One common question many prospective borrowers want to ask is if they can get a low-interest personal loan. A personal loan can refer to many different possible loan products out there. Generally, a personal loan is a loan that allows you to do whatever you want with loan funds. Those who take out personal loans have complete freedom regarding what they spend the money on. This is a huge advantage of this type of loan.

Sometimes, we all have unexpected expenses that come up. Borrowing a low-interest personal loan can be the best solution for handling these expenses in some cases. There are numerous advantages to borrowing money. Loans are not just used for large purchases, but they can also allow for debt consolidation. They can help you to organize your finances. Simplifying one’s debt is important for those who are paying on numerous credit accounts.

Get a Personal Loan With Low-Interest Rate

Before borrowing a personal loan, consumers should learn as much as they can about these loans. They also should do everything possible to search out a low-interest personal loan. A low-interest loan means a loan that costs less. You want to pay attention to the interest rates and other expenses of personal loan offers. This will help you pinpoint the low-interest option that’s easiest on your budget.

A number one priority when borrowing is staying on top of one’s debts. Before you borrow, you should work out your budget. Taking out a personal loan means you’ll have an additional expense each month. You need to plan carefully to avoid falling deeper into debt.

Low-Interest Personal Loans Defined

Low-interest personal loans are loans made to an individual borrower at an affordable interest rate. It’s helpful and important for borrowers to have access to loans like these whether they’re running a business or not. Personal loans are loans that give borrowers a lot of freedom to use the loan funds as desired.

Personal loans are much like any other type of loan. They involve a lender providing you with money and then charging you interest on it as you pay the loan back. However, personal loans are also distinct from some other common types of loans like auto loans and mortgages. Personal loans are usually an unsecured type of loan. The borrower qualifies for the loan based on their credit and income. Unlike with an auto or home loan, the borrower doesn’t need to use the funds on a specific item. The loan funds can be used for any purchases whatsoever. They can also be used as a low-interest debt consolidation loan.

There are numerous possible borrowing scenarios where a personal loan would be appropriate. A personal loan is a solution for a loan that doesn’t have to be spent on a specific purchase. These are loans that offer a great deal of freedom. Personal loans are also often used in debt consolidation.

How to Qualify for Low-Interest Personal Loans – Requirements

Those who want to take out personal loans for business purposes will need to meet a few requirements. These requirements can vary by lender. However, there are some common requirements among various lending companies. Generally, it will be necessary to meet a certain credit score. Business owners applying might also need to meet revenue requirements for their companies. Additionally, it could be necessary to have a business that’s been in operation for a given period of time. Some lenders could require that a business owner is in business for six months or more before qualifying for a business loan. This helps ensure that the applicant will continue to bring in income reliably to pay back the loan.

What if You Failed to Qualify for a Personal Loan?

Those who cannot qualify at the moment can increase their chances of qualifying in the future in a variety of ways. They can do this by taking some time to improve their credit scores. You can improve your credit score if you pay off some of your existing debt. And you can also improve your credit score by going a certain length of time without missing any payments on your credit accounts.

You can also increase your chances of qualifying by increasing your income. The more you are bringing in, the more creditworthy you’re likely to be for personal loan lenders.

Another thing you may want to do if you have failed to qualify is finding a cosigner. A cosigner can back up your application and help you to be approved. A cosigner with a good credit score and income level could make it possible for you to qualify for a low-interest personal loan right away without having to wait to improve your own qualities as a borrower.

Finding a Low-Interest Personal Loan

Of course, interest is generally the major expense to consider. If you want to regain control of your debts, a low interest debt consolidation loan is what you need. When looking for a low-interest personal loan, consider what the lender looks at in determining your interest rate. There are numerous things you can do to improve your credit standing. You may be able to reduce your interest rate.

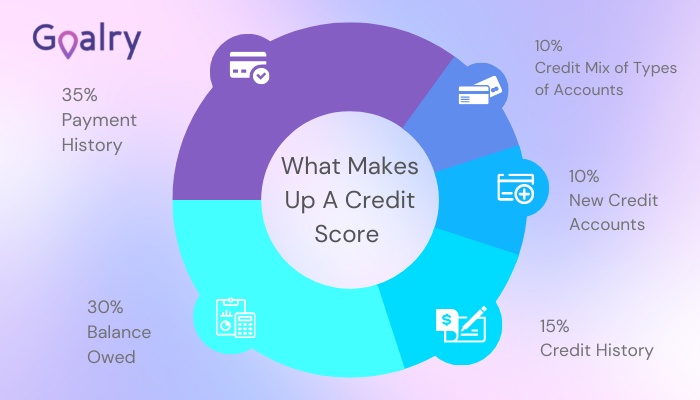

A credit score is generally achieved over time. However, there are a few things you can do to quickly raise your score. You can raise your score by keeping all accounts current. If you can afford to pay off a chunk of your debt, you could boost your score. Paying off debt an increasing available credit can quickly boost your score.

You may not be able to improve your score because you don’t have funds available to pay down debt. There are still some options for achieving lower interest rates. If you’re looking for a low-interest personal loan, you may get better rates with a cosigner. A cosigner is someone who will sign for the debt along with you. Perhaps you have a spouse or parent who will help you get a low-interest personal loan. They can cosign for you and you may get significantly lower rates.

You can also bring down the costs of borrowing by reducing the amount that you borrow. Your interest is generally a percentage of your loan amount. Therefore, borrowing more means paying more interest. Consider borrowing less if you’re concerned about the interest costs of a personal loan.

The term “personal loan” can actually refer to a few different loan products. The following are three of the main types of personal loans.

Traditional lenders commonly offer a low-interest personal loan. Any bank will offer some sort of personal loan product. However, qualifying to borrow with a traditional lender can be difficult. Personal loans from traditional lenders typically feature the best interest rates. However, they also tend to require that borrowers have certain credit scores. They will also consider the applicant’s income level. Borrowers typically need to reach a certain income level to qualify.

A secured loan could be a good personal loan option for those with lower credit scores. One of the most common types of secured loans is a title loan. With a title loan, the borrower uses their vehicle as collateral for a loan.

Other types of collateral can be used to secure loans. For example, a home equity loan allows a borrower to secure a loan with their home equity. These secure types of loans can be very useful. They basically allow anyone to borrow who owns some possessions of value. If you’re trying to qualify for a low-interest personal loan, consider what you own that you could use to secure a loan.

Nowadays, there are many online lenders of personal loans. You should definitely explore online lender possibilities to find the right personal loan. You’ll likely find that better deals are online. Online lenders can often offer lower rates because they don’t have the overhead of running physical locations.

Consumers are often impressed with the speed and convenience of borrowing money online. With many loan providers, applying takes only minutes. Also, loan funds are quickly put into the bank account of approved borrowers. Prospective borrowers definitely need to take advantage of the Web for comparing loan offers.

The Costs of a Low-Interest Loan

Anyone considering borrowing needs to carefully analyze the cost of a loan. It’s unfortunately easy to overlook expense when borrowing with all the loan funds are in front of you. However, you will be expected to pay all that money back with interest. When you borrow, you should be looking to improve your financial future. This means you shouldn’t take on an expense you can’t afford.

We all now that the interest charges are the major cost of a loan. However, many low-interest personal loan providers also charge loan fees. You need to pay attention to the fees that go along with a loan. A loan that has a low-interest rate but lots of upfront fees might not be such a great deal after all.

Interest Rates

Your main consideration when evaluating loan offers is interest rates. This what we are looking into in this blog. The interest rate the lender gives should be a percentage. As we said, the better your credit score, the lower the interest rate you can get. Personal loan interest rates can vary widely. Rates can vary from down around five percent to up to 30 percent.

The major determining factor in the interest rate is your credit. Those who have excellent credit scores over 720 get the best interest rates. However, most of us are in the fair to poor credit range. With fair credit, a consumer might struggle to find interest rates under 15 percent.

Borrowers shouldn’t just know the interest rate on loans. They should crunch the numbers and figure out costs over the life of the loan. For example, you pay $1,000 in interest if you are charged a rate of five percent on a $20,000 loan. Consumers need to consider not only the total costs of the loan but also the monthly payment. It’s important that consumers can budget their income effectively to be able to afford this monthly payment.

Loan Fees

Loan fees are the easily overlooked expense that goes along with some personal loans. Lenders will often add on fees for various reasons. There could be a fee for applying for a loan. There could also be origination or service fees on personal loans. Consumers shouldn’t underestimate how loan fees can add up.

Compare the total costs of different loan offers you consider. Add up all the interest and fee costs and find the most affordable option. And remember, even when you find a low-interest personal loan, it still has a cost attached to it. It may be not as expensive as when you pay more interest, but make sure to keep in mind that the interest has to be paid, no matter how low it is.

Options If You Can’t Get a Low-Interest Personal Loan

If you have poor credit or low income, you may have problems getting a low-interest personal loan, or any loan for that matter. If this is the case, try some of these:

No Credit Check Loans

If you have poor credit, you’ll be happy to know that no credit check loans are out there. You might find a loan offer that requires no credit check at all. This type of loan should be relatively easy to qualify for. However, these loans generally are secured loans. You’ll need to provide some collateral like your vehicle title for these loans. Also, no credit check loans are probably going to have high-interest rates. They will not be the most affordable option. Therefore, you’ll want to explore other loans if your credit is good.

Increase Your Income

Even if your credit history is perfect, you may struggle to borrow if your income is low. A lot of lenders will have an income requirement applicants must meet. Increasing your income can boost your credit and improve your finances over time. If you’re not bringing in a good income, it might not be a good idea to commit to a loan. In the meantime, bring up your income. You can increase your income by taking more hours at work or adding on a second job.

When you make more money, you look better to lenders. Lenders of traditional loans will ask for contact information from your employer. The lender may contact your employer to verify your income. In addition to contacting the applicant’s employer, lenders often also request pay stubs to verify the applicant’s employment. This is an especially common practice when it comes to payday loans.

Of course, increasing your income also makes more funds available to you. Taking time to increase your income is ideal for improving your finances overall. Exploit any income opportunities you can if you’re working to improve your financial situation.

Secured Loans

If you can’t qualify for a personal loan, you might try some other options for getting the financing your needs. In particular, you might want to look to secured loans. If you have collateral you can provide for a secured loan, you could be able to find fast funding. In particular, you can consider an automobile title loan or a home equity loan for a secured loan that will be easier to qualify for. You could also contact investors for quick business funding. Another option is to scout out opportunities to borrow a private loan through your business partners if you cannot currently qualify for a low-interest personal loan.

Conclusion

It’s always good to have an option available for a low-interest personal loan. Being able to conveniently borrow for a reasonable cost gives you an important financial asset. If you can borrow a personal loan, you can cover emergency expenses that come up. You can also take advantage of lucrative investment and business opportunities that come up but require capital.

Even if you’re not going to borrow right away, it’s a good idea to explore personal loans. A lot of consumers are surprised to find that it was easier to borrow than they thought. You can explore all the different personal loan types. Then, you can determine what option is best for someone with your income level and credit history. You should have a personal loan finance company in mind for acquiring a low-interest personal loan. Don’t just explore the interest rates they’re offering. Also, find a loan provider with great customer service.

By shopping online, you can discover many borrowing opportunities. The Internet has all the information you need in one place to look for a loan. We offer information on many borrowing opportunities on our site.

Katherine Davis is a freelance writer specializing in the subjects of finance, banking, and investment. Based in New York City, Katherine’s experiences combating the Big Apple’s outrageous real estate costs and living expenses have provided her with some great budgeting insights on stretching a dollar. A graduate of Penn State University, Katherine advises millennials to be disciplined when it comes to their finances and to start investing as soon as possible.

There are trade-offs to these discounters. In a Consumer Reports satisfaction survey, Costco earned the highest ratings possible for its prices on major appliances. Costco also received the lowest ratings possible for its product selection. Their appliances are sold only on Costco.com with a limited selection of display units in warehouse stores. You’ll find less than 100 models from which to choose. That includes all available electric and gas dryers. The selection includes only major manufacturers like LG and Whirlpool.

There are trade-offs to these discounters. In a Consumer Reports satisfaction survey, Costco earned the highest ratings possible for its prices on major appliances. Costco also received the lowest ratings possible for its product selection. Their appliances are sold only on Costco.com with a limited selection of display units in warehouse stores. You’ll find less than 100 models from which to choose. That includes all available electric and gas dryers. The selection includes only major manufacturers like LG and Whirlpool.