Having to pay back a student loan can be a real bummer and it’s a frustrating process, especially because of the student loan impact on credit score. But there can be an upside if you pay back the loans on time. In fact, regular payments can help your credit.

How Can a Student Loan Impact On Your Credit Score

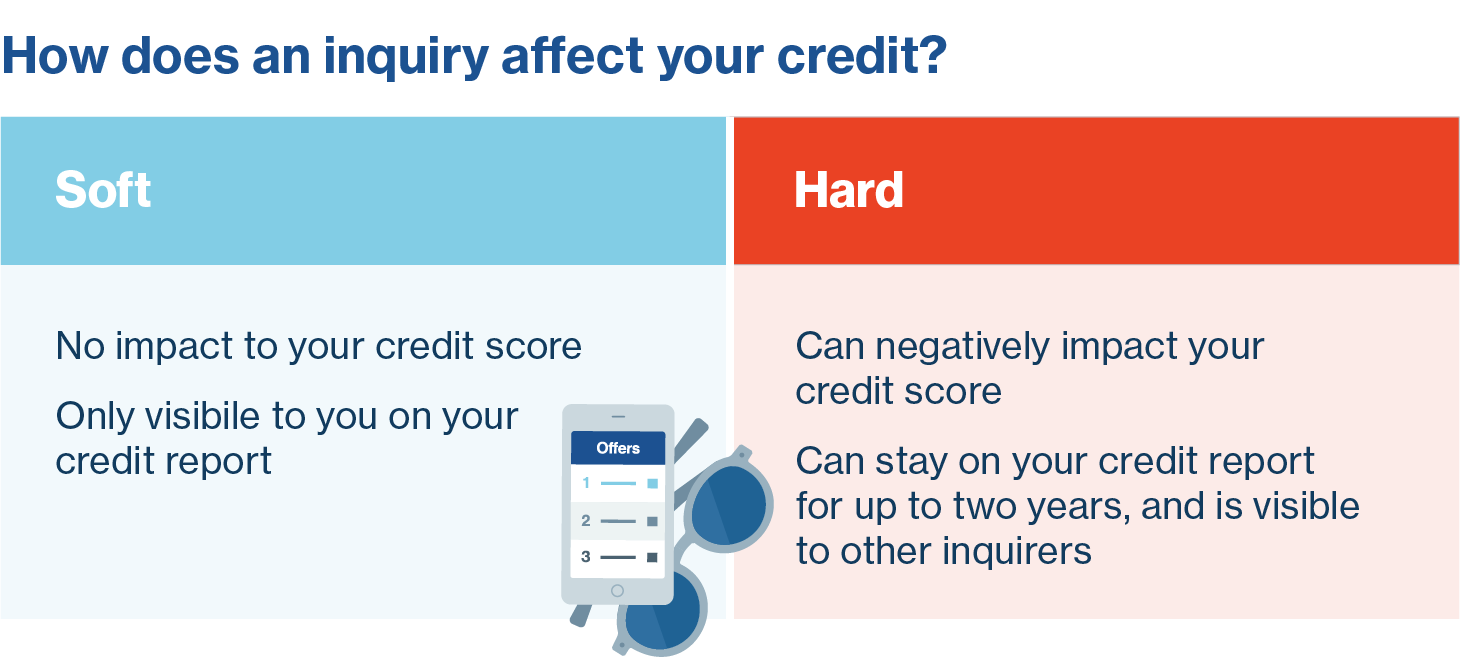

There can be both a negative and positive student loan impact on credit score depending on your payment practices. A student loan typically has a long repayment period so the score will get a boost from a long credit history. Your payment history has a big impact on your score so if you make your payments on time every month, it helps build up your credit. However, if you do default on the loan or have late payments, it can hurt the score.

Positives Impact of Student Loans on Credit Score

Student loans are not impossible to deal with. There are some positives when it comes to a student loan impact on credit score. If you make at least the minimum payment and make those payments on time, you can build the score with a positive credit history.

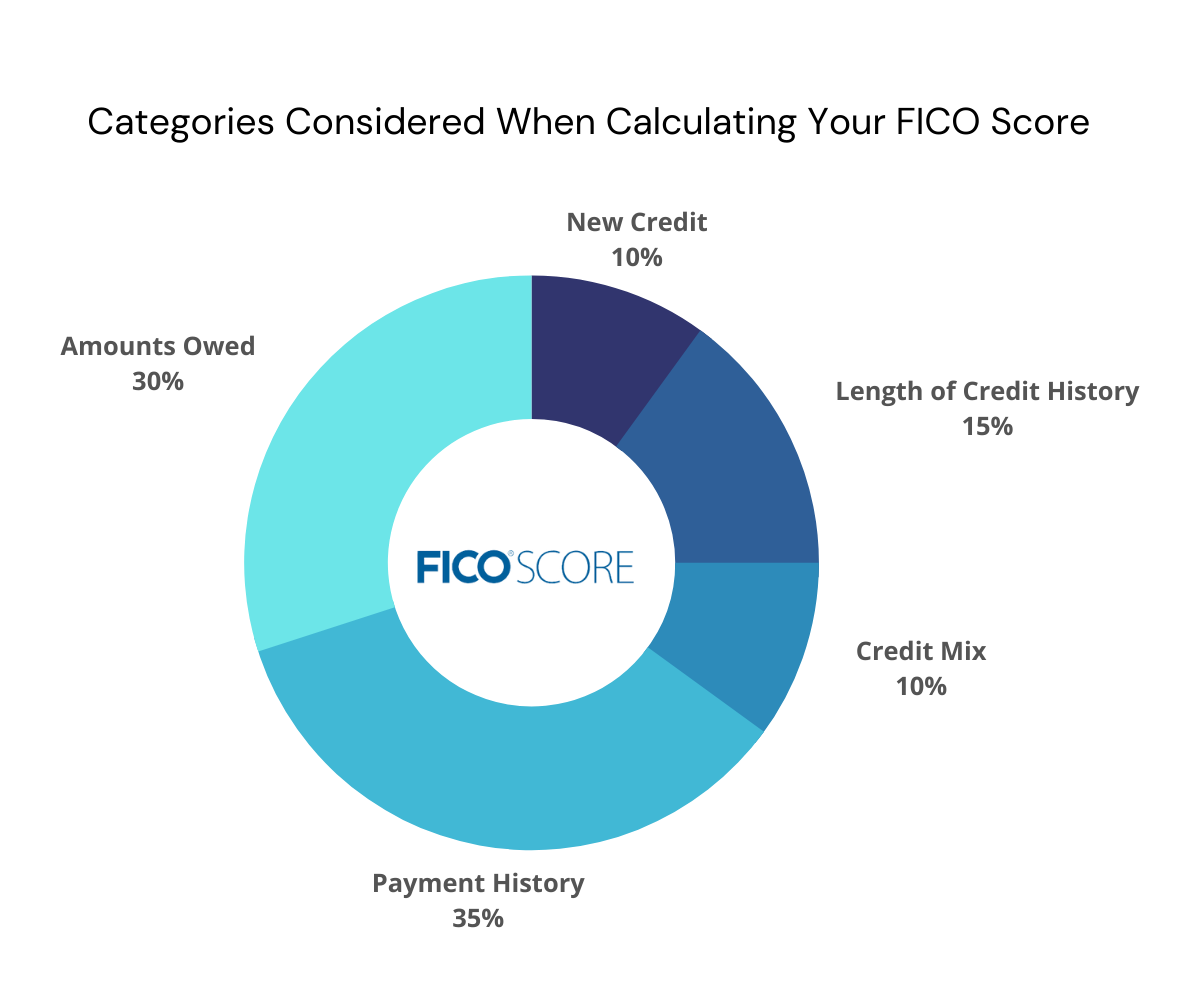

Paying On Time Makes Up 35% of the Score

Payment history has a big student loan impact on credit score. Many things you make a payment on, such as car insurance and rent, aren’t usually reported to credit bureaus until you stop paying them.

Even though some payments aren’t reported to credit bureaus and don’t have a positive impact on your score, student loans do. The payments you make on your student loans can help you establish a good payment history. If you don’t have any other loans in your name then paying a student loan on time can help you start building credit from a younger age.

Easier to Build a Credit Mix

A credit mix doesn’t have as big of an impact on your credit score but it’s still important. A credit mix is the mixture of credit you have and this can include auto loans, credit cards, and mortgages. The more you have and the better variety, the better it will look on a credit report. If you already have a credit card then a student loan will help give you more credit mix.

Long Repayment Means Long Credit History

Another positive student loan impact on credit score is the following. The length of your credit history will influence about 15% of the score. Since student loans usually come with 10-year repayment plans, having a student loan can help you build a long credit history. If you do have the opportunity to pay off your loans faster, you should still take it since there’s no reason to stay in debt for longer.

Negatives Impact of Student Loans on Credit Score

If you aren’t properly handling your repayments then student loans can wreak havoc on your credit score and you can get a negative student loan impact on credit score.

Paying Late

Since paying on time has a good impact on the score, paying late will have the opposite effect. In fact, paying late can be the most negative student loan impact on credit score. Getting behind on paying your loan will hurt your score as well as your credit history. Bad marks can stay on the report for seven years.

Your student loan servicers can report the delinquency as early as 30 days after payment is due so don’t think you can just skip a month and it won’t have an impact. If you can’t afford to make your student loan payments, you may qualify for an income-driven repayment plan if you have federal loans. If you have private loans, you may be able to refinance for a lower monthly payment.

Defaulting Greatly Damages Score

Another negative student loan impact on credit score is an account in collections. This is even worse than a late payment. Accounts in the collection will stay on your credit score for seven years, just like late payments. These accounts stay on your credit report even after you pay them off.

Creditors don’t want to lend you money unless you can be trusted to pay it back and defaulting will show creditors you can’t be trusted. Defaulting on student loans means that it can be harder to get credit for other things in the future.

Types of Student Loans

There are different types of loans for students. No matter which one you choose, the student loan impact on credit score will be similar.

Private Loan

Private loan can be hard to get if you don’t have a good credit score or someone with a good credit score who can co-sign your loan. A private lender will run a credit check to decide if you qualify. If your credit score passes but is still low then you will likely have to pay more in interest. A private student loan impact on credit score can be possible if you qualify.

Federal Loan

You may not have a credit score when you are just starting out in life and a fed student loan can be a good option. You can get a federal loan without a credit check and it can have a positive student loan impact on credit score.

Personal Loans for Students

A personal loan can be helpful to students who are drowning in debt and aren’t able to make ends meet. Students don’t have that many lending options that are available to help them get out of debt. Credit cards can only make the matter worse and it can be frustrating to keep borrowing from friends and family. A personal loan for students can come with a lower interest rate that is more manageable. The lower rate can help you invest money in other projects that can help your income grow.

If you have already gotten into some bad borrowing habits and your credit is not that great then you can still get a personal loan for students. Some lenders may offer slightly higher interest rates if your credit isn’t that great and others will shorten the amount of time you need to repay the loan. Personal loans can be processed quickly, allowing you to have the money that you need. Personal loans don’t need any collateral, which makes them easier for students to get since the chances are likely students don’t have a lot to borrow against.

Should You Do Debt Consolidation for Student Loans?

A personal loan will allow you to do debt consolidation. This process allows you to take your accumulated debts and make one payment with hopefully a lower interest rate. It can help to start getting your debt under control after graduation and when payments for student loans begin.

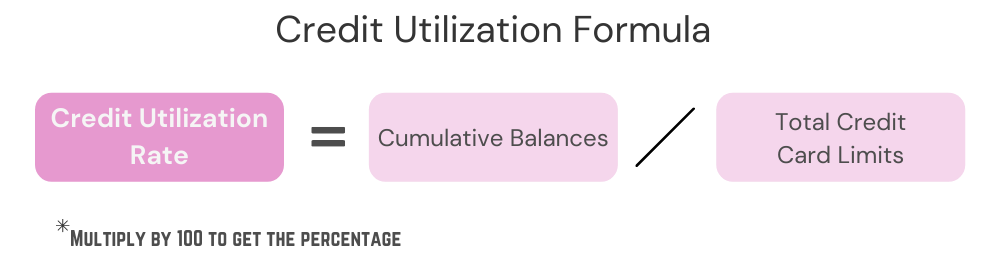

Since you already know about the student loan impact on credit score, does debt consolidation also hurt your credit score? Determining if debt consolidation can hurt your credit score will depend on the different options you choose. When you first are selecting a loan for debt consolidation, you are applying for new credit, which means a hard inquiry on your credit report. Any time you do have a hard inquiry, your credit score can suffer.

While it initially seems that getting a loan for debt consolidation can hurt your credit score, adding new credit or a new loan can cause your utilization ratio to go up and this can actually help your score. However, for this to work, you need to not be acquiring any new debt.

Is There Help for Student Loans?

Chances are if you are applying for college and are looking at how to afford it then you have heard of FAFSA. This stands for Free Application for Federal Student Aid. If you want to be considered for financial aid or even have a work-study job during your college years then you will need to fill out this form. The form will take your income and your family’s income into consideration. It will then determine your aid eligibility for loans or grants. Grants are financial aid you want since they won’t need to be repaid.

Even if you think your family earns enough money to prohibit you from qualifying for aid, it is still a good idea to complete the form. The form is needed if you are going to receive any scholarships and will also be needed if you want access to federal student loans. Even if you do have to take out student loans, and many people do, it helps to have the most options for paying for college. If you don’t fill out the form, you can miss out on student loans and scholarships, which you may have been eligible to receive.

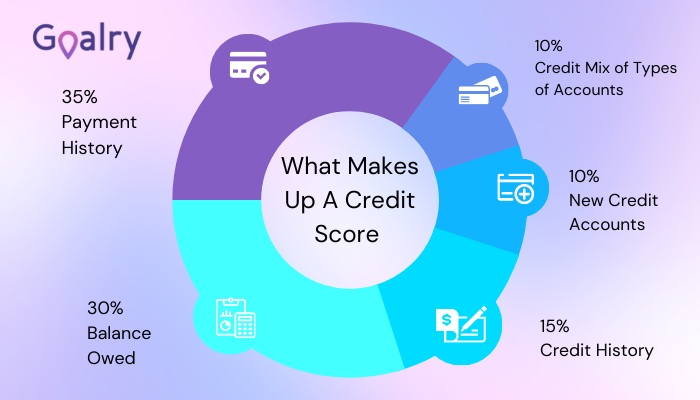

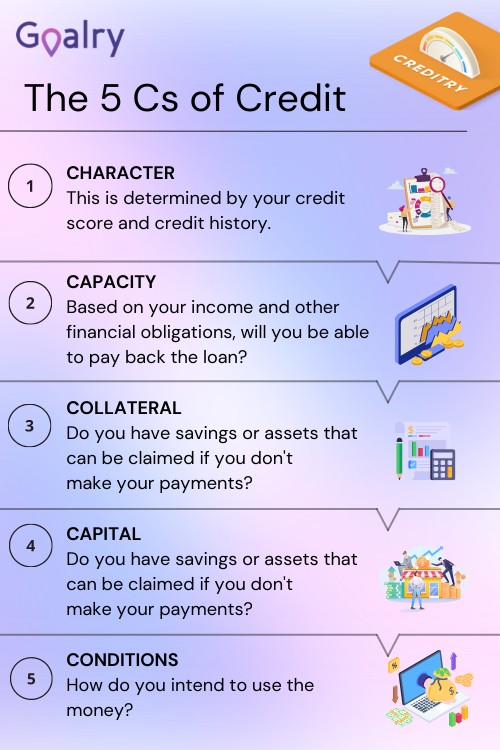

Understanding the 5Cs of Credit

Getting a loan approval can be dependent on your credit score but the credit score is only a portion of the decision on whether or not you are rejected or approved. Anything that can show the lenders whether you can repay will have an impact. A single item doesn’t determine your credit. Instead, it’s an equation with multiple factors that speak to the possibility and ability to repay the loan. These factors can be referred to as the five C’s of credit.

A person’s character can lead to decisions one makes, such as loaning money. Character is based on credit history. Your character is determined by your known financial actions. There is no way to see into the future about how your character can be so creditors go on past action.

A character can be judged more subjectively but capacity is straightforward. It’s the ability to repay. Lenders will look at income capacity to see whether or not you can repay the loan. If the outgoing money is more than your current income then you don’t have the capacity to pay the loan.

When you apply for a mortgage, a lender will want you to pay for a portion upfront. This can be low or it can be as high as the lender wants. This is also true with car loans. When you make a down payment, this is considered capital and it shows that you are serious about the purchase. You have some skin in the game and are invested in so you are more likely to pay off the loan and not lose your investment.

Collateral is slightly different than capital. In the loan world, this can be a check, piece of land, car title, or something else the lender sees as valuable enough to regain the money. Collateral can improve your chances of getting approved. Collateral is less of a financial risk for the lender.

Conditions are the conditions surrounding the loan. This can seem straightforward but there are conditions that can affect approval. A lender has to consider all conditions. Things like the interest rate and terms of the loan will also need to be factored in.

Establishing a Credit History

A student loan can have an impact on credit score, but what do you do if you are trying to establish a credit history? Students and young adults often have this problem and it seems unfair that you have to have a good credit rating in order to pay for something as important as education. Credit isn’t just about credit cards anymore and there are ways to establish a credit history even if you don’t already have one.

This is one of the easiest and painless ways so establish a credit history. This type of loan is one where you borrow a specific amount of money. The bank or credit union holds the money in an account you don’t have access to and you make monthly payments. When the amount is paid off you get the money minus any interest you needed to pay.

Many credit builder loans will be between $300 and $1000. It’s not about how much you can borrow but instead how much you can repay every month. You will need to be sure you can afford monthly payments before you begin the process. Otherwise, you can do damage to your credit score.

Your parents will likely have a credit card. You can ask to be an authorized user of your parent’s credit card. This means you won’t have a card of your own but can use theirs. You do need to check with the credit card company to see if they report any authorized users’ payments to them. If they don’t then this won’t work.

Make payments on time each month. If you don’t, not only are you hurting your credit history but also your parents’. The biggest advantage of being an authorized user is that their credit history will also make yours look good. You don’t even really need to use the card.

Some think that utilities, insurance, and rent are reported to credit bureaus. This is only true if you don’t pay. However, it’s still important to pay your bills in a timely manner. If you want credit bureaus to be notified of on-time payments then a third party reporting agency can be an option. You may have to pay for this service. But it can be worth it if you are trying to build up a credit history and do make all your payments on time.

If you have someone in your life with good credit you can ask them to co-sign a personal loan in order to build credit history. The payments you make on the loan will then be reported to the credit bureau so you can establish credit. It’s important that you don’t default on the loan since your co-signer will then be responsible for paying it and both your credit scores will be negatively affected.

No one will get a credit card before there is an established credit history but you may be able to get a secured card. This is when you put between $200 and $300 in the bank and let it sit there for about a year. The credit union or bank can see this as collateral for a secured credit card. You aren’t able to make large purchases with a secured card. But when you make the payments on time each month, the credit union or bank may give you an unsecured credit card in a couple of years.

Secured cards aren’t meant to be used long term and the purpose is to build or rebuild credit.

How to Increase Your Credit Score

Using student loans to your advantage and allowing the student loan impact on credit score to be positive can help you increase your credit score. There are also other ways to improve your credit score.

As it has been said time and time again, it’s extremely important to avoid late payments since this makes up such a big chunk of the credit score. If you aren’t able to remember your payments then sign up for automatic payments. If you can’t afford your payments then there are options you can consider, including debt consolidation.

Start Paying Down Revolving Debt First

Revolving debt includes credit cards. You want to keep credit card balances as low as possible and ideally at zero. Not only does this help with your credit but it also helps you avoid hefty interest fees. Pay off your debts to keep your credit utilization in check.

Since items like paying rent and other bills don’t help your credit score unless you are late, ask your landlord if you are able to pay for your rent on a credit card. Use the money that you would typically spend on rent and pay down the balance every month.

Be sure to review your credit report and check for any errors. Every year, you are entitled to one free credit report. Don’t miss this opportunity to check your score. Errors can be common and can be costly to your credit score. Review reports every year and then dispute anything that isn’t right.

Final Thoughts

When asking what is the student loan impact on credit score on my student loan, it helps to remember your specific situation. If you can pay your monthly payment on time and establish a good payment history then you can have a positive student loan impact on credit score. However, it’s easy to start having a negative student loan impact on credit score if you aren’t careful about making payments. For those having trouble making payments, debt consolidation can provide some relief.

There are ways to establish your credit for those who are just starting out. And ways to improve your credit score in the future. For students who want to travel, instead of taking out more student loans consider a travel loan for students.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com, Cashry.com, Debtry.com, Budgetry.com, Billry.com, Creditry.com and Taxry.com. Kevin shares his expertise with readers who want to create budget-friendly habits across the web.

The second of the five c’s of credit is capacity. While character can be judged more subjectively, capacity is pretty straightforward. It is simply the ability one has to repay.

The second of the five c’s of credit is capacity. While character can be judged more subjectively, capacity is pretty straightforward. It is simply the ability one has to repay. If one of the friends you are considering offers to put up half of the cost up front, you are probably most likely going to choose them- or at least move them to the top of the list. Why? Well, for one, they are easing your financial burden. If they put up half and you put up half, it is a lot less stress on you. Second, it shows that they really want to go and are serious about doing their part.

If one of the friends you are considering offers to put up half of the cost up front, you are probably most likely going to choose them- or at least move them to the top of the list. Why? Well, for one, they are easing your financial burden. If they put up half and you put up half, it is a lot less stress on you. Second, it shows that they really want to go and are serious about doing their part. Capital is not the same as collateral, though they have been confused a bit. Remember that capital is your friend paying a portion of the cost up front. Collateral, on the other hand, is something your friend lets you hold until they repay you. It could be a piece of jewelry, a piece of stereo equipment, or something else that they find valuable. The agreement is that if they do not repay, you have the right to sell that collateral to make back your money.

Capital is not the same as collateral, though they have been confused a bit. Remember that capital is your friend paying a portion of the cost up front. Collateral, on the other hand, is something your friend lets you hold until they repay you. It could be a piece of jewelry, a piece of stereo equipment, or something else that they find valuable. The agreement is that if they do not repay, you have the right to sell that collateral to make back your money. Conditions are just what it says- conditions surrounding the loan. That may seem pretty straightforward but there are many conditions that might affect approval.

Conditions are just what it says- conditions surrounding the loan. That may seem pretty straightforward but there are many conditions that might affect approval.

A hard inquiry occurs when a lender checks your credit. When you apply for a loan, the lender will check your credit, a hard inquiry, to determine your credit worthiness and financial responsibility before approving or denying your loan application. You need to use hard inquiries sparingly. A hard inquiry can remain on your credit for at least two years and can lower your credit score. Common loan applications that count as hard inquiries include

A hard inquiry occurs when a lender checks your credit. When you apply for a loan, the lender will check your credit, a hard inquiry, to determine your credit worthiness and financial responsibility before approving or denying your loan application. You need to use hard inquiries sparingly. A hard inquiry can remain on your credit for at least two years and can lower your credit score. Common loan applications that count as hard inquiries include