There comes a time in everyone’s life when they need some type of loan. These often tend to be stressful times because it usually means that you need money quickly to pay for some unexpected expense. One of the best ways to help eliminate stress during those unexpected times is to understand the options available to you. If you are already aware of the options, it makes those times easier for you. When you have more information you are in a better place to make the best decision for you at the time you need it.

There are a few facts you should understand about personal loans including the advantages and disadvantages of unsecured loans. Continue reading to find out all the information you need to make the best decisions for you.

Pros and Cons of Unsecured Loans

If you have not figured out by now, there are many advantages and disadvantages of unsecured loans. Before you visit loans shop online, you should understand all of the information, the good and the bad, about unsecured loans. You should not take on more debt without really thinking it through. You should keep in mind that this money is a loan and must be repaid. The lender is not just giving you money.

What Is A Personal Loan?

A personal loan is when a lender allows you to borrow money. When you borrow money from a lender, you are making a promise to repay the money. You repay by making regular payments each month of a set amount. The repayment length is anywhere from three to five months. The lender can be anyone from a traditional bank, a credit union, or even a family member. The lender charges you a fee for allowing you to borrow the money. The fee is called interest. an the lender sets the interest amount based on your credit score. The higher your credit score means the lower your interest rate may be. A personal loan can be used for any purpose you wish.

When you are interested in a personal loan, it is best that you do some loan shopping to find the lender with the best interest rate. There are many lenders available to provide you with a loan so you do not have to go with the first offer you find. There are many advantages and disadvantages of unsecured loans and you should be aware of all of them before you obtain a personal loan.

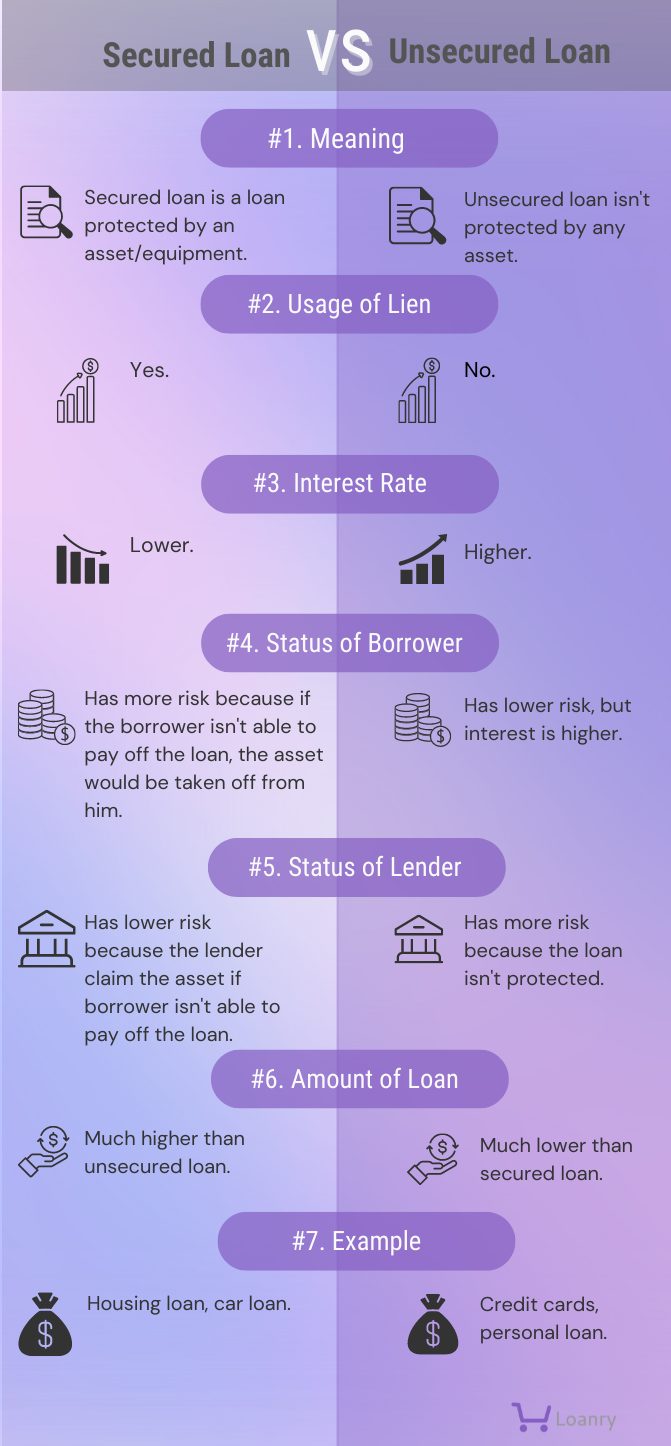

What Is the Difference Between a Secured and Unsecured Loan?

I started this article by telling you how important it is to have as much information as you can about personal loans. One of the factors to understand is the advantages and disadvantages of unsecured loans, but you should also understand the differences between a secured and unsecured loan.

I started this article by telling you how important it is to have as much information as you can about personal loans. One of the factors to understand is the advantages and disadvantages of unsecured loans, but you should also understand the differences between a secured and unsecured loan.

A secured loan is one that has collateral attached to it. Collateral is some type of asset that you own, such as a house or a car. It can also be some other item that has significant value, such as art or jewelry. A lender accepts your collateral to prompt you to pay back the loan on time. If you do not pay back the loan, the lender takes your collateral in place of your loan. In the case of a mortgage, you are offering your house as collateral and the bank can foreclose on your home. Once you repay the mortgage, the house becomes yours free and clear.

An unsecured loan is a loan that has no collateral as backing for the loan. The only thing that provides security for the lender is your credit worthiness, which is usually determined by your credit score and credit history. The interest rate for your loan is heavily based on your credit score. You can only be approved for some personal loans if you have a high credit score. A large percent of personal loans are unsecured loans. You can shop for unsecured personal loans online. You should do a lot of research when you want a loan, so you know what options are available to you.

Advantages of an Unsecured Loan

There are some benefits to consider about an unsecured loan when making the final determination about taking a personal loan. Unsecured loans are available to just about anyone, but you must qualify for the loan. Your credit score is the biggest piece of information that can qualify you. You do not have to worry about providing collateral for an unsecured loan because it is not needed. No type of collateral is accepted for an unsecured loan. You are able to get your money quickly, often as fast as a few days, because there is no need to appraise the collateral. An application for an unsecured loan can be completed in the same day.

Unsecured loans are great for those who do not have anything to offer as collateral. They are also good for those that may not have the best credit. You can also find unsecured loans online which makes researching them very easy. So you can fill out the application and upload documents all in the same online session. You can often be approved in the same day. Money is deposited in your bank account usually on the next business day. You are usually able to pay off your loan early, if you wanted, without any penalties.

Disadvantages of An Unsecured Loan

What kind of article about the advantages and disadvantages of unsecured loans if I failed to mention the disadvantages? People do not often like to talk about the bad stuff, but it is just as important to know when trying to make a decision like this.

One of the biggest negatives to unsecured loans is that many of them come with high interest rates. Unsecured loans have higher interest rates than secured loans. The lower your credit score is equals a higher interest rate. Lenders take on greater risk when they offer you unsecured loans. The lower your credit score means that the lender takes on even more risk. They are less willing to take on that risk when your credit score is low.

Unsecured loans come in limited amounts, so you may not be able to get an unsecured loan in the amount you need or want. A lender may only be willing to lend you a certain amount and it may not be enough for your needs. They typically do not have any flexibility. You probably will not be able to change the terms of your loan once you have agreed to the loan terms. Also, you may not be able to get a better rate on your existing loan. You would have to obtain a different loan for a better rate and pay off the first loan. An unsecured loan is still a loan, which means you are taking on more debt. Ultimately, that could negatively impact your credit score.

Are There Different Kinds Of Unsecured Loans?

In addition to many advantages and disadvantages of unsecured loans, you should also know about the various kinds of unsecured loans that are available to you.

There are personal lines of credit, which are loans that are open-ended. You can withdraw the funds you need as you need them over a specific period of time. Also, you can access the loans through a bank transfer or with a check. You are given a certain amount that you can borrow. They range anywhere from $1,000 up to $100,000. Interest only accrues when you withdraw the money and it only accrues on the amount of money that you withdraw. It only accrues until you pay back the money.

There are debt consolidation loans that can be unsecured as long as you have good credit. This type of loan allows you to combine all of your debts into one. You only have one payment instead of multiple different payments across many bills. And you may be able to get a lower interest rate with a debt consolidation loan than the high interest you pay on your other bills.

You can find loans to finance your wedding or a vacation. The interest rates may be higher on these types of loans, but they help you pay for something specific. You are able to reduce your stress by paying the money upfront for a trip or wedding and then make regular monthly payments.

You may also be able to get a loan to pay for a specific medical expense or need. Sometimes, these loans are harder to get and may have a higher interest rate. You may be able to get these loans from a medical provider or someone who only provides loans for medical purposes.

Are There Things I Should Avoid When It Comes To Unsecured Loans?

There are a few types of loans that you may want to avoid when it comes to personal loans. While there are advantages and disadvantages of unsecured loans, some loans have more disadvantages.

There are short term cash loans that are geared towards those who have poor credit scores. Just about anyone, with any type of credit, can be approved for these types of loans. They have repayment periods that are incredibly small. You have to be sure that you can repay these loans. These types of loans can put you in a bad financial position. You usually have to pay back the money in two weeks or less. If you do not pay back the money timely, you have to pay high fees or additional charges. You may need to take out another loan to cover the first one. That puts you in a dangerous cycle. These loans have sky-high interest rates.

There are also payday loans. These are also geared towards those that do not have the best credit. These loans are for smalls amounts. You have to repay them when you get your next paycheck. You have to provide a paycheck as proof of how much you earn with each paycheck. This also indicates to the lender how much they are willing to allow you to borrow. They do not let you borrow more than you make per paycheck. These loans also have high interest rates.

These types of loans often make things worse for you. Both of these types of loans are limited to small amounts. The low amounts limit how much you borrow. They may not cover all the debts you owe. You may have to take out many loans of this type. Every loan you have puts you further into debt. This may put you into a situation you cannot get out of.

What Should I Look For in an Unsecured Loan?

There some other things that you should look for when you are deciding about unsecured loans. In addition to all the advantages and disadvantages of unsecured loans, you want to understand the type of loan to which you want to apply. You should also know what the eligibility requirements are for a loan you are interested in. And you should know if the loan has an application fee or penalties for paying off the loan early.

You should make sure you have a clear understanding of the annual percentage rate (APR). This is the interest rate in addition to the origination fee that you are charged for borrowing the money. The better credit score that you have means the better interest rate you receive. The lender may be offering you a promotional rate, so you should understand how long the promotional period lasts. You should also understand what happens when the promotional period ends and if your interest rate increases. The interest rate may get so high that you may no longer be able to afford to repay the loan. The length of time you have to repay the loan can vary from one, three, or five years. The longer you have to repay the loan usually means that your interest rate is going to be higher.

Most loans have fees associated with them, so it is important for you to understand what fees are associated with your loan. You may have fees because you made a late payment, processing fees, and early payoff. There may be other perks or bonuses that can come along with your loan. You should be aware of all of those before you sign your loan agreement.

What Do I Need to Apply for an Unsecured Loan?

When you apply for a loan, there are a number of documents that you may have to provide to a lender. It is helpful if you have all of these documents available before you apply for the loan. This way, you already have them and you will not have to look for them. The first step you have to take is you need to fill out the application for the loan. No matter what type of loan you want and from which lender, you always have an application.

You have to provide proof of your identity. The lender needs to know that you are who you claim to be. Usually a valid photo identification card, such as a driver’s license, state ID, or military ID, should be sufficient. You may also need to provide proof of income, such as paystubs. You may also need to provide bank statements to show that you have the money to repay the loan. A lender may ask you to provide other documents to them. No matter what the lender asks you to provide, it is important that you do so quickly. If you do not provide them what they need within a certain period of time, it may a reason for them to deny your loan.

While you are going through the application process for a personal loan, when it seems that the lender is being difficult with their requests, keep in mind that this is another on the list of advantages and disadvantages of unsecured loans.

Do My Savings Impact an Unsecured Loan?

There are many advantages and disadvantages of unsecured loans as I have described throughout this article. It is important to have savings. However, those savings most likely will not help you be approved for an unsecured loan. When you create a budget, it gives you a clear idea of how much money you can save each month. It also gives you an idea of where you are spending all of your money each month. This also shows you where you can save money. You can cut out spending by reducing the number of times you eat out per month. It is a great way to reduce spending and increase your savings.

While there are many advantages and disadvantages of unsecured loans, you should still focus on your savings while determining if a personal loan is right for you. If you are able to cut your expenses enough, you may decide that you no longer need a loan.

Conclusion

This article gives you a lot of advantages and disadvantages of unsecured loans, but you still must make a smart decision when it comes to unsecured loans. You have to decide if you can afford to repay the loan. If you cannot, it is not a good idea for you to take on a personal loan. The best way for you to decide this is to create a budget for yourself to see how much money you can afford to repay each month. Even though there are many advantages and disadvantages of unsecured loans, you should not rush into this decision.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.