Usually, when someone is searching for a personal loan to alleviate their financial troubles, they are concerned with how this will affect their credit. Often times, people imagine that getting any type of loan will be bad for their credit. This is not necessarily the case. If you use a personal loan responsibly and pay it off on time, then getting a personal loan can actually improve your credit. If you are asking yourself, “Is it really possible for a personal loan to help credit?” then read on.

How Can a Personal Loan Help Credit Score

Whether or not you have a good or bad credit score can have an effect on your chances of getting a personal loan, but getting a personal loan can also have an effect on your credit score. This effect can be positive or negative, all depending on you and your actions. Below are some ways in which you can use a personal loan to improve your credit score.

Building a Credit History

It is hard to improve your credit score when you have no credit at all. It can feel like a vicious cycle, trying to apply for a credit card without any past credit. You get denied because you have no past credit. But then you cannot improve your credit by using a credit card and paying it off on time every month. Luckily a personal loan can be a good credit starter. By taking out a personal loan that you can repay monthly, you are showing lenders that you can have a positive relationship with credit.

Repaying the Loan on Time

By taking out a personal loan and then repaying it with reasonable monthly payments, you can prove that you are credit-worthy. Repaying your loan on time is essential to this strategy. By repaying the loan, including interest, on time, you can prove to creditors and lenders that you are credit-worthy. This can increase your credit score, as well as better your chances of getting the loans you need in the future, with much better interest rates.

Pay off a Credit Card

Getting a personal loan to pay off a credit card can help improve your credit score. Using a credit card can in itself help improve your credit score. Having credit cards and using them regularly can help you build credit. When you make purchases and then pay them off, you can end up with lower interest rates and a better credit score. If you cannot pay off the entirety of your credit cards alone, then a personal loan can assist you in spending more (and covering the expenses) while you continue to build credit at the same time.

Consolidate Your Debt

A personal loan can help you consolidate your debt, which improves your credit score for many reasons. One way debt consolidation loans increase your credit score is by allowing you to get rid of your debt faster. By decreasing your debt at a quicker rate, you will have less debt to show on your credit report. Besides having less debt, the type of debt for a personal loan does not affect your credit score as much as the debt on a credit card does. A personal loan is an installment loan. So your credit score will be less affected and you will have more access to available credit. In addition to this, the creation of a more varied mix of credit types will increase your credit score.

Types of Personal Loans?

A personal loan can be a great option for getting cash quickly. No matter what your current financial status is, you may find yourself in a bind due to unexpected circumstances. Whether you need an emergency medical procedure done or need to relocate for a new job, a personal loan may be the right choice for you.

It’s important that you go to the right lender when taking out a personal loan. Once you have decided that you definitely want to get a personal loan to help credit it is important to understand what your options are. There are many types of personal loans to choose from.

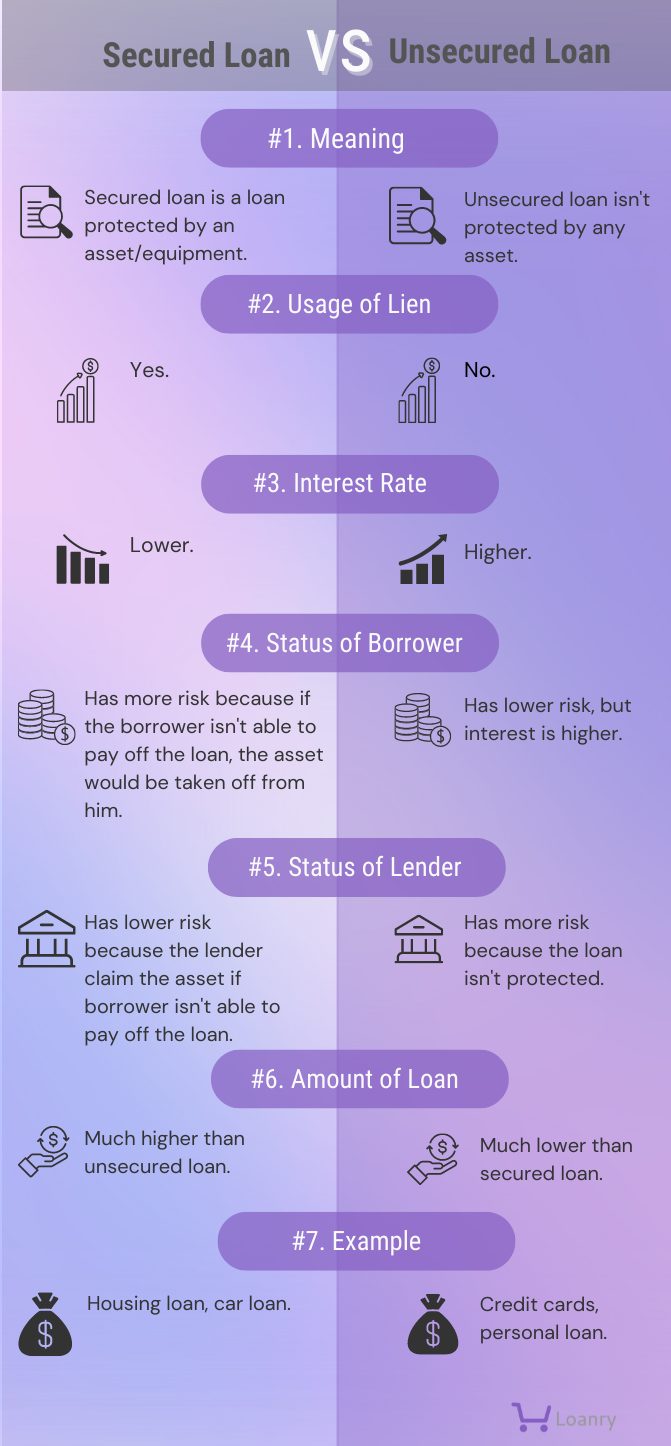

Unsecured Loan

An unsecured loan is a type of personal loan that does not have a call for collateral. Because there is no collateral used to back up the loan, an unsecured loan tends to be riskier for lenders to give out. While this type of loan can be fast and easy to get, the interest rates and fees tend to be higher.

For instance, Joan has a couple of credit cards that she was offered through the mail. On one of these credit cards, Joan spent $2,000 on various purchases. These credit cards are examples of unsecured loans, since there is no collateral used to back up the loan. If Joan does not repay the credit card company for the $2,000 of purchases, then they cannot automatically take her home or car to make up for their loss. If Joan does not pay this money back, then her case can be sent to a collection agency.

Secured Loan

A secured loan is a type of personal loan that does have a call for collateral. Collateral is some type of asset that can be used by the lender to recover the money that was lent, in case the borrower does not pay it back. Collateral is oftentimes a car or a home. The process of getting a secured loan is lengthier than the process of getting an unsecured loan. But the terms tend to be more favorable. One type of secured loan, a home equity line of credit (HELOC), is like a second mortgage, where your home is put up as collateral.

For example, Michael bought his car when he had a great job. He had worked for the same company for several years and had just been promoted. He felt like he could rely on his position at his company to last for several more years. Because of his comfortable financial situation, Michael bought the best car on the lot. He chose the biggest car, with all the new features. He loved his new car and always showed it off to his friends. Unfortunately, due to budget cuts, Michael lost his job a few months after his big car purchase. He tried to renegotiate the monthly payment of his new car, but he was unsuccessful. Because Michael could no longer make the monthly payments, his nice, new car was taken back as collateral.

Open-End Credit

Open-end credit refers to a credit option where you can “withdraw money as you need it, over an extended period of time.” This can be beneficial if you need to continuously withdraw small sums of money for individual expenses. In most cases, you will not even have to pay interest rates on the money that was not withdrawn from the account. Open-end credit can be done through lines of credit and credit cards.

For instance, Ross just got his first credit card. Ross is excited to have his first credit card, as he is also starting college next week and finally feels like an adult. Now that he even has his own line of credit. Ross is also excited that he has a credit card with no preset spending limits, so he can buy what he wants when he wants it.

During his first month at school, Ross buys a new telescope, new flat-screen TV for his dorm room, the newest gaming system, and tickets to a Taylor Swift concert. Ross was living it up until he realized that he actually does have to pay all of this money back to the credit card company. There was no collateral to back up the lender’s money. So they had to send Ross’s case to a collection agency. Instead of enjoying the Taylor Swift concert with his girlfriend, Ross had to work double shifts at the planetarium to pay off his debt.

Closed-End Credit

Closed-end credit refers to a credit option where you are given a set lump sum. This is an example of the traditional idea of loans. You borrow a set amount of money that you must pay back, including interest, over a set period of time. This can be beneficial if you need a large amount of money at once. If you get a single payment loan, then you will have to repay the full amount you borrowed, plus interest, in one sum. Closed-end credit can be done through appliance loans or consumer installment loans.

Imagine, Billy has always gone to the lake with his family for summer vacation ever since he can remember. Now that Billy is starting a family of his own, Billy wants to continue this tradition of taking his wife and kids to the lake for summer vacation. Since Billy and his family loves to water ski, he decides it would be a good investment to buy a boat.

He would save more in the long-run by buying his own boat than by renting a boat every summer. Billy doesn’t have enough money on-hand to pay for a boat though. So he finds the boat he wants and then searches for a boat loan to cover the immediate expenses. With the large lump sum he gets from the closed-end credit boat loan, Billy is able to afford the boat his family wants.

Bill Consolidation Loan

A bill consolidation loan is a type of loan which allows you to consolidate all of your debts into one loan that you can repay at once. This type of loan helps you pay your debts sooner, thus saving money in the long run. It is also easier for you to keep track of, since it is only one monthly payment instead of several different monthly payments. On the other hand, if your credit score is not very good, you may end up being stuck with high-interest rates.

For example, Kristi is excited about her future. She just graduated with her undergraduate degree in business and finance, and she has already been offered a job at a large consulting firm in Chicago. Kristi knows that she has a bright future ahead of her, as well as a larger-than-average starting salary. The only problem is that after her six-month grace period, Kristi will start having to pay back her student loans.

Kristi has enough money with her new salary to pay off the student loans every month. But she has trouble with all of the adult stuff she has to take care of and keep track of. She has to get her own health insurance, pay rent on her apartment, and find a cable company to take care of her Internet and TV connection. For Kristi, it makes sense to consolidate her student loans into one loan, so that she only has to pay one monthly payment. She finds out that with her consolidated loan, she even gets to pay a lower interest rate on her loan(s) now.

How Do I Know How Bad My Credit Is?

Do you know what your credit score is? If not, no problem! There are many online sites that allow you to find your credit score for free. Figuring out how bad, or good, your credit is is the first step in finding the right loan for you. If your credit score is not as high as you would like it to be, do not despair! “Getting a personal loan to help my credit” is a common solution.

But what even is a “good credit score”? Your credit score, which “expresses your relationship with credit in a three-digit number,” is good if it is between 700 to 749.

Some creditors will say that they consider anything above 720 excellent rather than just good. Some consider anything over 750 as being excellent. These numbers may not mean much to you on the surface. But it may help you to understand where these numbers come from. Here are a few of the things that make up what your credit score is:

Paying Off Debt

When you apply for a loan or financing of any kind, creditors are interested in seeing what your relationship is like with credit in the past. This means, did you pay the balance of your credit card statement every month? Did you pay the monthly payments on any past loans you have gotten, and did you do so on time? Creditors want to be assured that like a Lannister you always, or at least most of the time, pay back your debt. That way they feel comforted that you will repay whatever they lend you.

Where Creditors Report

There are three major credit bureaus that record credit scores: Equifax, Experian, and TransUnion. When a creditor, such as a place where you have a store credit card, reports your credit, they will only report to one or two of the three major credit bureaus. But definitely not to all three. Because of this differentiation in reporting, not everything will necessarily be considered in each credit score. So you may only fall in the fair credit set with one credit bureau, while you may fall in the good credit set with another credit bureau.

Landlord Credit Check

The fact that creditors do not report everything to all three major credit bureaus could be beneficial to you, while at other times it could set you back. In some cases, you may even be able to run your own credit report. For a landlord credit check, you can choose the credit bureau where your credit score is best. On the other hand, you cannot tell the bank which credit bureau to use in their credit check of you. So this will not always be possible.

Why Is Having Good Credit Important

Now that you have a better understanding of how credit scores and credit reports work, it is important to understand the importance of having good credit. Though you can still do (almost) anything with bad credit that someone with good credit could do, having good credit does make life easier. Here are some reasons why having good credit is important:

✓Being Credit-Worthy

Since having a good credit score reflects your relationship with credit, having a higher credit score means that there is a greater chance that you will repay your loans, in full and on time. While this may not necessarily true, it can be a good indicator. Because of this, having a good credit score increases your credit-worthiness as seen by lenders.

✓Easier to Find an Apartment

Once you find the apartment you want, you don’t want anything to stand in your way of being able to get it. If you have good credit, then a landlord will see you as a qualified applicant. On the other hand, if you do not have good credit, then you may not be a qualified applicant in the eyes of the lender. This could decrease your chance of renting the apartment you want.

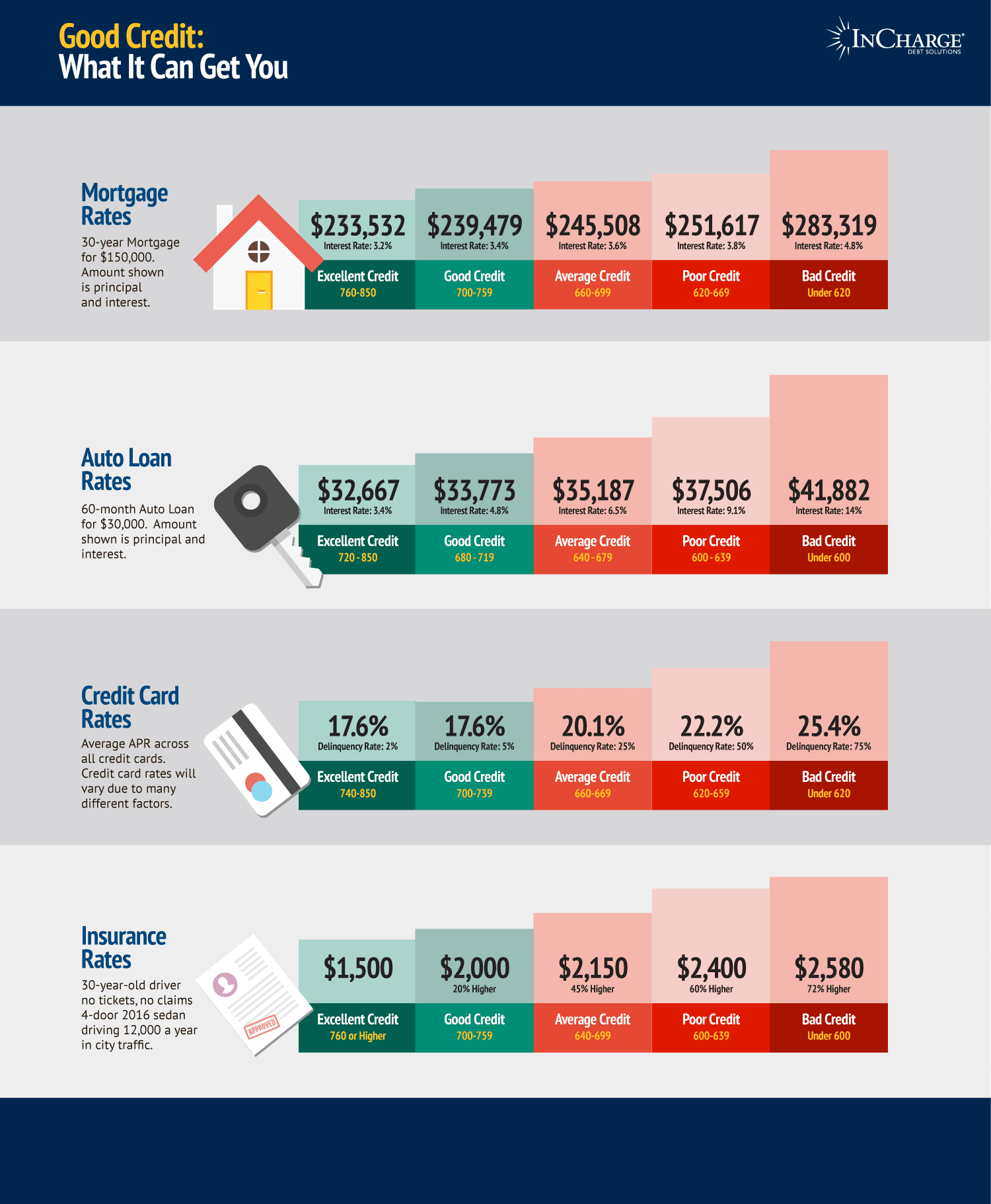

✓Lower Interest Rates

If you have bad credit, then you can still get personal loans, just like someone with good credit. The difference will lie in the terms and conditions of your contract. If you have a good credit score, then you will have lower interest rates than someone who has bad credit. Having good credit could save you money in the long run. Since you will have to pay less in interest than someone with bad credit will have to pay in interest.

✓Be In The Know

It is essential to be in the know when it comes to your credit. Being in the know allows you to make educated decisions about your financial situation. Also, you can prevent any previously unforeseen issues. For instance, when you know you have a major purchase coming up in the next 6 months, you should run a credit from at least one agency.

Because consumers are allowed to get one free credit report per year, it is important to use them when they could have an effect on upcoming purchases. Being in the know also means that if there is somehow a mistake on your credit report, then you can easily spot it in a timely manner. If you do that, you can dispute and have them removed before it has the chance to affect you negatively.

Can I Even Get a Loan With Bad Credit?

Anyone can get a loan, no matter what their credit score is. Though it will be easier for someone with good credit to get a loan — and with a better interest rate — it is still possible to get a personal loan with bad credit. Getting a loan with bad credit is at least easier than getting a loan with no credit at all.

If you have been rejected for more traditional personal loans, then you may still be able to get a personal loan for bad credit. Loans for bad credit can help you get the cash you need, even if you have a low credit score. Typically, there are two reasons for taking out this kind of loan. The first is to cover emergency expenses and the second to rebuild your credit score. Loans for bad credit can be beneficial to your financial future by restoring your credit. Making timely payments on your personal loan for bad credit can show that you are reliable. It also shows you’re likely to pay off future debts, and increase your credit score.

Though you should always shop around for different loan options, credit unions specifically tend to offer options for bad credit. Because of this, you should consider looking for personal loan options at your local credit unions before searching with other sources of credit and financing.

Conclusion

Remember, even if you don’t already have good credit, or if you have no credit history at all, there’s a solution. Getting a personal loan to help credit can kill two birds with one stone. You can get the loan you need and start building your way to great credit.

Grace Douglas is a master candidate in international security management by day and a personal finance writer by night! With powers in finance, writing, and languages that she received by being exposed to high dosages of university courses and being bitten by booklice while working in a rare books library, Grace loves to use her powers for good rather than evil. If you need help with budgets or personal loan questions, then just call Grace, your friendly neighborhood FinanceWoman!