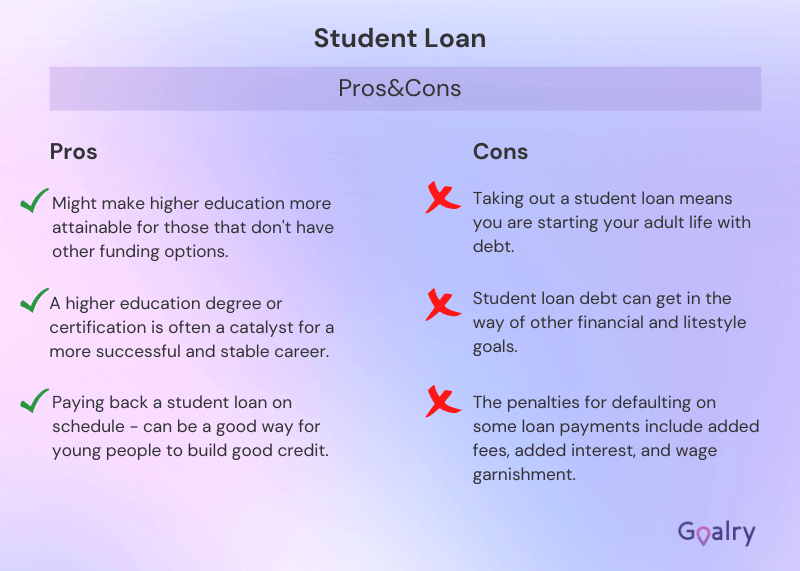

Debt is one of those ugly four-letter words that no one wants to deal with. And yet, millions of Americans seem to survive on debt. One of the most common forms is, of course, student debt. How many people could really afford a college education out-of-pocket?

The answer is very few. And that is why so many people are in massive amounts of student loan debt – wondering how to keep from defaulting on student loans. This guide is designed to help answer that question.

What Happens When Defaulting On Student Loans

Defaulting on student loans does more than add the stress of knowing you’re in debt. There are actually some pretty serious consequences. One of these is losing access to some programs that help, such as income-driven repayment plans and even loan forgiveness. While some loan service providers will work with you to get back on track, getting off track in the first place is risky, as you might not get the help you need.

Another potential problem is the actual collection methods. First and foremost, you have to understand that your interest is constantly accruing. And when you’re in default, collection fees are added that can be as high as 25 percent of both the loan principal and the interest.

These fees added to your loan balance can lead to some hefty payments. And if you can’t make them, you risk having your wages, income tax returns, and more garnished. I know someone who dealt with this, and she had an incredibly hard time paying her regular bills for years due to these garnishments.

And, of course, you have to remember that your student loans are reported to the credit bureaus. If you’re not paying and you go into default, it can impact your ability to get a loan for a home, vehicle, or just to get some breathing room to pay your bills. If you do manage to get a loan, you’re likely going to pay high interest rates.

So it is vital that you don’t default. I know that this can be easier said than done, which is why the following section will walk you through how to make sure you don’t.

How to Avoid Defaulting On Your Loans

Again, this is where we’ll talk about ways for you to stay out of default from the beginning to the end of your loan term. However, there are also some tips below to help you get out of default if you’re already there or on the brink.

Start Before You Sign the Line

The best way to avoid defaulting on your loans is to start before you ever even sign your loan paperwork. Take a good look at that paperwork and gather all of the necessary information, such as the interest rate, when your loan is due, what exactly happens if you miss a payment, and so on.

Next, take some time to think about other options. This can, of course, include other loan options. Gather information on several different loans and compare the terms.

Also, consider other ways to pay for your education. Grants and scholarships are available for people of all ages, occupations, genders, races, and more. If you do the research, you’re bound to find one or more that you can take advantage of. Every dollar you can get for free to help pay for your education is a dollar you don’t have to repay. So, whether it’s a $200 grant or a $10,000 scholarship, it’s worth the effort to apply.

Don’t forget that you can also pay cash for your education – and you don’t have to do it all at once. You can pay for a few credits at a time if you need to. This path might take a little longer to complete your program, but you won’t be graduating with debt, so it’s definitely worth considering.

If you like the idea of paying cash but don’t want to wait forever to graduate, take a look at other schools and compare the costs. Look into online programs or determine if a certificate program would be enough for your career goals. And you can split the cost of your program by paying cash for one or two classes a semester and getting loans for the others. Anything you can pay in cash means less debt when you graduate.

Take the Least Amount

If you’ve decided to go with loans, that’s okay. There’s still a way to save. When you apply for loans, they’ll typically offer you the maximum amount you qualify for. What most people don’t realize, however, is that they don’t always need that much for their schooling.

Instead, they’ll often get quite a bit back as a stipend. Some people use it to pay for a laptop or internet service. Some spend it on things they want. In either case, it’s money you don’t necessarily need. So, when you agree to a loan, ask for the minimum amount you need. This alone will make a big difference to the amount you owe at the end of your degree program.

Know Your Agreement

Your next step after taking out loans is to know the terms of your agreement – front, back, and sideways. Read over your paperwork several times until you understand fully what is expected of you, when you need to make your payments, how you need to set those payments up or make them manually, and so on. And be sure you understand exactly when and how interest accrues as well as what actions the loan provider will take if you miss a payment.

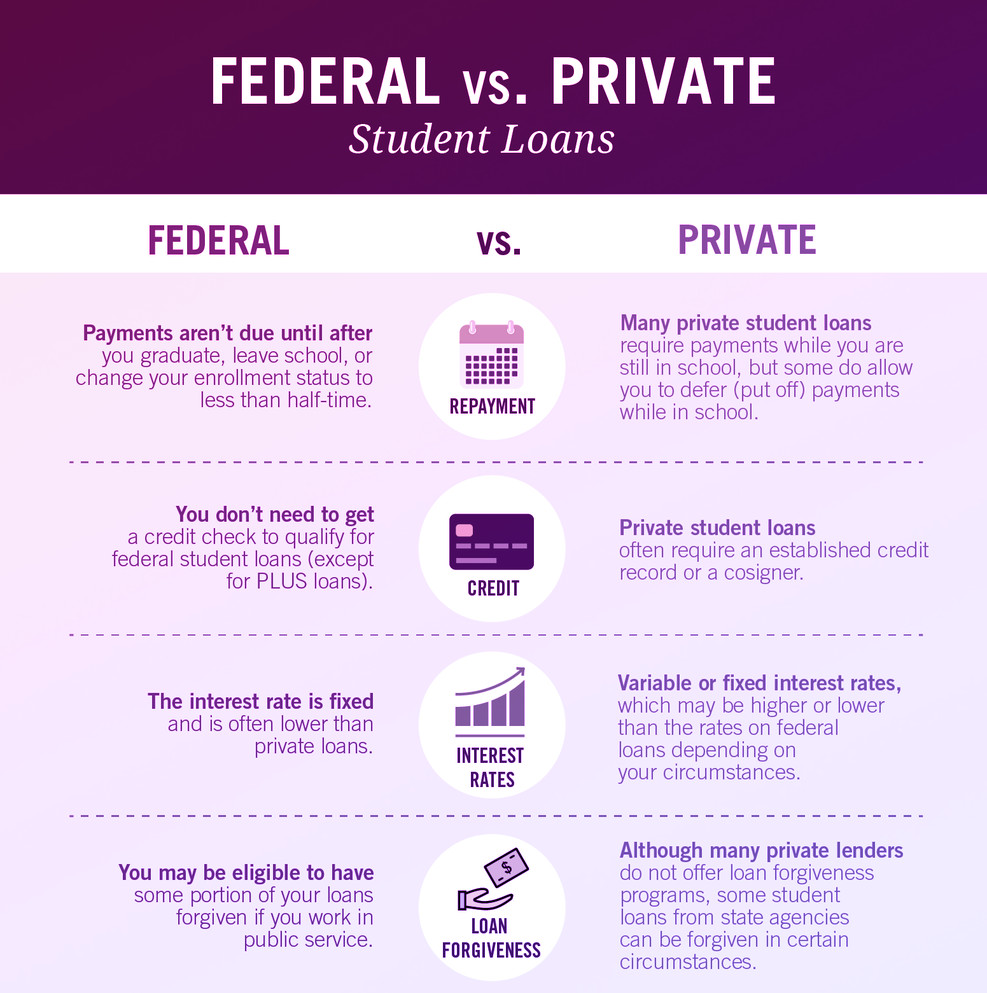

Understand, also, that most loans don’t come due until after you’ve graduated. However, others do. You need to know now which type of loan you have.

Make a Plan and a Budget

Alright, you know the terms of your agreement. Now, it’s time to make a plan to carry out that agreement. That starts by adding your payments to your budget. If you happen not to have a budget yet, it’s time to start one. Take advantage of the Budgetry store in the Goalry Mall to help you create and implement a budget that will keep you on track.

After adding your payments to your budget, you need to make sure you have the funds to cover them. Do some calculations to determine if there’s already enough money in your income to make those payments. If not, you’ll need to find a way to squeeze them in. This might be through cutting down on your coffee shop runs, picking up extra shifts at work, or being more careful with your grocery shopping. In either case, it’s time to determine where exactly your loan payments are going to come from, and commit to putting that money towards your loans.

Keep Up Online

Most loan service providers allow you online access to everything pertaining to your loans. Take advantage of this, as it can help you keep up with payments, access repayment options, and much more.

Defaulting on Student Loans – What to do?

While the steps above can definitely help prevent defaulting, we all know that things can go wrong. Sickness can keep you out of work. Your vehicle might decide it’s time to break down. In any event, stuff happens. Life throws curveballs, and it can throw you off track. So how do you keep from defaulting in those cases? The following tips can help.

Determine the Problem

First of all, you have to figure out what the problem actually is. Is it that your loan payments are due at the same time of the month that everything else is due? Do you just not bring in enough to cover the payments? Are there more unexpected expenses popping up than ever before and you simply don’t have enough savings to cover them?

Whatever the reason you’re having trouble making your payments, write it down. In some cases, you might be able to fix the problem simply by revisiting your budget, cutting down in some other areas, or being more vigilant with things like car maintenance. However, if you’re having an ongoing struggle to pay your loan payments, the following tips can help.

Communicate with Your Loan Provider

One of the first steps to take is to communicate with your loan service provider. Believe it or not, most people are willing to help you as much as they can. And collection methods cost money, so they’d much rather find a way to work with you than have to pay to collect their money. Call your provider, discuss the situation, and find out what options they have to help.

Look At Repayment Plans and Other Options

When you’re having a hard time paying because you don’t have enough income, there are a few ways to address this. Consider ways to make some extra cash, like a side hustle or working a few extra hours a month. You might dig into blogging, selling printables, or other ways to make side cash without spending too much time doing so.

Another option is to look into Income-Driven Repayment options. These base your payment amount on your income and can significantly decrease your monthly payment. In fact, if your income is low enough, it might just take your payments down to zero.

Please understand, though, that this doesn’t make your loans go away. It will actually increase the length of time you owe them. So if you need an income-driven repayment plan, take advantage of it. However, while you do, try to formulate a way that you can start paying your loan payments in full so that you’re not paying for them until past retirement.

Getting Out of Default

What happens if you’ve already defaulted on your loans? Well, you’re probably overwhelmed and afraid of what’s going to happen, but take a breath. You can still get out of this with some commitment and work.

Do An Assessment

Just like handling mishaps, the first step should be understanding what went wrong. What situations caused you to default? Are the payments too high? Did you lose a job? Did you miss work due to a death in the family? Write down everything you can think of that went wrong so you can take the necessary steps to address it.

Talk to Your Loan Service Provider

This should be your next step. Depending on the reason you defaulted, there are often programs available to help. For example, some providers offer help if you’ve suffered a job loss, medical issue, or loss of a loved one. However, you might not find out about any of these programs until you communicate with them.

There are also options like loan consolidation and loan rehabilitation. Loan consolidation means that you pay off all or a portion of your student loans by taking out a new loan. This can be helpful for some people, especially if they are able to get lower interest rates or more favorable terms.

Loan rehabilitation is a program through which your loan service provider agrees to accept “reasonable” payments for a set period of time, and then your loans come out of default status. Typically, “reasonable” payments mean they calculate 15 percent of your annual discretionary income, divide it by 12, and then accept that amount for around nine months.

After talking to your provider, you will get a better idea of what’s available to you and how it might help. Be sure to compare all the options provided so that you can make the best choice.

Look Into Other Loans

Let me start this by saying that this is not the best choice for everyone because you’ll not always find a loan that matches your needs. However, it is a good option to consider and look into. All you need to do is determine what – if any – personal loans you might get approved for. Compare their terms and interest rates with those of your student loans. If the terms and interest rates are better, consider applying for those loans and pay off your student debt.

Conclusion

Defaulting on student loans can lead to many problems, but it can be challenging to prevent it from happening. Remember the old saying, “Where there’s a will, there’s a way.” This saying is true, but it can take some time and dedication to find that way. Still, take heart. Remember, you’re not the only one fighting this battle, and even in the toughest times, it’s a battle you can win.

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.