College is expensive. I am sure you are thinking ‘yeah, no kidding’. There is not a student (or parent of a student) out there thinking about college that is not also thinking about how to pay for it. According to Educationdata, the average cost of tuition in 2022 was around $35,807 for private institutions and close to $10,000 for in-state residents at public schools. Fortunately, students can find help to pay for college in the way of student loans. There is another tool available that many may not know about and that is income share agreements. Continue reading to find out more about traditional student loan versus an income share and how each option may be beneficial to you.

What Is A Student Loan?

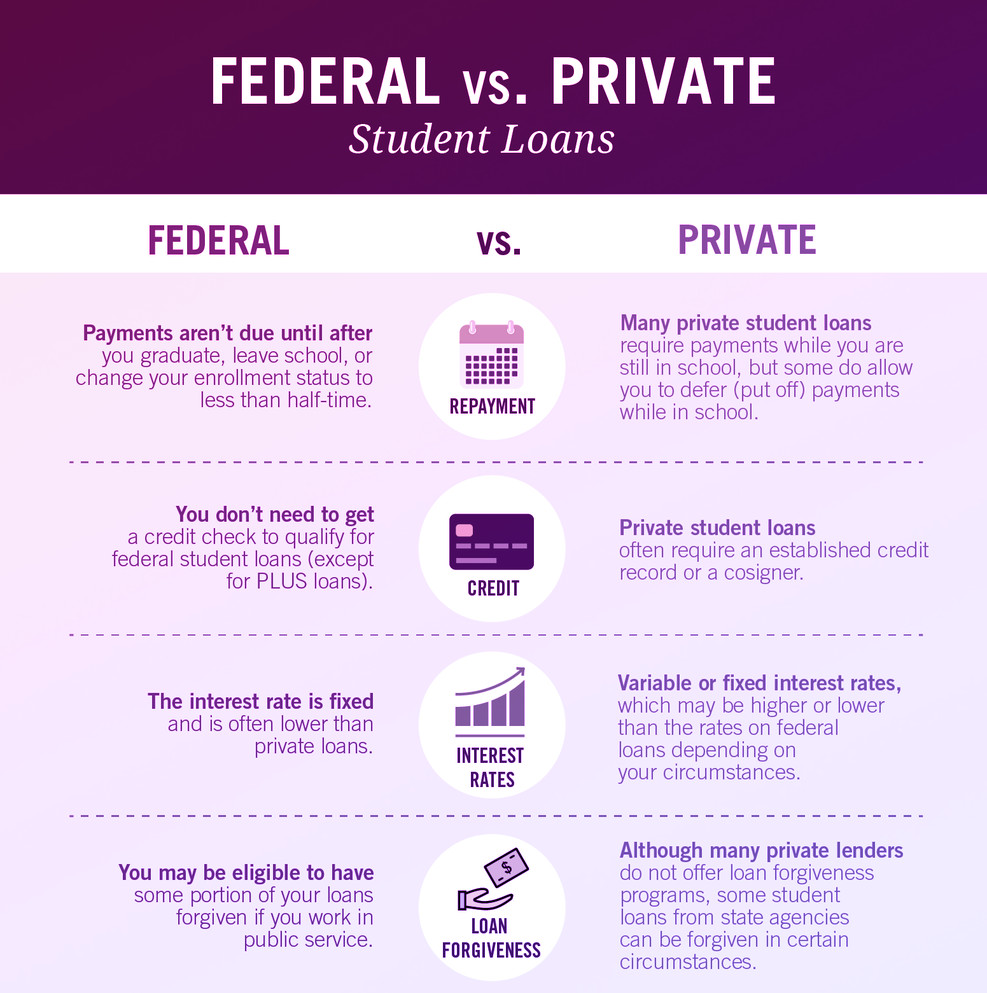

When considering a traditional student loan versus an income share, it is important to fully understand the difference between the two. A student loan is money you borrow to pay for school that you promise to repay with interest. Loans can come from different sources and there are benefits to each one. The amount of money you can borrow depends on if you are an undergraduate or graduate student. It also depends on if you are a parent or a professional working student. You do not have to repay most student loans until you either graduate from college or become a part-time student. However, some lenders expect repayment immediately. Most loans have flexible repayment plans and are easy to finance or postpone.

Typically the interest rate on a student loan is fixed and lower than most other interest rates. Often you may not need a credit check to have a student loan approved. When making the decision about applying for loans to pay for college, weigh all of your options carefully. It may not impact you today, or while you are in school, but it will. You have to pay back the loans once you graduate and the decisions you made years earlier may come back to haunt you.

What is An Income Share Agreement?

Income share agreements may be something about which you know little. An income share agreement is typically set up with the school in which you plan to attend but can be another institution, where you agree to pay the tuition later when you have a job. You are borrowing the money for your tuition and agreeing to pay your tuition with a percentage of your future earnings. In a sense, you are using yourself as equity.

You are saying that the education you get today provides you the opportunity to gain employment that allows you to repay the loan. The amount you can borrow depends on your major and the length of the loan. Keep in mind, the school is projecting how much money you will make if you find a job. The amount you are able to borrow may not cover your tuition needs, so you might have to get another type of loan.

Are There Benefits To Student Loans?

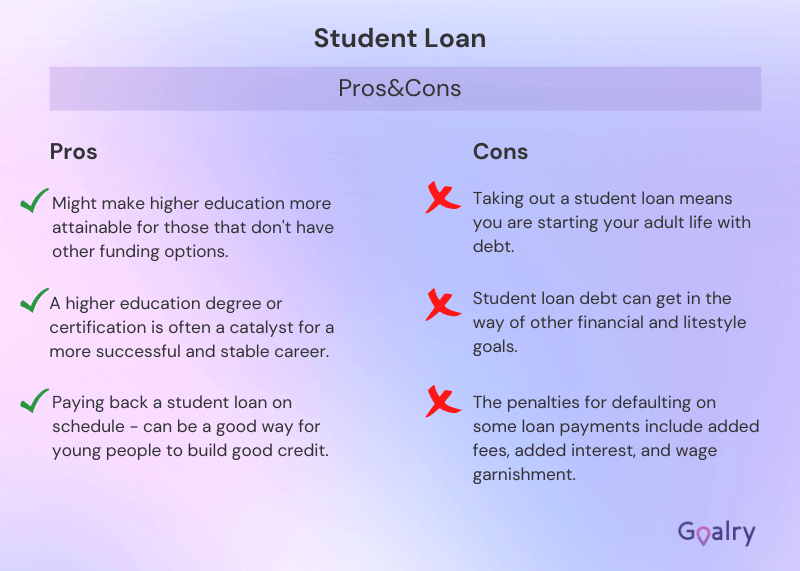

One might say that a major benefit to any type of student loan is you are getting money today to go to school. For some, that is enough. The plan to figure it out later. They feel that if they do not go to college, they will not be able to get a job or be stuck where they are. They would rather risk taking on debt to try to secure themselves a future. That is a definite benefit to student loans. When students consider traditional student loan versus an income share, they may only look at who is going to give them the most money all at once.

Believe it or not, the federal government often offers the best loan terms. Do not shut down that option before looking at the details. However, that does not mean you should only consider a federal loan. You need to consider all of your options. That includes scholarships, grants, and work study. There may be other ways for you to get money to go to school. You need to put all your options all the table, look at the benefits and negatives and make decisions that are in your best interest.

Are There Benefits To An Income Share Agreement?

The intention of income share agreements is to provide you the money you need for school with the promise to repay the loan once you have a job. It intends to keep you from having to pay a ridiculous amount each month in student loan debt. It caps the amount you pay back per year by making it a percentage of your earnings.

If you get a raise, the percentage does not change, but the amount you repay does because you earnings increased. No matter how you slice it, you have to pay back money. If you are like most college students, your income is going to be low, much lower than you think it should be. If you are like most college students upon graduation, you will feel weighed down by the burden of your school debt.

Unfortunately, there may not be anything you can do about that, unless you manage to leave school with no debt or loans. If you come from a wealthy family, that may happen for you.

However, if you are like most college students, that is not the case and you will have debt. As I stated many times in the article, you have to do what is best for you and your particular circumstance. Any size does not fit all and what works for your bestie may not be right for you. Educate yourself on all of your options before making a decision.

What Are The Negatives To Student Loans?

When thinking about traditional student loan versus an income share, the one thing that remains true about both of them is they are a type of loan. When you borrow money, you must repay it at some point. That has to be the biggest negative to student loans…paying them back. Depending on the type of loan, you may be able to defer the repayment but there always comes a point when you need to pay it back. Really, there probably is never a good time. Unless you have found the job of your dreams making a ton of money and you have extra money to spare. It is a great dream, but unlikely to happen. For your sake, I hope it does.

A student loan could possibly hurt your credit score. We will talk in depth about that a little further down. In general, if you stay on top of your payments, it should not hurt too much. Student loans are a burden. They are a burden to you, your parents and our economy. That is the largest downside to the trillions of dollars in student loan debt.

The Downside to Income Share Agreement

I have talked quite a bit about student loans in general. When it comes to the traditional student loan versus an income share debate, there seems to be more negatives to an income share agreement. Ok, maybe that is not fair. The better way to say it is there are more positives to a federal loan than an income share agreement.

The major downsides to an income share agreement is the limit on funding you receive. Each school has a cap, which varies from school to school, on how much they loan a student. Most likely, this amount does not cover tuition for a year. That means you have to find other ways to make up the difference. Perhaps it is not a significant amount and you find a job that pays you enough. Maybe your parents can pay the difference. But, what if none of that applies to you? Then you need to get another loan.

So in addition to the income share agreement, which, let’s be real, is a loan, you need to get another loan. Upon graduation, you have multiple loans you must pay. Federal loans tend to be incredibly flexible in payment amount and when you start, but income share agreements may not have that same freedom.

What Makes The Most Sense For Me?

I hope I have been successful at driving home the point that there is no right answer for everyone. The best thing looks a little different for each person. When you are deciding about traditional student loan versus an income share, keep yourself in mind. You must consider your finances today and the goals you hope to achieve in the future.

Keep in mind, you are making decisions based upon what you want in your future. You are guessing about the type of job you have and the salary that goes along with you. I know you all have dreams, but when making decisions about college loans, you have to think realistically. Otherwise, you may set yourself up for a large amount of debt that you are not able to repay.

Yes, it is true, federal loans are a little more forgiving. As surprising as that is, it is true. They work with you to create a repayment plan that works for you. They are willing to defer more often based on your circumstances. In some cases, with specific rules, they may completely forgive a portion of the loan so you do not have to repay all of it.

What If I Can’t Find A Job After College?

When talking about paying back a traditional student loan versus an income share, you should attempt to pay the payments you can. Student loan debt is an astonishing plague on recent graduates. You want to do everything you can to pay it off as soon as you can. Hopefully, you can find a job in your field and begin your career path. If you are not able to do that and you cannot pay the bills with the job you have, what do you do?

I am going to start by telling you what not to do. Do not ignore your loans. Do not ignore your debts. You either must pay them or contact the lender and set up some other type of agreement. You should never just ignore them. That is a bad idea. In as short as 90 days, your loans are delinquent and you start getting late fees. The lender most likely reports your late or missing payments to the credit bureaus. Then the phone calls begin.

In six months, you officially are in default. When this happens, your balance is due immediately. Not only that, but chances are no one can help you by deferring your payments or creating some other type of payment plan. The sad thing about this is, if you just contact the lender, you can do something. You can defer your payments until you are more stable financially. You may be able to set up a different payment plan allowing you to pay less money per month. I encourage you to take that approach if you find yourself in this position.

Can I Refinance My Student Loans?

You might be able to, depending on the type of loan you have. The amount of average college debt is astounding. The cost of higher education is to blame for this inflated debt. Americans owe roughly $1.5 trillion in student loan debt. That is just crazy.

The first thing you should know about federal loans is that you cannot refinance them. These interest rates are set by Congress and become law. Your credit score, no matter how good it is, does not change your interest rate on a federal student loan. However, you may be able to refinance your federal loan into a private loan. You should only do this if you can find a better deal than the current interest rate on your federal loan.

You should use a loan refinance calculator to determine if you can find a better rate. This is a tool where you enter your current loan information, including how much you owe and the interest rate. This tool may also ask you what you believe your credit score is currently. The calculator gives you a list of potential lenders that offer a better deal than what you currently have. Keep in mind that when you refinance a loan, it changes the terms of the loan. That means if you current loan takes you two years to repay it, refinancing it may take you four years to repay it. You must always look at all the details before agreeing to refinance your loan to ensure it is a better deal for you.

What Are the Impacts on My Credit?

When considering a traditional student loan versus an income share and the impacts to your credit score, it is important to know that they can impact your credit in the same way. As long as you pay back your loans timely, it should not impact your credit score at all. The key is to make regular payments on time for the full monthly amount. Another item of note is that when you make regular timely payments, that can positively impact your credit score. Those payments may help your credit score increase.

The key here is the same with any type of loan or bill that you have. If you pay them on time and for the full amount, it typically does not hurt your credit. When you do not make regular and timely payments, the effects are devastating. Not only does it hit your credit hard, but it adds stress to your life.

Once you credit score has been negatively impacted, it takes hard work to improve it. In addition, you may not be able to get other lines of credit for a house or car. You may not be able to get car insurance. It may interfere with your ability to rent an apartment. When you do not pay your student loans, it has far reaching implications. It impacts things that you probably have not even considered. You want to do everything you can to pay your student loans on time each month.

How Can a Budget Help Me?

It always comes back to the budget, doesn’t it? It seems that no matter the subject, having a budget is always a good idea. I know it is hard when you are not making a ton of money to even consider a budget. Truthfully, this is the best time for you to start one. There are plenty of application available to you to help you create a budget. Right now, you (hopefully) do not have many bills. I realize you may not have much income either, but that is exactly why a budget can help you.

You write down all of your expenses and all your income. After you have listed all expenses, see if there are any that you can get rid of. Do you have a gym membership or subscriptions you are not using? Cancel them immediately. That is a quick way to clean up your budget. Are you spending money on useless things? Now is the time to stop. Before you begin to create some really bad habits or get used to a certain lifestyle, cut those items.

When you create a budget, include a percentage of your income that automatically goes to savings. Make sure it is a percentage. That way as your income increases so does the amount of money you are saving each month. Trust me when I tell you, now is the time to start. Create these healthy financial habits and you will not regret it. Yes, it may be difficult at first, but it will be worth it. Once you get used to living with less money and your savings grow, you will be so happy you did it.

Conclusion

One last point I would like to note that I have not mentioned, any student loan payments you make may be tax-deductible for you. Make sure you have a 1098 e form that shows all payments you have made so that you can claim that deductions on your taxes. I gave you a lot of information to consider about student loans. It can seem overwhelming, I know. I am sure that you do not want to make the wrong choice. Believe me, I completely understand. Making lifelong financial decisions are tough. They should be.

You do not want to make any of these decisions without thoroughly thinking through them. You want to weight the good and the bad and make a sound decision. Be sure you understand all aspects of your loan options. If you do not fully understand them, talk to a student loan planner. That person has a vast amount of knowledge to help you make the right choices. There is no shame in reaching out to someone who has more knowledge than you to get all the information you need.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.