The recreational vehicle industry broke records both in dollars spent on new RVs and units sold in 2018, following a record 2017. Perhaps not coincidentally, many RV segments saw price drops between 2014 and 2019, according to the Recreational Vehicle Industry Association, and sizes are trending down, as well.

says National Marine Manufacturers Association president Frank Hugelmeyer, who spent four years leading the RVIA. As for 2022, the RV Industry Association President & CEO Craig Kirby claims that after a record-breaking 2021 their forecast shows another very strong year for the RV industry. It’s no surprise if you want to jump in on the trend yourself. So let’s look at some RV financing options.

Ways to Finance Your Mobile Home

Some dealerships offer financing on-site. As with automobiles, they may carry the note themselves but must partner with an outside lender to make things easy and help close the deal before the buyer has a chance to change their mind. Most are typical term loans – a fixed interest rate for a set amount of time, paid monthly until paid in full. The RV acts as collateral, just like any other new vehicle would. If you fail to make your payments, the lender has the right to repossess your RV.

If you have a strong credit score, dealer financing might be a reasonable way to go. That doesn’t mean you should take the first thing they offer you, however. You might be able to secure better terms through your local bank or credit union or by utilizing an online lending marketplace like Loanry. We just happen to know quite a few reputable online lenders who love offering competitive rates or flexible terms in order to secure new business, and we’re happy to connect you with them with absolutely no cost or obligation.

Multiple RV manufacturers mean better quality, more variety, and lower prices – that’s the nature of the modern free market. The world of lending is not so different.

What about Bad Credit?

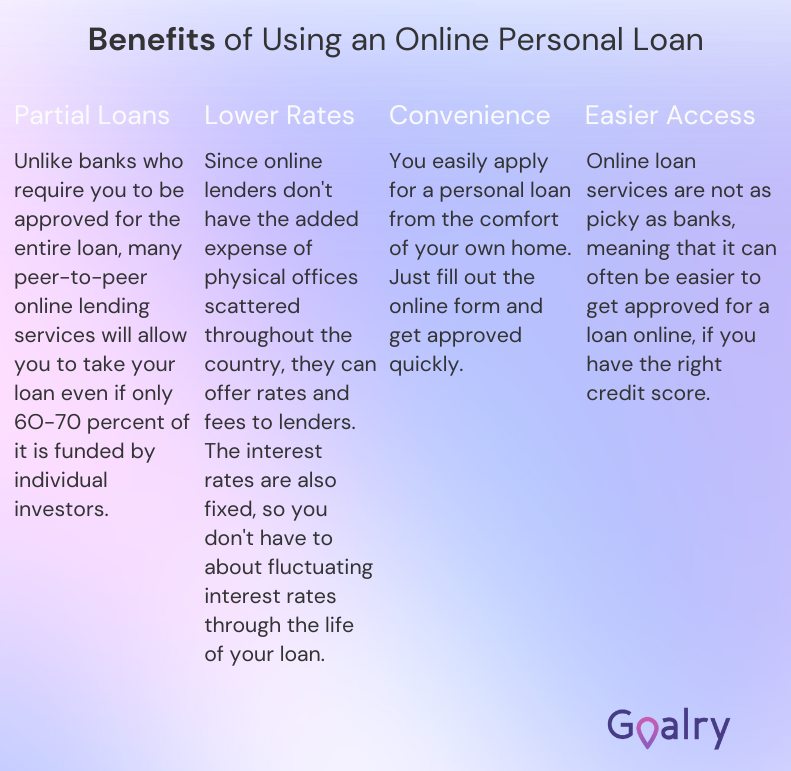

If you need RV financing for bad credit, online lenders are almost always your best choice. You’ll be applying for a personal loan designed for folks with lower credit scores or other credit history issues. The reason these are often considered an entirely separate type of loan is their source. Some traditional financial institutions will offer bad credit RV loans, but they’re largely the specialty of online lenders who specifically serve borrowers with poor credit.

These lenders will look at your credit history and scores but are more likely to consider your current situation as well – your job, your reliable income, how long you’ve lived in once place, etc. Remember, too, that as you pay on your RV loan, you’re building and strengthening your credit score and credit history. Next time you need financing, you’ll have even more options – and on even better terms!

Wherever you finance a mobile home, you should try to make a down payment of at least 10% – ideally something closer to 20%. Some lenders will make bad credit camper loans with a smaller down payment or no down payment, but that means much higher monthly payments and more interest paid over the life of the loan.

If you know you may have trouble qualifying based on your credit score or credit history, be prepared to document your current income and job history. Lenders who specialize in poor credit RV financing may consider your debt-to-income ratio and other factors instead of relying exclusively on your credit rating. If you still have difficulty, consider delaying your purchase until you can raise your credit score and save money for a larger down payment.

Personal Loan Option for Buying RV

Another option to finance a mobile home is a personal loan. A personal loan for an RV is unsecured – you’re not using the RV or any other property as collateral for the loan. This is especially common with used RV loans where the value of the RV could fall below the balance owed on the loan at some point along the way. Because it’s unsecured, you may find it more difficult to qualify for this sort of loan. You should also expect higher interest rates. On the other hand, you can use these sorts of camper loans for a much wider variety of things related to your RV – repairs, maintenance, storage, park fees, etc. Like personal loans, their use is entirely at your discretion.

Let’s Talk Budgets

Next, sit down and be honest with yourself about your budget. If you don’t already have a workable household budget, stop everything and do this first. This should NOT become a consideration only once you decide to finance a mobile home! If you already have an effective household budget, you can skip to the next section. Otherwise – and be honest, here – you really need to stay with me for a few more paragraphs. I promise we’ll get back to the shiny new RVs in a moment.

On paper or a computer spreadsheet, list all of your monthly income, in detail. Next, list all of your monthly expenses. This usually means pulling up the last few months of utility bills, digging through your check register or online statements, etc. It’s essential that you know exactly how much you make each month and how much you spend. Even more importantly, you should know where your money goes – every dollar, every time.

At the moment, you’re looking at your budget to see how much you can realistically afford on monthly payments if you do finance a mobile home. Financing is about more than the size of the monthly payments – there are other factors we should care about as well. But the most basic consideration before you finance a mobile home is whether or not you can pay for it. If not, we should be looking at other priorities and come back to this one when it’s more practical.

Reasons for Recreational Vehicle Loans

There are a number of reasons why you could use an RV loan.

- Payments: If you have already financed your RV, payments could be straining your budget. However, getting a personal RV loan can help make the payments more affordable so these payments aren’t a strain.

- Purchase Loans: Purchasing an RV can be a big investment. There are different options when you are financing an RV and you will have to find the one that works best for you. Banks can offer RV loans that are similar to car loans, but these often require the best credit. RV loans can be an easier way to purchase an RV if your credit isn’t as perfect. There is also more flexibility with these loans.

- Bad Credit: Even if your credit is bad, you don’t have to give up your dreams of owning an RV.

- Park Fees: If you spend a lot of time on the road or decide to live in your RV year-round, the park fees for an RV can be a big expense. If your budget is tight and you need some help paying for these fees, then a loan may be able to help. A personal RV loan is flexible so you can use it to pay for these fees.

- Repair and Remodel: RVs will need care. Even with the best maintenance, your RV may still need repairs at some point and insurance may not cover the cost. If you want to remodel part of your RV, it can also come as an additional expense. Use a personal loan to pay for these expenses.

- Rental Loans: If you aren’t sure if the RV life is for you, you may want to rent one for a trip to test it out. If you need help with the payments, consider an RV loan.

- Storage: When you aren’t on the road, you will have to figure out where to keep your RV. If you don’t have space in your driveway or garage or live in a place where you aren’t allowed to park RVs, you will need to find storage. If you don’t have room in your budget for storage fees, then a personal loan may be the answer.

Shopping for an RV In Stages

If you’re already an RV-owner, or you’ve leased a motorhome before, or even traveled with friends in a recreational vehicle, you may already know what you want in an RV and what you can live without. If you’re new to the world of RVs, however, it might be worth doing a little pre-shopping to familiarize yourself with the options before you start narrowing down your choices – and definitely before you start worrying about how to finance a mobile home purchase.

1. Get All The Information From The Dealers

I suggest checking out a few dealers in your area. Be honest about what you’re doing – trying to get a lay of the land, as it were. Most of them will be happy to educate you about various features and options, and knowing you’re an RV-newbie will help them focus on models and information suitable for your needs. You can also do some online shopping at this stage. Dealer or manufacturer websites are great for foundational information. There are also motorhome lovers and online groups who love sharing their opinions with anyone who’ll listen.

2. Be Patient and Find The Best Offer

Don’t get overwhelmed. You’re just getting ideas and learning some basics. There’s not going to be a multiple-choice exam or anything. Obviously, RV dealers would like for you to purchase from them eventually, but they also want you to be happy with what you buy when you’re ready. This is an industry known for thinking long-term; if you’re going to finance a mobile home from them, they want you to enjoy it enough to come back to them when you’re ready to move up or recommend them to their friends and family.

If you’re still uncertain, consider leasing an RV for a short time to see how you like it. Think of it as a “try before you buy” opportunity. If you live near any of the better-known RV parks, go crazy and take it there while you’re at it. You might as well get a feel for the whole motorhome world before you dive the rest of the way in!

Things to Avoid with Recreational Vehicle Loans when Financing a Mobile Home

When you are purchasing an RV there can be a lot to consider. It’s a serious investment and purchasing one does mean budgeting for years for payments, along with travel-related expenses and monthly costs. One of the keys to getting recreational vehicle loans is to make sure that the purchase will fit comfortably into your budget and routine. RV ownership can be a lifestyle change so people should be prepared for that.

Taking Price at Face Value

Just like other luxury items, there is a markup when it comes to RVs. Dealerships will expect you to haggle. In additional to dealerships, there are sites that can give you an idea of any RV deals and prices. Be sure to do your research so you can get the most value when purchasing an RV. If you are able to lower the price, then you can get a lower amount for the loan or have some money for other maintenance expenses without causing too much strain on your budget.

Not Looking at Your Credit Score

Your credit score is an important part of the loan terms and interest rate you will get. You should check your credit score before applying. A good credit score, which is something in the mid 700s, will give you the best rate.

If you have a lower score, you can still qualify but you will end up paying more. Interest rates can vary between different states, but some interest rates can get as high as 24%. RV financing is similar to financing a different type of vehicle, but there are different options when it comes to RVs. You could claim an RV as a residence, whether it’s primary or secondary. This can help lower your taxes.

Overestimating What You Can Afford

RVs tend to cost more than regular vehicles, so a loan can look more like a mortgage payment instead of a typical car loan. You can use a personal loan calculator to estimate your monthly payments and interest.

This can help you estimate the cost of ownership. It’s important to not just think about the payments but the overall cost, including taxes and registration fees. Some other costs include utility costs, storage fees, maintenance costs, and mileage rates.

Taking the First Loan Available

As with any loan, you don’t want to settle for the first offer you get. Some RV loans have a 20-year term, which can seem like it’s more affordable than it is. Be sure to research your options so you can pick the right loan for your budget and still get the RV you want.

Owing More than the Future Sale Price of the RV

A new RV can depreciate in value quickly just as other vehicles can. There is a high risk of being upside down on this loan. This means that is more is owed on the loan that it is worth. In order to avoid being upside down, it helps to make a large down payment.

This way you will owe less if you want to sell your vehicle in the future. Another strategy is to start small and build up to having a bigger RV. If you buy a lower priced model at first, you can easily pay this off and then be able to trade it in for an improved model later.

Conclusion

RVs aren’t for everyone, but until you’ve explored the possibilities, you don’t know for sure whether or not RVs are for you. It’s essential to know your options and think about what’s important to you before you make a final decision.

Financing RV is the same way. Until you know your options, you don’t have enough information to make the right decision for you. As it turns out, that’s something we can help you with – whenever you’re ready. What you decide after that is, of course, entirely up to you.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.