Many people use personal loans to suit a wide variety of different needs. Some people use them to pay off debt, fund a vacation, or even pay for car repairs. There are many uses of personal loans, which you can easily see if you ever try to get one. This is why the right question to ask is whether personal loans affect your tax return.

Personal loans are designed for general use and don’t have to be used for specific things, unlike a house loan or car loan. Although personal loan functions as added funds, in addition to your income, it’s not considered income. However, there are circumstances when a personal loan is considered income. In these situations, personal loans affect your tax return.

How Do Personal Loans Affect Taxes?

As discussed earlier, personal loans affect your taxes when they’re forgiven. A personal loan becomes taxable in this instance. Plus, you may have to report your interest payments on a loan if they are tax-deductible. Personal loans affect your tax return if your lender sends you a tax form called a 1099 C. You’ll have to report the loan’s principal or interest to the IRS as taxable income. Personal loans that are used for investments, business expenses, and qualified education expenses are tax-deductible.

Exceptions in Cancellation of Debt

Generally speaking, cancelled debt or personal loan is considered taxable income. Here are some cases when this is not the case:

- ☛If a loan is forgiven as a gift from a private lender, it’s not considered income. The exceptions don’t end there.

- ☛If a lender forgives a loan of thirteen thousand dollars or less as a gift, it’s protected under the million-dollar lifetime exemption gift tax. It’s not taxable as income.

- ☛If a lender dies and cancels a debt in the will it’s not counted as income either.

- ☛Other circumstances that may exclude a loan from taxation include a Chapter 7 or Chapter 13 bankruptcy. In addition, if your loan was discharged as a result of a Chapter 11 bankruptcy, you won’t owe taxes.

What is a Personal Loan?

Personal loans are for general use and can be used for anything. Generally speaking, personal loans aren’t considered income. They must be repaid and aren’t considered income because of this. These loans can be obtained through banks, peer to peer lending systems or an employer, as well as from many other sources. These loans differ from other loans, like car and house loans, because they are unsecured and don’t usually require collateral. A house or car loan that goes unpaid can result in the loss of a house or repossession of a car. This is an important thing to consider when thinking about whether personal loans affect your tax return.

The ABC’s of Personal Income Tax

Taxes are taken out of our paychecks before we ever see the dollars we work so hard for. When you buy items at the store, sales tax is charged in addition to the cost of the item. Savings accounts are interest-bearing and the interest is taxable. In addition, if you own a home you will more than likely pay property tax. Even when you buy a car, you pay special taxes upfront as well as in your car note.

You can’t escape taxes. They are everywhere. But it’s important to be educated enough to understand personal income taxes. The tax dud date is the 15th of April everywhere. Once you file your taxes, you will get a refund if you’ve paid more income tax than you owe. If you owe more than you’ve paid, you’ll have to pay the difference. If you don’t receive a refund and owe nothing, you’ve had enough withholdings and deductions to pay all of your tax liabilities. Understanding how your income tax works is part of tax management.

Why Isn't a Personal Loan Considered Income?

Although a personal loan increases the amount of money you have, it's not considered income. The primary reason why a personal loan isn't considered income is that it's money you have to pay it back. This is also the reason why a personal loan isn't considered taxable income.

Main Points to Remember About How Personal Loans Affect Your Tax Return

Conversely, there are scenarios when personal loans affect your tax return. If your loan is forgiven by the lender, the money you received will be considered income because you don’t have to pay it back. Other situations include scenarios when the lenders forgive the loan and consider it a gift. Once the loan is forgiven, it is considered a COD or cancellation of debt and you no longer have to pay it back.

These are examples of how a personal loan can be considered taxable income. In certain situations, personal loans affect your tax return. A loan can be looked at as income if it has has been forgiven. In addition, if the interest on your loan is taxable, you will have to report that as well. The circumstances under which Personal Loans affect your Tax Return is very specific. If your loan is forgiven and you are required to report the interest on your loan, are both situations where your personal loans affect your tax return. However, it should be noted that a loan of $13,000 or less, that a lender decides to gift to you, is not considered income and is not taxable. However, there are some situations when personal loans affect your tax return.

If You Owe Income Tax From a Personal Loan

If you’re lucky enough to get your loan forgiven, you’ll need to prepare yourself to pay the income tax on your loan. It is now considered a cancellation of debt which means that its no longer a loan. It’s income because you don’t have to pay it back. It may be scary to find yourself responsible for paying the income tax on a forgiven loan. However, you’ll need to act quick. If you don’t have funds available to pay your income tax debt you may need to set up a payment plan.

Beware, however, because the payment plans often include higher interest and penalties. You may be better off taking out another loan if you’re left with a costly payment plan. Just keep in mind that you do have options. Don’t panic. Use all the tools available to find the best method to eliminate this tax debt. You may find yourself taking out another loan to cover your tax debt.

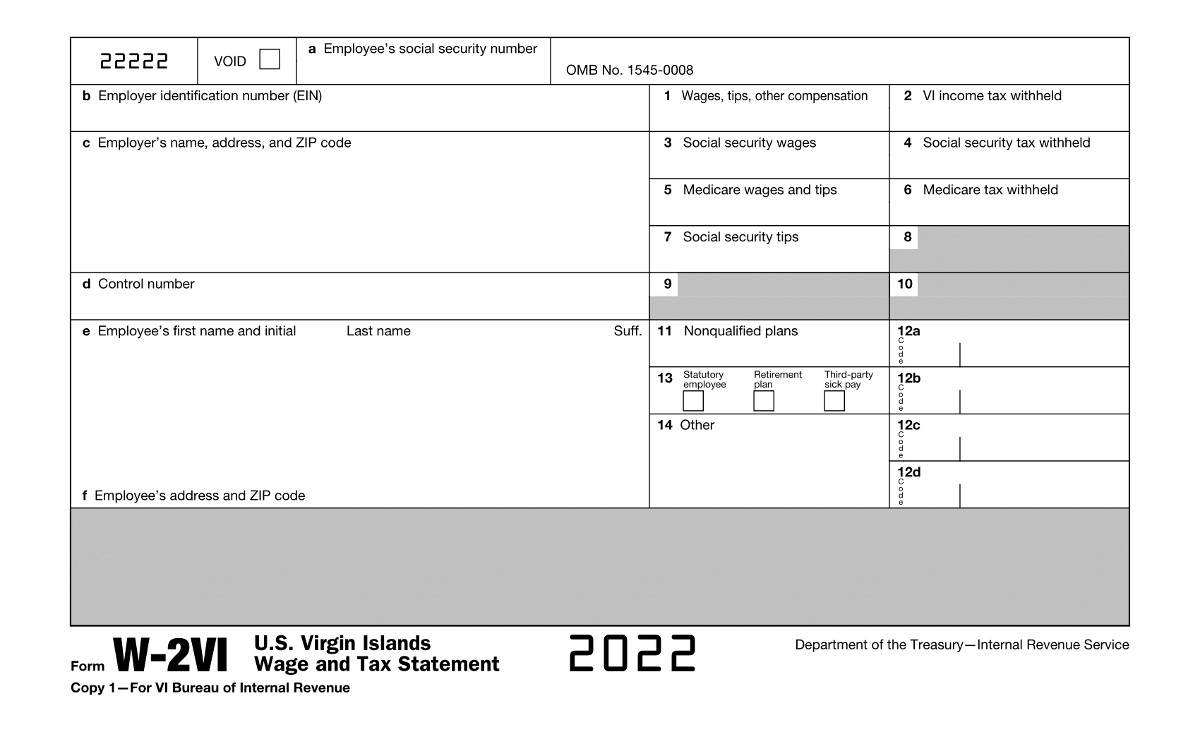

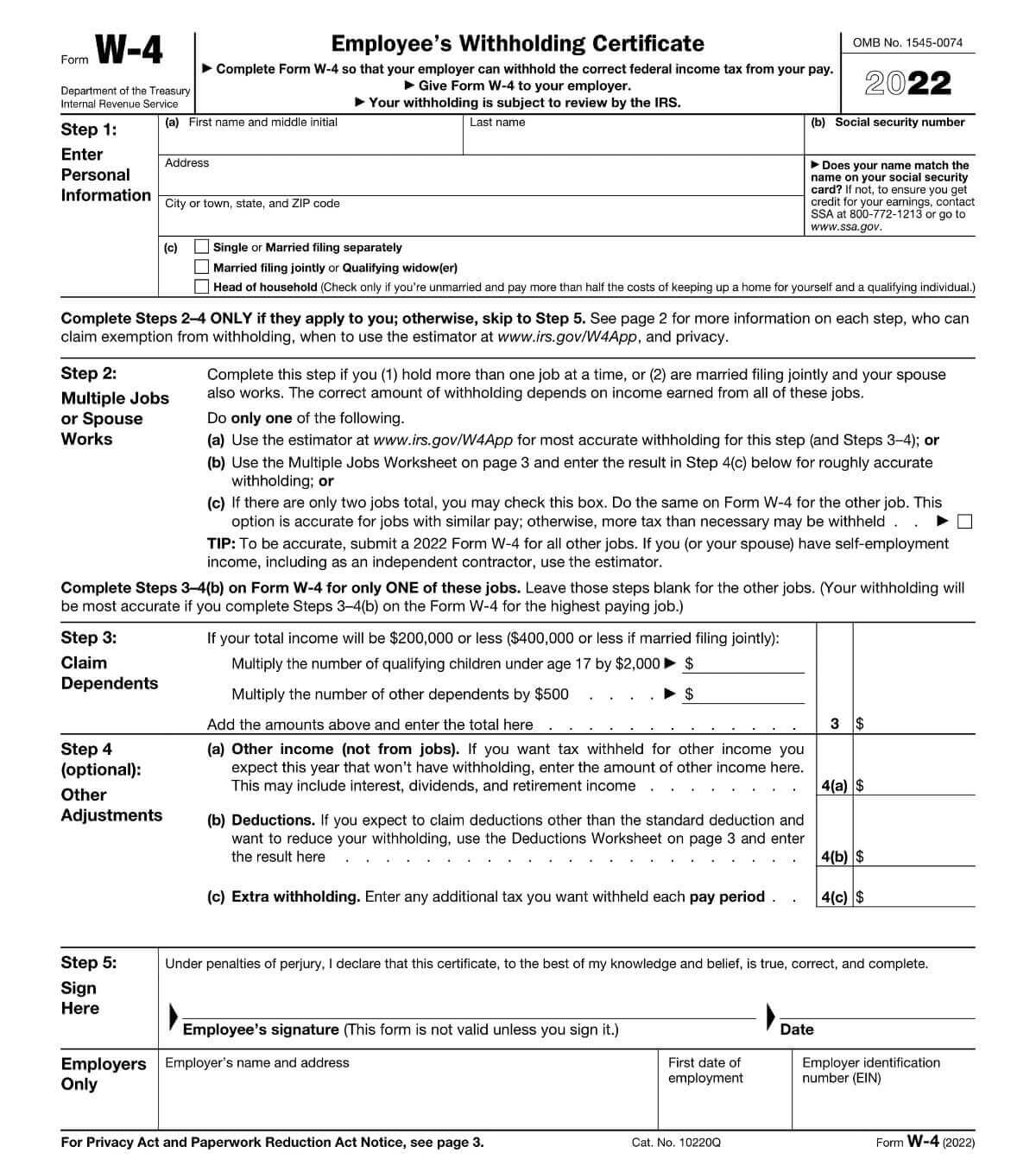

What is a W-2 and a W-4

When you’re hired as an employee you’re required to fill out a form called a W-4. This form allows you to choose how much federal income tax is withheld from your paycheck. There are many tax tips you can employ when it comes to filling out your W-4. Your W-4 will tell your employee how much to withhold from each of your paychecks. A W-2 is the form that employers send you at the beginning of each year which indicates how much you made during the prior year as well as how much was withheld. You will need to use the information on your W-2 to fill out your tax return.

Should You Take Out a Personal Loan to Pay Off Income Tax?

If you file your income tax and owe money you will need to pay the money owed by April 15th. If you don’t have the money, the IRS does offer payment options. However, these options include penalties and interest. As a result, many people consider taking out a personal loan to pay off the debt.

A personal loan has advantages over many other payment options. Personal loans can have lower interest rates than credit cards. Both options usually have higher interest rates and penalties than the IRS plan depending on your credit and other factors. More often than not, a personal loan allows you to pay the IRS what you owe, but you need to make sure you’re not paying more than what’s offered by an IRS payment plan. A consumer loan is often a wise choice when it comes to paying off debts if you can save on interest or you need lower payments with a longer-term loan.

Conclusion

It’s obvious that education is a big part of the solution when it comes to understanding personal loans and income tax and how the two work together. It’s also a good idea to know what it takes to qualify for a personal loan and what to do if you don’t qualify. There are usually alternative options that you can try if you can’t get a conventional loan. However, regardless of what you do take your time and read the fine print. Pay attention to the interest rate, terms, and the amount of the loan. Don’t take the first offer you get. If you’re uncomfortable with any part of the loan, don’t take it. Use the online tools and a finder to help you decide on the best loan for your particular situation. You won’t be sorry that you took your time and found what was best for you.

Remember, an ounce of prevention is always worth a ton of cure, even in situations that are rare and unlikely. Personal loans are rarely considered income. However, do your homework to ensure that you’re not missing any important details, and to be aware whether personal loans affect your tax return in your specific situation.

Nwayita is a personal finance writer who knows the value of getting the most out of her dollars. She understands that financial savvy is the key to making her budget stretch. She takes pride in sharing her financial planning and spending advice generously and prolifically. Her passion lies in helping millennials, as well as people of all ages and from all walks of life, develop rich habits they can use for life.