If you have not needed a lawyer, yet, consider yourself lucky. Unfortunately, in today’s world, there are many situations where you may need legal advice. You may find yourself in that position someday. When you find yourself in a position for legal help, it is probably not in a great situation. There are some good instances where you may need a lawyer. Obtaining a lawyer does not have to be a bad thing. Regardless of the reason, you will soon find out they are expensive. Before you begin to worry, continue reading to find out more about lawyer’s fees, how to pay them, including information on law firm loans.

How Do I Pay a Lawyer?

If you need a lawyer, it is important to understand how you pay for one. If you have never had an interaction with a lawyer, this information is going to be new to you. That is ok. This article provides you with some necessary information. Typically, a lawyer charges you a retainer. This is a preset fee that the lawyer charges upfront. It is a set fee that the lawyer charges everyone. And it is intended to cover the time your lawyer spends on your case. It covers a certain number of hours of work. When you discuss the retainer, the lawyer should explain how many hours it will cover. If you need only a small amount of consultation, the retainer may be enough to cover the services.

If you need extensive legal help, including court appearances, the retainer most likely will not cover all of it. After the retainer has been used, the lawyer begins charging an hourly rate. The lawyer should discuss this rate with you before you sign any documents. These hourly rates and any additional fees add up quickly. You may need to consider law firm loans. Another option is to ask if your lawyer works on a contingency.

This is valid only in the instance of you suing someone and expecting some type of settlement. When a lawyer works on contingency, all of the legal fees are taken from any money you are awarded as part of your settlement. Your lawyer may consider charging a flat fee. If you have a typical case, your lawyer most likely has a good idea of the time it takes and may charge you a flat rate instead of an hourly one.

How Much Are Legal Fees?

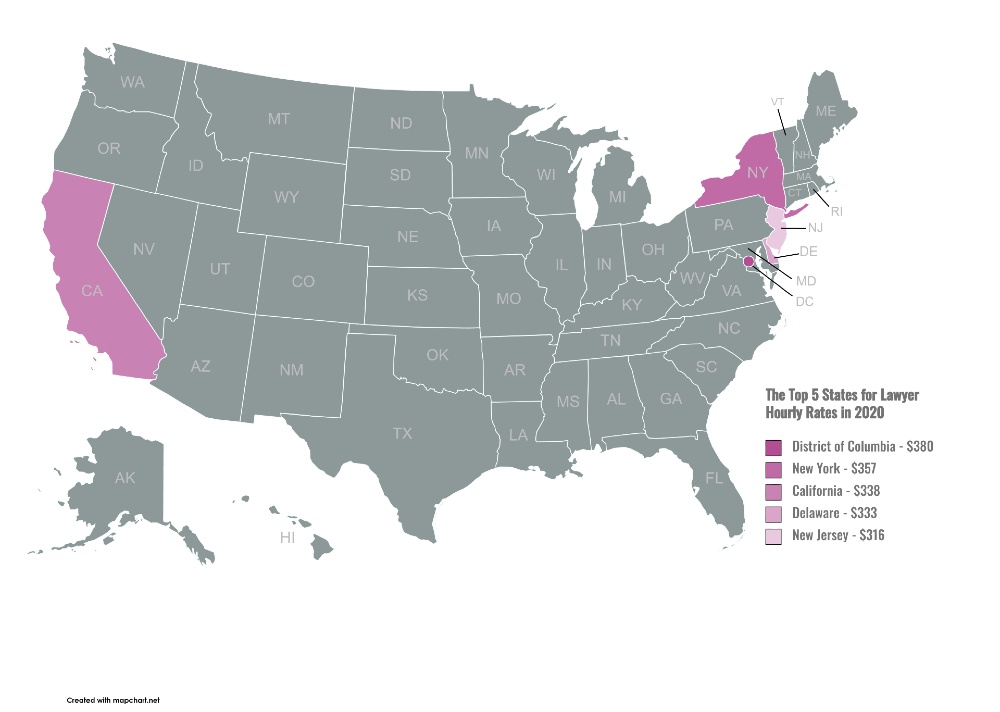

To give you an idea of just how expensive, I am going to give you some examples of possible legal charges. Please keep in mind, there are just estimated costs. I do not guarantee that these are the actual costs of a lawyer in your area. You should expect higher fees with a more experienced and well-known lawyer. You want someone who is an expert, but just be aware, you pay more. When you are looking for a lawyer that is highly specialized, you will pay higher fees.

Lawyers.com estimates lawyers’ rates are usually between $100 to $200 per hour in smaller towns. The hourly rate goes up in areas that are more metropolitan. Those rates tend to be between $200 to $400 per hour. The hourly rate depends on factors such as operating expenses, location, and expertise. You should be careful when selecting a lawyer. Remember, you may not want to pick the one with the cheapest rate because many things come with a lawyer that costs a little more. You get a lawyer that may be better able to address your situation faster and is better able to estimate the number of hours needed for your case. If you want a pricey lawyer but cannot afford the cost, you may want to consider law firm loans.

is the average hourly rate for lawyers across all states and legal fields.

If you opt for a contingency fee, the lawyer may take as much as 30 percent to 40 percent of your settlement. You may be able to negotiate the percentage they take from your settlement. The amount your lawyer takes from your settlement may also depend on when settlement is made on your case. The earlier the settlement is made, the less your lawyer has to do and the percentage may be lower.

Can I Get A Loan For A Lawyer?

The short answer is yes, you can get a loan to pay for a lawyer. You may be concerned about the cost of a lawyer and with good reason. They are not cheap. Most people do not have a budget item for attorney fees. Well, some people might, but probably not the average person. If you are considering a lawyer, but do not think you can afford one, you do have the option of financing legal fees.

You can get law firm loans, more commonly known as a personal loan. You can get a personal loan for any purpose. It is money given to you by a lender for you to do with what you will. When you obtain a loan, you can pay for the lawyer upfront without having to scramble to find the money. You can pay the retainer fee and the hourly rate after that.

A personal loan is when a lender allows you to borrow money and you promise to repay that money. You repay it by making regular payments, usually once a month, for the term of the loan. The term is the amount of time you have to repay the loan, typically three to five years. The lender charges you interest as a fee for allowing you to borrow money. The lender sets the interest amount based on your credit score. All of the terms of the loan are outlined in the loan agreement, which you should read before signing.

Advantages of A Law Firm Loan

There are some advantages to obtaining a legal loan. One of the most obvious ones is that it can reduce the amount of stress on you to come up with a lump sum for the lawyer’s retainer. If you need a lawyer, it is already a stressful situation. You do not want to add any more stress by having to worry about finding the money. You still have to pay back the money, but it is easier to make monthly payments than to come up with one lump sum.

If you expect to receive some type of settlement, you can pay off law firm loans when you get that lump sum. This may be just a temporary solution while you are waiting for additional funds. You may be able to find a loan with low interest, especially if you have good credit. This may be a better solution than not having a lawyer if you need to appear in court. It may be a price worth paying if the alternative solution is not having a lawyer to defend you.

What Does Pro Bono Mean?

The words 'pro bono' are Latin and it means that work is taken voluntarily and for no charge. The actual translation of the words 'Pro Bono' is 'for the good of the people'. Typically this term is used for legal purposes, but there are other cases where someone provides a service for free. There are many organizations that provide services pro bono, because it is for the public good. They recognize there is a need for a specific service to a specific population of people and they offer those services to help make the world a better place. If you cannot afford a lawyer and are unable to obtain law firm loans, you should look for organizations offering pro bono.

Disadvantages of A Law Firm Loan

While there may be some important advantages to a lawyer loan, there are also some disadvantages. You need to consider both the pros and the cons to be able to make the right decision. If you are expecting a settlement and you plan to pay off the loan with that money, it may take a long time before you see the money. Some settlements can take a long time. If you have a loan, you have to make regular payments and you must continue to make them even if you have not gotten your settlement. The longer you make monthly payments for your loan means the more interest you pay.

When looking for law firm loans, you should be careful in which lender you select. Not all lenders have your best interest in mind. Some are just trying to make money and they do not care how their interest and fees impact you. It is your responsibility to understand the terms of the loan. You must read all contracts and agreements thoroughly before you sign them. If you do not understand something, ask questions. Once you sign the document, it is up to you to comply with the terms.

Another drawback to getting lawyers’ loans is you are taking on more debt. This is money that you must repay and now you are on the hook to pay it back each month. If you do not have any additional funds with which to make the payments, you can put yourself in a bad position. You are also adding to your debt to income ratio, which could lower your credit score. All of this should be carefully considered before you take on a loan, even if it is to pay for lawyer’s fees.

Q&A

You are the only person that can decide if law firm loans are a good idea for you. It does not matter what type of loan you are considering, you should always make sure you can afford it. You have to take a look at your budget and determine if you can truly afford the monthly payments that go along with a loan. You must remember a loan is money that you are borrowing. It is not a gift, you must repay the loan. Even for law firm loans, you still have to repay the money regardless if you receive a settlement.

If you know that cannot afford a loan, you should not even consider it. Taking out a loan that you cannot afford to repay puts you in a bad financial position. It negatively impacts your credit and you have to deal with collection calls. If you already need a lawyer, it is probably a stressful situation. Do not make it a worse situation by adding financial problems on top of it. Most lenders do whatever they have to do to get their money. That may mean suing you, which puts you right back in the position of needing a lawyer. However, now you will not have the option of obtaining a loan to pay for the lawyer. You have to make a sound decision when determining if you should obtain a loan. That decision includes determining if you can repay the loan.

It may come as a surprise to you in today’s world that you cannot use a credit card to pay for something. Typically, a lawyer does not accept payment by credit card. There are always exceptions so you may be able to find one that will take credit card payments. The bottom line is the attorney wants to make sure the money is in their account. This is why they ask for money up front in the form of a retainer.

Lawyers that accept credit card payments move the money into their trust account to ensure that it is there in advance. If you use a credit card, the lawyer will have you sign a document that allows the lawyer to charge your credit card for a specific amount on the same day of each month. This way the lawyer has a binding contract with you.

It may be simpler and cheaper for you if you obtain law firm loans. Most often, you can obtain a loan that has a lower interest rate than what your credit card offers. However, you may want to consider a credit card that offers a special promotion of 0 percent interest for a specified amount of time.

I am sure you are thinking that there has to be a way to decrease legal fees. If you do not want law firm loans, you may consider some other options. There are some items you can handle for yourself. You should do some research online to determine what needs to happen in your particular case. Then you can fill out as many documents as you can on your own. For example, if you need a lawyer to file for divorce, there is a lot of it that you can do for yourself. You can get the forms online and fill them out. This way all the lawyer has to do is review them. You can determine your rights and be prepared for what you want to achieve as a result of hiring a lawyer. The more information you know before seeking legal assistance, the better off you will be.

When you do select a lawyer, find out all the fees up front. Every contact you have with your lawyer costs you money. You should find out how much upfront. Be sure to get an itemized list of fees including phone calls and emails. Remember each phone call you make to your lawyer adds to your bill. You should call as little as possible. Perhaps it costs less to email, so that may be your preferred method of communication.

You should know what documentation your lawyer needs. Gather as much of that information as you can and get digital and paper copies. This saves time for your lawyer and money for you. This way your lawyer does not have to acquire these documents and create a digital or paper copy. You have it all available already.

Legal aid is something that is offered through the state and sometimes federal government to provide legal assistance to those with little to no money. Often there are nonprofit organizations that also provide legal assistance. Legal aid is available specifically to those in financial need. If you are already receiving some type of government assistance, you most likely also qualify for legal aid.

For those who have little to know income, law firm loans may not be an option. The type of service for which you are eligible is directly related to your family income. It is not just your income, but the income of everyone in your household. When determining if you qualify for assistance, your gross income matters. Your gross income is the amount of money you earn before taxes or any other deductions.

It is not the amount of money you see in your paycheck. This is an important thing to understand when it comes to qualifying for assistance. There are also varying levels of assistance. In some cases, you may be eligible for advice over the phone, but not true representation. In other cases, you may be eligible for representation. It also depends on the type of assistance you require, for example, if it is a domestic violence case, you may be eligible for more services even with a slightly higher income.

Lawyers typically want to receive their money up front. They understand that most often they are dealing with people in stressful situations and want to ensure they are getting paid for their work. They also know that cases can often be long and drawn out, so they want to make sure they continue to get paid. Let’s face it, lawyers are trying to earn a living, too. While they are in this business to help people, they want to be paid. Many lawyers are not interested in setting up payment plans, but you never know. It always helps to ask the question. If you can pay the retainer, they may be willing to set up a payment plan after that based on the number of hours they estimate for your case.

It also depends heavily on the type of case you have as to what the lawyer is willing to agree. If you have a case where there is going to be a settlement, the lawyer may be willing to work on contingency, or some type of payment plan. If it is a defense case with no money settlement at the end, the lawyer may be less willing to accept a payment plan. You should talk honestly with your potential lawyer and see what agreement you can find. Until you have a conversation, you will not know. As a last resort, you may want to consider law firm loans.

Does My Credit Matter?

Anytime you are considering borrowing money, your credit matters. Your credit score matters for so many things including getting a house, a car, insurance, and sometimes, a job. It also matters when considering law firm loans. You should consider getting a copy of your credit record to see your credit score. There are many apps where you can pull your credit record. You are entitled to one free copy per year. You should review it and understand your credit report. It contains details about your credit history.

You actually might be surprised at all the details it contains about you. Your credit report shows your entire credit history, including credit cards, homes, balances in your bank accounts. It also shows every missed or late payment that you have made. In addition, it shows how late your payments were, 30 days, 60 days, 90 days, etc. It shows your credit utilization and any bankruptcies you have had. If you have hand any businesses, that shows up on your credit report, also.

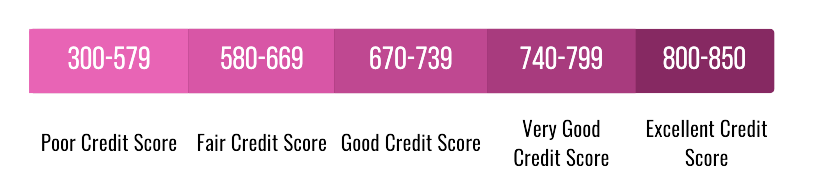

Your credit score appears on your credit report. A score of 850 is an excellent credit score, but really anything above 800 is considered excellent. Anything within the range of 670 to 800 is considered good. Most people have a credit score between 600 to 750. When your credit score falls between 580 to 669, it is considered ok, or fair. Anything that is 570 or below is considered poor, or bad. This number is an indicator to lenders about your credit worthiness. It is also an indicator to lenders about how risky it is to lend you money. If they feel you are a high risk, they may not allow you to borrow money.

Conclusion

I have provided a lot of information about lawyers and law firm loans. There are some items that you should keep in mind when you are considering a lawyer. You should realize upfront that a lawyer is a hefty expensive, so you do you really need one? Can you handle the situation without using a lawyer? If you determine that you do need a lawyer, determine how much can you handle on your own. Do some research about your situation. You have access to so much information online, you should take advantage of it and find out as much as you can. Also, you may be able to fill out forms and get documentation that saves you money in the long run because a lawyer will not have to do it.

You should also consider if you have any legal aid or pro bono options. There may be ways that you can obtain legal assistance without having to pay the full cost. You should sit down and have an honest conversation with the lawyer you pick. You should be honest about your situation and what you can afford. The two of you may be able to come up with an agreement up front that fits both of your needs. You maybe only need assistance over the phone on an as needed basis. Depending on your situation, you may only need a lawyer to show up and make an appearance. There may be ways of decreasing the cost, but you must first understand your situation and then be honest with your lawyer. When you have more information up front, you are better able to help yourself.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.