Personal loans can be used for anything an individual needs. Anything other than business, but sometimes people use them for start up cost. Otherwise, it will be a business loan. Either a loan for working capital, advertising, business expansion, and the like. You can use a personal loan for emergencies, holiday expenses, car/house fixtures, shopping, and other personal needs.

Also, when it comes to personal loans nowadays, there are many choices available with more lenient requirements. We no longer live in a day when the only way a person can get a personal loan is by going to a traditional bank or credit union. Nor in a day these financial institutions require you have what some refer to as the three C’s – credit, cash, and collateral.

Unsecured Loans in California

We live in a time now when you can get a California personal loan even with bad credit. There is no need for collateral. When it comes to cash, you must show proof of income. However, you don’t have to have a lot of money. You just need a steady monthly income that is as low as $800 a month in some cases.

There are so many personal loans available that you can get with fewer requirements now. Furthermore, these personal loans can be categorized as secured personal loans and unsecured personal loans. They vary in terms and interest rates. So, there is a personal loan out there that is just right for you.

Where to Get a Loan

Getting a loan is easier than ever before. You don’t even have to commute to a traditional brick and mortar company many times to get a loan. Just from the comfort of your home, you can loan shop online. And even if you are still required to go to a physical building after loan shopping online, there will point you to personal loan companies near you in California.

Getting a loan is easier than ever before. You don’t even have to commute to a traditional brick and mortar company many times to get a loan. Just from the comfort of your home, you can loan shop online. And even if you are still required to go to a physical building after loan shopping online, there will point you to personal loan companies near you in California.

There are unsecured personal loan companies in several locations in California throughout cities and towns across the nation. You can start by searching online for the right personal loan company instead of wasting gas or bus fare to travel from place to place. While checking online, you’ll see guidelines to determine whether the business suits your needs. You will also be able to find out what information you should provide to complete the application process. You will most likely be able to complete the application process online. Loanry cuts the time you spend researching. We can connect you with reputable lenders right away.

From there, you can proceed by either getting the results of your application or by getting instructions on where to complete the rest of the application process. You may also obtain instructions on the information that they will require you to submit. (i.e., proof of income, bank account information, driver’s license, etc.). If applicable, there will be a location nearby to complete the loan process that they will tell you.

What You May Likely Need for the Application Process

As mentioned before, many of these companies approve loans for bad to good credit, no collateral, and so forth. In these cases, these loans are considered to be unsecured personal loans. However, even though unsecured loans in California are convenient in that you are not required to have the three C’s; there are other details you must follow in order to go through the smoothest application process possible. The following includes other details most likely needed to complete the application process quickly and efficiently:

✓Obtain Clarification About Your Preferences

Before going to a financial institution, you should perform your due diligence. For example, know what lenders look for on your credit report and what other items they might collect. The aim is to find out the details of the application process and other terms by thoroughly checking loan packages. Especially when you California loan shop online. Please be aware of the type of loan you want and the terms that are affordable to you.

✓Ask Questions

You can contact the business via phone, instant chat, their online form, or email. Make sure to ask all the questions to ensure you have all areas covered. You also can make sure they have loan packages you desire. Other questions to ask the company include loan eligibility, timelines for the application and approval process. Of course don’t forget to ask about the required documents and materials. Different financial agencies have different requirements and finding out the requirements upfront will save you a lot of trouble.

✓Find out the Limitations

Even though many agencies accept bad credit applications, they have their limitations concerning the lowest credit score they will approve. There may be other guidelines, such as the least amount of steady income you must have, the acceptance of their terms, and the interest fees.

Personal Installment Loans

A California personal installment loan is a consumer loan that is paid on a fixed schedule with a principal and interest rates. The length of time to pay off these loans can range from a few months to several decades. You can use these loans for various reasons. Also, these loans are typically more affordable and safer than title and payday loans. As mentioned these loans can be secured or unsecured personal loans.

Personal installment loans can be retrieved fairly easily as well. You can accept a personal installment loan offer on a network. Also, you can carefully read the loan offer terms before accepting the terms. You also can digitally sign the agreement. The funds could enter your account within 24 hours to a few days, depending on the lender. For instance, unsecured loans in California will normally can enter one’s personal bank account within 24 hours. These loans are not secured but unsecured loans in California which have a log of competition and being unsecured makes less paperwork required to show collateral, for instance.

When Should I Receive My Funds?

Depending on the lender, you should receive your funds within a few days, though it could vary from one business day up to several weeks. They will typically deposit the funds into the checking account you specify during the loan process, and you can then withdraw them as cash, spend them via your bank card, or use them to make payments and purchases online like any other funds.

With an installment loan, you’ll not only have a significantly lower interest rate, but you’ll be able to make regular monthly payments and be more likely to stay on track. Plus, those regular payments can also help you boost your credit score when you make them on time each month. This can help ensure you’ll have an easier time finding the financing you need in the future.

If you can’t qualify for a personal installment loan due to your bad credit, you should still explore every other option you have before taking on an expensive and potentially dangerous short-term loan. That includes consumer credit cards, as even the worst subprime card will charge less interest than a payday loan.

How Soon Can I Get an Installment Loan?

If you apply right now for a personal installment loan then you can potentially have anywhere from $500 to $25,000 cash in your bank account as soon as tomorrow morning. That’s right, tomorrow morning, but not in all cases!

Lender’s sometimes even accept applications 24 hours a day – 7 days a week but all final processing for California cash loans is usually done during normal business hours and funds could be sent via ACH directly to your bank account.

You can borrow between $500 and $25,000 instantly. However, personal installment loans are usually based on your income and therefore only borrow the amount you can afford. The lender will certainly allow you and even encourage you to repay the loan in full any time you can afford it.

More Details on Secured and Unsecured Personal Loans in California

California secured personal loans are loans in which lenders require borrowers’ to make pledges or promises of collateral for the loan if the individual defaults on it. The most common types of secured loans are home or auto loans. If the home goes into foreclosure or the car gets repossessed, the lender can retrieve the home or auto, auction it, and then bill you for the rest if the balance is not paid in full after auctioning it. Because of this, carrying full coverage insurance may be required for your collateral when it comes to a secured loan. This way, the lender will have a shared interest in the home/car which will protect the both of you.

There are much more unsecured loans in California and other places in the market than secured loans. This fact is good for those without collateral even though lenders know that the risks are higher with these loans.

What About the Sorted Risks Associated With Those Loans?

Another difference between unsecured personal loans and secured personal loans is the sorted risks associated with either type of personal loan. With the secured personal loan, you can lose your home or car when you default on the loan. With unsecured personal loans, lenders may report negatively on your credit, they may put a lien on your home, or they can garnish your wages when defaulting on a loan.

Different Types of Unsecured Personal Loans

There are also different types of unsecured personal loans available, including student loans, personal loans, and credit cards. These loans are all term or revolving loans. The other type of unsecured personal loan is called the consolidation loan. A revolving loan is a loan with a credit limit that you can repay, spend, and spend again. Personal lines of credit and credit cards are examples of revolving unsecured loans. A term loan is a loan that requires the borrower to pay in equal installments until they pay off the balance in full. The consolidation loan is a signature loan from a bank used to pay off credit card debt in equal installments until the balance is paid in full.

Other Important Notes

With all these wonderful features about unsecured loans, there are some things to take into consideration. For one, these loans are riskier to lenders, so these loans carry higher interest rates. Also, these loans require higher credit scores many times. In these cases, these loans don’t require a perfect credit score. As a matter of fact, these average scores can be an average score of 620, for instance.

In 2020, California’s income per capita was $38,576 among various professions and regions, thus ranking 11th place among the states in the US. Some areas in this state have a greater need for finance than other areas in the state, and thus, different types financing is required. Furthermore, borrowers of unsecured loans in California with average credit scores of 580 to 720 are typically approved for these personal loans.

Payday loans are considered unsecured personal loans that provide merchant cash advances. Even though these loans may be partially secured by these companies requiring an agreement to permit automatic bank withdrawals from the applicant’s checking accounts and a postdated check, it is still known as an unsecured personal loan. There is no need for collateral, like your car or home. These types of loans have a short term, comes with a higher interest rate, and you typically pay them back in a single lump sum on your next pay period.

What Else Do Lenders Take Into Consideration?

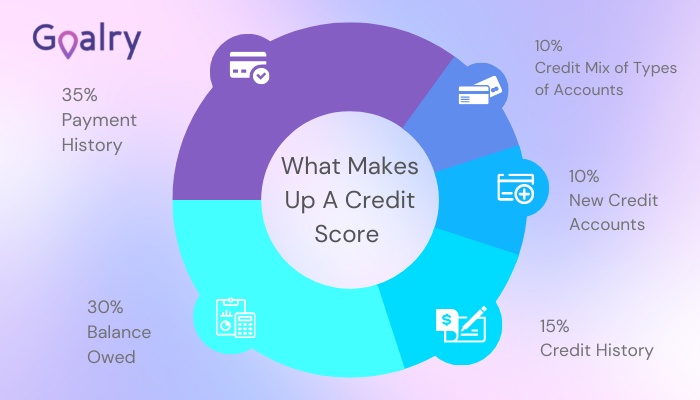

Besides the stipulations concerning income and credit score, lenders take into consideration other details when it comes to being qualified for a personal loan in California. Lenders look at the debt-to-income. Even if your credit score is fairly descent if you have more debt to the amount of your income, the lender still may reject you. Also, even if your credit score isn’t so great, paying back your credit score will be a spectacular way to improve your score. Lenders will report to credit agencies and through consumer reports that can help you greatly to obtain future credit and loans.

Several ways to improve your credit for improving your chances to get approved for a personal loan include the following:

- Following your total payments’ groupings

- Choose which groupings to make several small payments to become current on bills

- Lower balances and request for an increase of credit limit

- Improve credit utilization and eliminate card balances by using debt consolidation loans

- Pay on-time to improve your credit

Other ways to improve your chances of getting a loan include feeling and looking organized. You must be confident to go through the loan application process.

Conclusion

Unsecured loans in California are an amazing relief for us these days. You can use these loans for any personal thing or situation an individual needs the loan for. You can use unsecured personal loans for emergencies, holidays, car/house fixtures, shopping, and more. Also, when it comes to personal loans nowadays, there are many choices available with more lenient requirements.

We no longer live in a day when the only way a person can get a personal loan is by going to a traditional bank or credit union, and the person must have what some refer to as the three C’s- credit, cash, and collateral. Furthermore, we don’t have to worry about the possibility of losing our homes or vehicles when defaulting on these loans. There are negative consequences of negative reporting being on our credit. However, we all can take care of that situation when a short amount of the defaulting on a loan occurs.

There are much more unsecured loans in California available that you can get with fewer requirements, and the process can be quick and easy so you may receive funds into your account in as soon as tomorrow.

Blaine Koehn is a former small business manager, long-time educator, and seasoned consultant. He’s worked in both the public and private sectors while riding the ups-and-downs of self-employment and independent contracting for nearly two decades. His self-published resources have been utilized by thousands of educators as he’s shared his experiences and ideas in workshops across the Midwest. Blaine writes about money management and decision-making for those new to the world of finance or anyone simply sorting through their fiscal options in complicated times.