Okay, let me be straight with you. It is radically important that you pay all of your bills on time. Medical bills fall into one of those categories of bills though that you must pay on time and must repay period. The other category is your housing – your mortgage or rent.

Why Pay Your Medical Bills on Time

If you do not repay your medical bills, a hospital can actually refuse you treatment. As horrible as that sounds, you could get denied admission, even to the emergency room.

Ideally, your insurance pays for the medical treatment. You should only need to pay your co-pay when you visit the doctor, specialist, hospital, physical therapist, etc. Sometimes though, if you have to go out of network for treatment, you will have additional costs.

The other awful scenario is if you do not have medical insurance. Right away, you know that you will need to pay for every penny on your own.

Medical bills can be huge. Even small items, like a dental visit for a root canal, can top $1,000. If you do not have medical insurance, chances are you do not have $1,000 or more sitting in the bank to pay it. You might need to apply for loans for medical treatment. Since you probably aren’t an aging grandpa looking to amuse yourself in TSA lines, you need a plan for the medical bills because elective surgery isn’t covered by most insurance.

How to Pay Your Medical Bills On Time

What? You did not plan to become a medical finance expert? Well, welcome to the 21st century where four to six types of health insurance plans exist, you can open a flexible health savings account (FHSA) to pay for certain items and the cost of medical care keeps skyrocketing. Without health insurance and an FHSA, you need medical bill loans unless you are independently wealthy.

Taking out a loan for medical bills proves way smarter than letting the bills slide. According to Loanry, as of 2012, 30 percent of non-elderly US adults had past-due medical bills.

Start before you need to get treatment for anything. That means adhere to preventive care steps like healthy diet and regular exercise, monthly breast self-exams if you are female, and regular wellness checkups.

Let’s say you do become ill though or you are injured in an accident. You need treatment at a hospital or out patient facility.

Rather than have your bills go unpaid which ruins your credit, you can reduce the medical bills and obtain help paying them off. Your credit affects your ability to get a job, take out a mortgage, obtain a car loan and more.

Reducing and Paying Medical Bills

After you have been treated and you obtain your first bill, you may experience shock at its size. Let’s look at some ways to reduce the bills, then pay them off.

Have an Advocate Check for Errors

Medical billing advocates say they find errors on 80 percent of the claims they examine.

A NerdWallet analysis revealed errors on 49 percent of Medicare claims.

Those clerical errors result in overcharges. A medical billing advocate examines medical bills for errors, then advocates for the patient to lower the costs. They typically advocate for patients with extremely high medical bills after a long treatment time.

You can do this same thing for every bill you receive. Simply review the bill when you receive it. Check to make sure that you have been charge the correct amount. If the charges do not reflect the appropriate amount for a medical service, you should phone them and have it corrected. You will need to have a copy of your medical records and your insurance company’s explanation of benefits.

Seek Preventative Care

Use every preventative care program or resource available to you to maintain your health. Visit the doctor as soon as you feel ill. Small health issues can grow quickly into serious conditions. Accept it as soon as your doctor suggests medicine or a procedure that could hold off the development of a larger issue.

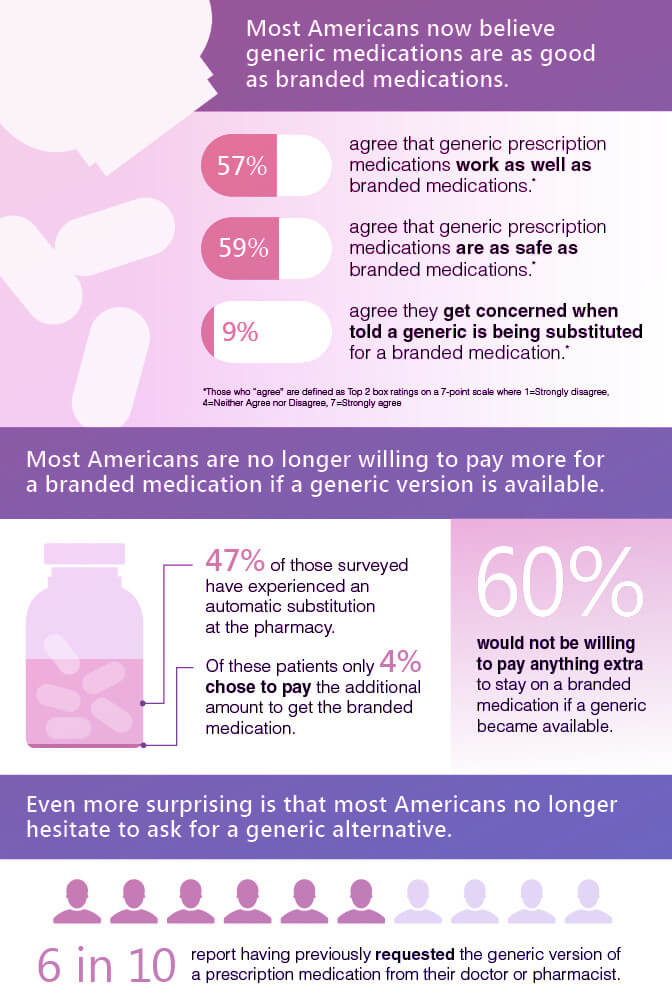

Opt for Generic and Test Drugs

Choose the generic version of drugs. These typically cost less than branded drugs. If an over-the-counter version exists, you can try it, too, to save money. Also, inquire about test medications. You may be able to enter a drug trial that lets you obtain free or extremely low cost medications. This can cut down on or completely eradicate one of the largest medical bills you could incur.

Open a Health Savings Account

If you do not already have a health savings account, open an account. You can auto-deposit funds into it on a monthly basis as a pre-tax withdrawal. You can also invest the money in the account so it grows. If you start saving now, by the time a medical emergency rolls around, you have a ready made store of funds.

Persistently Haggle the Medical Bills Down in Price

Find out what the cheapest charges are for the medical service you received. Typically, that is the cost provided to those with insurance. Even if you do not have insurance, you can haggle your bill down in cost. Negotiate with your hospital or doctor’s office, or even your health insurer to reduce the costs. Negotiate with the medical billing manager. They are capable of fixing bill errors or negotiating a discount. Try using the following to document your request for a discounted bill:

- Phone calls,

- Faxes,

- Emails,

- Letter

When the doctor or hospital agrees to a lower rate, get a copy of the agreement in writing.

Crowdfunding to Pay Medical Bills

Sure, you’ve seen such things listed on crowdfunding sites like GiveForward. You can do this, too. There’s no reason you can’t ask for help. Do it right though. You need to be able to prove you really do have the medical bill. Most people only donate to the causes they find that are genuine. Crowdfunding, the process of gathering many donations from a large group of people in support of a need or cause, can help you to pay the medical bill quickly. Most websites that let you crowdfund charge a small percentage for administration fees. Some let you access funds even if you do not raise your goal amount, others let you have partial funds.

Look for crowdfunding platforms with a strong social media presence that share campaigns virally. Also, share it to your own Facebook, Twitter, etc.

Apply for Assistance

Low income households or individuals experiencing financial hardship from a medical issue should apply for assistance. Many medical centers and hospitals provide assistance programs. Contact their help desk or billing office for information. The hospitals may be able to refer you to other assistance, such as charities that assist with your bills. This may include the local chapter of your Elks or Lions Club. If you attend church, inquire with your minister if the congregation provides charitable assistance for members. Also, check with your local government or state government for medical assistance programs.

Taking Out a Medical Loan

After exhausting all of those avenues of payment assistance, apply for a medical loan. A medical loan can help you pay for your needed treatments, so you do not hurt either your medical health or financial health. If you stop paying your medical bills, your doctors and hospital may stop providing you treatment. A health care loan can provide you with the funds to immediately pay the medical bills, so you can continue getting treatment.

Many reasons abound for taking out a medical loan. These include:

- Consolidating your medical debt into a single, minimum monthly payment. You can probably land a lower interest rate, too

- You can avoid high interest rates. Medical loans often offer lower interest rates.

- It lets you avoid trying to piecemeal the charges onto a number of credit cards. Those cards typically have high interest rates

- This method helps to improve your credit score because with every on time payment your credit score improves. That makes it easier to get loans in the future

- You avoid pop-up fees because medical loans provide extended details of the loan agreement. You will not experience hidden fees. Once you pay the upfront fees of the loan, you are done

Medical loans are usually rather easy to obtain. They’re an unsecured loan that requires no collateral as security. The lender can require you to only spend the money on medical debt though.

Benefits of Medical Loans

You may not think of it as a benefit to take out a loan, but there are many reasons to want to obtain a loan. Think of it this way:

- You get treated at your choice of hospital. Your insurance may limit you to in-network, but a medical loan never will.

- The loan length, or tenure, is pretty flexible. You can make monthly payments to repay it in monthly installments with up to 24 months to pay it off.

- Medical loans have no prepayment penalties. You can prepay the loan payments. This reduces the amount of interest you must pay.

- You do not need collateral. These loans are unsecured.

- They are easier to qualify for than a conventional loan.

- They require truly minimal documentation. Typically, you only need to submit details of your treatment and your medical history.

- There are medical loans specifically designed for those with bad credit or no credit.

Regardless of the reasons you need to take out a medical loan, you can do so with good, bad or no credit. A medical loan lets you obtain the medical treatment that you need, when you need it. Make it your last option though, after exhausting other avenues of bill negotiation and crowdfunding.

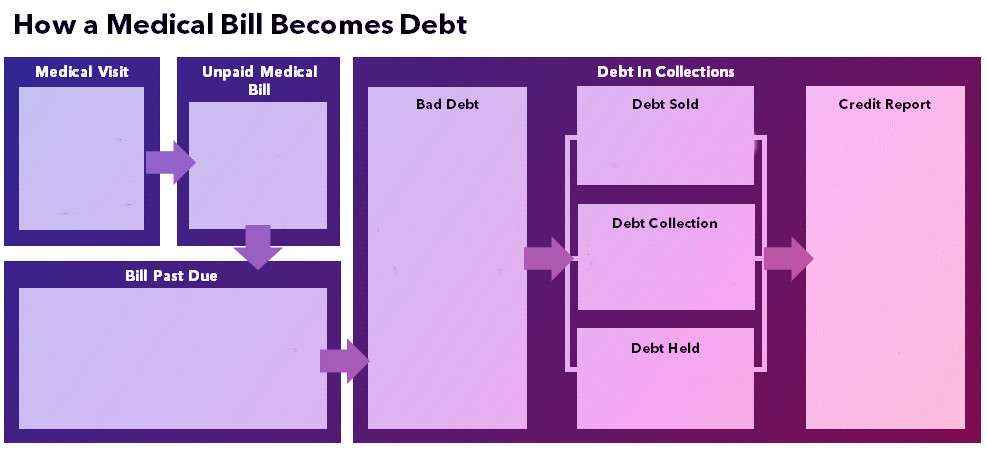

Medical Bills in Collections

Ethically, you should pay every bill as soon as possible and definitely by the due date. However, sometimes, life takes over and that is not possible. When you fall ill or get hurt in an accident, you may not be able to work, therefore you may get behind on the medical bills, along with the rest of them. Sometimes, these get sent to collections. At this point, you may feel that things have grown hopeless and ask yourself,

“Should I pay a medical bill in collections?”

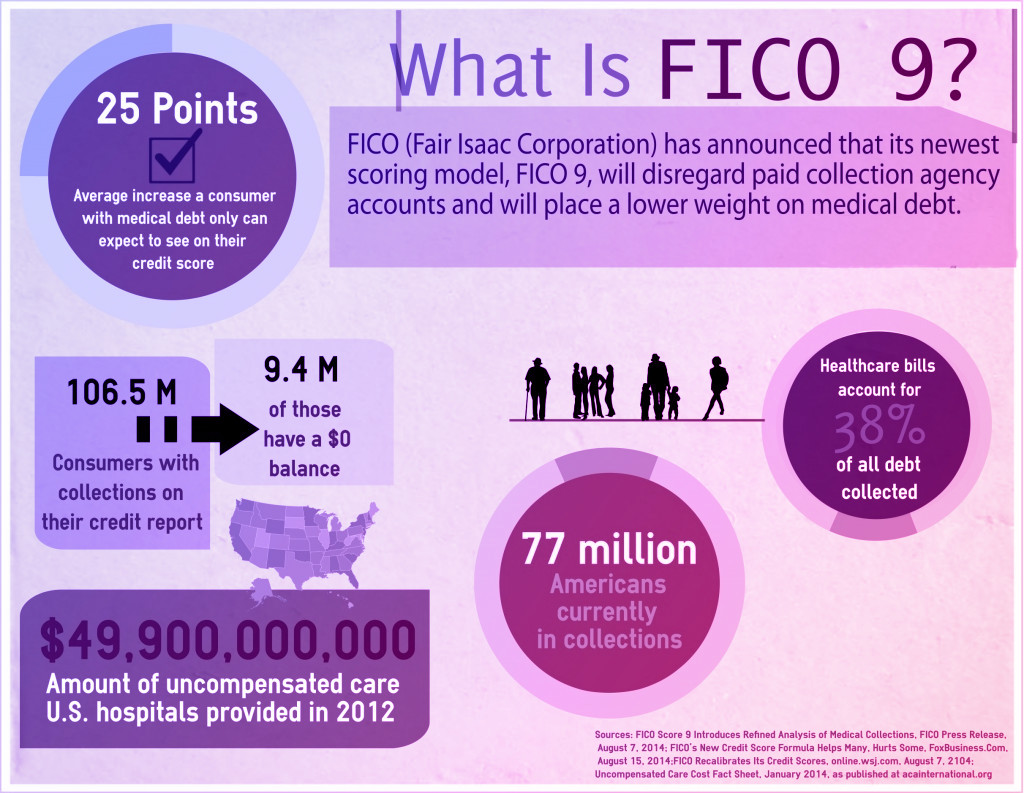

Fico 9 Rules

If the total cost of the medical costs has you basically hyperventilating, take a deep breath and negotiate. You might be able to settle the bill for a fraction of the cost. Once upon a time, settling also created a negative comment on your credit report, but not with the new FICO 9 rules.

As long as your potential lender uses FICO 9, you will benefit from paying off the medical bill that went into collections. While not every lending institution has begun using this new calculation, FICO is moving more institutions to it.

Begin by offering the collection agency one third of the medical balance. Negotiate from there. If the amount they forgive exceeds $600, it counts as income and you will receive a 1099. You will need to include this on your state and federal income taxes.

Since the older debts will fall off of the credit report first, you should prioritize repaying your newest credit lines and loans first. Those show up on your credit report the longest.

The Dreaded Lawsuit

If a creditor takes legal action and sues you, breathe. It is not the end of the world. Go to court when the summons says to do so. Explain why you have not paid the bill and why you simply need time and a payment plan. Make payment arrangements with them.

Let the court know what your current income is and what you can afford to pay each month. Let the judge know you want to pay, but need to make reasonable monthly payments rather than a lump sum. The great thing about a court payment plan is it protects you. Once the court orders you to pay in a specific manner, the collections agency cannot demand anything else. They cannot come back a month later and harass you and demand full payment all at once. It actually benefits you to go to court and set up a payment plan.

In Conclusion

You can pay off all your bills. You can do it. It will take time, budgeting, hard work and lots of telephone time to negotiate. You will end up with a good credit score and you’ll be able to get loans and credit cards when you need them. You have to take a deep breath and start making a plan to get out from under your debt. Start at Budgetry.com. Visit Loanry.com to find an appropriate medical loan, if needed. You can pay it all off and benefit from a strong credit score and a debt-free life.

Carlie Lawson writes about business and finance, specializing in entertainment, cryptocurrency and FOREX coverage. She wrote weekly entertainment business and finance articles for JollyJo.tv, Keysian and Movitly for a combined seven years. A former newspaper journalist, she now owns Powell Lawson Creatives, a PR firm, and Powell Lawson Consulting, a business continuity and hazards planning consultancy. She earned BAs in Journalism and Film & Video Studies from the University of Oklahoma. She also earned her Master of Regional & City Planning at OU. Her passion lies in helping people make money while reducing risk.