If you have bad credit and you need something, you may have to seek assistance from bad credit lenders. Bad credit lenders are companies that will issue loans to people who have sub-par credit scores. These lenders issue auto loans for bad credit, personal loans, and other products that consumers need to get by. You might have to talk to a bad credit lender if you’ve had trouble getting financial products from traditional lenders. However, you need to know some of the secrets that such lenders don’t want you to know about their practices and procedures.

Facts About Bad Credit Lenders

Make sure you read through our list and educate yourself before you take a credit card for bad credit or a loan from bad credit lenders. These are the top things that they don’t want you to know.

☛The Interest Rates Might Be High

One thing that you should know about bad credit lenders and their products is that they may be expensive. Bad credit lenders want to make sure that they will get their money back and make a profit, as well. They sometimes boost the interest rates on their loans to compensate for a person’s risky creditworthiness. It could put you in a real bind if you don’t research it first and find out the terms before you sign on the dotted line. Make sure you ask about the interest rate of the loan before you take it.

Some loans are good, but some are more trouble than they’re worth. You want to make sure you’re getting a loan that you can handle, and it doesn’t cost you three times the amount of the loan proceeds. It might be best to get some help from a company that has connections with fair lenders.

☛You May Have to Use Collateral

Another thing you have to watch out for when you deal with bad credit lenders is collateral. Some lenders will give you a loan if you have bad credit only if you agree to put up collateral. Collateral is something of value that you can offer the lender in case you default on the loan. It might be the deed to your home or the title to your car. Those are the most common collateral types. Lenders may also take other offerings such as stocks, bonds, CDs, precious metals, and the like. The goal is not to take your goods away.

The goal is to simply ensure that you repay the funds you borrow. The lender might feel more secure by placing a lien on your property until you pay your loan entirely. The lender will release the lien as soon as you pay all the funds back. It’s as simple as that. Keep this simple fact in mind when you consider getting bad credit loans to pay off debt.

☛The Term May Be Short

You may also find that you have a minimal amount of time to repay the advance you get from the provider. The amount of time you have to repay a loan from a bad credit lender will depend on what type of bad credit loan you get. An installment loan may provide you with 90 days to one year of leeway to repay the advance.

On the other hand, a payday loan will only give you about 14 or 15 days to make the payment. If you go the way of a title loan, then you’re looking at about 30 days to return the funds to the lender. Don’t jump into any loan quickly or lightly. Make sure you review your options before you make a final decision on a financial product.

☛There Might Be Hidden Fees

The interest rate isn’t the only thing you have to worry about when you deal with bad credit lenders. Your “loan package” may also come with some hidden fees that you can miss if you don’t pay attention to the fine print and such. Examples of some charges that the lender might add to your loan are processing fees, approval fees, and late fees.

There might even be some fees attached to the loan of which you’ve never heard. Again, research and patience are the keys to success when you’re looking for the right loan product for yourself. You should have a financial expert help you sift through the available lenders to find your perfect match.

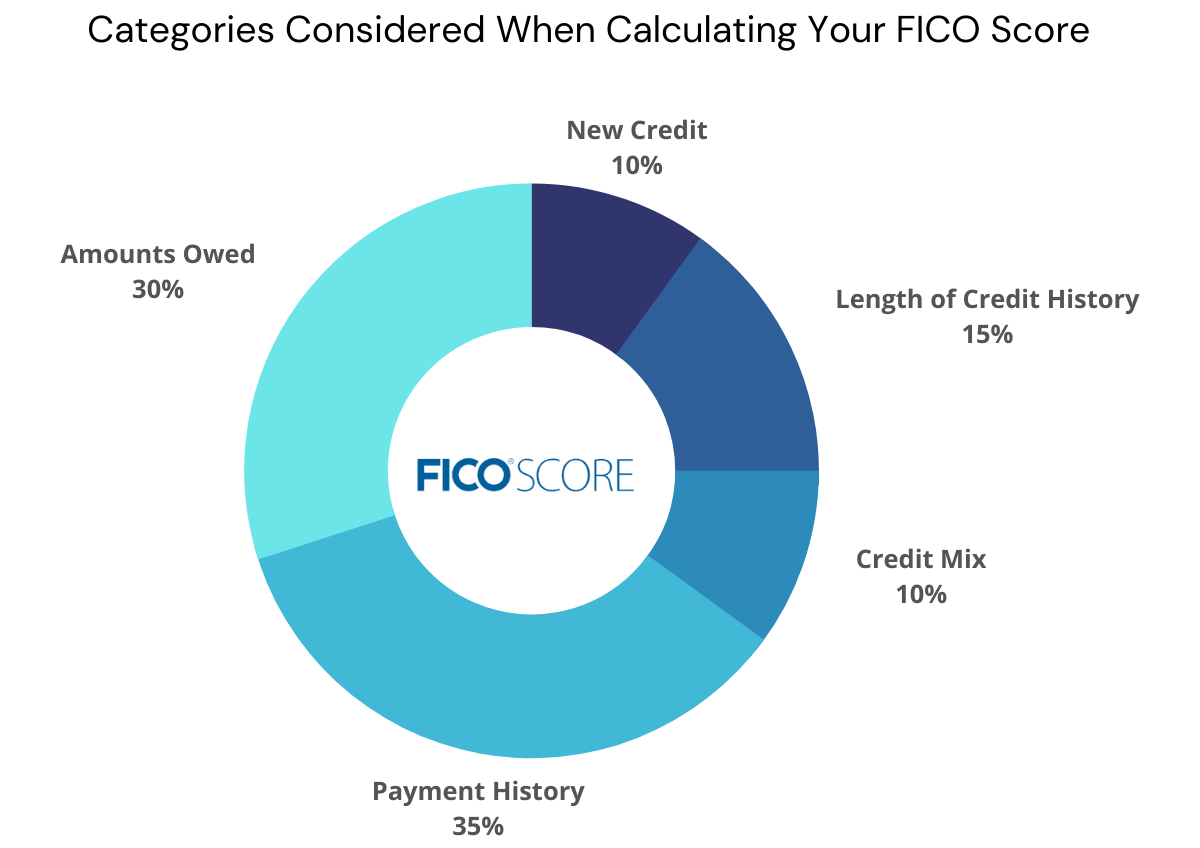

☛They May Still Check Your Credit

Many bad credit lenders boast about their customers not needing good credit to get cash advances. However, some of them still check your credit. They may do a soft pull just to verify your identity and make sure that you are who you say you are. Other bad credit lenders will look at your credit score the same way a traditional lender looks at it. They may deny you a cash advance, as well.

Some of them say that they approve over 99 percent of their applicants. While that is a high percentage, you still may fall into the percentage of people who don’t gain approvals. You never know.

☛A Bad Credit Loan Can Still Affect Your Credit Score

Keep in mind that a bad credit loan can still affect your credit score even if the lender doesn’t use your score to qualify you. If you fall delinquent, a bad credit lender can still report your delinquency to a credit bureau. A delinquent loan can make your credit score go down significantly, and it can cause you more problems getting approved for the products you need in the future. The lender still has the right to do debt collections on you, as well. Your debt will subject you to the same harassment and negative profile notches that you could get from a traditional lender.

☛Short-Term Loans May Be Limited

Many short-term loans for bad credit are limited in loan amounts. For example, you may only qualify to receive $100 the first time you borrow something from a bad credit lender. That might not be anywhere near the amount of money you need for what you’re trying to do. The good news is that some other lenders may offer you up to $2,500. The even better news is that you can get much more than that if you own a new vehicle. A brief consultation with one of our agents can bring your needs to light. We can then get you in contact with some companies that are designed to meet those needs.

☛You Might Have to Have a Bank Account

Some bad credit lenders will require you to have a bank account in good standing. That means that it should be active for at least three months before you can use it to secure a bad credit loan. Also, your bank account will have to have a positive balance, and you cannot have any insufficient funds transactions or anything like that.

The reason they ask for a bank account is that they will use it to disburse your funds. When it’s time for you to make your first payment, they will use that same bank account to deduct it. Bank account transfers make loans and repayments easy and hassle-free for everyone involved.

☛Some Bad Credit Lenders Are Better Than Others

The world did not create bad credit lenders equally. Some lenders care about the customers, and they do everything in their power to treat them fairly and give them the money they need for their emergencies.

The world did not create bad credit lenders equally. Some lenders care about the customers, and they do everything in their power to treat them fairly and give them the money they need for their emergencies.

Other lenders, however, do not have the customer’s best interests at heart. These lenders behave like loan sharks. They do not work with their clients or give them the benefit of the doubt. They charge sky-high interest rates and give their clients no time to repay their loans. You don’t want that kind of lender. You want a lender that has a compassionate and caring nature. We can help you find such a lender.

☛You Still Need a Qualifying Income

Even though you are applying for a bad credit loan, you still have to meet certain criteria. One of the qualifying factors might be your income. Generally, bad credit lenders like to see an income of at least $1,500 a month before they will consider giving you loan proceeds. You will most likely have to submit four pay stubs for them to review so that they can make their decision.

You Could Lose Your Collateral

If you put up collateral for your bad credit loan, you have to make sure that you can repay the advance on time. Bad credit lenders will put liens on your property, and the liens will give them the right to take your property as a means to get their funds back.☛Bad Credit Loans Are Best for Emergencies

Because of the fees and interest rates involved with bad credit loans, they are best used in emergencies. You should first see if there’s any other way you can get your hands on the funds you desire. Try talking to family and friends. See if your employer is willing to offer you an advance. Try some applications that can help you get funds from your paycheck. If you can’t solve your issue with any of those solutions, then you may proceed to the bad credit lenders and complete an application.

☛You Should Read Reviews

You should always read consumer reviews before you sign up for anything, including a bad credit loan. Consumers are very honest about the experiences they have with lenders, and they are willing to tell the stories. Read through a large number of reviews to see if you come across any repetitive complaints. This can be very helpful if you want a loan for your new car or to travel somewhere. Be suspicious of any company where you read a lot of negative comments.

☛The BBB Score Tells a Lot

Check with the Better Business Bureau and see if the company you’re considering has an account with them. The BBB score measures the number of complaints and complaint resolutions each company has, and it comes up with a grade score based on that information. You should only consider doing business with a provider that has a rating higher than a C.

☛You Should Review Your Budget

Most importantly, you must review your budget before you take a loan from bad credit lenders. Let’s say that you need a bad credit loan to cover your wedding expenses. It is important to calculate your disposable income and make sure that you will have the funds to repay the provider after you calculate the interest and fees. If everything looks good, you can feel confident completing an application and asking for help from the provider.

In Conclusion

Now you know a lot of the truth about bad credit personal loan lenders. They are not all bad by any means. Some lenders are very kind and courteous to debtors, and they genuinely want to help those people get the products they need. Our company works with a variety of lenders. We connect people with all credit scores with the lenders that match their needs and their situation. We have been assisting consumers for many years and have helped a multitude of people. Contact us by telephone or short form. We would love to assist you if you need a loan, and you think you have a bad credit score.

Let one of our agents know that you’re looking for loan products for low credit scores. The agent will join you in your journey to find a reliable lender who will most likely approve your request. We will try our best to help you, but you have to reach out to us to get the process started.

Timiarah Spriggs is a personal finance writer who specializes in credit score growth and smart budgeting. She share budgeting, saving, and financial planning advice with various renowned finance shows, podcasts, and finance sites. Timiarah discovered the world of personal finance out of necessity. Her passion lies in helping consumers stay afloat in the world of finance and become masters of their profiles.

This lender provides various types of loans, including secured and unsecured options. They offer loans in varying amounts from $1,000 to $20,000. The better your credit is, the more they are willing to lend you. They offer repayment terms of 2, 3, 4 or 5 years, so they are incredibly flexible. Of course, they reserve the higher amounts for those with better credit. They offer interest rates ranging from 18 percent to 35.99 percent, based on credit, of course. They have branch offices you can visit, or you can handle all of your business online. It is up to you.

This lender provides various types of loans, including secured and unsecured options. They offer loans in varying amounts from $1,000 to $20,000. The better your credit is, the more they are willing to lend you. They offer repayment terms of 2, 3, 4 or 5 years, so they are incredibly flexible. Of course, they reserve the higher amounts for those with better credit. They offer interest rates ranging from 18 percent to 35.99 percent, based on credit, of course. They have branch offices you can visit, or you can handle all of your business online. It is up to you.

This lender is another great choice for those with poor credit. They will give you a loan when your credit score is as low as 580. They even approve your loan if you have a low income as they have no income requirements. Their loans range from $2,000 up to $35,000. Their loan terms are also flexible at 2, 3, 4 or 5 years. Interest rates range from 9.95 percent to 35.99 percent. They do have an origination fee of as much as 4.75 percent of your loan amount.

This lender is another great choice for those with poor credit. They will give you a loan when your credit score is as low as 580. They even approve your loan if you have a low income as they have no income requirements. Their loans range from $2,000 up to $35,000. Their loan terms are also flexible at 2, 3, 4 or 5 years. Interest rates range from 9.95 percent to 35.99 percent. They do have an origination fee of as much as 4.75 percent of your loan amount.

This is a peer to peer lender. That means lenders and borrowers are matched together while removing traditional banks from the process. Individuals are willing to lend money to help others. However, you must have a credit score of at least 600. Loans range in amounts from $4,000 to $25,000 with interest rates of 5.99 percent to 29.99 percent. This lender takes a little longer to get the money to you, up to 2 weeks. There is an origination fee of 1 to 5 percent.

This is a peer to peer lender. That means lenders and borrowers are matched together while removing traditional banks from the process. Individuals are willing to lend money to help others. However, you must have a credit score of at least 600. Loans range in amounts from $4,000 to $25,000 with interest rates of 5.99 percent to 29.99 percent. This lender takes a little longer to get the money to you, up to 2 weeks. There is an origination fee of 1 to 5 percent. Upstart is a great lender if you do not have much credit history. They may loan money if you have a credit score of 580. You must have an income of at least $12,000 per year. You can borrow $1,000 to $50,000 with terms of 3 and 5 years. The origination fee is from 1 to 6 percent of your loan amount.

Upstart is a great lender if you do not have much credit history. They may loan money if you have a credit score of 580. You must have an income of at least $12,000 per year. You can borrow $1,000 to $50,000 with terms of 3 and 5 years. The origination fee is from 1 to 6 percent of your loan amount. This is another peer to peer lending facility. The loan amounts can vary from $1,000 up to $40,000. The loan terms are three or five years. Lending Club has a high origination fee of anywhere between 1 to 6 percent of your loan amount. Interest rates range from 6.95 percent to 35.89 percent. You must have a credit score of at least 600. They want you a credit history of at least 3 years and your debt to income ratio to be under 40 percent.

This is another peer to peer lending facility. The loan amounts can vary from $1,000 up to $40,000. The loan terms are three or five years. Lending Club has a high origination fee of anywhere between 1 to 6 percent of your loan amount. Interest rates range from 6.95 percent to 35.89 percent. You must have a credit score of at least 600. They want you a credit history of at least 3 years and your debt to income ratio to be under 40 percent. This lender accepts credit scores of 640 and wants a credit history of 2 years. They do not have a minimum income requirement. You can have a debt to income ratio of 50 percent maximum, but no bankruptcies within the past year. They offer interest rates of around 6.95 to 35.99 percent.

This lender accepts credit scores of 640 and wants a credit history of 2 years. They do not have a minimum income requirement. You can have a debt to income ratio of 50 percent maximum, but no bankruptcies within the past year. They offer interest rates of around 6.95 to 35.99 percent. When looking for personal loans for poor credit, this may not be the best one, but you can consider it, if you are out of options. Interest rates start at 34 percent (ouch) and can go up to 155 percent (double ouch). They accept credit scores as low as 550. You even have a day to change your mind about borrowing the money. Loans range from $1,000 to $10,000.

When looking for personal loans for poor credit, this may not be the best one, but you can consider it, if you are out of options. Interest rates start at 34 percent (ouch) and can go up to 155 percent (double ouch). They accept credit scores as low as 550. You even have a day to change your mind about borrowing the money. Loans range from $1,000 to $10,000.