It isn’t easy to pay for a college education. The average price of one year at a public university, including tuition, fees, room, and board at the in-state rate is almost $21,000. The private school rate is almost $47,000. That can exhaust 529 plan savings pretty quickly. That’s why so many college students and their parents take out student loans to bridge the financial gap. So many loans that it is estimated there is $1.53 Trillion in student loan debt swirling around out there.

When it comes to borrowing money to pay for college, there are options. Here is what you need to know about the types of student loans that are available to you.

Types of Federal Student Loans

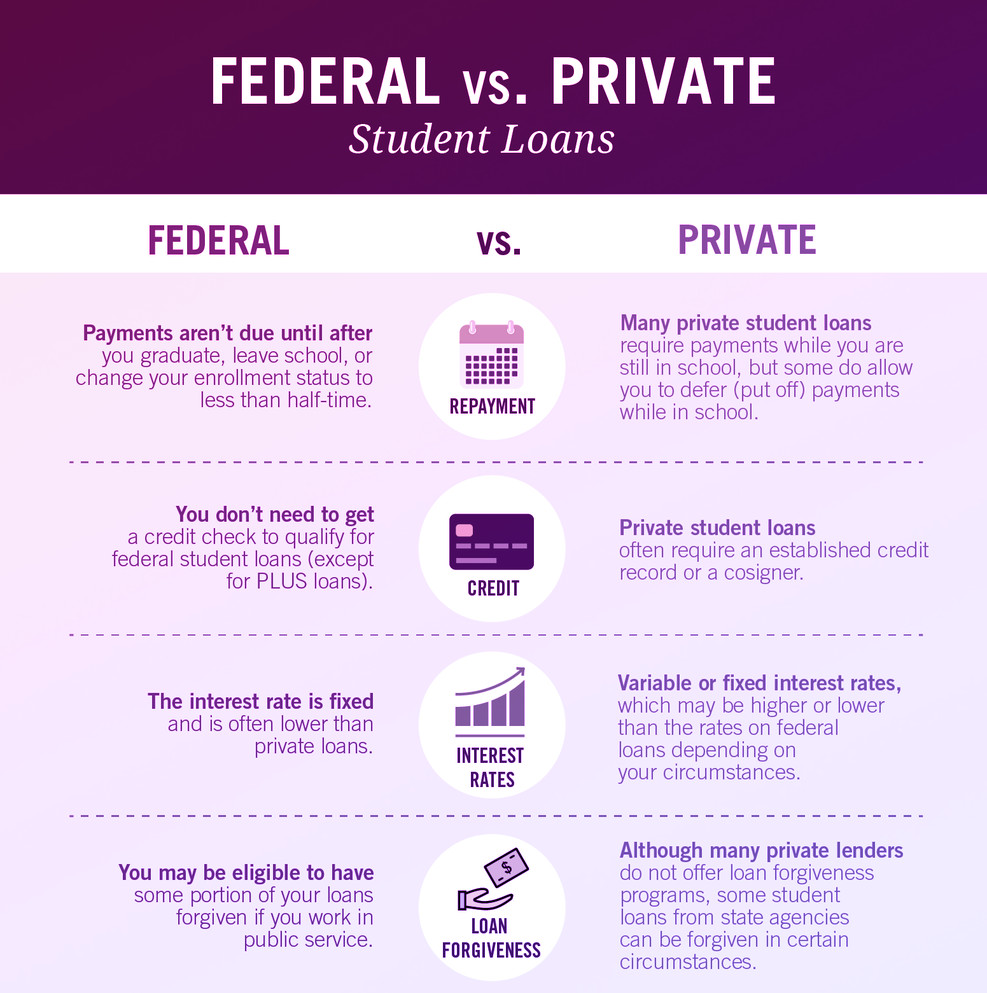

A loan is simply money you borrow that has to be repaid over time with interest. The federal government offers student loans and usually has better repayment terms than private lenders, like banks.

The federal government offers four types of student loans.

- Direct Subsidized Loans – These types of student loans are for undergraduate students who demonstrate the need for assistance paying for college.

- Direct Unsubsidized Loans – These are student loans offered to graduates and students. These types of student loans are not based on financial need.

- Direct PLUS Loans – These types of student loans are for graduate or professional students or parents with undergraduate dependents who are students. These loans are designed to help with college expenses that aren’t already covered by financial aid. Borrowers of Direct PLUS loans have to pass a credit check.

- Direct Consolidation Loans – These types of student loans allow a borrower with multiple outstanding federal loans to roll that debt into a single lump sum that is managed by a loan servicer.

How Do You Apply for Federal Student Loans?

The first step toward obtaining a fed student loan is to complete the Free Application for Federal Student Aid form, or FAFSA. Before you sit down to work on this application, gather up your Social Security number, previous Income Tax Returns, and W2s that demonstrate your income. You may need bank records and records of investments as well. If you are a dependent student you will need to have all of this information about your parents as well. You aren’t eligible to receive any federal loans or grants until your FAFSA is completed.

Based on the results of the application, your college or career school will make you an offer of financial aid that may include grants and loans. This is the time when you will be able to compare the financial aid being offered to you by different schools.

Before accepting an offer of federal student aid, you will be given counseling to make sure that you understand that the assistance is a loan that will have to be paid back with interest.

The FAFSA will need to be updated by you each year. Schools often make decisions about scholarships based on the information in the FAFSA.

How Much Federal Aid Will You Receive?

Undergraduate students may have a borrowing maximum somewhere between $5500 and $12,500 each year in Direct Subsidized Loans and Direct Unsubsidized Loans.

Graduate or professional students can borrow up to $20,500 in Direct Unsubsidized Loans each year.

Parents with dependent children who are undergraduates may borrow Direct PLUS loans for outstanding costs of college not already covered by financial aid.

One important note about offers of federal financial aid. Just because the government offers you money, you don’t have to take it. You can accept only part of what is offered to you if it aligns better with your repayment goals.

What are Some of the Positive Features of Federal Student Loans?

Federal loans are usually offered at a fixed interest rate. And that rate is usually lower than what is available at banks.

Most of the time no credit check or co-signer is required when taking out a federal student loan.

Federal loans offer a six-month grace period between the end of college and when payments on the loan have to begin. This is designed to give new graduates the chance to get on firmer financial ground. Interest does accrue during those six months.

The federal government offers flexible repayment plans including some that are income-driven and assume you’ll be making more money as you gain experience in the work world. You can ask for new repayment terms at any time. The government also works with borrowers who are having trouble meeting their loan obligations. Sometimes payments are lowered or temporarily suspended so that the borrower can get back on track.

The federal government also has programs in place that sometimes forgives the balance of student loans. One is called Public Service Loan Forgiveness, or PSLF. It is sometimes available for borrowers who work in qualifying government jobs or jobs in the non-profit sector. After the borrower makes 120 monthly payments, the program could be used to pay off all remaining student loan debt.

There is also a Teacher Loan Forgiveness program that educators can apply for after they have taught for five complete and consecutive years in a low-income school. That loan forgiveness program could discharge up to $17,500 worth of student loan debt.

Private Lender Student Loans

There are private lenders that are in the business of loaning money to college students. These types of student loans come from banks, credit unions, and some online loan shops. You should only begin shopping for private loans if you have already exhausted all the available options in loans from the federal governments. The interest rates tend to be larger than government-backed loans. And the student’s credit history plays a factor in the loan.

How Do You Shop for Loans from Private Lenders?

When you are shopping for a student loan through a private vendor you are searching for the types of student loans with the best interest rate and the most favorable repayment schedule. You want to apply to a number of lenders so that you can compare their offers. Unlike the FAFSA form, you will be filling out applications for each potential lender. Private lenders don’t allow you to change your repayment plan as the federal government does. Changing the terms of a private loan requires refinancing or consolidating.

Some online stores bring you multiple offers from lenders very quickly after filling out their forms. These include sites like Credible and College Ave. These sites work as a student loan locator service. Their lending partners prequalify potential borrowers for loans at particular rates. You don’t pay more to use their service. The lenders pay a fee to be a part of their network. You also fill out one application and you may see as many as 10 loan offers which give you the tools to make comparisons.

Filling out one of these online forms doesn’t impact your credit score at all. It is noted as a soft request. Only hard inquiries become part of your credit history.

What is the interest rate on the loan and is the interest fixed or variable? Fixed interest is set for the life of the loan. Variable interest changes throughout the loan and is tied to a financial metric. Sometimes interest rates on a variable interest loan can change without much notice.

The shorter the loan the less interest you will pay, but each monthly payment will be higher. This step requires looking into the future and evaluating the payments you’ll be able to afford.

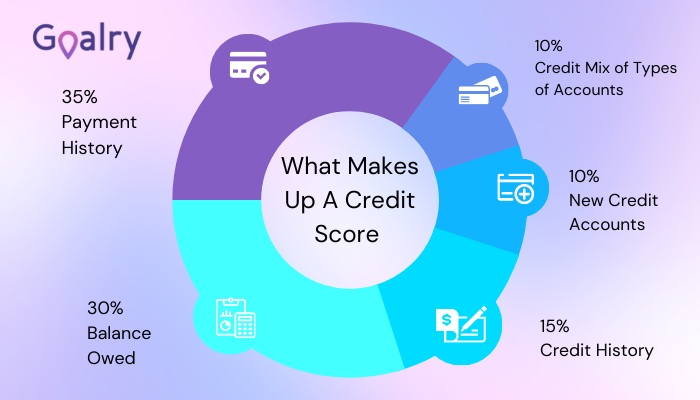

Private lenders will do credit checks on loan applicants. Expect to pay a higher interest rate on a loan if your credit score is less than 690. Your credit score is based on your credit history and is usually reported as a 3-digit number. Three of the major credit reporting agencies are TransUnion, Experian, and Equifax. Many lenders require a co-signer for borrowers with low credit scores. This happens to recent college graduates who haven’t yet build a solid history of managing credit and debt.

If someone co-signs for your loan, your credit history becomes meshed with theirs. If payments are missing or late it impacts the credit score of the co-signer as well as you. Successfully managing a student loan is one way to build a positive credit history.

Should You Take Out a Personal Loan to Pay Off a Student Loan?

It is usually not a good idea to take out a personal loan to pay off any type of student loan. In general, the interest rates on personal loans are higher than student loans. And personal loans usually come with a shorter payback time. Most have to be paid in full in five years.

A personal loan will not come with any grace period to begin making payments as federal student loans do. The interest on a personal loan isn’t tax-deductible. The interest on a student loan is.

Income Share Agreement

An Income Share Agreement, or ISA, is a non-traditional method for financing a college education. An ISA is an agreement between the student and the school that the student will repay the cost of the education after they have graduated and are out in the workforce. Instead of borrowing money upfront to pay for college, this is money paid on the back end.

In an Income Share Agreement, the school calculates what it believes to be the student’s future earning power based on what they studied and sets the payments accordingly. Tying the cost of college to a student’s major requires complete transparency on the part of the school and how it reports student success.

Income Share Agreements are only available at a limited number of colleges and universities.

Should I Put College Costs on a Credit Card?

When it comes to paying tuition with a credit card there isn’t one answer for everyone about whether it is right or wrong. If tuition is going to end up as a balance on a credit card that is subject to high interest and late payment fees, then taking out a student loan is a smarter choice. But if you are interested in capitalizing credit card rewards, charging tuition to a card might be a good strategy.

- If the credit card accumulates reward points based on each dollar spent, then paying for a chunk of college could rack up many rewards.

- Some cards will offer a sign-up bonus that increases the number of reward points exponentially.

- Some card issuers offer 0-percent interest for a limited time when the card is brand new.

- If your card has a minimum spending limit before rewards kick in, then putting tuition on that card may be the way to get to that threshold.

There are some things to watch out for that may erase the benefits of putting the cost of college on a credit card. Not all schools accept credit cards. But most of the ones that do will add a convenience fee on top of the payment. A convenience fee on a big purchase like tuition may erase any rewards or benefits that were earned. Another issue with putting college on a credit card is that the limit on the card might not be large enough for a tuition-sized expense.

If you use a credit card for educational costs treat it like it is a debit card. Completely pay the balance when it is due so that interest doesn’t begin to accumulate. Student loans offer a much better interest rate than credit cards.

Should I Consolidate My Student Loan Debt?

Consolidating multiple types of student loans into one loan can make it easier to track what has to be paid and when it is due. If your loans are all federal loans you can request that they are consolidated. The interest rate will be based on the interest rates of the original loans, so this isn’t a way to reduce payments by scoring really low-interest terms.

When private loans are consolidated it is usually referred to as refinancing. It is often done to capture a better interest rate. If you are consolidating federal loans and private loans into one package the federal loans lose some of the special considerations they once had like repayment options and forgiveness.

Conclusion

The first steps toward paying for a college education include tapping savings, applying for scholarships and grants and investigating work/study opportunities. But if you need student loans to bridge the gap between what you have and what college costs, start with the federal government. The government is in a position to offer the best interest rates on these types of student loans. The federal government usually doesn’t need a credit check before the loan is originated and offers a six-month grace period where no payments are due after graduation. Borrowers can request to change the repayment terms of their loan or consolidate multiple federal loans into one loan at any time. If you are beginning the search for federal loans you have to fill out a FAFSA form located on the www.studentaid.gov website.

Private lenders also issue student loans. They usually come with a higher interest rate than federal loans. When shopping for private loans you can compare the terms different lenders are offering you on these types of student loans. That includes interest rates and the length of the loan. You can go to individual lenders, like banks or credit unions, and fill out applications for each one. Or you can go to an online mall and fill out a single application that can prequalify you and pair you with loan quotes from the site’s preferred partners.

No matter where your loan originates you should commit to paying it back in full and on time. That will help you build a solid credit history.

Carla Turchetti is a personal finance writer who lives in a world where dollars make sense. Some of her favorite topics include financial planning, budgeting, understanding taxes and the ins and outs of running a small business. Carla’s thoughts on money matters have appeared across digital, print and broadcast platforms including American Express OPEN Forum, Intuit’s Blog for Small Business, CanDo Finance, Progressive Insurance, Northwestern Mutual, Insperity, Kabbage and the Raleigh News & Observer. Carla budgets as much as she can to fuel her mad online shopping habit.