When you were a kid, did you ever hear your parents argue about money? I did. In fact, many kids have and it is not fun. Now imagine if those arguments you heard were over how much they spent on their wedding. You would think that a wedding would be the one day that both parties would be okay with spending, but that is not the case.

Debt is debt and it is stressful regardless of when it occurred. I would go into debt to pay for my kids’ colleges if I had to without batting an eye, but that does not make the bill any easier to pay. As they say, “Love don’t pay the bills.” If only it did…

Since it does not, we have to be practical or risk stress that should not be there. If you want a big, beautiful, fancy, expensive wedding, you can have one, but you need a practical approach to have it. A very smart thing to do would be to make a wedding payment plan. When you are ready to dive in, I will walk you through it.

How to Make Your Wedding Finance Plan

We are now going to make your wedding payment plan. This plan is exactly what it states: your plan for paying for your wedding. It is easier than you think. First, you need something to write all of this out on. You can use an app or spreadsheet if you like, but I find it easier to do my initial planning with paper and pencil. When it is finalized, I transfer it to a digital plan.

Step 1

You should now have the amount you are willing to spend on your wedding. For the sake of this exercise, I am going to use $10,000 for that total. First things first, you have to figure out the amount you need to work toward. This is very simple to determine- just subtract the amount you can save from your total. In my case, I will say I can save $1000. This leaves me with $9,000 more to come up with. Put all of this on your planning paper.

Grand Total- $10,000

Will Save- 1,000

I Still Need- 9,000

You now have your goal. There are several ways to come up with this money, but first, you might find it useful to learn ways to save on wedding expenses. It is always better to minimize costs than it is to pay more than you have to for things.

Step 2

Really search your brain for the money you are not thinking about. Have you left money in an old savings account that you forgot about? Do you have CDs that have matured? Do you have your Aunt Louise’s antique radio in your attic that she no longer wants? How about an old, broken down car that you can sell for scrap metal or for a few hundred bucks to someone who can fix it up? I once heard a story about a man who found that he had a first edition of a very important book. It was worth a lot of money and it had been sitting on his shelf for 15 years. Think hard and look around- you never know what you will find.

Step 3

Next, talk to your folks. They may be willing to pitch in as a wedding gift, or they may know that Grandma Jean always talked about paying for your wedding dress. Uncle James may have some tuxedos you can borrow, or your cousin may have a beautiful yard that they want to host your wedding in. If any of that is the case, write it on your plan, i.e. Mom and Dad- $1,000. Now your total is $8,000.

Step 4

Let’s say your treasure hunt banked you $500 more bringing your total to $7,500. Consider a side gig: can you babysit on Saturdays for an extra $200 per month? Maybe your mom wants to pay you $100 a month for helping her clean out her clutter. We will say that you will be able to make another $1200 for your wedding with a side job, which brings your total to $6,300. You will, of course, have written all of these different categories on your wedding planning sheet.

Loans for Wedding Expenses

At this point, you have looked for and calculated every dime you think you can make. What do you do now? Loans for wedding expenses are an option and can be added to your wedding payment plan if you choose. In fact, some couples choose to take one out to pay for the whole wedding, then just pay the monthly payments. It may be a good idea in some cases.

For instance, suppose that the only money from the previous example I would have is the $1,000 I could save. If I had no way to come up with $9,000 more, I may choose to take out a personal installment loan for the $9,000. That $9,000 loan comes with a fixed interest rate of 10% and a five year repayment term. Let’s do a little math:

$9,000 x 10% interest= $900

$9,000 + $900= $9,900

$9,900/ 60 months= $165 per month

It may be more feasible to come up with $165 per month to pay a loan that it is to make a wedding payment plan in other ways.

How to Make a Wedding Budget

The first step in a wedding payment plan, or any other payment plan, is to make a budget. I know it sounds delightful, but please try to contain yourself. Most people cringe when they hear that dreaded “B” word. It is mundane and it sounds so restrictive. Here is the crazy part though: budgets actually give you freedom. I promise I am not crazy. Let me explain by giving you two separate examples.

So What is a Budget Exactly?

Those may seem like extreme scenarios, but I have seen similar things many times. The secret to having a budget is mastering your money instead of letting it master you. You are telling your money where to go, not the other way around. Additionally, when you develop a budget and follow it, you begin to see where your money actually goes. As you become strong-willed in not moving outside of your budget, you will start to notice things that you spent a great deal of money on. For instance, you may not think you spend much on sodas at work. If you budget $10 for sodas because that is how much you think you normally spend, you might find yourself doing without multiple sodas a day.

When we are not watching our money, it disappears- it never fails. Making a wedding budget and diligently following it can make a huge difference in your life, but do not just take my word for it. Try it for yourself, even if it is just for a month or for one event- like a wedding. Test the process and see if you notice a difference.

Why a Wedding Budget is an Important?

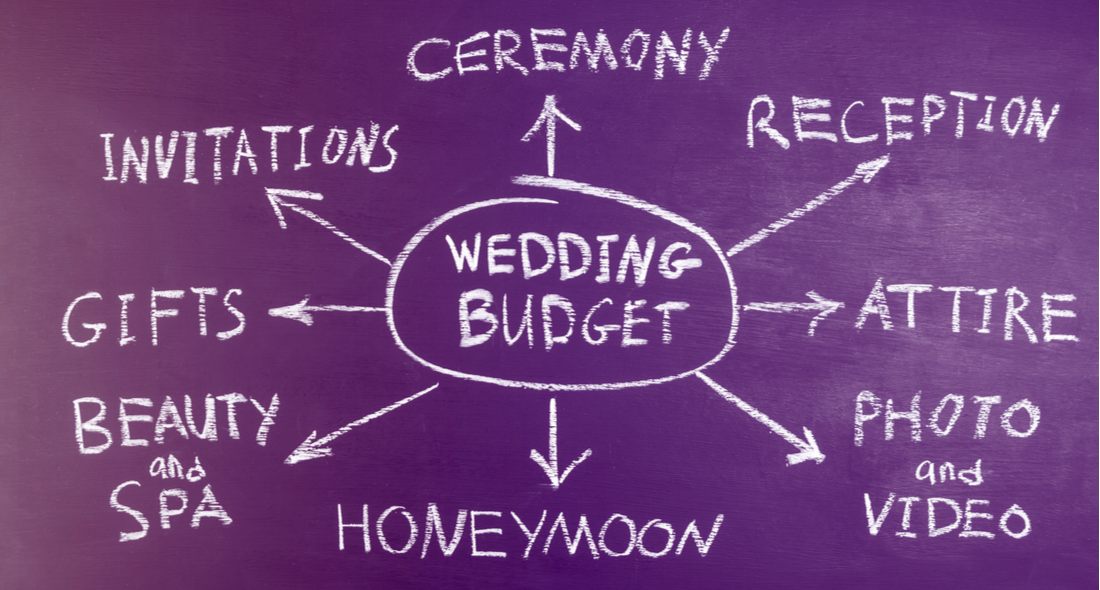

A wedding budget is important because you set aside specific amounts for specific items. If you budget $2,000 for your dress and $200 for your shoes but find shoes that are $400, you have two choices: subtract the extra $200 from your dress fund or find a pair of shoes that fits into your budget. Your budget helps you remember what is important to you.

A way to help you stick with your budget is to pay cash for everything. Get envelopes and mark them for each item on your budget, such as “Dress”, “Venue”, and “Shoes”. Put the exact amount you have written in your budget into those envelopes. When you go shopping for any of those items, only take the envelope that is meant for that item.

How to Make the Budget

Are you ready to get to work? Let’s dive in.

Prep Work

- Grab your fiancé. This is a team effort.

- Gather your bills and check stubs or income statements.

- Gather bank statements and any other places you may have money, i.e. investments, a CD that you can soon cash out, that type of thing.

Calculate

- Add up your bills for a month.

- Then add up your income and other financial sources.

- Subtract the bills from the income.

The Results

- If the total is over $0, congratulations. You have something to work with. If it is a negative number, you have some extra work to do- but that is okay. You can do it.

- Is there any money left of your income to save for your wedding? If so, this is your starting point. For instance, if you are getting married in 12 months and you can save $100 per month, you will have $1200 to spend on your wedding. That total, however, is only if you keep the spending habits that you currently have.

- Did you get a negative number? No problem. The next step can help with both scenarios. First, though, write down how much more you need to make or find to be able to save something.

Analyze

- Regardless of if you are in the negative or simply want to save more than your current finances are allowing, it is time to play detective. Grab your bank statements and receipts. Look at your purchases. I mean really look. Most people that have no budget assume they spend much less on certain things than they actually do.

- Categorize your purchases into necessary and unnecessary.

- Very strategically, work your way down the unnecessary column and decide what to cut out or down.

- Perhaps you now have $200 extra per month to save for your wedding. Maybe you could not make many changes. Whatever the case, recalculate your total that you can now save for your wedding per month and multiply the number of months you have by that number.

- Decide if the total is enough for the two of you to spend. This will depend largely on how much you want for your wedding. If you want everything you can get at a wedding, including hula dancers, $500 is probably not going to cut it. However, if you are looking for a very simple ceremony, it might. As a team, decide if the amount you can save from your income adds up to the amount you are willing to spend. If so, congratulations! You can start planning your wedding. If you want to spend more, let’s continue.

Considering a Loan?

While loans for wedding expenses can help you make out your wedding payment plan much easier, there are things to consider:

Benefits

Loans can get you the money you need for a wedding immediately. This can decrease stress levels since the wedding expenses can be paid for all at once, and payments are just made over time. They can also be very helpful when you cannot attain enough money to cover your wedding expenses, including small, simple weddings and big, fancy weddings. The loans can open up more possibilities to you and give you more time to pay for those expenses.

Risks

Like everything, there are downsides to using loans in your wedding payment plan. First, money is one of the leading causes of divorce, and divorce is one of the leading causes of more money trouble. Walking into a marriage with a rain cloud of debt hanging over the two of you might not set the stage for a fruitful and happy marriage. Also, if you are not responsible with it, you may spend more on your wedding than you ever wanted to just because the money is available. Just carefully think it through before taking out the loan.

Tips For Getting a Loan

If you are going to take out a loan to fund your wedding payment plan, the type of loan and the details of the loan are vitally important. A personal installment loan is usually the wisest choice because they offer lower interest and longer repayment terms. The interest rate may also vary depending on your credit score. Find a reputable lender for your loan online and go through the entire process quickly and efficiently.

Is There a Way to Avoid Loans for Wedding Expenses?

I am so glad you asked. Let me first say that the old saying, “Where there’s a will, there’s a way” still rings true to this day. If you truly want to stay away from loans for wedding expenses, you can do it. The question is how far are you willing to go? There are many fun and creative ways to pay for a wedding, or decrease the amount of wedding finance you need.

Before you sign any paperwork, understand your interest, whether it is fixed or compounded, and how much you will be paying monthly for how many months. You need all of that information to decide if the loan is a good idea. If the payment is going to be too high, try decreasing the amount you need to borrow even more.

Conclusion

Any time you are trying to get somewhere, you need a plan- or a map. A wedding is no different. The bride and groom need to determine what is important to them for their wedding, and then make a wedding payment plan to fulfill those desires. Knowing how it will be paid for is almost as important as the wedding itself. Work your way through the plan, and if you find yourself in need of a loan, you can trust Loanry to help you find a reputable lender.

Brandy Woodfolk is an educator, home business owner, project manager, and lifelong learner. After a less than stellar financial upbringing, Brandy dedicated her schooling and independent studies to financial literacy. She quickly became the go-to among family, friends, and acquaintances for everything finance. Her inner circle loves to joke that she is an expert at “budgeting to the penny”. Brandy dedicates a large portion of her time to teaching parents how to succeed financially without sacrificing time with their little ones. She also teaches classes to homeschooled teenagers about finances and other life skills they need to succeed as adults.

Brandy writes about smart money management and wealth building in simple and relatable ways so all who wish to can understand the world of finance.