There are many reasons you might consider getting an auto loan. Are you purchasing a new or used car and do not have enough money in the bank to pay for this vehicle out of pocket? Are you looking for a chance to refinance an auto loan you already have? If either of these situations reflect your own personal situation, then it may be time to consider getting an auto loan? Are you concerned about being able to buy the car you need because you have a low income or bad credit. Don’t worry — it is possible to get auto loans with low income and bad credit. You can even get auto loans for bad credit online.

How to Get an Auto Loan with Low Income

Getting a personal loan is so easy it can be done in three simple steps. If you are looking for auto loans with low income, then you may feel like your task is impossible. Trust me, it’s not. You can do this. Searching for auto loans with low income just requires you to work a little bit harder. For instance, you cannot be afraid to ask for help. There are many companies whose sole purpose is to help consumers find auto loans with low income.

These companies offer their services for free and help consumers find a local dealership in their area that will help you find auto loans with low income. Or they help you find a lender that is right for you. You usually apply by filling out a short form online that can be completed in just a few minutes.

When it comes to getting an auto loan with low income, patience is the key. You may stumble upon several obstacles, and surely getting a loan will not be as easy. But it is far from impossible. With the right help, you may find great auto lenders and get approved for a loan.

How to Get an Auto Loan with Bad Credit

While we’re at it, let’s talk about another unfavorable situation – bad credit. Same as with low income, bad credit is an obstacle to getting a loan. It will not stop you from getting a loan, but it can hurt your chances of getting a loan with a low-interest rate. In fact, if you are looking for an auto loan with bad credit, then there are auto loans out there made just for you.

In order to get auto loans with bad credit, you should consider requesting a meeting with a loan officer. At this meeting, you can show the loan officer who you are, with a positive presentation and demeanor, as well as explain what your personal situation is. This meeting can give you a leg up in your chances of getting an auto loan.

In addition to meeting with a loan officer, consider the cosigner or collateral option. If you have bad credit, then you may still be able to get an auto loan if you have someone cosign with you. This other cosigner is agreeing to the absolute responsibility of repaying the auto loan, so that if you do not pay, then the lender knows that someone will. If you are not comfortable asking someone to cosign with you, then you can consider putting up collateral for an auto loan. This means that if you do not make the payments on your auto loan, you could lose the collateral you put up for the loan, such as your car or house.

Auto Loan Basics

Auto loan basics are basics for a reason: they’re the basics that everyone should know. This does not mean you should feel bad or uneducated because you do not know something here, but if you don’t know something mentioned below, then it means you are definitely in the right place. If you are considering getting an auto loan, then you need to make yourself familiar with these auto loan basics:

What Is a Car Loan and How Does It Work?

There are two types of auto loans. You can either get direct lending or dealership financing. If you choose direct lending, then you get to make the arrangements of your auto loan with the financial institution of your choice. If you choose dealership financing, however, you will have to make the arrangements through the dealership. Both options have pros and cons, and in general, the two options are not dramatically different.

When choosing to go with direct lending, you are choosing more freedom. Because you can choose whichever financial institution you most prefer, you have the freedom to comparison shop for auto lenders. Auto loan shopping allows you to find an option that fits your budget, with realistic payment options and better rates and terms. Plus, if you have pre-approved financing, then you are sometimes able to negotiate a better price.

Dealership financing can be a simpler option. You do not have to deal with auto loan comparison shopping, spending a lot of time and effort to find the auto loan with the best terms. If you choose dealership financing, then the dealership will do this for you. They will either do the financing internally — if they have their own financing department — or do the financing externally — through a finance company that they have a prior agreement with.

One benefit of dealership financing is that it means you already know what car you want, which means that you already know how much financing you need before getting your loan. This could save you money in the long run, so that you don’t have to pay back even more — including that compounded interest — in the future.

The Car Loan Process

Getting a car loan isn’t very difficult, but it can be made even easier if you understand the car loan process. The first thing you should do is to use an online auto loan calculator to set a realistic budget for yourself. Once you have your budget, you should check your current credit report, so that you have an idea of what loan options you will have. It is possible to get auto loans for bad credit online, but it is a good idea to inform yourself of your situation early on in the process. This can allow you to set realistic expectations for what your loan options will be.

Before getting a car loan, it is a good idea to know what you are looking for in a car. Research is essential. If there is a specific make or model you prefer, or any special features you know you do not want to go without, then you should keep that in mind when researching the range of prices for similar cars to your preferences. Many people trust and rely on the Kelley Blue Book to see what current average prices of specific cars are.

Once you know what your current financial status — including your credit score — is and what your will be likely to have to pay on average for the kind of car you want to buy, then it is time to do some auto loan shopping online. This can help you find the best auto loan for you and your personal needs.

Auto Loan Statistical Overview

The statistics on US auto loan rates show that, on average, Americans borrow $20,446 for used vehicles and more than 31,000 for new ones.

Types of Loans

Before you make a commitment to getting an auto loan, you should know what your options are. There are many types of loans out there, and there is certainly an option out there that is right for you. An auto loan is just one type of personal loan. Below are some other types of personal loans:

Unsecured Loan

An unsecured loan is a type of personal loan that does not have collateral backing it up. This means that if you do not make your monthly loan payments in full and on time every month, then the lender cannot just take something from you in order to make up for the money you did not pay. This means that an unsecured loan is more risky for lenders. Though very uncommon, it is possible to get an unsecured auto loan.

Secured Loan

A secured loan is a type of personal loan that does have collateral backing it up. Items put up for collateral are typically worth a lot of money, so that they can make up for whatever you decide not to pay on your loan. For instance, if you get a secured auto loan and do not make your payments on the loan on time, then your new car can be taken away. Auto loans are most often secured loans.

Open-End Credit

Open-end credit is a type of credit where you can “withdraw money as you need it, over an extended period of time.” Two common options for open-end credit are lines of credit and credit cards. This is a good option for someone who is, for instance, working on a project where they need to take out multiple smaller sums of money, depending on what individual expenses they have. One advantage of open-end credit is that you typically do not have to pay interest on whatever money you do not withdraw.

Closed-End Credit

This is a type of credit where you get one set lump sum. Closed-end credit is typically done in the format of a traditional loan. You request to borrow a certain amount of money, and you get that amount of money in a lump sum. Then, you must repay this lump sum, plus interest, over an agreed-upon period of time. If you decide to get a single payment loan, then you will be required to pay the entirety of the loan -- what you borrowed plus interest -- in one lump sum.

Auto Loan Rates

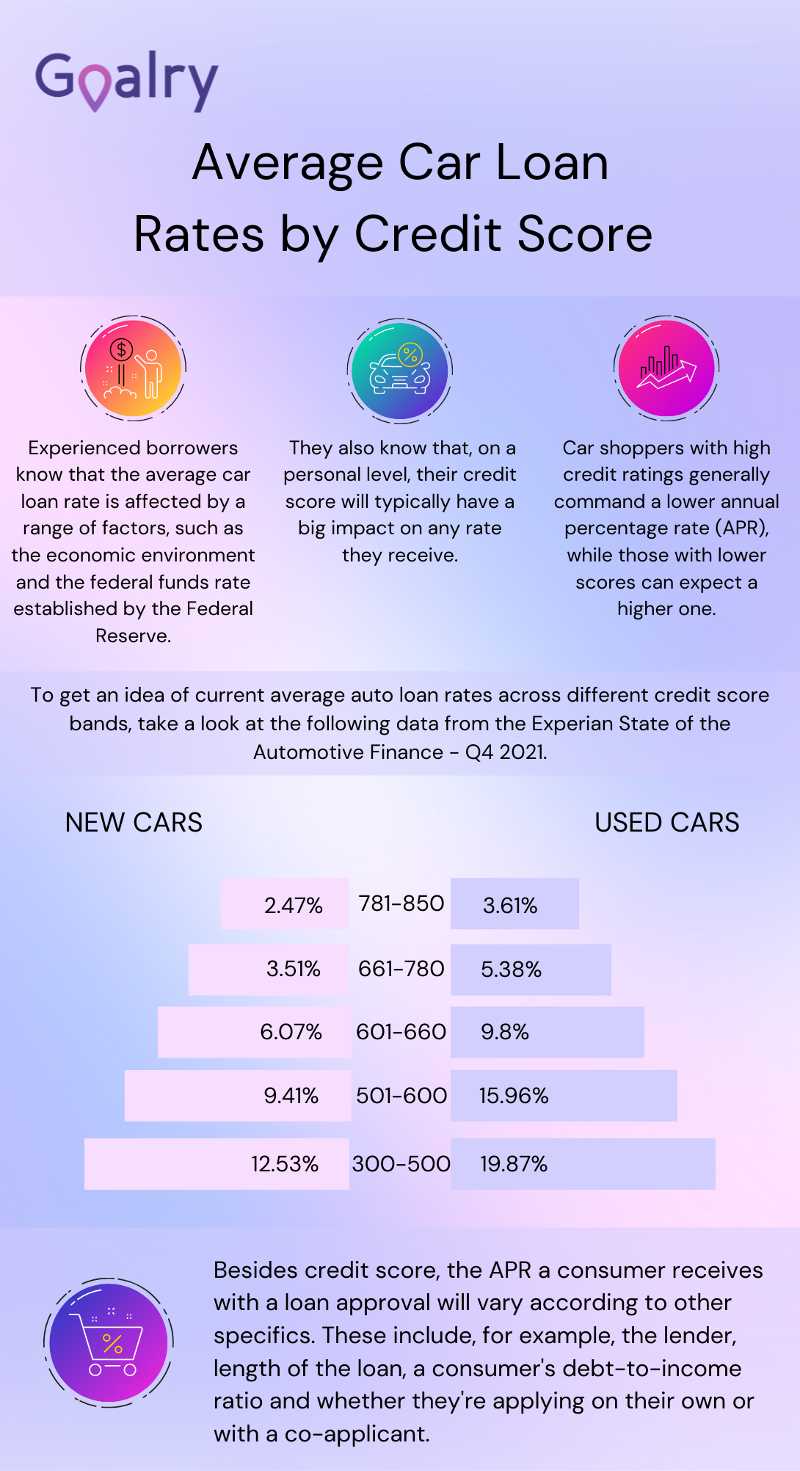

It is impossible to say what your auto loan interest rate will be without knowing your exact situation. Rates can vary from lender to lender, and dealers may push special promotions in order to quickly get rid of certain stock. Regardless of these uncertainties, there are some things you can be certain will have an effect on what rate you end up getting.

Your credit history will be sure to affect what interest rate you get. Though it is possible to get auto loans for bad credit online, you are not likely to be able to get an interest rate as low as someone who has good credit. On the other hand, getting a loan — and repaying the full amount due on time every month — could actually help strengthen your credit.

The length of the loan can also have an impact on your interest rate. Generally, though not always, loans that will last longer have higher rates. Sometimes you don’t have a choice; if you cannot afford to take an option with a shorter loan, then get the longer loan that is more realistic for you, however, if you can afford to get a shorter loan, then that is a better option that will allow you to spend less overall in the end.

Not all cars are equal. What you buy will determine how high or low your interest rate is. If you are interested in financing to purchase a new car, then you may be able to take advantage of introductory rates or special financing. If, on the other hand, you are interested in financing to purchase a used car, then you may not be able to find such deals.

This is because “used cars are considered a greater risk for lenders, since their resale value is already lower and the chances are good you’ll owe more than the car is technically worth at some point down the road.” Used cars may come with a lower sale price, but they also come with higher interest rates.

What You Need to Know About Auto Loan Shopping

If you have decided to take part in auto loan shopping, then there are some basics that you need to know before taking action. First of all, you should budget before you shop for auto loans. If you budget before beginning auto loan shopping, then you will be more aware of your realistic expectations in finding an auto loan. For instance, budgeting will help you determine how much you are able to pay up front for a car, as well as how much you will be able to pay in monthly payments after you get the car.

Besides budgeting, it is important to explore all of your options. This is why auto loan shopping is so important. If you take the time to look at multiple auto lenders, then you will see what options are available — with what terms and rates. This could help you get better rates in the end, since you usually do not get the best offer on your first try. Exploring your options will help you find the absolute best auto loan for you.

Conclusion

Getting auto loans with low income can be stressful, but with the help provided above, the process should be much easier. You can also get help from Loanry and look into our lender recommendations.

Grace Douglas is a master candidate in international security management by day and a personal finance writer by night! With powers in finance, writing, and languages that she received by being exposed to high dosages of university courses and being bitten by booklice while working in a rare books library, Grace loves to use her powers for good rather than evil. If you need help with budgets or personal loan questions, then just call Grace, your friendly neighborhood FinanceWoman!