you are making it easier to repay the personal loan to repair your car. Regardless of how you use it, your monthly payment and terms remain the same.

Steps for the Future

As much as I wish it were, it is just not possible to prevent all future car issues. You cannot control a nail in the road, you cannot control the weather, and you definitely cannot control how other people drive. So it is safe to assume that you will experience more car trouble at a later time. What you can do is minimize your chances of car trouble and decrease the impact it has on your life by doing regular maintenance and creating an emergency fund for these types of situations.

Conclusion

When you are met with the inevitable headache of car trouble and need some type of repairs, you have a few options. Though a personal loan to repair your car is an option, do not make this decision lightly. Be ready to commit to the loan until it is fully repaid. And, of course, apply only through trusted lenders to prevent any additional headaches, like scams and identity theft. Be wise and diligent in all of your financial decisions.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.