Limited finances can impede your special day. A lack of money does not have to be the end of the road, though. Did you know that there are loans for wedding expenses? Furthermore, you can get wedding loans online that come with a quick and easy application process.

You can essentially be strapped for cash one moment a have all the money you need for your big day the next with the possibility of wedding loans online. Read on to learn more about loans for wedding expenses.

Unlike traditional personal advances, loans for wedding expenses may come with faster approval. Since traditional banks are not the only financial institutions that grant such advances, it is very possible to get wedding loans online in a matter of minutes. Such a fast approval process really helps when you are in a bind and need to give the caterer a deposit today instead of tomorrow.

In short, a wedding loan is a personal loan. You apply for an advance to pay for your wedding and agree to pay back the amount with interest.

How Do I Get Wedding Loans Online?

One of the main benefits of wedding loans online is convenience. You can apply for wedding finance from home or your mobile phone. Some banks even let you sign and submit documents online so that the whole process is seamless.

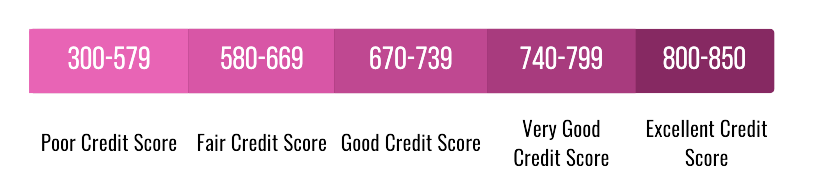

You should know that wedding loans, in all of their convenience, come with certain income and credit requirements. Lenders typically want you to have good credit.

A credit score greater than 700 points is usually considered good credit.

You also need the income to support the loan. Paycheck stubs are the best way to prove income. It is a good idea to seek a loan with monthly payments that consume no more than 10 percent of your net monthly income. You should, therefore, search for an advance with monthly payments no higher than $300 per month if you earn $3,000 per month.

Lenders also factor in your debt-to-income ratio. You may want to think twice about looking for wedding loans online if you are already over-extended. Remember that your overall debt, notwithstanding monthly mortgage or rent payments, should be no more than 30 percent of your monthly income. You should factor in your monthly car note as well as credit card commitments before applying for a wedding loan.

Bank statements are one of the best ways to prove stability when applying for wedding loans online. Three months of your account being in the black shows lenders that you do not live beyond your means on a regular basis. You may also consider uploading a utility bill that shows a current status to prove that you make timely monthly payments.

Can You Be Denied by an Online Lender?

As with any personal loan, wedding loans online are not guaranteed. You may be denied funding if you do not furnish proof of income or if your debt-to-income ratio is too high. Remember that lenders want a return on their investments. Your borrowing is an investment that needs to be repaid within the given time frame.

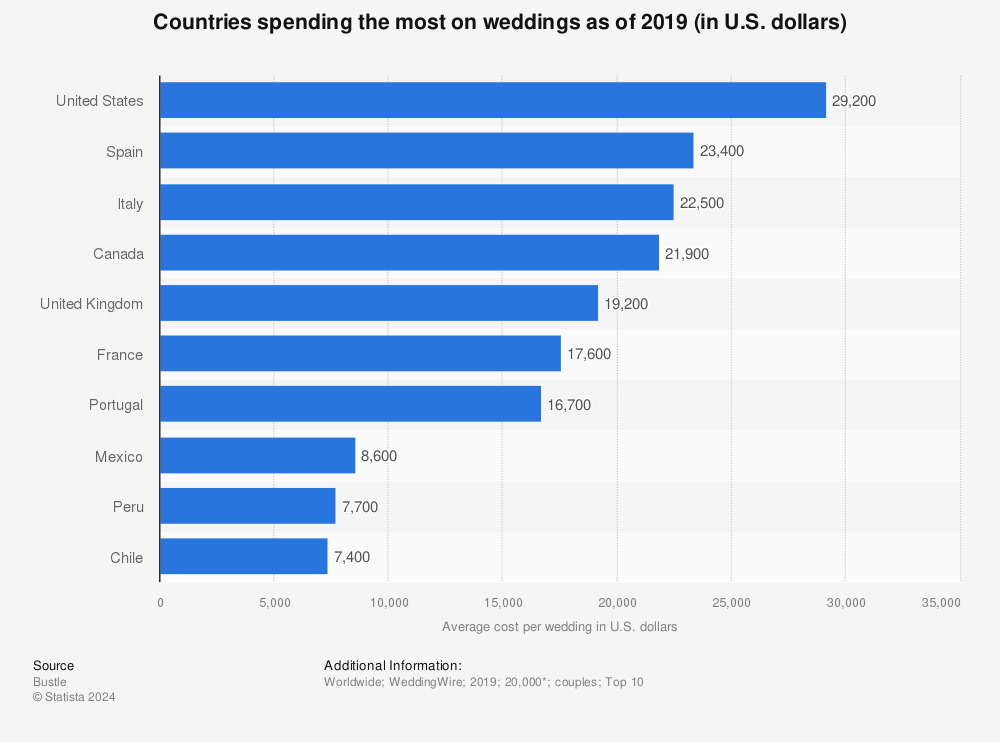

Did you know that the cost of wedding ceremonies and receptions are at an all-time high in the United States? On a national scale, couples spend upwards of $23,000 for expenses. That figure was about $7,000 less than two years ago.

Some lenders do not take a chance. They will deny you outright if your credit score is not good. There are other financial institutions, though, that specialize in wedding loans for bad credit. These firms may approve you even if your credit score is low.

Of course, wedding loans for bad credit may require double the income and more collateral. You may even need a co-signer to provide the extra backing that you need for approval. Still, all is not lost if you have less-than-desirable credit and need wedding finances.

Who Should Look for Wedding Loans Online?

Any couple looking to tie the knot within the next few months should consider wedding loans online. An advance could be the thing that you need to keep the ship sailing.

You should be mindful when borrowing. Remember that a wedding loan is a personal loan. It may not be the best idea to immediately reach for an application if you do not have a budget. How would you know how much you need to borrow?

How to Make Wedding Loans Online Work for You

The key to getting the most out of any personal loan is responsible borrowing. You would not buy the most expensive car on the lost just because you have the means to do so. Why, then, would you buy the most expensive dress in the shop just because you have the cash?

Proper budgeting tells you what you need and what you want. You have to buy the essentials. You can forgo a few of the things that you want if it means your wedding will be less expensive. Then, you can approach the borrowing process with a figure that is sensible and not extreme, which means that you will not have problems with repayments. Of course, the loan officer can also help you determine affordability so that you are sure to agree to a loan that truly fits your means.

Why Not Use a Credit Card?

Some couples choose wedding loans the route of working with what they have. There is nothing wrong, after all, with going for a cheaper venue and forfeiting the best chef in town. Other lovebirds refuse to trade in their dream wedding for something frugal. You may find such persons using their credit cards to pay for everything.

There is certainly nothing wrong with putting all wedding expenses on your credit card. Some experts even say that using such a method comes with benefits. Credit cards come with protections against fraud. You may, in other words, be able to recover funds if things are not on the up-and-up with a vendor. What about all the cons, though?

Anyone who has ever had a credit card knows that the comfort of a revolving loan is dangerous. You may not reconsider items on your budget if you know that you can just charge these things to what seems like a never-ending source of funds. In the end, you could find yourself in mounds of debt with an extremely high-interest rate.

There is little worse than starting your new life with your spouse on the wrong financial footing. Such is the reason why those considering credit cards as a funding source should look into wedding loans online.

Interest Rates on Wedding Loans Online

It is true that loans for wedding expenses come with interest rates. The amount that you pay in interest on a personal loan, however, is minimal when compared to that of a credit card. Some of the best credit cards charge around a nine percent interest rate. Cards for bad credit are even higher with some rates getting into 25 or even 30 percent. Imagine having to pay 30 percent on top of $35,000 plus additional hidden fees. Suddenly, the wedding of your dreams turns into a $70,000 nightmare.

Credit cards are great for emergencies. They are not ideal for ongoing expenses and certainly not the first thing you grab when paying for wedding expenses. Wedding loans online are a more economical way to pay for costs related to your big wedding day.

Is Home Equity an Option for Wedding Funding?

Some parents on the hook for funding the daughter’s wedding may look into home equity loans. These types of advances have more cons than pros.

For those who do not know, a home equity loan is an advance that you take out against the mortgage of your home. You basically tell the bank that you want to borrow against the savings accrued from your timely mortgage payments. You agree to pay a home equity loan back with interest just as you would a personal loan.

The main issue with these types of advances is their direct connection to your home. You run the risk of putting your dwelling place in jeopardy if you default on a home equity loan.

Meanwhile, wedding loans online do not come with the risk of you losing everything if you happen to miss a few payments. Of course, responsible borrowers who only use what they need do not run into the problem of defaulting on loans. Still, wedding loans online provide the comfort of you knowing that your home is not up as collateral.

Can I Save for My Wedding?

There is definitely nothing wrong with saving for your wedding until you have enough money to pay for one like your dreams. Even careful planning comes with loopholes, though. How will you hold your space if the venue that you want requires a deposit several months in advance? Furthermore, what about the other contributors who make your dream wedding possible? They, too, want a deposit.

Wedding loans online are ideal for careful planners because they cover unexpected costs. Instead of re-arranging your timeline so that you can give the caterer his first payment, you can simply find an advance to finance your immediate need. You have still performed your due diligence of saving and budgeting. The loan is just the money you need to tide things over.

The most successful weddings have organized budgets. You should have a general overview of what you want and how much it will cost to make your dreams a reality. Some planners use a spreadsheet to get their ideas on paper. They then shop around for the best prices and compare several options before deciding what they want to do.

Creating a budget in this way lets you find the most frugal sources and prevents you from spending too much for too little. So many couples are excited about their big day and forget to ask vital questions during the initial interviews. Taking down vital information and revisiting such concepts at a later date may provide more clarity.

Another element of budgeting that couples miss is setting a figure. You should establish how much you want to spend before searching out venues and caterers. Using this method sets a stopping point for you and your lover. You may have to turn down the best coordinator in town if her price is $20,000 and your budget for the whole event is $35,000. You would probably be tempted to hire her, though, without an established stopping point.

In many cases, having a stopping point is why some couples reach for wedding loans online first. You know that you cannot go over $50,000 if that is all that your wedding loan will allow. But you may be tempted to overstretch if you only use your saving or checking account. You do, after all, get paid every two weeks and can always make it up on your next check.

Wedding loans online and budgeting essentially go hand-in-hand. You cannot have a great borrowing experience without first establishing a budget. You also cannot sustain a great budget with a stopping point unless you have the firmness that comes with an advance.

But Doesn’t a Wedding Loan Add More Debt?

Some lovebirds shy away from the idea of wedding finance for fear of not being able to pay back the loan. “We are starting our lives together,” some couples think. “We do not want to begin in debt.” The truth is that you will begin your lives in debt with or without a wedding loan.

Unless you marry fresh out of high school, you and your spouse probably have credit cards and mortgages with which to contend. Both of these elements are forms of debt. You are in even greater debt if you buy or lease a car. The lender expects your payments on time as does the car insurance company.

In reality, the notion of having a fresh start is just an illusion. Both your spouse and yourself bring bills to the table. Why, then, would you choose to make things more difficult by trying to fit the cost of a wedding into a budget that is already complicated by the bare necessities?

Wedding loans online give you the relief and cushion that you need to plan the wedding that you deserve. You do not have to worry about robbing Peter to pay Paul when you secure separate financing for your big day.

Final Thoughts

Wedding loans online are the ideal solution if you are stuck in a temporary bind and need cash for your wedding fast. The approval process may be quick and easy so that you can worry about other things surrounding that big day.

Use our services when you want to find wedding loans online. Our database may be able to connect you with the right lender. Get started on the path of wedding financing today!

Theresa Hammond is a single parent who learned the basics of personal finance the hard way. She now spends her days researching and writing about financial tips and tricks that are relevant to everyday people. She’s also raising two children who have more financial sense than she had before the age of 21. Her writing extends from personal finance to health, wellness, and even a bit of fiction.