In many cases, the right bank approves a personal for the low credit scores. Your credit score dictates the interest rate of that loan. Personal loans are available to you when you have an emergency expense pop up but you don’t have extra funds to pay for the repair. The most important key to receiving a personal loan and the interest rate you receive is your credit score.

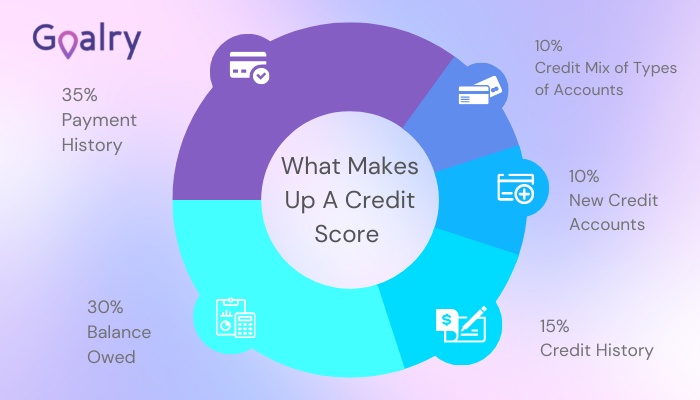

That three digit number holds your future in its grasp. It indicates to lenders how much they can trust you as a borrower. It’s important to understand how your credit score is measured. Once you understand this, you can begin to take control of your lending eligibility. Any person with a bank account, credit cards, or any type of loan has a credit score. Your credit score is an indication of how well you pay back your debts.

How to Get a Personal Loan With a 620 Credit Score

Personal loans are unsecured, which means there is nothing for collateral, so the bank is taking a chance by giving you a loan. This is the reason that interest rates can be all over the place depending on those three digits that control everything.

A difference of 50 to 70 points may not seem like a lot to you. In the lending world, it’s a huge difference and could cause a much higher percentage interest on a loan. The average rate for a credit score between 720 and 850 may be 10 percent to 13 percent. The average rate for a poor credit score between 300 and 639 could be as high as 28.5 percent to 32 percent.

1. Work on Improving Your Credit Score

You can’t improve your credit overnight. It is slow and steady work to improved credit. There are some things you can do to work towards better credit. Pay your bills on time. Set up reminders to pay your bills on time. You could even set up automatic payment, so you don’t have to remember. If you have missed payments, get the account current. You should also reduce your debt. This is hard, you can do it. Stop using your credit cards. If you continue to use them, keep the balance low. Most importantly, check your credit report for any errors. If there are errors, fix them.

2. Online Lenders Willing to Lend to Fair Credit

It is possible to get personal loan online with fair credit. There are many lenders willing to lend to people in the fair credit range. Loanry provides a list of available loan options for fair credit. These options include a personal loan to payday loans to credit cards. You can get an online personal loan with a 620 credit score. You should be aware not all online lenders are reputable.

Make sure you are using an experienced lender with a good reputation. Adding an online loan to your credit report along with auto loans and mortgage payments can help your credit score. Online loans are installment loans, so you know exactly how much you owe and when. Unlike credit cards, the amount of interest you pay is set when you sign the loan terms. It does not get added on every month.

3. Consider a Secure Loan like a Title Loan (With Caution)

Title loans have a short repayment time, usually less than a month. They are short term loan lenders. It is a cash loans bad credit situation. You are using your vehicle for collateral. Typically any vehicle works as long as the value of the vehicle is more than the loan. They have high interest rates of 25 percent per month. These loans must be paid in full.

Cashry outlines the pros and cons of a title loan. These lenders do not check your credit. You get cash fast regardless of your credit score. It comes with a great cost. If you consider this type of loan, be sure you can pay it back without hurting your finances.

Is a Credit Score of 620 Good or Bad?

There are ranges for credit scores. These ranges are exceptional, very good, good, fair, and very poor. A credit score of 620 is considered fair. It isn’t the worst range, but it’s far from the best. According to Experian, one of the three credit reporting agencies, 18 percent of all consumers have fair credit. Experian’s statistics state that 28 percent of the people in this range are likely to become delinquent.

Those statistics scare lenders and many of them choose not to lend to the fair range. Some lenders look for people in this range and offer them high interest rate loans. If you are having a hard time getting a personal loan with a 620 credit score, there are other various personal loan options you may consider.

You could consider short term loan lenders online. These lenders give small amounts of money with repayment in a short amount of time. There are also cash loans bad credit lenders available. These lenders tend to lend a larger amount of money with a longer repayment schedule. If you choose these lenders, make sure you understand the terms of your loan. You should know how much interest you are paying. You should know how often you have to make a payment, weekly, bi weekly, or monthly.

Credit Score of 620: Should I Get a Personal Loan?

Getting a personal loan with a 620 credit score can be a good way to consolidate debt. Paying off high interest debt at one time and consolidating it into one payment sounds great. But, does it make sense for you? You should really consider this option before you jump into it. Loanry provides helpful money tools to calculate payments you may consider when thinking about a personal loan.

You should consider if a personal loan will improve your situation. Or will it put you in a worse financial position? You should be sure that you can pay this debt for the life of the loan and meet all financial needs. A personal loan with a 620 credit score may have a high interest rate. You should consider how long it will take to pay off the debt without the loan. If a personal loan helps you stop interest from mounting and pay the debt faster, it may be right for you. You may need to change some of your habits. You might need to take a look at how much money you’re spending and put some controls in place.

Personal Loans For Good And Fair Credit

People are realizing that high credit card debt is almost impossible to pay off. You just can’t get out from under the interest charged that continue to add up. According to Loanry, personal loans are a popular way for people to get out from under that debt. For many, a personal loan with a 620 credit score is a great way to pay off credit card debts with high payments. Those with good credit have a great chance of getting a loan with the best rate.

Anyone with a credit score over 740 should get a loan interest loan. When your credit dips below 739, it becomes more difficult to get the best rate. A credit rating of 670 to 739 is good but lenders start looking at other factors. If your credit score is under 669 you are considered subprime. This is where the interest rates start to get high.

Conclusion

An excellent credit score is the key to financial freedom. Once your credit score starts to decrease, it is hard to get it to go back up. It can with hard and consistent work. Consolidating and paying off debts timely is one way to make that happen.

You can get a personal loan with a 620 credit score. A personal loan is sometimes the best answer. You can pay off all that high interest debt with one payment a month. If you find yourself in the situation of high debt and a credit score creeping downward, consider a personal loan.

Julia Peoples is a long-time business manager focused on providing decision making assistance to the public. She works with people at key points of their lives who are making important retirement and financial decisions. She has had many articles published that educate the public on sound financial decision making.

Julia writes for those who are working towards financial freedom or a better understanding of how finances work. She has shared her financial insights with individuals on a one on one basis for years.